General Mills Reaches 52-Week High - Analyst Blog

26 Febbraio 2013 - 6:35PM

Zacks

General Mills Inc. (GIS) recently reached a

52-week high of $46.01 on Feb 25, 2013, on the back of solid second

quarter 2013 results announced in December. Interestingly, the food

giant announced an impressive guidance for fiscal 2014 last

week.

Growth Drivers

General Mills reported second quarter 2013 results on Dec 19, 2012

with its top and bottom lines beating Zacks Consensus

Estimates.

General Mills’ second quarter fiscal 2013 adjusted earnings rose

13% year on year to 86 cents per share. The quarterly earnings

comprehensively beat the Zacks Consensus Estimate of 79 cents. The

upside was driven by recent acquisitions, better-than-expected

sales and profits in the U.S. retail business and lower interest

expenses and taxes.

Total revenue of the global consumer food company increased 6% year

over year to $4.88 billion. Revenues slivered past the Zacks

Consensus Estimate of $4.87 billion. Revenues mostly benefited from

recent acquisitions, mainly the purchases of Brazilian food maker

Yoki Alimentos (in August this year) and Yoplait Canada. Sales were

up 2% excluding the impact of the acquisitions.

In addition, General Mills recently reaffirmed its previously

provided fiscal 2013 guidance at the CAGNY investor conference held

in New York. The food giant expects growth in 2014 to be in line

with its long-term goals.

In fiscal 2014, General Mills intends to record strong earnings

growth and increase cash returns to shareholders. Growth is

expected to be in line with its long-term targets; high

single-digit growth in earnings, low-single digit growth in net

sales, and mid-single digit growth in segment operating

profit.

General Mills carries a Zacks Rank #3 (Hold).

Some stocks going strong in the food industry include

ConAgra Foods, Inc (CAG), Flower Foods

Inc. (FLO) and J&J Snack Foods Corp

(JJSF), all carrying a Zacks Rank #1 (Strong Buy).

CONAGRA FOODS (CAG): Free Stock Analysis Report

FLOWERS FOODS (FLO): Free Stock Analysis Report

GENL MILLS (GIS): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

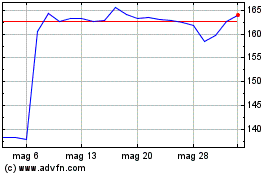

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024