What to Expect from Kellogg's Earnings? - Analyst Blog

29 Aprile 2013 - 7:15PM

Zacks

Kellogg Company (K) is set to report its

first-quarter fiscal 2013 results on May 2 before the market opens.

Last quarter it posted 3.1% positive surprise. Let’s see how things

are shaping up for this announcement.

Factors to Consider This Quarter

During the first quarter, sales growth is expected to be solid.

We believe the improving volume trends in North America and strong

performance of its Pringles business will once again drive the top

line in the quarter. Kellogg acquired The Procter &

Gamble Company’s (PG) snack unit in Jun 2012 which

included the iconic potato snack brand, Pringles, for $2.7 billion.

Pringles is now the second-largest brand at Kellogg.

However, the company expects adjusted operating profit to

decline slightly year over year due to higher costs of input and

other cost increases. Earnings per share are also expected to be

down in the first quarter due to difficult year-ago comparisons

(which included a $0.05 benefit from interest rate hedges) and

headwinds from the Venezuela currency devaluation.

Earnings Whispers?

Our proven model does not conclusively show that Kellogg is

likely to beat earnings this quarter. That is because a stock needs

to have both a positive Earnings ESP (Read: Zacks Earnings ESP: A

Better Method) and a Zacks Rank of #1, 2 or 3 for this to happen.

That is not the case here, as you will see below.

Negative Zacks ESP: The Earnings ESP is

-0.97%.

Zacks #2 Rank (Buy): Kellogg carries a

Zacks Rank#2 (Buy). However the Zacks #2 Rank when combined with a

negative ESP makes surprise prediction difficult. We caution

against stocks with Zacks #4 and #5 Ranks (Sell rated stocks) going

into the earnings announcement.

Other Stocks to Consider

Here are some other food companies you may want to consider, as

our model shows they have the right combination of elements to post

an earnings beat this quarter:

- Flower Foods Inc. (FLO), with Earnings ESP of

+14.63% and a Zacks Rank #1 (Strong Buy).

- J&J Snack Foods Corp. (JJSF), with

Earnings ESP of +9.84% and a Zacks Rank #2 (Buy)

FLOWERS FOODS (FLO): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

KELLOGG CO (K): Free Stock Analysis Report

PROCTER & GAMBL (PG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

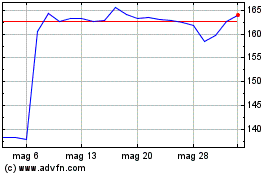

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024