Hershey Reaches 52-Week High - Analyst Blog

28 Febbraio 2013 - 1:00PM

Zacks

The Hershey Company (HSY) recently reached a

52-week high of $82.69 on Feb 27, 2013 on the back of solid fourth

quarter 2012 results and its impressive guidance for fiscal

2013.

Growth Drivers

Hershey’s fourth quarter 2012 adjusted earnings of 74 cents a share

rose 5.7% from the prior-year quarter. Earnings, however, missed

the Zacks Consensus Estimate by a penny as top-line growth was

offset by operating margin declines and rising advertising

expenses.

Hershey’s net sales rose 11.7% from the prior-year quarter driven

by volume growth, which was boosted by holiday-driven spending.

The company is consistently gaining market share in core U.S.

retail channels. Hershey’s U.S. CMG (Candy, Mint, Gum) business,

which accounts for over 90% of the U.S retail business, grew

significantly in the fourth quarter of 2012.

Hershey’s adjusted gross margin for the quarter expanded 140 basis

points (bps) driven by pricing and productivity benefits and

improved efficiencies from supply chain initiatives offset

headwinds from rising input costs.

The company also discussed several initiatives to drive growth over

the long term and aims to be a $10 billion company by 2017.

Hershey maintained its outlook for net sales growth in a range of

5%–7% for the long term. Volume growth of core brands driven by

increased promotional efforts and innovation are expected to help

Hershey achieve its sales targets.

Gross margins are expected to expand in 2013 by 180–200 basis

points as input cost inflation subsides. Productivity gains and

costs savings will also boost margins.

The company maintained its adjusted earnings guidance in a range of

$3.56–$3.63, which represents growth of 10%–12% year over year.

Investments in core brand marketing, regular product innovation,

productivity improvement and moderate commodity cost inflation are

expected to help it achieve these targets despite a challenging

macroeconomic environment.

Valuation is Decent

Hershey currently trades at a forward price-to-equity (P/E) of

22.8x, a discount of 14.1% to the peer group average of 26.55x. On

a price-to-sales and price-to-book basis, the stock is trading at a

premium to the peer group average. However, on a return on equity

(ROE) basis, the stock looks attractive. The stock has a

trailing12-month ROE of 73.7%, which is above its peer group

average of 7.8%.

Hershey carries a Zacks Rank #2 (Buy).

Other companies in the sector that warrant investor attention

include Flowers Foods, Inc. (FLO), ConAgra

Foods, Inc. (CAG) and J&J Snack Foods

Corp. (JJSF), all carrying a Zacks Rank #1 (Strong

Buy).

CONAGRA FOODS (CAG): Free Stock Analysis Report

FLOWERS FOODS (FLO): Free Stock Analysis Report

HERSHEY CO/THE (HSY): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

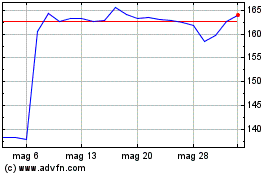

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Ott 2023 a Ott 2024