J & J Snack Foods Corp. (NASDAQ-JJSF) today announced sales and

earnings for the first quarter ended December 28, 2019.

Sales increased 4% to $282.9 million from $271.6

million in last year’s first quarter. Net earnings decreased to

$17.1 million in the current quarter from $17.5 million last year.

Earnings per diluted share decreased to $.89 for the first quarter

from $.93 last year. Operating income decreased 2% to $21.7 million

in the current quarter from $22.1 million in the year ago quarter.

Operating income was impacted by approximately $1 million of costs

related to the relocation of our ICEE company’s headquarters to

Tennessee.

Net earnings for last year’s quarter benefited from

a reduction of approximately $900,000 in tax, or $.05 per diluted

share, as the provision for the one time repatriation tax as a

result of the Tax Cuts and Job Act of 2017 was reduced as the

amount recorded the year prior was an estimate. Excluding the

reduction in the provision for the one-time repatriation tax, our

effective tax rate was 28.0% in last year’s quarter. Our

effective tax rate was 27.3% in this year’s quarter.

Gerald B. Shreiber, J & J’s President and Chief Executive

Officer, commented, “We remain committed to long term profitable

sales growth.”

J&J Snack Foods Corp. (NASDAQ: JJSF) is a leader and

innovator in the snack food industry, providing innovative, niche

and affordable branded snack foods and beverages to foodservice and

retail supermarket outlets. Manufactured and distributed

nationwide, our principal products include SUPERPRETZEL, the #1

soft pretzel brand in the world, as well as internationally known

ICEE and SLUSH PUPPIE frozen beverages, LUIGI’S Real Italian Ice,

MINUTE MAID* frozen ices, WHOLE FRUIT sorbet and frozen fruit bars,

SOUR PATCH KIDS** Flavored Ice Pops, Tio Pepe’s & CALIFORNIA

CHURROS, and THE FUNNEL CAKE FACTORY funnel cakes and several

bakery brands within DADDY RAY’S, COUNTRY HOME BAKERS and HILL

& VALLEY. With nearly twenty manufacturing facilities, and more

than $1 billion in annual revenue, J&J Snack Foods Corp. has

continued to see steady growth as a company, reaching record sales

for 48 consecutive years. The company consistently seeks out

opportunities to expand its unique niche market product offering

while bringing smiles to families worldwide. For more information,

please visit http://www.jjsnack.com.

*MINUTE MAID is a registered trademark of The Coca-Cola

Company **SOUR

PATCH KIDS is a registered trademark of Mondelēz International

group, used under license.

|

J & J SNACK FOODS CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF EARNINGS |

|

(Unaudited) |

|

(in thousands, except per share amounts) |

|

|

|

|

|

| |

Three months ended |

| |

December 28, |

|

December 29, |

| |

2019 |

|

2018 |

| |

|

|

|

| Net Sales |

$ |

282,897 |

|

$ |

271,612 |

| |

|

|

|

| Cost of goods sold |

205,036 |

|

194,749 |

| Gross Profit |

77,861 |

|

76,863 |

| |

|

|

|

| Operating expenses |

|

|

|

| Marketing |

22,732 |

|

21,442 |

| Distribution |

23,542 |

|

23,952 |

|

Administrative |

9,618 |

|

9,243 |

| Other general

expense |

266 |

|

144 |

|

Total Operating Expenses |

56,158 |

|

54,781 |

| |

|

|

|

| Operating Income |

21,703 |

|

22,082 |

| |

|

|

|

| Other income (expense) |

|

|

|

| Investment income |

1,786 |

|

1,040 |

| Interest expense &

other |

(26) |

|

(27) |

| |

|

|

|

| Earnings before |

|

|

|

| income taxes |

23,463 |

|

23,095 |

| |

|

|

|

| Income tax expense |

6,404 |

|

5,569 |

| |

|

|

|

| NET EARNINGS |

$ |

17,059 |

|

$ |

17,526 |

| |

|

|

|

| Earnings per diluted

share |

$ |

0.89 |

|

$ |

0.93 |

| |

|

|

|

| Weighted average

number |

|

|

|

| of diluted shares |

19,144 |

|

18,897 |

| |

|

|

|

| Earnings per basic share |

$ |

0.90 |

|

$ |

0.93 |

| |

|

|

|

| Weighted average number

of |

|

|

|

| basic shares |

18,898 |

|

18,765 |

|

|

|

|

|

|

J & J SNACK FOODS CORP. AND SUBSIDIARIES |

|

|

|

|

CONSOLIDATED BALANCE

SHEETS |

|

|

|

|

(in thousands, except share amounts) |

|

|

|

| |

December 28, |

|

|

|

| |

2019 |

|

|

September 28, |

| |

(unaudited) |

|

|

2019 |

| Assets |

|

|

|

|

| Current assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

170,327 |

|

|

$ |

192,395 |

| Marketable securities

held to maturity |

63,594 |

|

|

51,091 |

| Accounts receivable,

net |

131,574 |

|

|

140,938 |

| Inventories |

125,789 |

|

|

116,165 |

| Prepaid expenses and

other |

3,862 |

|

|

5,768 |

|

Total current assets |

495,146 |

|

|

506,357 |

| |

|

|

|

|

| Property, plant and equipment,

at cost |

|

|

|

|

| Land |

2,494 |

|

|

2,494 |

| Buildings |

26,582 |

|

|

26,582 |

| Plant machinery and

equipment |

324,511 |

|

|

315,360 |

| Marketing

equipment |

250,308 |

|

|

240,681 |

| Transportation

equipment |

10,218 |

|

|

9,725 |

| Office equipment |

32,072 |

|

|

31,217 |

| Improvements |

40,750 |

|

|

40,626 |

| Construction in

progress |

8,291 |

|

|

10,039 |

|

Total Property, plant and equipment, at cost |

695,226 |

|

|

676,724 |

| Less accumulated

depreciation |

|

|

|

|

| and amortization |

431,596 |

|

|

423,276 |

|

Property, plant and equipment, net |

263,630 |

|

|

253,448 |

| |

|

|

|

|

| Other assets |

|

|

|

|

| Goodwill |

119,484 |

|

|

102,511 |

| Other intangible

assets, net |

75,848 |

|

|

54,922 |

| Marketable securities

held to maturity |

55,289 |

|

|

79,360 |

| Marketable securities

available for sale |

16,541 |

|

|

19,903 |

| Operating lease

right-of-use assets |

64,399 |

|

|

- |

| Other |

2,698 |

|

|

2,838 |

|

Total other assets |

334,259 |

|

|

259,534 |

| Total

Assets |

$ |

1,093,035 |

|

|

$ |

1,019,339 |

| |

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

| Current Liabilities |

|

|

|

|

| Current finance lease

liabilities |

$ |

342 |

|

|

$ |

339 |

| Accounts payable |

71,919 |

|

|

72,029 |

| Accrued insurance

liability |

11,615 |

|

|

10,457 |

| Accrued

liabilities |

13,140 |

|

|

7,808 |

| Current operating lease

liabilities |

13,762 |

|

|

- |

| Accrued compensation

expense |

12,709 |

|

|

21,154 |

| Dividends payable |

10,867 |

|

|

9,447 |

|

Total current liabilities |

134,354 |

|

|

121,234 |

| |

|

|

|

|

| Noncurrent finance lease

liabilities |

628 |

|

|

718 |

| Noncurrent operating lease

liabilities |

53,300 |

|

|

- |

| Deferred income taxes |

61,730 |

|

|

61,920 |

| Other long-term

liabilities |

503 |

|

|

1,716 |

| |

|

|

|

|

| Stockholders'

Equity |

|

|

|

|

| Preferred stock, $1 par value;

authorized |

|

|

|

|

| 10,000,000 shares; none

issued |

- |

|

|

- |

| Common stock, no par value;

authorized, |

|

|

|

|

| 50,000,000 shares;

issued and outstanding |

|

|

|

|

| 18,900,000 and

18,895,000 respectively |

47,511 |

|

|

45,744 |

| Accumulated other

comprehensive loss |

(12,178) |

|

|

(12,988) |

| Retained Earnings |

807,187 |

|

|

800,995 |

|

Total stockholders' equity |

842,520 |

|

|

833,751 |

| Total Liabilities and

Stockholders' Equity |

$ |

1,093,035 |

|

|

$ |

1,019,339 |

| |

|

|

|

|

|

J & J SNACK FOODS CORP. AND SUBSIDIARIES |

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

|

(Unaudited) (in

thousands) |

|

|

| |

|

|

|

| |

Three months ended |

| |

December 28, |

|

December 29, |

| |

2019 |

|

2018 |

| Operating activities: |

|

|

|

|

Net earnings |

$ |

17,059 |

|

$ |

17,526 |

| Adjustments to reconcile

net |

|

|

|

| earnings to net

cash |

|

|

|

| provided by operating

activities: |

|

|

|

|

Depreciation of fixed assets |

11,887 |

|

10,774 |

|

Amortization of intangibles |

|

|

|

|

and deferred costs |

843 |

|

861 |

|

Share-based compensation |

1,299 |

|

972 |

|

Deferred income taxes |

(231) |

|

689 |

|

Loss on marketable securities |

9 |

|

1,027 |

|

Other |

14 |

|

82 |

|

Changes in assets and liabilities |

|

|

|

|

net of effects from purchase of companies |

|

|

|

|

Decrease in accounts receivable |

10,254 |

|

14,386 |

|

Increase in inventories |

(8,524) |

|

(4,974) |

|

Decrease in prepaid expenses |

1,922 |

|

340 |

|

Decrease in accounts payable and |

|

|

|

|

accrued liabilities |

(963) |

|

(8,872) |

|

Net cash provided by operating activities |

33,569 |

|

32,811 |

| Investing activities: |

|

|

|

| Payments for purchases

of companies, |

|

|

|

| net of cash

acquired |

(44,970) |

|

- |

| Purchases of property,

plant |

|

|

|

| and equipment |

(17,605) |

|

(11,837) |

| Purchases of marketable

securities |

(4,000) |

|

(17,513) |

| Proceeds from redemption

and sales of |

|

|

|

| marketable

securities |

18,782 |

|

17,125 |

| Proceeds from disposal

of property and |

|

|

|

| equipment |

898 |

|

577 |

| Other |

38 |

|

(236) |

|

Net cash used in investing activities |

(46,857) |

|

(11,884) |

| Financing activities: |

|

|

|

| Proceeds from issuance

of stock |

468 |

|

1,704 |

| Payments on finance

lease obligations |

(86) |

|

(83) |

| Payment of cash

dividend |

(9,447) |

|

(8,438) |

|

Net cash used in financing activities |

(9,065) |

|

(6,817) |

|

Effect of exchange rate on cash |

|

|

|

|

and cash equivalents |

285 |

|

(875) |

| Net (decrease) increase

in cash |

|

|

|

| and cash

equivalents |

(22,068) |

|

13,235 |

| Cash and cash

equivalents at beginning |

|

|

|

| of period |

192,395 |

|

111,479 |

| Cash and cash

equivalents at end |

|

|

|

| of period |

$ |

170,327 |

|

$ |

124,714 |

| |

|

|

|

| |

Three months ended |

|

|

December 28, |

|

December 29, |

| |

2019 |

|

2018 |

|

|

(unaudited) |

|

|

(in thousands) |

| Sales to External

Customers: |

|

|

|

| Food Service |

|

|

|

|

Soft pretzels |

$ |

49,941 |

|

$ |

48,991 |

|

Frozen juices and ices |

7,043 |

|

7,527 |

|

Churros |

16,391 |

|

15,135 |

|

Handhelds |

7,189 |

|

8,802 |

|

Bakery |

96,372 |

|

94,245 |

|

Other |

6,512 |

|

5,326 |

| Total Food Service |

$ |

183,448 |

|

$ |

180,026 |

| |

|

|

|

| Retail Supermarket |

|

|

|

|

Soft pretzels |

$ |

9,826 |

|

$ |

10,186 |

|

Frozen juices and ices |

10,093 |

|

10,996 |

|

Biscuits |

6,978 |

|

7,864 |

|

Handhelds |

2,761 |

|

2,568 |

|

Coupon redemption |

(543) |

|

(694) |

|

Other |

311 |

|

359 |

| Total Retail

Supermarket |

$ |

29,426 |

|

$ |

31,279 |

| |

|

|

|

| Frozen Beverages |

|

|

|

|

Beverages |

$ |

35,255 |

|

$ |

31,167 |

|

Repair and |

|

|

|

|

maintenance service |

22,486 |

|

19,915 |

|

Machines revenue |

11,981 |

|

8,904 |

|

Other |

301 |

|

321 |

| Total Frozen

Beverages |

$ |

70,023 |

|

$ |

60,307 |

| |

|

|

|

| Consolidated Sales |

$ |

282,897 |

|

$ |

271,612 |

| |

|

|

|

| Depreciation and

Amortization: |

|

|

|

| Food Service |

$ |

6,918 |

|

$ |

6,322 |

| Retail Supermarket |

359 |

|

335 |

| Frozen Beverages |

5,453 |

|

4,978 |

| Total Depreciation and

Amortization |

$ |

12,730 |

|

$ |

11,635 |

| |

|

|

|

| Operating Income : |

|

|

|

| Food Service |

$ |

18,034 |

|

$ |

17,697 |

| Retail Supermarket |

2,217 |

|

2,211 |

| Frozen Beverages |

1,452 |

|

2,174 |

| Total Operating

Income |

$ |

21,703 |

|

$ |

22,082 |

| |

|

|

|

| Capital Expenditures: |

|

|

|

| Food Service |

$ |

8,403 |

|

$ |

6,278 |

| Retail Supermarket |

960 |

|

552 |

| Frozen Beverages |

8,242 |

|

5,007 |

| Total Capital

Expenditures |

$ |

17,605 |

|

$ |

11,837 |

| |

|

|

|

| Assets: |

|

|

|

| Food Service |

$ |

757,781 |

|

$ |

686,192 |

| Retail Supermarket |

30,963 |

|

28,100 |

| Frozen Beverages |

304,291 |

|

219,692 |

| Total Assets |

$ |

1,093,035 |

|

$ |

933,984 |

| |

|

|

|

RESULTS OF OPERATIONS

Net sales increased $11,285,000 or 4% to $282,897,000 for the

three months ended December 28, 2019 compared to the three months

ended December 29, 2018. Excluding sales from the acquisition of

ICEE Distributors in October 2019, sales increased 3%.

FOOD SERVICE

Sales to food service customers increased $3,422,000 or 2% in

the first quarter to $183,448,000. Soft pretzel sales to food

service increased 2% to $49,941,000 as higher sales to convenience

store chains more than offset lower sales to schools.

Frozen juices and ices sales decreased 6% to $7,043,000 in the

three months with sales decreases primarily to school food service

customers.

Churro sales to food service customers were up 8% in the quarter

to $16,391,000 with sales increases to warehouse club stores and

generally across our customer base.

Sales of bakery products increased $2,127,000 or 2% in the first

quarter to $96,372,000 with significant offsetting increases and

decreases in sales to particular customers.

Sales of handhelds decreased $1,613,000 or 18% in the quarter

with the decrease primarily coming from lower sales to co-pack

customers. Sales of funnel cake increased $1,240,000 or 25% in the

quarter primarily due to higher sales to one casual dining

restaurant chain.

Sales of new products in the first twelve months since their

introduction were approximately $2.5 million in this quarter. Price

increases were approximately $2.7 million for the quarter and net

volume increases accounted for approximately $700,000 of sales in

the quarter. Operating income in our Food

Service segment increased from $17,697,000 to $18,034,000 in the

quarter primarily because of higher volume and improved operations

at our Hill & Valley bakery.

RETAIL SUPERMARKETS

Sales of products to retail supermarkets decreased $1,853,000 or

6% to $29,426,000 in the first quarter. Soft pretzel sales for the

first quarter were down 4% to $9,826,000, sales of frozen juices

and ices were down 8% to $10,093,000 in the first quarter and sales

of biscuits were down 11% to $6,978,000 in the first quarter as we

lost some volume and placements in all three product categories due

to price increases implemented a year ago. We expect volume to at

least stabilize beginning in our second quarter. Handheld sales to

retail supermarket customers increased 8% to $2,761,000 in the

quarter.

There were virtually no sales of new products in the first

quarter. Price increases provided about $1.3 million of sales in

the quarter and net volume decreased by about $3.2

million.

Operating income in our Retail Supermarkets segment was

$2,217,000 in this year’s first quarter compared to $2,211,000 in

last year’s quarter as the benefits of higher prices offset the

negative impact of lower volume.

FROZEN BEVERAGES Frozen beverage

and related product sales increased 16% to $70,023,000 in the first

quarter. Beverage related sales were up 13% to $35,255,000.

Excluding sales from the acquisition of ICEE Distributors in

October 2019, frozen beverages and related product sales increased

12% and beverage related sales increased 4%. Gallon sales were up

6% for the three months exclusive of ICEE Distributors’ gallons.

Service revenue increased 13% to $22,486,000 in the first quarter

with sales increases and decreases spread throughout our customer

base.

Machines revenue (primarily sales of frozen beverage machines)

were $11,981,000, an increase of 35%. Operating income in our

Frozen Beverage segment decreased to $1,452,000 in this quarter

compared to $2,174,000 last year as a result of generally higher

costs, including approximately $1 million of costs for the

relocation of ICEE’s headquarters. We expect additional relocation

costs of about $800,000 in our second quarter.

CONSOLIDATED

Gross profit as a percentage of sales was 27.52% in the three

month period this year and 28.30% last year. Gross profit

percentage decreased because of lower volume in our combined food

service and retail supermarket segments, product mix changes

including higher machines sales in our frozen beverages segment and

generally higher costs in our frozen beverages segment.

Total operating expenses increased $1,377,000 in the first

quarter but as a percentage of sales decreased to 19.9% from 20.2%

last year. Marketing expenses increased to 8.04% of sales in this

year’s quarter from 7.89% last year. Distribution expenses were

8.32% of sales in this year’s quarter and 8.82% of sales in last

year’s quarter primarily because of lower freight rates.

Administrative expenses were 3.40% of sales this quarter compared

to 3.40% of sales last year.

Operating income decreased $379,000 or 2% to $21,703,000 in the

first quarter as a result of the aforementioned items.

Investment income increased by $746,000 in the first quarter

primarily because of recognized unrealized gains of $71,000 this

year compared to recognized unrealized losses of $1,027,000 last

year.

Net earnings decreased $467,000, or 3%, in the current three

month period to $17,059,000. Net earnings in last year’s quarter

benefitted by a reduction of approximately $900,000 in tax as the

provision for the one time repatriation tax as a result of the Tax

Cuts and Job Act of 2017 was reduced as the amount recorded the

year prior was an estimate. Excluding the reduction in the

provision for the one time repatriation tax, our effective tax rate

was 28.0% in last year’s quarter. Our effective tax rate was 27.3%

in this year’s quarter.

There are many

factors which can impact our net earnings from year to year and in

the long run, among which are the supply and cost of raw materials

and labor, insurance costs, factors impacting sales as noted above,

the continuing consolidation of our customers, our ability to

manage our manufacturing, marketing and distribution activities,

our ability to make and integrate acquisitions and changes in tax

laws and interest rates.

The forward-looking statements contained herein

are subject to certain risks and uncertainties that could cause

actual results to differ materially from those projected in the

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements, which reflect

management’s analysis only as of the date hereof. The Company

undertakes no obligation to publicly revise or update these

forward-looking statements to reflect events or circumstances that

arise after the date hereof.

Contact:

Dennis G. MooreSenior Vice President

Chief Financial

Officer(856) 532-6603

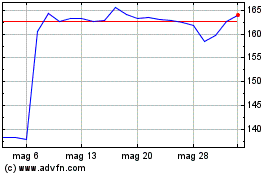

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Ago 2024 a Set 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Set 2023 a Set 2024