Whole Foods Downgraded to Neutral - Analyst Blog

20 Febbraio 2013 - 11:40AM

Zacks

Whole Foods Downgraded to

Neutral

On Feb 14, 2013, we downgraded our

recommendation on Whole Foods Market, Inc. (WFM),

the natural and organic foods supermarket, to Neutral based on the

company’s cautious stance for the remainder part of fiscal 2013.

The stock currently holds a Zacks Rank #3 (Hold).

Why the

Downgrade?

Whole Foods has been witnessing

downward estimate revisions since the company came out with its

first-quarter fiscal 2013 results and provided a conservative

outlook for the remaining quarters. The company’s first-quarter

earnings of 78 cents a share jumped 20% year over year and came a

penny ahead of the Zacks Consensus Estimate. Revenue of $3,856

million rose 13.7% but fell short of the Zacks Consensus Estimate

of $3,875 million.

Management hinted that the rate of

growth in earnings per share in the remaining part of the fiscal

2013 would not be at a similar level as that of the first quarter

as gross margin would remain under pressure, primarily in the

second and third quarters. This is due to tough year-over-year

comparison, along with competitive pricing strategy to gain market

share against other supermarket chains.

The Zacks Consensus Estimates for

fiscal 2013 fell by 1% to $2.87 per share over the last 7 days. For

the second and third quarter, the Zacks Consensus Estimates dropped

by 1.4% and 1.3% to 73 cents and 74 cents, respectively, over the

same time frame.

Causes for

Concern

We observe that comparable and

identical store sales growth trend is softening. Whole Foods said

that comparable-store sales rose 7.2% in the quarter, down from

8.7% in the prior-year quarter and from 8.5% in the previous

quarter. Identical-store sales climbed 7.1% in the quarter compared

with 8.2% in the year-ago quarter and 8.3% in the preceding

quarter.

Consequently, Whole Foods narrowed

its sales outlook. Whole Foods now projects an escalation of 10% to

11% in total sales compared with 10% to 12% growth forecasted

earlier.

Other Stocks to

Consider

There are certain other stocks that

warrant a look, such as Flowers Foods, Inc. (FLO)

and J&J Snack Foods Corp. (JJSF), both of

which hold a Zacks Rank #1 (Strong Buy) and are expected to

continue with their upbeat performances. Another stock that should

be merited is The Hershey Company (HSY), which

holds a Zacks Rank #2 (Buy).

FLOWERS FOODS (FLO): Free Stock Analysis Report

HERSHEY CO/THE (HSY): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

WHOLE FOODS MKT (WFM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

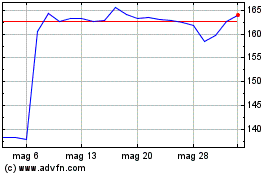

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024