Smucker Exceeds, Ups EPS View - Analyst Blog

15 Febbraio 2013 - 2:30PM

Zacks

The J.M. Smucker Company (SJM),a leading

manufacturer of food products,reported better-than-expected third

quarter fiscal 2013 adjusted earnings (excluding special project

costs) of $1.47 per share. The results exceeded both the Zacks

Consensus Estimate of $1.37 by 7.3% and the prior-year adjusted

earnings of $1.22 per share by 20% on the back of robust sales

growth and lower share count due to share buybacks.

Revenue and Margin Details

Net sales in the quarter increased 6% year over year to $1.560

billion compared with $1.468 billion a year ago, driven by benefits

of acquisition and favorable sales mix. The acquisition of Sara Lee

business contributed $59.7 million to net sales growth.

The year-over-year improvement was also driven by volume gains

in the higher priced K-Cups coffee brand and peanut butter

business. The results were slightly above the Zacks Consensus

Estimate of $1.557 billion. Organic net sales grew 2% to $1.50

billion in the quarter.

The company acquired Sara Lee Corporation’s North American

foodservice coffee and hot beverage business in January last year.

Later in June, Sara Lee had become two independent companies after

the spin-off in May, with D.E MASTER BLENDERS 1753 focusing on the

international Coffee & Tea business, and Sara Lee’s North

American business was named as Hillshire Brands

Company (HSH), focusing on meat-centric food products and

foodservice operations.

Adjusted gross margin expanded 190 basis points to 34.5%, driven

by the acquired Sara Lee foodservice business, favorable mix and

lower green coffee costs which offset the impact from higher peanut

costs. Despite higher operating expenses, adjusted operating

margins increased 120 basis points to 17.1%, reflecting strong

sales.

Segment Performance

U.S. Retail Coffee Market: The company’s

biggest segment, U.S. Retail Coffee Market, reported a 2% decline

in sales to $627.7 million due to the impact of price declines

taken from the past year. The segment’s operating margin expanded

520 bps to 27.9% in the quarter as favorable mix and volume growth

more than offset the significant increase in marketing

expenses.

U.S. Retail Consumer Foods: U.S. Retail

Consumer Foods segment sales rose 4% to $581.3 million, driven by

higher price realization and favorable sales mix, which offset a 1%

decline in volume. The segment’s profit margin contracted 90 bps to

18.3% in the quarter, primarily due to increase in costs of peanut

butter. These were partially offset by higher price realization,

sales mix and a decrease in marketing and selling expenses.

International, Foodservice and Natural Foods:

Net sales in the International, Foodservice and Natural Foods

segment increased 28% from the previous-year quarter to $350.6

million, driven by acquisitions, favorable sales mix and higher

price realization. The segment’s profit margin contracted 10 basis

points to 14.2% in the third quarter of fiscal 2013 due to higher

raw material costs and higher distribution expenses.

Fiscal 2013 Guidance

Management raised its lower end of its earnings guidance,

excluding special project costs of 40 cents per share, to the range

of $5.17 to $5.22 per share compared with $5.12 to $5.22 per share

announced previously.

The company expects its fiscal 2013 net sales to increase 6%

over the prior-year period, reflecting the expected net sales

contribution from the Sara Lee food service business. The company

earlier expected growth of 7% over the fiscal 2012 period.

Our Take

We are encouraged with the company’s continued focus on its

brands through innovations and promotional offerings, strategic

acquisitions, improving volumes, and effective utilization of cash

through buybacks. The company is well positioned to drive profits

in the coming quarters.

Other stocks worth a look in the food products industry are

Flower Foods Inc (FLO) and J&J Snack

Foods Corp (JJSF), both of them carrying a Zacks Rank #1

(Strong Buy).

FLOWERS FOODS (FLO): Free Stock Analysis Report

HILLSHIRE BRAND (HSH): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

SMUCKER JM (SJM): Free Stock Analysis Report

To read this article on Zacks.com click here.

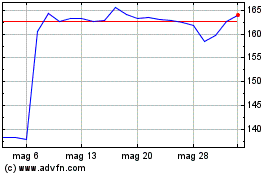

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024