0000807863FALSE00008078632025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2025

MITEK SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35231 | 87-0418827 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | |

| 770 First Avenue, Suite 425 | | |

| San Diego, | California | | 92101 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (619) 269-6800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MITK | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On February 10, 2025, Mitek Systems, Inc. (the “Company”, “we”, “us” and “our”) issued a press release announcing the Company’s financial results for the first fiscal quarter ended December 31, 2024. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File, formatting Inline Extensible Business Reporting Language (iXBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Mitek Systems, Inc. |

| | | | |

| February 10, 2025 | | By: | /s/ Dave Lyle |

| | | | Dave Lyle |

| | | | Chief Financial Officer |

Mitek Reports Fiscal 2025 First Quarter Financial Results

Raises Lower-End of Adjusted EBITDA Margin Guidance Range for Fiscal 2025

SAN DIEGO, CA, February 10, 2025 - Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek” or the “Company”), a global leader in digital identity verification, mobile capture and fraud management, today reported financial results for its first quarter ended December 31, 2024 and raised the lower end of its Adjusted EBITDA margin guidance range for its fiscal 2025 full year ending September 30, 2025 (“fiscal 2025”).

“We delivered a solid first quarter, with results ahead of our expectations in our SaaS products, which grew 29% year over year, offset by year-over-year variances in software license sales,” said Ed West, Mitek’s CEO. “We are encouraged by the performance of our Identity product portfolio, the continued resilience of our Deposit solutions, and the accelerating momentum of our fraud offerings. Our cultural and technological integration efforts are now well underway, which we believe are strengthening the company’s foundation for durable, profitable revenue growth in fiscal 2026 and beyond.”

Fiscal 2025 First Quarter Financial Highlights

GAAP

•Revenue of $37.3 million was relatively flat year-over-year, compared to $36.9 million a year ago.

•Gross profit of $28.0 million was relatively flat year-over-year, compared to $28.1 million a year ago.

•GAAP gross profit margin was 75.1%, compared to 76.2% a year ago.

•GAAP net loss was $4.6 million, compared to a GAAP net loss of $5.8 million a year ago.

•GAAP net loss per diluted share was $0.10, compared to a GAAP net loss of $0.13 a year ago.

•Total cash and investments was $137.9 million at December 31, 2024, a decrease of $3.9 million from $141.8 million at September 30, 2024.

•Mitek repurchased 0.4 million shares at an average per share price of $8.99, totaling approximately $3.3 million.

Non-GAAP

•Non-GAAP gross profit was flat at $31.5 million for both periods.

•Non-GAAP gross profit margin was 84.5%, compared to 85.4% a year ago.

•Adjusted EBITDA was $7.8 million, compared to $5.9 million a year ago.

•Adjusted EBITDA margin was 21%, compared to 16% a year ago.

•Non-GAAP net income was $6.6 million, compared to $6.3 million a year ago.

•Non-GAAP net income per diluted share was $0.15, compared to $0.14 a year ago.

•Free cash flow was $0.2 million, compared to negative $9.7 million a year ago, and was $40.2 million for the twelve months ended December 31, 2024, compared to $15.7 million for the corresponding period a year ago.

Fiscal 2025 Full Year Guidance

Mitek is updating its guidance for its fiscal 2025 year ending September 30, 2025, as follows:

•Mitek is maintaining its fiscal 2025 full-year revenue guidance of between $170 million and $180 million.

•Mitek is raising the lower end of its fiscal 2025 full-year adjusted EBITDA margin guidance by 100 basis points, resulting in a new guidance range of 25%-28%.

Conference Call Information

Mitek management will host a conference call and live webcast for analysts and investors today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss the Company’s financial results for its fiscal 2025 first quarter. To access the live call, dial 844-481-3005 (US and Canada) or +1 412-317-1889 (International) and ask to be joined to the Mitek call. A live and archived conference call webcast will also be accessible on the Investor Relations section of the Company’s website at www.miteksystems.com. A phone replay will be available approximately two hours after the end of the call and will remain available for one week. The phone call replay can be accessed by dialing 877-344-7529 (US or Canada) or +1 412-317-0088 (International) and entering the passcode: 9576188.

About Mitek Systems, Inc.

Mitek (NASDAQ: MITK) is a global leader in digital access, founded to bridge the physical and digital worlds. Mitek’s advanced identity verification technologies and global platform make digital access faster and more secure than ever, providing companies new levels of control, deployment ease and operation, while protecting the entire customer journey. With solutions trusted by 7,900 organizations around the world, including the majority of North American financial institutions which rely on our mobile check deposit solutions, Mitek helps companies reduce risk and meet regulatory requirements. Learn more at www.miteksystems.com. [(MITK-F)]

Follow Mitek on LinkedIn and YouTube, and read Mitek’s latest blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the Company or its management’s intentions, hopes, beliefs, expectations or predictions of the future, including, but not limited to, statements relating to the Company’s fiscal 2025 guidance, are forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, risks related to the Company’s ability to withstand negative conditions in the global economy, a lack of demand for or market acceptance of the Company’s products, the impact of the Company’s acquisition of HooYu Ltd. including any operational or cultural difficulties associated with the integration of the businesses of Mitek and HooYu Ltd., the Company’s ability to continue to develop, produce and introduce innovative new products in a timely manner, the Company’s ability to capitalize on a growing market, quarterly variations in revenue, the profitability of certain sectors of the Company, the performance of the Company’s growth initiatives, the outcome of any pending or threatened litigation or investigation, and the timing of the implementation and launch of the Company’s products by the Company’s signed customers.

Additional risks and uncertainties faced by the Company are contained from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (SEC), including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2024, as filed with the SEC on December 16, 2024 and its quarterly reports on Form 10-Q and current reports on Form 8-K, which you may obtain for free on the SEC’s website at www.sec.gov. Collectively, these risks and uncertainties could cause the Company’s actual results to differ materially from those projected in its forward-looking statements and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company disclaims any intention or obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Investor Contact:

Todd Kehrli or Jim Byers

PondelWilkinson, Inc.

tkehrli@pondel.com

jbyers@pondel.com

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted accounting principles (“GAAP”) financial measures for non-GAAP cost of revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income, non-GAAP net income per share, non-GAAP operating income, non-GAAP operating margin, adjusted EBITDA, adjusted EBITDA margin and non-GAAP operating expense that exclude acquisition-related costs and expenses, litigation and other legal costs, executive transition costs, stock compensation expense, non-recurring audit fees, enterprise risk, portfolio positioning and other related costs, restructuring costs and amortization of debt discount and issuance costs. These financial measures are not calculated in accordance with GAAP and are not based on any comprehensive set of accounting rules or principles. In evaluating the Company’s performance, management uses certain non-GAAP financial measures to supplement financial statements prepared under GAAP. Management believes these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management and the Board of Directors of the Company utilize these non-GAAP financial measures to gain a better understanding of the Company’s comparative operating performance from period-to-period and as a basis for planning and forecasting future periods. Management believes these non-GAAP financial measures, when read in conjunction with the Company’s GAAP financial statements, are useful to investors because they provide a basis for meaningful period-to-period comparisons of the Company’s ongoing operating results, including results of operations against investor and analyst financial models, which helps identify trends in the Company’s underlying business and provides a better understanding of how management plans and measures the Company’s underlying business.

The Company has not provided a reconciliation of its forward outlook for non-GAAP operating margin with its forward-looking GAAP operating margin in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company is unable, without unreasonable efforts, to quantify share-based compensation expense, which is excluded from our non-GAAP operating margin, as it requires additional inputs such as the number of shares granted and market prices that are not ascertainable due to the volatility of the Company’s share price. Additionally, a significant portion of the Company’s operations are in foreign countries and the transactional currencies are primarily Euros and British pound sterling and the Company is not able to predict fluctuations in those currencies without unreasonable efforts. The Company expects these items may have a potentially significant impact on future GAAP financial results.

We define free cash flow as net cash provided by operating activities, less cash used for purchases of property and equipment. We define free cash flow margin as free cash flow as a percentage of revenue. In addition to the reasons stated above, we believe that free cash flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash in excess of our capital investments in property and equipment in order to enhance the strength of our balance sheet and further invest in our business and potential strategic initiatives. A limitation of the utility of free cash flow as a measure of our liquidity is that it does not represent the total increase or decrease in our cash balance for the period. We use free cash flow in conjunction with traditional U.S. GAAP measures as part of our overall assessment of our liquidity, including the preparation of our annual operating budget and quarterly forecasts and to evaluate the effectiveness of our business strategies. There are a number of limitations related to the use of free cash flow as compared to net cash provided by operating activities, including that free cash flow includes capital expenditures, the benefits of which are realized in periods subsequent to those when expenditures are made. We may refer to certain financial metrics on a Last Twelve Months (“LTM”) basis. LTM figures represent the sum of the most recently reported four fiscal quarters and are used to provide a view of the company's financial performance over the past year.

Mitek encourages investors to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, which it includes in press releases announcing quarterly financial results, including this press release, and not to rely on any single financial measure to evaluate Mitek’s business.

| | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| (amounts in thousands except per share data) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| Revenue | | | | | | | |

| Software and hardware | $ | 11,985 | | | $ | 15,980 | | | | | |

| Services and other | 25,269 | | | 20,937 | | | | | |

| Total revenue | 37,254 | | | 36,917 | | | | | |

| Operating costs and expenses | | | | | | | |

| Cost of revenue—software and hardware (exclusive of depreciation & amortization) | 67 | | | 40 | | | | | |

| Cost of revenue—services and other (exclusive of depreciation & amortization) | 5,877 | | | 5,494 | | | | | |

| Selling and marketing | 9,695 | | | 9,856 | | | | | |

| Research and development | 8,323 | | | 8,874 | | | | | |

| General and administrative | 11,901 | | | 15,538 | | | | | |

| Amortization and acquisition-related costs | 3,657 | | | 3,983 | | | | | |

| Restructuring costs | 808 | | | 48 | | | | | |

| Total operating costs and expenses | 40,328 | | | 43,833 | | | | | |

| Operating income (loss) | (3,074) | | | (6,916) | | | | | |

| Interest expense | 2,398 | | | 2,263 | | | | | |

| Other income (expense), net | 563 | | | 1,642 | | | | | |

| Income (loss) before income taxes | (4,909) | | | (7,537) | | | | | |

| Income tax benefit (provision) | 297 | | | 1,744 | | | | | |

| Net income (loss) | $ | (4,612) | | | $ | (5,793) | | | | | |

| Net income (loss) per share—basic | $ | (0.10) | | | $ | (0.13) | | | | | |

| Net income (loss) per share—diluted | $ | (0.10) | | | $ | (0.13) | | | | | |

| Shares used in calculating net loss per share—basic and diluted | 45,195 | | | 46,294 | | | | | |

| Shares used in calculating net loss per share—diluted | 45,195 | | | 46,294 | | | | | |

| | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| (amounts in thousands except share data) |

| | | |

| December 31, 2024 | | September 30, 2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 90,617 | | | $ | 93,456 | |

| Short-term investments | 30,591 | | | 36,884 | |

| Accounts receivable, net | 32,348 | | | 31,682 | |

| Contract assets, current portion | 15,588 | | | 15,818 | |

| Prepaid expenses | 5,054 | | | 4,514 | |

| Other current assets | 2,639 | | | 2,697 | |

| Total current assets | 176,837 | | | 185,051 | |

| Long-term investments | 16,667 | | | 11,410 | |

| Property and equipment, net | 2,418 | | | 2,564 | |

| Right-of-use assets | 2,653 | | | 4,662 | |

| Goodwill and intangible assets | 172,508 | | | 185,711 | |

| Deferred income tax assets | 19,272 | | | 19,145 | |

| | | |

| Contract assets, non-current portion | 3,897 | | | 3,620 | |

| Other non-current assets | 1,707 | | | 1,590 | |

| Total assets | $ | 395,959 | | | $ | 413,753 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,983 | | | $ | 7,236 | |

| Accrued payroll and related taxes | 7,544 | | | 10,324 | |

| Accrued liabilities | 508 | | | 424 | |

| Accrued interest payable | 498 | | | 205 | |

| Value added tax payables | 1,768 | | | 1,222 | |

| Deferred revenue, current portion | 21,694 | | | 21,231 | |

| Lease liabilities, current portion | 639 | | | 805 | |

| | | |

| | | |

| Other current liabilities | 912 | | | 700 | |

| Total current liabilities | 38,546 | | | 42,147 | |

| Convertible senior notes | 145,706 | | | 143,601 | |

| | | |

| Deferred revenue, non-current portion | 692 | | | 753 | |

| Lease liabilities, non-current portion | 2,317 | | | 4,230 | |

| Deferred income tax liabilities | 3,642 | | | 3,889 | |

| Other non-current liabilities | 4,139 | | | 4,332 | |

| Total liabilities | 195,042 | | | 198,952 | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.001 par value, 1,000,000 shares authorized, none issued and outstanding | — | | | — | |

| Common stock, $0.001 par value, 120,000,000 shares authorized, 45,211,865 and 44,998,939 issued and outstanding, as of December 31, 2024 and September 30, 2024, respectively | 45 | | | 45 | |

| Additional paid-in capital | 251,967 | | | 247,326 | |

| Accumulated other comprehensive loss | (12,950) | | | (2,302) | |

| Accumulated deficit | (38,145) | | | (30,268) | |

| | | |

| Total stockholders’ equity | 200,917 | | | 214,801 | |

| Total liabilities and stockholders’ equity | $ | 395,959 | | | $ | 413,753 | |

| | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

DISAGGREGATION OF REVENUE BY PRODUCT AND TYPE |

| (Unaudited) |

(amounts in thousands) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| Deposits | | | | | | | |

| Deposits software and hardware | | | | | | | |

| Software | $ | 11,097 | | | $ | 14,048 | | | | | |

| Hardware | — | | | — | | | | | |

| Total deposits software and hardware | 11,097 | | | 14,048 | | | | | |

| Deposits services | | | | | | | |

| SaaS | 2,221 | | | 1,355 | | | | | |

| Maintenance | 5,685 | | | 5,495 | | | | | |

| Professional services and other | 282 | | | 179 | | | | | |

| Total deposits services | 8,188 | | | 7,029 | | | | | |

| Total deposits revenue | $ | 19,285 | | | $ | 21,077 | | | | | |

| | | | | | | |

| Identity | | | | | | | |

| Identity software and hardware | | | | | | | |

| Software | $ | 888 | | | $ | 1,913 | | | | | |

| Hardware | — | | | 19 | | | | | |

| Total identity software and hardware | 888 | | | 1,932 | | | | | |

| Identity services | | | | | | | |

| SaaS | 16,207 | | | 12,898 | | | | | |

| Maintenance | 425 | | | 600 | | | | | |

| Professional services and other | 449 | | | 410 | | | | | |

| Total identity services | 17,081 | | | 13,908 | | | | | |

| Total identity revenue | $ | 17,969 | | | $ | 15,840 | | | | | |

| | | | | | | |

| Consolidated results | | | | | | | |

| Total software and hardware | | | | | | | |

| Software | $ | 11,985 | | | $ | 15,961 | | | | | |

| Hardware | — | | | 19 | | | | | |

| Total software and hardware | 11,985 | | | 15,980 | | | | | |

| Total services | | | | | | | |

| SaaS | 18,428 | | | 14,253 | | | | | |

| Maintenance | 6,110 | | | 6,095 | | | | | |

| Professional services and other | 731 | | | 589 | | | | | |

| Total services | 25,269 | | | 20,937 | | | | | |

| Total revenue | $ | 37,254 | | | $ | 36,917 | | | | | |

| | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

| NON-GAAP GROSS PROFIT RECONCILIATION |

| (Unaudited) |

| (amounts in thousands) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| Software and hardware | | | | | | | |

| Revenue | $ | 11,985 | | | $ | 15,980 | | | | | |

| Cost of revenue (exclusive of depreciation and amortization) | 67 | | | 40 | | | | | |

| Depreciation and amortization | 1,190 | | | 1,136 | | | | | |

| | | | | | | |

| GAAP gross profit for software and hardware | 10,728 | | | 14,804 | | | | | |

| Depreciation and amortization | 1,190 | | | 1,136 | | | | | |

| | | | | | | |

Non-GAAP gross profit for software and hardware | $ | 11,918 | | | $ | 15,940 | | | | | |

| | | | | | | |

GAAP gross margin for software and hardware | 89.5 | % | | 92.6 | % | | | | |

Non-GAAP gross margin for software and hardware | 99.4 | % | | 99.7 | % | | | | |

| | | | | | | |

| Services and other | | | | | | | |

| Services and other revenue | $ | 25,269 | | | $ | 20,937 | | | | | |

| Cost of revenue (exclusive of depreciation and amortization) | 5,877 | | | 5,494 | | | | | |

| Depreciation and amortization | 2,131 | | | 2,106 | | | | | |

| GAAP gross profit for services and other | 17,261 | | | 13,337 | | | | | |

| Depreciation and amortization | 2,131 | | | 2,106 | | | | | |

Stock-based compensation expense | 161 | | | 129 | | | | | |

| Non-GAAP gross profit for services and other | $ | 19,553 | | | $ | 15,572 | | | | | |

| | | | | | | |

| GAAP gross margin for services and other | 68.3 | % | | 63.7 | % | | | | |

| Non-GAAP gross margin for services and other | 77.4 | % | | 74.4 | % | | | | |

| | | | | | | |

Consolidated results | | | | | | | |

| Total revenue | $ | 37,254 | | | $ | 36,917 | | | | | |

| Cost of revenue (exclusive of depreciation and amortization) | 5,944 | | | 5,534 | | | | | |

| Depreciation and amortization | 3,321 | | | 3,242 | | | | | |

| GAAP gross profit | 27,989 | | | 28,141 | | | | | |

| Depreciation and amortization | 3,321 | | | 3,242 | | | | | |

Stock-based compensation expense | 161 | | | 129 | | | | | |

| Non-GAAP gross profit | $ | 31,471 | | | $ | 31,512 | | | | | |

| | | | | | | |

| GAAP gross margin | 75.1 | % | | 76.2 | % | | | | |

| Non-GAAP gross margin | 84.5 | % | | 85.4 | % | | | | |

| | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

| NON-GAAP OPERATING EXPENSE RECONCILIATION |

| (Unaudited) |

| (amounts in thousands) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| Selling and marketing | $ | 9,695 | | | $ | 9,856 | | | | | |

| Non-GAAP adjustments: | | | | | | | |

| Stock-based compensation expense | 974 | | | 820 | | | | | |

| Non-GAAP selling and marketing | $ | 8,721 | | | $ | 9,036 | | | | | |

| | | | | | | |

| Research and development | $ | 8,323 | | | $ | 8,874 | | | | | |

| Non-GAAP adjustments: | | | | | | | |

| Stock-based compensation expense | 1,124 | | | 1,041 | | | | | |

| Non-GAAP research and development | $ | 7,199 | | | $ | 7,833 | | | | | |

| | | | | | | |

| General and administrative | $ | 11,901 | | | $ | 15,538 | | | | | |

| Non-GAAP adjustments: | | | | | | | |

| Stock-based compensation expense | 2,206 | | | 1,440 | | | | | |

Litigation and other legal costs(1) | 233 | | | 2,169 | | | | | |

| Executive transition costs | 494 | | | 209 | | | | | |

| Non-recurring audit fees | 867 | | | 1,638 | | | | | |

Enterprise risk, portfolio positioning and other related costs(2) | — | | | 996 | | | | | |

| Non-GAAP general and administrative | $ | 8,101 | | | $ | 9,086 | | | | | |

| | | | | | | |

| Total Non-GAAP operating expense | $ | 24,021 | | | $ | 25,955 | | | | | |

(1)During the three month periods ended December 31, 2024 and 2023, our legal team used third party legal experts to perform and provide advice regarding a variety of activities including intellectual property litigation matters and risk analysis and in providing support for customers in their litigation, matters and options related to getting our SEC filings current, the process for a potential delisting from the Nasdaq Capital Market, ongoing litigation support, and various other projects.

(2)During the three months ended December 31, 2023, we used three third party experts to evaluate our product portfolio positioning, competitive landscape, enterprise risk and other related analyses.

| | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

| GAAP NET INCOME TO ADJUSTED EBITDA RECONCILIATION |

| (Unaudited) |

| (amounts in thousands) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| GAAP net income (loss) | $ | (4,612) | | | $ | (5,793) | | | | | |

| Add: | | | | | | | |

| Income tax (benefit) provision | (297) | | | (1,744) | | | | | |

| Other (income) expense, net | (563) | | | (1,642) | | | | | |

| Interest Expense | 2,398 | | | 2,263 | | | | | |

| GAAP operating income (loss) | $ | (3,074) | | | $ | (6,916) | | | | | |

| | | | | | | |

| Non-GAAP Adjustments | | | | | | | |

| Depreciation and amortization | $ | 395 | | | $ | 391 | | | | | |

| Amortization of intangibles | 3,657 | | | 3,848 | | | | | |

| Net changes in estimated fair value of acquisition-related contingent consideration | — | | | 136 | | | | | |

Litigation and other legal costs(1) | 233 | | | 2,169 | | | | | |

| Executive transition costs | 494 | | | 209 | | | | | |

| Stock-based compensation expense | 4,465 | | | 3,430 | | | | | |

| Non-recurring audit fees | 867 | | | 1,638 | | | | | |

Enterprise risk, portfolio positioning and other related costs(2) | — | | | 996 | | | | | |

Restructuring costs(3) | 808 | | | 48 | | | | | |

| Adjusted EBITDA | $ | 7,845 | | | $ | 5,949 | | | | | |

Total revenue | $ | 37,254 | | | $ | 36,917 | | | | | |

Adjusted EBITDA margin | 21 | % | | 16 | % | | | | |

(1)During the three month periods ended December 31, 2024 and 2023, our legal team used third party legal experts to perform and provide advice regarding a variety of activities including intellectual property litigation matters and risk analysis and in providing support for customers in their litigation, matters and options related to getting our SEC filings current, the process for a potential delisting from the Nasdaq Capital Market, ongoing litigation support, and various other projects.

(2)During the three months ended December 31, 2023, we used three third party experts to evaluate our product portfolio positioning, competitive landscape, enterprise risk and other related analyses.

(3)Restructuring costs consist of employee severance obligations and other related costs. Restructuring costs were $0.8 million in the three months ended December 31, 2024 and were related to expenses incurred to relocate employees and a restructuring that occurred in the first quarter of fiscal 2025. Restructuring costs were $48,000 in the three months ended December 31, 2023.

| | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

| NON-GAAP NET INCOME RECONCILIATION |

| (Unaudited) |

| (amounts in thousands except per share data) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| Net income (loss) | $ | (4,612) | | | $ | (5,793) | | | | | |

| Non-GAAP adjustments: | | | | | | | |

Amortization of acquisition-related intangibles(1) | 3,657 | | | 3,848 | | | | | |

Net changes in estimated fair value of acquisition-related contingent consideration(1) | — | | | 136 | | | | | |

Litigation and other legal costs(2) | 233 | | | 2,169 | | | | | |

| | | | | | | |

| | | | | | | |

| Executive transition costs | 494 | | | 209 | | | | | |

| Stock-based compensation expense | 4,465 | | | 3,430 | | | | | |

| Non-recurring audit fees | 867 | | | 1,638 | | | | | |

Enterprise risk, portfolio positioning and other related costs(3) | — | | | 996 | | | | | |

Restructuring costs(4) | 808 | | | 48 | | | | | |

| Amortization of debt discount and issuance costs | 2,147 | | | 1,970 | | | | | |

| Income tax effect of pre-tax adjustments | (1,919) | | | (2,967) | | | | | |

| | | | | | | |

Cash tax difference(5) | 493 | | | 641 | | | | | |

| Non-GAAP net income | $ | 6,633 | | | $ | 6,325 | | | | | |

| Non-GAAP income per share—basic | $ | 0.15 | | | $ | 0.14 | | | | | |

| Non-GAAP income per share—diluted | $ | 0.15 | | | $ | 0.14 | | | | | |

| Shares used in calculating non-GAAP net income per share—basic | 45,195 | | | 46,294 | | | | | |

| Shares used in calculating non-GAAP net income per share—diluted | 45,195 | | | 46,294 | | | | | |

(1)December 31, 2023 amounts reflect reclassifications to conform to the current year presentation.

(2)During the three month periods ended December 31, 2024 and 2023, our legal team used third party legal experts to perform and provide advice regarding a variety of activities including intellectual property litigation matters and risk analysis and in providing support for customers in their litigation, matters and options related to getting our SEC filings current, the process for a potential delisting from the Nasdaq Capital Market, ongoing litigation support, and various other projects.

(3)During the three months ended December 31, 2023, we used three third party experts to evaluate our product portfolio positioning, competitive landscape, enterprise risk and other related analyses.

(4)Restructuring costs consist of employee severance obligations and other related costs. Restructuring costs were $0.8 million in the three months ended December 31, 2024 and were related to expenses incurred to relocate employees and a restructuring that occurred in the first quarter of fiscal 2025. Restructuring costs were $48,000 in the three months ended December 31, 2023.

(5)The Company’s non-GAAP net income is calculated using a cash tax rate of 15% in fiscal 2025 and 9% in fiscal 2024. The estimated cash tax rate is the estimated annual tax payable on the Company’s tax returns as a percentage of estimated annual non-GAAP pre-tax net income. The Company uses an estimated cash tax rate to adjust for the historical variation in the effective book tax rate associated with the reversal of valuation allowances, and the utilization of research and development tax credits which currently have an overall effect of reducing taxes payable. The Company believes that the cash tax rate provides a more transparent view of the Company’s operating results. The Company’s effective tax rate used for the purposes of calculating GAAP net income for fiscal 2025 and 2024 was 6% and 23%, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MITEK SYSTEMS, INC. |

NON-GAAP FREE CASH FLOW RECONCILIATION |

| (Unaudited) |

| (amounts in thousands) |

| Three months ended | | Twelve months ended December 31, 2024 |

| March 31, 2024 | | June 30, 2024 | | September 30, 2024 | | December 31, 2024 | |

| Net cash provided by (used in) operating activities | $ | 7,064 | | | $ | 12,985 | | | $ | 21,102 | | | $ | 565 | | | $ | 41,716 | |

| Less: | | | | | | | | | |

| Purchases of property and equipment, net | (483) | | | (431) | | | (283) | | | (335) | | | (1,532) | |

| Free Cash Flow | $ | 6,581 | | | $ | 12,554 | | | $ | 20,819 | | | $ | 230 | | | $ | 40,184 | |

| | | | | | | | | |

| Three months ended | | Twelve months ended December 31, 2023 |

| March 31, 2023 | | June 30, 2023 | | September 30, 2023 | | December 31, 2023 | |

| Net cash provided by (used in) operating activities | $ | 6,301 | | | $ | 16,552 | | | $ | 3,473 | | | $ | (9,463) | | | $ | 16,863 | |

| Less: | | | | | | | | | |

| Purchases of property and equipment, net | (218) | | | (284) | | | (378) | | | (241) | | | (1,121) | |

| Free Cash Flow | $ | 6,083 | | | $ | 16,268 | | | $ | 3,095 | | | $ | (9,704) | | | $ | 15,742 | |

| | | | | | | | | | | | | | | |

|

| STOCK-BASED COMPENSATION EXPENSE |

| (Unaudited) |

| (amounts in thousands) |

| | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | | | |

| Cost of revenue | $ | 161 | | $ | 129 | | | | |

| Selling and marketing | 974 | | 820 | | | | |

| Research and development | 1,124 | | 1,041 | | | | |

| General and administrative | 2,206 | | 1,440 | | | | |

| Total stock-based compensation expense | $ | 4,465 | | $ | 3,430 | | | | |

v3.25.0.1

Cover

|

Feb. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 10, 2025

|

| Registrant Name |

MITEK SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35231

|

| Entity Tax Identification Number |

87-0418827

|

| Entity Address, Address Line One |

770 First Avenue, Suite 425

|

| Entity Address, Postal Zip Code |

92101

|

| Entity Address, State or Province |

CA

|

| Entity Address, City or Town |

San Diego,

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MITK

|

| City Area Code |

619

|

| Local Phone Number |

269-6800

|

| Entity Emerging Growth Company |

false

|

| Central Index Key |

0000807863

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

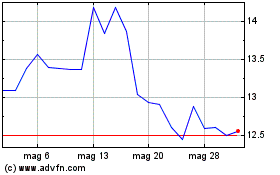

Grafico Azioni Mitek Systems (NASDAQ:MITK)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Mitek Systems (NASDAQ:MITK)

Storico

Da Feb 2024 a Feb 2025