Molson Coors Likely to Beat 1Q Earnings - Analyst Blog

06 Maggio 2013 - 1:50PM

Zacks

We expect beverage maker Molson Coors Brewing

Company (TAP) to beat expectations when it reports first

quarter 2013 results on May 7.

Why a Likely Positive Surprise?

Our proven model shows that Molson Coors is likely to beat

earnings because it has the right combination of two key

ingredients.

Positive Zacks ESP: Molson Coors’Expected

Surprise Prediction or ESP (Read: Zacks Earnings ESP: A Better

Method) stands at +2.86%. This represents the difference between

the Most Accurate estimate and the Zacks Consensus Estimate. This

is very meaningful and a leading indicator of a likely positive

earnings surprise for shares.

Zacks Rank #3 (Hold): Molson Coors currently

carries a Zacks Rank #3 (Hold). Note that stocks with Zacks

Ranks #1, #2 and #3 have a significantly higher chance of beating

earnings. The sell rated stocks (#4 and #5) should never be

considered going into an earnings announcement.

The combination of the stock’s Zacks Rank #3 (Hold) and an ESP

of +2.86% makes us confident of an earnings beat on May 7.

What is Driving the Better Than Expected

Earnings?

The improvement in beer volumes on the back of a recovery in the

U.S. economy and increase in consumer spending is driving the stock

higher. In addition, the company is making efforts to expand in

fast growing emerging markets and introduce new products, going

forward. The addition of the StarBev operations is also expected to

boost net sales growth in the upcoming quarter.

The acquisition of StarBev (June 2012) has significantly

enhanced the company’s portfolio of premium brands, despite a

sluggish European economy. It has also created opportunities for

the company in Central Europe to extend its key brands, taking

advantage of the attractive beer market. Also, with economic

recovery underway in the U.S. and China, the company expects

increased consumer spending.

Overall, we are encouraged with the company’s strong brand

portfolio and cost-saving initiatives. Molson Coors has also grown

its market share through innovation. Other than this, the company

liquidated its under-performing China joint venture, restructured

its Coors Light business in the rest of China, improved performance

in Japan, and integrated the Central Europe license and export

business in 2012. These initiatives are expected to improve the

efficiency of the organization and generate additional resources to

invest in brands and innovation in the coming quarters.

Other Stocks to Consider

Molson Coors is not the only firm looking up this earnings

season. You can also consider these stocks that offer exposure to

the attractive consumer staples sector:

J&J Snack Foods Corp (JJSF) with Earnings

ESP of +0.90% and a Zacks Rank #2 (Buy)

Campbell Soup Company (CPB) with Earnings ESP

of +1.79% and a Zacks Rank #2 (Buy)

Hillshire Brand Company (HSH) with Earnings ESP

of +6.67% and a Zacks Rank #2 (Buy).

CAMPBELL SOUP (CPB): Free Stock Analysis Report

HILLSHIRE BRAND (HSH): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

MOLSON COORS-B (TAP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

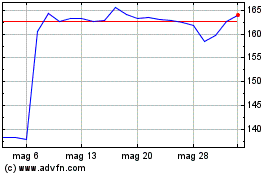

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024