false

0001507605

0001507605

2025-02-26

2025-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 26, 2025

MARA

HOLDINGS, INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36555 |

|

01-0949984 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

NE Third Avenue, Suite 1200

Fort

Lauderdale, FL 33301

(Address

of principal executive offices and zip code)

(800)

804-1690

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

MARA |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

February 26, 2025, MARA Holdings, Inc. (the “Company”) issued a shareholder letter announcing its financial results for the

fiscal quarter and full year ended December 31, 2024. The Company also issued a press release announcing its earnings webcast and conference

call to be held on February 26, 2025. The full text of the shareholder letter and press release are attached hereto as Exhibit 99.1 and

Exhibit 99.2, respectively, and are incorporated herein by reference.

The

information furnished pursuant to this Item 2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MARA

HOLDINGS, INC. |

| |

|

|

| Date:

February 26, 2025 |

By: |

/s/

Zabi Nowaid |

| |

Name: |

Zabi

Nowaid |

| |

Title: |

General

Counsel and Corporate Secretary |

Exhibit

99.1

|

|

| |

IR.MARA.COM |

Q4

2024

Shareholder

Letter

| SHAREHOLDER LETTER Q4 2024 | 3 |

To

Our Shareholders

2024

was a transformative year for MARA. We accelerated our transition to a vertically integrated energy and digital infrastructure company.

What

does this mean for MARA?

That

we now have greater control over our energy, infrastructure, technology, and ultimately, our future. But before we explore what lies

ahead for MARA, let’s reflect on the key financial and operational milestones that made 2024 truly transformative.

Despite

the April halving, we had record-high revenue, net income, and Adjusted EBITDA for the full year and Q4 2024. Direct energy cost per

bitcoin for 2024 was $28,801 from owned sites.

| ● | Revenues

increased 37% to $214.4 million in Q4 2024 from $156.8 million in Q4 2023. For the

full year, revenues grew 69% to $656.4 million from $387.5 million in 2023. |

| ● | Net

income increased 248% to $528.3 million in Q4 2024 from $151.8 million Q4 2023. For

the full year, net income grew 107% to $541.0 million compared to $261.2 million in 2023. |

| ● | Adjusted

EBITDA increased 207% to $794.4 million in Q4 2024, a new benchmark for the industry,

from $259.0 million in Q4 2023. Full-year Adjusted EBITDA was $1.2 billion compared $417.1

million in 2023. |

| ● | Total

blocks won increased 25% in Q4 2024 to 703 from 562 in Q4 2023. For the full year,

blocks won grew 24% to 2,132 from 1,725 in 2023. |

| ● | Our

direct energy cost per bitcoin was $28,801 and cost/KWh was $0.039 for our owned

sites in 2024. |

| ● | Cost

of revenue per petahash per day improved by 17% for the full year and 5% in Q4 2024

(excluding depreciation). |

| ● | Energized

hashrate (“EH/s”) increased 115%

to 53.2 EH/s in Q4 2024 from 24.7

EH/s in Q4 2023. |

| ● | Bitcoin

holdings (including loaned and collateralized bitcoin) increased 197% to 44,893 BTC (c. $4.6B)

at year end, of which approximately 10,374 BTC was loaned to third parties or utilized

as collateral for borrowings, generating additional return. |

| ● | In

Q4, we mined 2,492 BTC and purchased 15,574 BTC using cash and proceeds from our

zero-coupon convertible senior notes offerings. |

| ● | For

2024, we had a BTC yield per share of 62%. We did not sell any bitcoin (“bitcoin”

or “BTC”) during the fourth quarter. |

| SHAREHOLDER LETTER Q4 2024 | 4 |

In

2024 we set in motion a transformation into a vertically integrated energy and technology solutions provider – a transformation

we are accelerating in 2025.

| 1. | Since

the beginning of 2024, we have secured 300% more energy capacity, expanding our total energy

portfolio from ~0.5 GW to ~1.7 GW to continue vertically integrating and meet growing

energy demand in our mining business. |

| ● | We

secured approximately 1.2 GW of capacity at prices 28% lower than what our peers paid for

similar acquisitions. As a result, we increased our owned data center portfolio since the

beginning of the year from 0% to approximately 70%, reducing reliance on third parties and

lowering our owned direct energy cost to $28,801 per bitcoin for 2024. |

| 2. | We

deployed our first owned power generating assets, now operating 136 MW of capacity, reducing

our reliance on grid power. |

| ● | We

launched a 25-megawatt micro data center initiative at wellheads in Texas and North Dakota,

converting excess flared gas into power for our operations. These sites reduce our reliance

on grid power and provide us with the lowest cost per bitcoin mined of our currently operational

sites. |

| ● | We

acquired a wind farm in Texas with 240 MW of interconnection capacity and 114 MW of nameplate

wind capacity. By taking excess wind behind the meter, we will reduce grid congestion and

achieve near zero marginal costs. This will enable us to extend the economic life of last-generation

hardware in ways our competitors cannot. This acquisition closed in Q1 2025. |

| 3. | We

converted waste heat into opportunity, subsidizing our mining costs while providing a valuable

service to local communities. |

| ● | In

Finland, we deployed two pilot projects to recycle heat from our operations, providing heat

to communities with a total population of nearly 80,000 residents. These sites offset our

production costs through heat sales while reducing the local communities’ reliance on high

carbon emitting biomass through the use of hydro power, delivering renewable energy and more

affordable heating to communities. |

| 4. | We

deployed Auradine ASIC miners and invested in distributed energy technology. |

| ● | We

continue to receive timely shipments of Auradine ASIC miners and are deploying them. As a

U.S.-based manufacturer founded by top Silicon Valley engineers, Auradine serves as a reliable,

domestic hardware supplier. Our direct investments in Auradine reduce our dependency on foreign

suppliers and the impact of potential tariffs. |

| ● | In

2024, we led the seed round for a residential solar and battery storage company that enables

homeowners to mine bitcoin with excess energy. Their mission aligns with MARA’s vision

of unlocking near zero energy costs and expanding distributed energy systems that reduce

reliance on centralized power grids. |

| SHAREHOLDER LETTER Q4 2024 | 5 |

We’re

proud of our transformation. But we’re far from done. While we remain bullish on bitcoin and our mining business, we’re continuing

to explore how MARA can emerge as a leader in the next major opportunity: AI.

Today,

the AI industry is at an inflection point, entering its second wave, and we intend to capitalize on the opportunities it will present.

The

first wave saw an arms race to build massive, expensive data centers for training Large Language Models (“LLMs”) –

AI models that process vast amounts of data to recognize patterns, generate text, and perform complex tasks. Companies locked themselves

into high-capex, fixed-capacity infrastructure deals to meet the intense compute demands of AI training. These contracts were built on

first-wave economics, where training was expensive, GPU supply was constrained, and hyperscalers raced to scale their compute capacity

as fast as possible.

But

the economics have changed. DeepSeek’s recent breakthrough with its R1 model has drastically reduced AI processing costs,

forcing a rethink of AI deployment strategies. Generating one million tokens with DeepSeek-R1 costs just $2.19, compared to $12 for OpenAI’s

ChatGPT-01 Mini – an 82% reduction. Efficiency gains like this are challenging AI economics and are only expected to continue.

However, these efficiency gains may also fuel greater adoption of AI, reinforcing Jevons’ Paradox – an economic theory suggesting

that efficiency gains often lead to increased overall consumption.

This

perspective is echoed by Jon Gray, president and COO of Blackstone – one the largest investors in data centers and AI-driven infrastructure.

He was recently quoted as saying that “the cost of compute is coming down pretty dramatically. But at the same time, that’s going

to lead to more usage to more adoption.” We believe his comments suggest that there might be less training due to reduced intensity,

but more inference and cloud computing.

We

believe the second wave of AI is moving to inference on the edge, where trained LLMs are deployed to process requests, generate responses,

and interact with users. Unlike training, which was concentrated in a few hyperscaled data centers, inference will require distributed,

low-latency, and energy-efficient infrastructure closer to end users.

This

shift is happening fast. According to Jefferies, AI inference workloads will grow from 12% in 2022 to 38% by 2027, which we believe

will drive the vast majority of AI-related revenue.

Source:

Jefferies, Bain & Company, Inc.

| SHAREHOLDER LETTER Q4 2024 | 6 |

Furthermore,

a former Microsoft energy executive recently noted that “most of the GPUs that Nvidia ships over the next five years will end up

as in inferencing, not training . . . inferencing is where the workload will go, and inferencing is going to look a whole lot like traditional

cloud in terms of the infrastructure, the proximity to workloads and people, AZ configurations where you don’t have monolithic, a single

site that can support three gigawatts, but rather you have three one-gigawatt sites that are all 20 kilometers from one another so that

you’re going to have redundancy in all the time that you’re looking for.”

We

believe MARA is well positioned to support this development. AI inference requires scalable, cost-effective compute infrastructure, something

we excel at.

While

many of our competitors rushed into AI hosting and high-performance compute (“HPC”) build outs, betting on large, high-capex

data centers, MARA took a strategic pause, and for good reason. History has shown that the biggest opportunities often emerge in the

second wave, not from those who jumped in first, but from those who observed the situation carefully and positioned themselves strategically.

To

stay ahead, MARA is focusing on energy management, load balancing, and infrastructure technologies at the edge – key enablers of

scalable inference.

| ● | Energy

Management & Load Balancing – AI inference has variable, spiky energy demand,

creating challenges for energy management. When AI workloads spike, they can strain the grid,

drive up costs, and disrupt energy markets. When demand drops, excess capacity goes unused.

MARA can co-locate with AI inference data centers to smooth out these fluctuations by adjusting

power use in real time – scaling down when AI demand surges and ramping up when it

tapers off, helping stabilize grids, monetize excess energy, and create a more predictable

energy load. |

| ● | Infrastructure

Technologies at the Edge – AI inference infrastructure needs to be closer to

end users, and companies are already scouting commercial buildings and smaller data center

sites for on-site or adjacent deployment. MARA is developing turnkey AI-at-the-edge immersion

systems that allow operators to drop in GPUs and go. Our next-generation two-phase immersion

cooling (2PIC) systems are designed specifically for these deployments, optimizing energy

use and improving sustainability for data centers by eliminating water usage. We are currently

deploying approximately 30 MW of 2PIC to internal and external customers. |

Looking

ahead, our priorities for 2025 are centered around three key themes: Generate, Activate, and Differentiate.

In

2024, we focused on energizing, optimizing, and diversifying – and we delivered. MARA is now widely recognized as the largest and

one of the most efficient and diversified bitcoin miners. Our fleet of 16 data centers spans six states and four continents. We operate

large, grid-connected deployments that help monetize excess energy and stabilize power grids, alongside small, modular sites that transform

stranded or otherwise wasted energy into productive, sustainable assets.

Now,

we aim to own and operate our infrastructure – not just data center assets but energy generation assets as well. To achieve this,

we need to further activate opportunities to identify potential sites where we can generate low cost energy.

By owning energy assets, we optimize how power is consumed, stored, and distributed. This allows us to activate new services

for data centers, AI operators, and energy markets. We can co-locate with them, balance their load, and generate revenue

to offset costs in ways that grid-reliant miners simply cannot.

For

those miners still relying on grid-attached power, the writing is on the wall. Energy costs will only rise. The 2028 halving will likely

force another industry-wide reckoning. Many may not survive. Those that do will need to differentiate by securing low cost

energy, vertically integrating their operations, and expanding beyond traditional bitcoin mining to leverage their infrastructure for

broader compute applications. Those that fail to differentiate will be relegated to being price takers in an increasingly

competitive market.

MARA

is taking an early lead. We have spent the last several months methodically executing a plan to build infrastructure that is not just

about mining bitcoin, but about being the lowest-cost producer in an environment where efficiency and adaptability are paramount. Our

ability to acquire sites and generate low cost energy, activate depreciated hardware and energy assets, and

run a vertically integrated model – from software and hardware, and now, to energy generation – will provide us greater control

over costs.

| SHAREHOLDER LETTER Q4 2024 | 7 |

On

January 17, 2025, MARA composed the “Trump 47”

block

commemorating the inauguration of President

Donald

Trump – only made possible through MARA’s

vertically

integrated tech stack.

Additionally,

by ramping up our development and sales of data center infrastructure, we’re building a business that is more resilient to bitcoin’s

price volatility. Like Cisco during the internet boom, we believe MARA will be the base layer of infrastructure that powers HPC applications.

Whether for bitcoin mining or AI inference, we believe our technologies will activate others to build while MARA provides

the picks and shovels to deploy new systems and services, such as energy management, load balancing, and infrastructure.

While

we’re taking proactive steps to differentiate, we believe our peers will have to scramble to adapt or be left behind.

We

established the company’s leadership in bitcoin mining through an asset light model, transformed it to a vertically integrated energy

and infrastructure company in 2024, and in 2025, we will continue to focus on being the dominant player in bitcoin mining while expanding

our footprint in energy generation. In conjunction with our emerging technology business, we are taking steps today, including investing

in research and development, to establish our presence in AI and adjacent markets, which we expect will create additional revenue opportunities

over the long term. We expect our costs to decline as we realize savings from owning our own sites and generating our own power, and

we will be laser-focused on efficiency as we drive towards our goal of near zero cost of energy.

We

assess opportunities with discipline, move with conviction, and execute at scale. The companies that dominate this industry will

be those that generate their own energy, activate new products and services from leveraging their infrastructure and technology, and

strategically differentiate themselves from the pack. We are paving that path.

We’re

grateful to our partners for their trust, our employees for their hard work, and our shareholders for their support.

Sincerely,

____________________________________

MARA

Chairman & CEO

| SHAREHOLDER LETTER Q4 2024 | 8 |

Fourth

Quarter and Full Year 2024 Financial and Operational Discussion

Highlights

| – | For

the full year and Q4 2024,

we had record high revenue, net income, and Adjusted EBITDA. |

| – | Revenues

increased 37% to $214.4 million in Q4 2024 from $156.8 million in Q4 2023. For 2024, revenues

grew 69% to $656.4 million from $387.5 million in 2023. |

| – | Our

direct energy cost per bitcoin was $28,801 and cost/KWh was $0.039 for our owned sites in

2024. |

| – | Cost

of revenue per petahash per day (excluding depreciation) continued to improve by 5% this

quarter and 17% for the full year. |

| – | Net

income increased 248% to $528.3 million, or $1.24 per diluted share, in Q4 2024 from net

income of $151.8 million, or $0.66 per diluted share, in Q4 2023. Net income includes $742.7

million income on fair value of digital assets. Full year net income grew 107% to $541.0

million compared to net income of $261.2 million in 2023. |

| – | Adjusted

EBITDA increased to $794.4 million in Q4 2024, a new benchmark for the industry, from $259.0

million in Q4 2023. Full year Adjusted EBITDA was $1.2 billion compared to adjusted EBITDA

of $417.1 million in the prior year period. |

| – | For

the quarter, total blocks won increased 25% over the previous year to 703 from 562 in Q4

2023. For the full year, blocks won grew 24% to 2,132 from 1,725 in 2023. |

| – | Energized

hashrate increased 115% to 53.2

EH/s in Q4 2024 from 24.7

EH/s in Q4 2023. Deployed 132,000 new miners with current energy efficiency of 19.2

joules per terahash (“J/TH”), as of January 2025. |

| – | At

year end, we held 44,893 BTC (including loaned and collateralized bitcoin) . During Q4

2024, we mined 2,492 BTC and purchased 15,574 BTC using proceeds from our convertible

senior note offerings. For 2024, we had a BTC yield per share of 62.4%. We did not sell any

BTC in Q4 2024. |

| – | Combined

unrestricted cash and cash equivalents and BTC (including loaned and collateralized bitcoin)

increased to $4.6 billion as of December 31, 2024. |

| – | In

2024, we acquired sites at an average price of ~$400K/MW, paying on average 28% less than

what our three closest competitors paid for similar acquisitions. |

| – | Return

on Capital Employed of 30.6% over the last 12-month period remains top tier amongst our competitors. |

Fourth

Quarter and Full Year 2024 Production Highlight

| | |

Prior Quarter Comparison | | |

Year-over-Year Comparison | |

| Metric | |

Q4 2024 | | |

Q3 2024 | | |

% Δ | | |

FY2024 | | |

FY2023 | | |

% Δ | |

| Number of Blocks Won | |

| 703 | | |

| 604 | | |

| 16 | % | |

| 2,132 | | |

| 1,725 | | |

| 24 | % |

| BTC Produced | |

| 2,492 | | |

| 2,070 | | |

| 20 | % | |

| 9,430 | | |

| 12,852 | | |

| (27 | )% |

| Average BTC Produced per Day | |

| 27.1 | | |

| 22.5 | | |

| 20 | % | |

| 25.8 | | |

| 35.2 | | |

| (27 | )% |

| Share of Available Miners Rewards (1) | |

| 5.6 | % | |

| 4.8 | % | |

| N/A | | |

| 4.1 | % | |

| 3.6 | % | |

| N/A | |

| Energized Hashrate (EH/s) (2) | |

| 53.2 | | |

| 36.9 | | |

| 44 | % | |

| 53.2 | | |

| 24.7 | | |

| 115 | % |

| 1. | Defined

as the total amount of block rewards including transaction fees that MARA earned during the

period divided by the total amount of block rewards and transaction fees awarded by the Bitcoin

network during the period. |

| 2. | Defined

as the amount of hashrate that could theoretically be generated if all miners that have been

energized are currently in operation including miners that may be temporarily offline. Hashrates

are estimates based on the manufacturers’ specifications. All figures are rounded. |

| SHAREHOLDER LETTER Q4 2024 | 9 |

In

2024, we strategically transitioned into a vertically integrated energy and digital infrastructure company by acquiring five data centers

which we own and operate, increasing our percentage of owned capacity to approximately 70%. This is a critical step toward achieving

greater operational control and efficiency.

ACQUISITIONS

Granbury,

TX and Kearney, NE: In January 2024, we acquired two operational bitcoin mining sites totaling 390 MW of nameplate capacity. We believe

our state-of-the-art 290 MW nameplate capacity data center in Granbury is one of the largest containerized liquid immersion-cooled sites

worldwide. Since acquiring the site, profitability nearly doubled, we grew our average operational hashrate by 200%, and cost per petahash

per day improved by 45%. In addition, we have made significant investments in the local community and continue to be a strategic partner.

Garden

City, TX: In April 2024, we acquired an operational bitcoin mining site with 132 megawatts of operational capacity and 200 MW of

nameplate capacity.

Hannibal,

Hopedale, and Findlay, OH: In November 2024, we acquired two operational data centers with 222 MW of interconnect-approved capacity.

In addition to the acquired data centers, we began developing a 150 MW greenfield operational data center in Findlay, Ohio.

Hansford

County, TX: In February 2025, we acquired a wind farm with 240 MW of interconnection capacity and 114 MW of nameplate wind capacity.

REVENUE

Despite

the April 2024 halving event and the 66% increase in global hashrate, MARA delivered record revenues for the year.

Revenues

increased 37% to $214.4 million from $156.8 million in the fourth quarter of 2023. With the average price of BTC mined 132% higher this

quarter than the prior year period, the increase in revenue was primarily driven by a $119.9 million increase in the average price of

BTC, partially offset by a $64.2 million decrease in BTC production due to the halving event.

For

the year ended December 31, 2024, we generated revenues of $656.4 million, compared to $387.5 million in the prior year period. The $268.9

million, or approximately 69% increase in revenues, was primarily driven by a $348.5 million increase in the average price of bitcoin

mined, partially offset by a $111.3 million decrease in bitcoin production due to the April 2024 halving, and the inclusion of $31.6

million in revenues generated from providing hosting services as a result of site acquisitions in 2024.

We

produced an average of 27.1 BTC each day during the quarter compared to 46.1 BTC each day in the prior year period and 1,750 less BTC

in the fourth quarter of 2024 as compared to the prior year period, primarily due to the halving and increased global hashrate, partially

offset by an increase in the our share of the network hashrate, which resulted in a 25% increase in number of blocks won.

| SHAREHOLDER LETTER Q4 2024 | 10 |

*as

of last day of quarter

NET

INCOME AND EARNINGS

We

reported a net income of $528.3 million, or $1.24 per diluted share, in the quarter compared to a net income of $151.8 million, or $0.66

per diluted share, in the fourth quarter of last year. This was primarily driven by a $156.0 million increase in operating income, the

$299.8 million change in fair value of digital assets - receivable, net, offset by a $102.2 million income tax benefit in the current

period compared to the prior year period.

For

the full year, we recorded net income of $541.0 million compared to net income of $261.2 million in the prior year period. The $279.8

million increase in net income was primarily driven by a $85.2 million increase in operating income, partially offset by a $69.1 million

decrease in net gain from the extinguishment of debt and a $59.1 million income tax expense in the current period compared to the prior

year period.

The

price of BTC improved on December 31, 2024 versus September 30, 2024, resulting in income on digital assets (including BTC receivable)

of $742.7 million during the fourth quarter of 2024. As we continue to hold a larger number of BTC on our balance sheet, we expect the

volatility in BTC price to impact our earnings to a larger extent. For example, a $10,000 change in BTC price will result in over a $450

million impact in our earnings solely due to our large HODL position.

COST

OF REVENUE

Our

energy and hosting costs in the quarter were $127.4 million compared to $75.1 million in the prior year period. The $52.3 million or

approximately 70% increase was primarily driven by the growth in our hashrate from the deployment and energization of mining rigs in

existing and new facilities, which increased energy and hosting costs compared to the prior year period.

For

the year ended December 31, 2024 energy and hosting costs totaled $381.6 million compared to $223.3 million in the prior year period.

The $158.3 million or approximately 71% increase was primarily driven by the growth in our hashrate from the deployment and energization

of mining rigs compared to the prior year period. Partially offsetting the increase was the impact of unexpected equipment failures and

transmission line maintenance, which resulted in downtime that reduced energy and hosting costs.

Our

cost of revenue per petahash per day improved 17% from $42.3 in the fourth quarter of 2023 to $35.1 dollar per petahash per day in the

fourth quarter of 2024. Sequentially, we improved this cost from $37.1 in Q3 2024, reflecting a 5% improvement despite a higher difficulty

level to mine due to a higher global hashrate. Due to our shift from an asset-light to a vertically integrated strategy, we believe we

are well-positioned to reduce our operating costs over time as we further expand our owned initiatives.

Finally,

our direct energy cost per bitcoin for owned mining sites was $28,801 for 2024. Direct energy cost per bitcoin is calculated as the amounts

paid to utility companies for power consumed divided by the quantity of bitcoin produced during the period related to our owned mining

operations.

| SHAREHOLDER LETTER Q4 2024 | 11 |

Depreciation

and amortization in the fourth quarter was $136.8 million, a $65.8 million increase from the same quarter in the prior year. The change

was predominantly the result of deploying additional mining rigs since last year. Our energized hashrate grew 115% year-over-year from

24.7 exahash last year to 53.2 exahash at the end of 2024.

Our

non-GAAP total margin, excluding depreciation and amortization was $84.0 million in the fourth quarter, compared to $81.7 million in

the prior year period. The change was predominantly related to higher average BTC prices and increased operational efficiency.

| SHAREHOLDER LETTER Q4 2024 | 12 |

GENERAL

AND ADMINISTRATIVE EXPENSES

In

the fourth quarter of 2024, general and administrative expenses (“G&A”), excluding stock-based compensation, was $23.9

million compared with $19.3 million in the prior year period. For the full year, G&A expenses excluding stock-based compensation

was $114.4 million compared to $59.8 million in the prior year period.This increase in expenses was primarily due to the increasing scale

of the business and acquisitions, including payroll and benefits, professional fees, facility and equipment repair and maintenance expenses,

and other third-party costs. Our headcount grew from 48 employees at the end of Q4 last year to approximately 152 employees at the end

of Q4 this year. We expect to continue funding diversified growth initiatives as we scale. Finally, G&A per petahash declined 40%

sequentially in Q4 2024 and almost 20% year-over-year as we deployed more efficient miners and our hashrate grew 44% during the quarter.

ADJUSTED

EBITDA

Primarily

due to an increase in revenue, driven by higher average bitcoin price mined at a lower cost per petahash per day and an increase in the

change in fair value of digital assets, partially offset by higher G&A expense excluding stock-based compensation, we reported adjusted

EBITDA of $794.4 million compared to $259.0 million in the prior year period. The fair market value gain on digital assets was $742.7

million and $213.6 million for the periods, respectively.

Adjusted

EBITDA was $1.2 billion for the year ended December 31, 2024 compared to adjusted EBITDA of $417.1 million in the prior year period.

The $815.1 million increase was primarily due to an $80.2 million margin improvement from higher average bitcoin price mined at a lower

cost per petahash per day and a $782.1 million increase in the change in fair value of digital assets, partially offset by an $54.7 million

increase in G&A excluding stock-based compensation.

BALANCE

SHEET AND TREASURY MANAGEMENT

At

year end, we held 44,893 bitcoin (including loaned and collateralized bitcoin) . During Q4 2024, we mined 2,492 BTC and purchased 15,574

BTC using proceeds from our convertible senior notes offerings. For the full year, we acquired 22,065 bitcoin at an average price of

$87,205 and mined an additional 9,430 bitcoin, increasing our total bitcoin holdings to 44,893 as of December 31, 2024. These holdings

were valued at approximately $3.9 billion based on a spot price of $93,354 per bitcoin at December 31, 2024. For 2024, we had a

bitcoin yield per share of 62.4%. We did not sell any bitcoin during the quarter.

*including

loaned and collateralized BTC

Digging

more into our BTC holdings and cash position, unrestricted cash and cash equivalents totaled $391.8 million, up from $357.3 million in

the prior year period. Combined, our balance of cash and BTC (including loaned and collateralized bitcoin) was approximately $4.6 billion

as of December 31, 2024.

| SHAREHOLDER LETTER Q4 2024 | 13 |

Our

HODL strategy and the opportunistic BTC purchases that we made during the quarter have benefited our shareholders as they continue to

see sustained yield when it comes to our BTC holdings from a per share perspective. A shareholder holding one million shares of MARA

stock hypothetically holds approximately 97.0 BTC as of the end of Q4 2024, reflecting a 62.4% increase in BTC yield per share since

last year. BTC yield is a key performance indicator that represents the ratio between our BTC holdings and fully diluted shares outstanding.

Finally, it is important to note that our HODL per share is approximately three times more than our closest competition.

During

2024, we acquired 22,065 bitcoin at an average price of $87,205 and mined an additional 9,430 bitcoin, increasing our total bitcoin holdings

to 44,893 as of December 31, 2024.

During

2024, we raised $1.9 billion from at-the-market (“ATM”) equity sales which we primarily used for miner purchases, operating

costs, acquisition of infrastructure and for other general corporate purposes. ATM usage represented 43% of cash needs during the year

compared to 97% in 2023.

MARA’s

return on capital employed (defined as Trailing 12-months Adjusted EBITDA divided by Average Capital Employed)

during the last 12-month period remains top tier amongst our competitors. This is a testament of MARA systematically investing

in its mining and data center operations carefully and creating top tier value for our stockholders from a capital efficiency standpoint

in this capital intensive industry. While ATMs have been the primary source of capital in this sector, as the industry evolves, we expect

additional sources of capital and project finance availability thereby reducing reliance on ATM sales.

Finally,

as of December 31, 2024, we held approximately $4.3 million, or 35 million Kaspa coins, on our balance sheet. During the year, we incurred

significantly less cost to produce Kaspa , compared to bitcoin, which helps pay for our expenses and allows us to hold a larger amount

of BTC on our balance sheet.

*including

loaned and collateralized BTC

_____________________________________________

MARA

Chief Financial Officer

| SHAREHOLDER LETTER Q4 2024 | 14 |

Earnings

Webcast and Conference Call

MARA

will hold a webcast and conference call today, February 26, 2025, at 5:00 p.m. Eastern

time to discuss its financial results for the quarter and year ended December 31, 2024.

To

register to participate in the conference call or to listen to the live audio webcast, please use this link. The webcast will

also be broadcast live and available for replay via the investor relations section of our website.

Earnings

Webcast and Conference Call Details

Date:

Wednesday, February 26, 2025

Time:

5:00 p.m. Eastern time (2:00 p.m. Pacific time)

Registration

link: LINK

If

you have any difficulty connecting with the conference call, please contact MARA’s investor relations team at ir@mara.com

About

MARA

MARA

(NASDAQ: MARA) is a global leader in digital asset compute that develops and deploys innovative technologies to build a more sustainable

and inclusive future. MARA secures the world’s preeminent blockchain ledger and supports the energy transformation by converting clean,

stranded, or otherwise underutilized energy into economic value.

For

more information, visit www.mara.com, or follow us on:

| Twitter |

@MARAHoldings |

| Linkedin |

MARAHoldings |

| Facebook |

MARAHoldings |

| Instagram |

@MARAHoldingsinc |

MARA

Company Contacts:

Telephone:

1.800.804.1690

Email:

ir@mara.com

MARA

Media Contact:

Email:

mara@wachsman.com

| SHAREHOLDER LETTER Q4 2024 | 15 |

MARA

Holdings, Inc. and Subsidiaries

Consolidated

Statements of Operations (Unaudited)

| | |

Three

Months Ended December 31, | | |

Year

Ended December 31, | |

| (in

thousands, except share and per share data) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

$ | 214,394 | | |

$ | 156,768 | | |

$ | 656,378 | | |

$ | 387,508 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Mining and hosting services | |

| (130,420 | ) | |

| (75,111 | ) | |

| (412,045 | ) | |

| (223,338 | ) |

| Depreciation and amortization | |

| (136,767 | ) | |

| (70,957 | ) | |

| (403,706 | ) | |

| (179,513 | ) |

| Total cost of revenues | |

| (267,187 | ) | |

| (146,068 | ) | |

| (815,751 | ) | |

| (402,851 | ) |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| (77,924 | ) | |

| (38,014 | ) | |

| (272,078 | ) | |

| (92,418 | ) |

| Change in fair value of digital assets | |

| 442,918 | | |

| 213,616 | | |

| 813,814 | | |

| 331,484 | |

| Change in fair value of derivative instrument | |

| 33,192 | | |

| — | | |

| (2,043 | ) | |

| — | |

| Research and development | |

| (4,105 | ) | |

| (1,239 | ) | |

| (13,229 | ) | |

| (2,812 | ) |

| Early termination expenses | |

| — | | |

| — | | |

| (38,061 | ) | |

| — | |

| Amortization of intangible assets | |

| (261 | ) | |

| — | | |

| (22,919 | ) | |

| — | |

| Total operating expenses | |

| 393,820 | | |

| 174,363 | | |

| 465,484 | | |

| 236,254 | |

| Operating income | |

| 341,027 | | |

| 185,063 | | |

| 306,111 | | |

| 220,911 | |

| Change in fair value of digital assets, restricted | |

| 299,796 | | |

| — | | |

| 299,796 | | |

| — | |

| Gain on investments | |

| — | | |

| — | | |

| 4,236 | | |

| — | |

| Gain (loss) on hedge instruments | |

| 1,712 | | |

| (17,421 | ) | |

| (580 | ) | |

| (17,421 | ) |

| Equity in net earnings of unconsolidated affiliate | |

| (680 | ) | |

| 30 | | |

| (1,505 | ) | |

| (617 | ) |

| Net gain from extinguishment of debt | |

| 13,121 | | |

| — | | |

| 13,121 | | |

| 82,267 | |

| Interest income | |

| 8,056 | | |

| 1,443 | | |

| 16,711 | | |

| 2,809 | |

| Interest expense | |

| (8,029 | ) | |

| (1,214 | ) | |

| (12,996 | ) | |

| (10,350 | ) |

| Other non-operating income (loss) | |

| (8,458 | ) | |

| — | | |

| (8,391 | ) | |

| — | |

| Income before income taxes | |

| 646,545 | | |

| 167,901 | | |

| 616,503 | | |

| 277,599 | |

| Income tax expense | |

| (118,262 | ) | |

| (16,075 | ) | |

| (75,495 | ) | |

| (16,426 | ) |

| Net income | |

$ | 528,283 | | |

$ | 151,826 | | |

$ | 541,008 | | |

$ | 261,173 | |

| Net loss attributable to noncontrolling interest | |

| 245 | | |

| — | | |

| 245 | | |

| — | |

| Net income attributable to MARA | |

$ | 528,528 | | |

$ | 151,826 | | |

$ | 541,253 | | |

$ | 261,173 | |

| Series A preferred stock accretion to redemption value | |

| — | | |

| — | | |

| — | | |

| (2,121 | ) |

| Net income attributable to common stockholders | |

$ | 528,528 | | |

$ | 151,826 | | |

$ | 541,253 | | |

$ | 259,052 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share of common stock - basic | |

$ | 1.36 | | |

$ | 0.67 | | |

$ | 1.87 | | |

$ | 1.41 | |

| Weighted average shares of common stock - basic | |

| 388,689,395 | | |

| 227,444,786 | | |

| 289,961,989 | | |

| 183,855,570 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share of common stock - diluted | |

$ | 1.24 | | |

$ | 0.66 | | |

$ | 1.72 | | |

$ | 1.06 | |

| Weighted average shares of common stock - diluted | |

| 419,880,332 | | |

| 233,358,831 | | |

| 311,841,347 | | |

| 192,293,277 | |

| SHAREHOLDER LETTER Q4 2024 | 16 |

| Unaudited | |

Three

Months Ended December 31, | | |

Year

Ended December 31, | |

| (in

thousands, except share and per share data) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Supplemental information: | |

| | | |

| | | |

| | | |

| | |

| BTC production during the period, in whole BTC | |

| 2,492 | | |

| 4,242 | | |

| 9,430 | | |

| 12,852 | |

| Average BTC per day, in whole BTC | |

| 27.1 | | |

| 46.1 | | |

| 25.8 | | |

| 35.2 | |

| General and administrative expenses excluding stock-based compensation | |

$ | (23,867 | ) | |

$ | (19,277 | ) | |

$ | (114,436 | ) | |

$ | (59,774 | ) |

| Energized Hashrate

(Exahashes per second) - at end of period (2) | |

| 53.2 | | |

| 24.7 | | |

| 53.2 | | |

| 24.7 | |

| Direct Energy

Cost per bitcoin (2) | |

$ | 31,527 | | |

$ | — | | |

$ | 28,801 | | |

$ | — | |

| Cost per kilowatt

per hour (“KWh”) (2) | |

| 0.046 | | |

| — | | |

| 0.039 | | |

| — | |

| Cost per Petahash per day (2) | |

$ | 35.1 | | |

$ | 42.3 | | |

$ | 38.6 | | |

$ | 46.4 | |

| BTC Yield (2) | |

| 23.6 | % | |

| (3.1 | )% | |

| 62.4 | % | |

| (22.1 | )% |

| Average cost

BTC mined (2) | |

$ | 52,035 | | |

$ | 18,086 | | |

$ | 41,908 | | |

$ | 17,530 | |

| Average cost

BTC purchased (2) | |

$ | 98,531 | | |

| N/A | | |

$ | 87,205 | | |

| N/A | |

| Share of available miner rewards | |

| 5.6 | % | |

| 4.4 | % | |

| 4.1 | % | |

| 3.6 | % |

| Number of blocks won | |

| 703 | | |

| 562 | | |

| 2,132 | | |

| 1,725 | |

| Transaction fees as a percentage of total | |

| 3.5 | % | |

| 13.4 | % | |

| 6.2 | % | |

| 7.7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation to Adjusted

EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 528,283 | | |

$ | 151,826 | | |

$ | 541,008 | | |

$ | 261,173 | |

| Interest expense (income), net | |

| (27 | ) | |

| (229 | ) | |

| (3,715 | ) | |

| 7,541 | |

| Income tax expense | |

| 118,262 | | |

| 16,075 | | |

| 75,495 | | |

| 16,426 | |

| Depreciation and amortization | |

| 140,169 | | |

| 72,550 | | |

| 438,995 | | |

| 181,590 | |

| EBITDA | |

| 786,687 | | |

| 240,222 | | |

| 1,051,783 | | |

| 466,730 | |

| Stock compensation expense | |

| 54,057 | | |

| 18,737 | | |

| 157,642 | | |

| 32,644 | |

| Change in fair value of derivative instrument | |

| (33,192 | ) | |

| — | | |

| 2,043 | | |

| — | |

| Early termination expenses and other | |

| — | | |

| — | | |

| 33,825 | | |

| — | |

| Net gain from extinguishment of debt | |

| (13,121 | ) | |

| — | | |

| (13,121 | ) | |

| (82,267 | ) |

| Adjusted

EBITDA (1) | |

$ | 794,431 | | |

$ | 258,959 | | |

$ | 1,232,172 | | |

$ | 417,107 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation to Return on

capital employed: | |

| | | |

| | | |

| | | |

| | |

| Adjusted

EBITDA (1) | |

| | | |

| | | |

$ | 1,232,172 | | |

$ | 417,107 | |

| Average capital

employed (1) | |

| | | |

| | | |

| 4,032,570 | | |

| 1,481,959 | |

| Return on capital employed | |

| | | |

| | | |

| 30.6 | % | |

| 28.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation to Total margin

excluding depreciation and amortization: | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

$ | 214,394 | | |

$ | 156,768 | | |

$ | 656,378 | | |

$ | 387,508 | |

| Total cost of revenues | |

| (267,187 | ) | |

| (146,068 | ) | |

| (815,751 | ) | |

| (402,851 | ) |

| Total margin | |

| (52,793 | ) | |

| 10,700 | | |

| (159,373 | ) | |

| (15,343 | ) |

| Less: Cost of revenues - depreciation and amortization | |

| 136,767 | | |

| 70,957 | | |

| 403,706 | | |

| 179,513 | |

| Total margin excluding the depreciation and amortization: | |

| | | |

| | | |

| | | |

| | |

| Mining | |

| 85,118 | | |

| 81,657 | | |

| 243,098 | | |

| 164,170 | |

| Hosting services | |

| (1,144 | ) | |

| — | | |

| 1,235 | | |

| — | |

| Total margin

excluding the depreciation and amortization: | |

$ | 83,974 | | |

$ | 81,657 | | |

$ | 244,333 | | |

$ | 164,170 | |

| SHAREHOLDER LETTER Q4 2024 | 17 |

(1)

Non-GAAP Financial Measures. In order to provide a more comprehensive understanding of the information used by our management team

in financial and operational decision-making, we supplement our Consolidated Financial Statements that have been prepared in accordance

with generally accepted accounting principles in the United States (“GAAP”) with the non-GAAP financial measures of adjusted

EBITDA, return on capital employed and total margin excluding depreciation and amortization.

The

Company defines adjusted EBITDA as (a) GAAP net income (loss) plus (b) adjustments to add back the impacts of (1) interest income, (2)

interest expense, (3) income tax expense (benefit), (4) depreciation and amortization, and (5) adjustments for non-cash and/or non-recurring

items with currently include (i) stock compensation expense, (ii) change in fair value of derivative instrument, (iii) early termination

expenses and other and (iv) net gain from extinguishment of debt. The Company defines return on capital employed as (a) adjusted EBITDA

divided by (b) average capital employed calculated by averaging the trailing four quarters of total assets less current liabilities.

The Company defines total margin excluding depreciation and amortization as (a) GAAP total margin less (b) depreciation and amortization.

Management

uses adjusted EBITDA, return on capital employed and total margin excluding depreciation and amortization, along with the supplemental

information provided herein, as a means of understanding, managing, and evaluating business performance and to help inform operating

decision-making. The Company relies primarily on its Consolidated Financial Statements to understand, manage, and evaluate its financial

performance and uses non-GAAP financial measures only supplementally.

We

believe that adjusted EBITDA, return on capital employed and total margin excluding depreciation and amortization are useful measures

to us and to our investors because they exclude certain financial, capital structure, and/or non-cash items that we do not believe directly

reflect our core operations and may not be indicative of our recurring operations, in part because they may vary widely across time and

within our industry independent of the performance of our core operations. We believe that excluding these items enables us to more effectively

evaluate our performance period-over-period and relative to our competitors.

Adjusted

EBITDA, return on capital employed and total margin excluding depreciation and amortization are not recognized measurements under GAAP.

When analyzing our operating results, investors should use them in addition to, but not as an alternative for, the most directly comparable

financial results calculated and presented in accordance with GAAP. Because our calculation of these non-GAAP financial measures may

differ from other companies, our presentation of these measures may not be comparable to similarly titled measures of other companies.

(2)

Mining and hosting services margin excluding the impact of depreciation and amortization is calculated using revenues less cost of revenues,

excluding depreciation and amortization, for mining and hosting services, respectively. The Company defines Energized Hashrate as the

total hashrate that could theoretically be generated if all mining rigs that have been operational are currently in operation and running

at 100% of the manufacturers’ specifications (includes mining servers that are offline for maintenance or similar reasons). The

Company uses this metric as an indicator of progress in bringing rigs online. Hashrates are estimates based on the manufacturers’

specifications. Direct Energy Cost per Coin is calculated as the amounts paid to utility companies for power consumed divided by the

quantity of bitcoin produced during the period related to our owned mining operations. Cost per KWh is calculated using the amounts paid

to utility companies for power consumed divided by the KWh consumed. Cost per Petahash per day is calculated using mining cost of revenues,

excluding depreciation and amortization, divided by the daily average operational hashrate online during the period, excluding the Company’s

share of the hashrate for the equity method investee, by a factor of 1,000. BTC Yield is a key performance indicator that represents

the percentage change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Fully Diluted Shares

Outstanding. Assumed Fully Diluted Shares Outstanding refers to the aggregate of the Company’s actual shares of common stock outstanding

as of the end of the applicable period plus all additional shares that would result from the assumed conversion of all outstanding convertible

notes, exercise of all outstanding warrants and settlement of all outstanding restricted stock units and performance-based restricted

stock units. Average cost of BTC mined is calculated using the bitcoin mining cost of revenues, excluding depreciation and amortization,

divided by the bitcoin production, excluding the Company’s share of the bitcoin produced for the equity method investee, the ADGM

entity. Average cost of BTC produced is calculated using the total cost of bitcoin purchased divided by the total bitcoin purchased.

All figures are estimates and rounded.

The

Company believes that these metrics are useful as an indicator of potential BTC production. However, these metrics cannot be tied directly

to any production level expected to be actually achieved as (a) there may be delays in the energization of hashrate and (b) the Company

cannot predict when operational mining rigs may be offline for any reason.

| SHAREHOLDER LETTER Q4 2024 | 18 |

Investor

Notice

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties

and forward-looking statements described under the heading “Risk Factors” in our most recent annual report on Form 10-K and

any other periodic reports that we may file with the U.S. Securities and Exchange Commission (the “SEC”). If any of these

risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our

securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only

ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be

used to anticipate results in the future. See “Forward-Looking Statements” below.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the federal securities laws. All statements, other than statements

of historical fact, included in this press release are forward-looking statements. The words “may,” “will,” “could,”

“anticipate,” “expect,” “intend,” “believe,” “continue,” “target”

and similar expressions or variations or negatives of these words are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Such forward-looking statements include, among other things, statements related

to our strategy, future operations, growth targets, developing technologies and expansion into adjacent markets. Such forward-looking

statements are based on management’s current expectations about future events as of the date hereof and involve many risks and

uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements.

Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not

undertake to update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place

undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety

by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking

statements as a result of various factors, including, but not limited to, the factors set forth under the heading “Risk Factors”

in our most recent annual report on Form 10-K and any other periodic reports that we may file with the SEC.

Exhibit

99.2

MARA

Announces Fourth Quarter and Full Year 2024 Results

Record-high

Revenue, Net Income, and Adjusted EBITDA for the full year and Q4 2024

$28.8K

direct energy cost per bitcoin for 2024 from owned sites

BTC

yield per share of 62.9% for 2024

Fort

Lauderdale, FL – February 26, 2025 – MARA Holdings, Inc. (NASDAQ: MARA) (“MARA” or the “Company”),

a global leader in leveraging digital asset compute to support the energy transformation, today

announced its fourth quarter and full year 2024 financial results in a letter to shareholders.

Investors

are invited to access the fourth quarter 2024 shareholder letter at MARA’s website at ir.mara.com. A copy of the letter

will also be furnished to the Securities and Exchange Commission on a Form 8-K.

MARA

will hold a webcast and conference call at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) today

to discuss these financial results. To register to participate in the conference call, please use this link. The webcast will

also be available for replay via the investor relations section of the Company’s website.

Earnings

Webcast and Conference Call Details

Date:

Wednesday, February 26, 2025

Time:

5:00 p.m. Eastern time (2:00 p.m. Pacific time)

Registration

link: LINK

If

you have any difficulty connecting to the conference call, please contact MARA’s investor relations team at ir@mara.com.

About

MARA

MARA

(NASDAQ: MARA) is a global leader in digital asset compute that develops and deploys innovative technologies to build a more sustainable

and inclusive future. MARA secures the world’s preeminent blockchain ledger and supports the energy transformation by converting

clean, stranded, or otherwise underutilized energy into economic value.

For

more information, visit www.mara.com, or follow us on:

Twitter:

@MARAHoldings

LinkedIn:

www.linkedin.com/company/MARAHoldings

Facebook:

www.facebook.com/MARAHoldings

Instagram:

@MARAHoldingsInc

MARA

Company Contact:

Telephone:

800-804-1690

Email:

ir@mara.com

MARA

Media Contact:

Email:

mara@wachsman.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

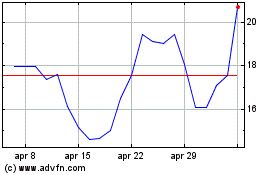

Grafico Azioni MARA (NASDAQ:MARA)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni MARA (NASDAQ:MARA)

Storico

Da Mar 2024 a Mar 2025