Raises Lower-End of Adjusted EBITDA Margin

Guidance Range for Fiscal 2025

Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek”

or the “Company”), a global leader in digital identity

verification, mobile capture and fraud management, today reported

financial results for its first quarter ended December 31, 2024 and

raised the lower end of its Adjusted EBITDA margin guidance range

for its fiscal 2025 full year ending September 30, 2025 (“fiscal

2025”).

“We delivered a solid first quarter, with results ahead of our

expectations in our SaaS products, which grew 29% year over year,

offset by year-over-year variances in software license sales,” said

Ed West, Mitek’s CEO. “We are encouraged by the performance of our

Identity product portfolio, the continued resilience of our Deposit

solutions, and the accelerating momentum of our fraud offerings.

Our cultural and technological integration efforts are now well

underway, which we believe are strengthening the company’s

foundation for durable, profitable revenue growth in fiscal 2026

and beyond.”

Fiscal 2025 First Quarter Financial Highlights

GAAP

- Revenue of $37.3 million was relatively flat

year-over-year, compared to $36.9 million a year ago.

- Gross profit of $28.0 million was relatively flat

year-over-year, compared to $28.1 million a year ago.

- GAAP gross profit margin was 75.1%, compared to 76.2% a

year ago.

- GAAP net loss was $4.6 million, compared to a GAAP net

loss of $5.8 million a year ago.

- GAAP net loss per diluted share was $0.10, compared to a

GAAP net loss of $0.13 a year ago.

- Total cash and investments was $137.9 million at

December 31, 2024, a decrease of $3.9 million from $141.8 million

at September 30, 2024.

- Mitek repurchased 0.4 million shares at an average per

share price of $8.99, totaling approximately $3.3 million.

Non-GAAP

- Non-GAAP gross profit was flat at $31.5 million for both

periods.

- Non-GAAP gross profit margin was 84.5%, compared to

85.4% a year ago.

- Adjusted EBITDA was $7.8 million, compared to $5.9

million a year ago.

- Adjusted EBITDA margin was 21%, compared to 16% a year

ago.

- Non-GAAP net income was $6.6 million, compared to $6.3

million a year ago.

- Non-GAAP net income per diluted share was $0.15,

compared to $0.14 a year ago.

- Free cash flow was $0.2 million, compared to negative

$9.7 million a year ago, and was $40.2 million for the twelve

months ended December 31, 2024, compared to $15.7 million for the

corresponding period a year ago.

Fiscal 2025 Full Year Guidance

Mitek is updating its guidance for its fiscal 2025 year ending

September 30, 2025, as follows:

- Mitek is maintaining its fiscal 2025 full-year revenue guidance

of between $170 million and $180 million.

- Mitek is raising the lower end of its fiscal 2025 full-year

adjusted EBITDA margin guidance by 100 basis points, resulting in a

new guidance range of 25%-28%.

Conference Call Information

Mitek management will host a conference call and live webcast

for analysts and investors today at 2:00 p.m. Pacific Time (5:00

p.m. Eastern Time) to discuss the Company’s financial results for

its fiscal 2025 first quarter. To access the live call, dial

844-481-3005 (US and Canada) or +1 412-317-1889 (International) and

ask to be joined to the Mitek call. A live and archived conference

call webcast will also be accessible on the Investor Relations

section of the Company’s website at www.miteksystems.com. A phone

replay will be available approximately two hours after the end of

the call and will remain available for one week. The phone call

replay can be accessed by dialing 877-344-7529 (US or Canada) or +1

412-317-0088 (International) and entering the passcode:

9576188.

About Mitek Systems, Inc.

Mitek (NASDAQ: MITK) is a global leader in digital access,

founded to bridge the physical and digital worlds. Mitek’s advanced

identity verification technologies and global platform make digital

access faster and more secure than ever, providing companies new

levels of control, deployment ease and operation, while protecting

the entire customer journey. With solutions trusted by 7,900

organizations around the world, including the majority of North

American financial institutions which rely on our mobile check

deposit solutions, Mitek helps companies reduce risk and meet

regulatory requirements. Learn more at www.miteksystems.com.

[(MITK-F)]

Follow Mitek on LinkedIn and YouTube, and read Mitek’s latest

blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the

Company or its management’s intentions, hopes, beliefs,

expectations or predictions of the future, including, but not

limited to, statements relating to the Company’s fiscal 2025

guidance, are forward-looking statements. Such forward-looking

statements are subject to a number of risks and uncertainties,

including, but not limited to, risks related to the Company’s

ability to withstand negative conditions in the global economy, a

lack of demand for or market acceptance of the Company’s products,

the impact of the Company’s acquisition of HooYu Ltd. including any

operational or cultural difficulties associated with the

integration of the businesses of Mitek and HooYu Ltd., the

Company’s ability to continue to develop, produce and introduce

innovative new products in a timely manner, the Company’s ability

to capitalize on a growing market, quarterly variations in revenue,

the profitability of certain sectors of the Company, the

performance of the Company’s growth initiatives, the outcome of any

pending or threatened litigation or investigation, and the timing

of the implementation and launch of the Company’s products by the

Company’s signed customers.

Additional risks and uncertainties faced by the Company are

contained from time to time in the Company’s filings with the U.S.

Securities and Exchange Commission (SEC), including, but not

limited to, the Company’s Annual Report on Form 10-K for the fiscal

year ended September 30, 2024, as filed with the SEC on December

16, 2024 and its quarterly reports on Form 10-Q and current reports

on Form 8-K, which you may obtain for free on the SEC’s website at

www.sec.gov. Collectively, these risks and uncertainties could

cause the Company’s actual results to differ materially from those

projected in its forward-looking statements and you are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The Company disclaims any

intention or obligation to update, amend or clarify these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted

accounting principles (“GAAP”) financial measures for non-GAAP cost

of revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP

net income, non-GAAP net income per share, non-GAAP operating

income, non-GAAP operating margin, adjusted EBITDA, adjusted EBITDA

margin and non-GAAP operating expense that exclude

acquisition-related costs and expenses, litigation and other legal

costs, executive transition costs, stock compensation expense,

non-recurring audit fees, enterprise risk, portfolio positioning

and other related costs, restructuring costs and amortization of

debt discount and issuance costs. These financial measures are not

calculated in accordance with GAAP and are not based on any

comprehensive set of accounting rules or principles. In evaluating

the Company’s performance, management uses certain non-GAAP

financial measures to supplement financial statements prepared

under GAAP. Management believes these non-GAAP financial measures

provide a useful measure of the Company’s operating results, a

meaningful comparison with historical results and with the results

of other companies, and insight into the Company’s ongoing

operating performance. Further, management and the Board of

Directors of the Company utilize these non-GAAP financial measures

to gain a better understanding of the Company’s comparative

operating performance from period-to-period and as a basis for

planning and forecasting future periods. Management believes these

non-GAAP financial measures, when read in conjunction with the

Company’s GAAP financial statements, are useful to investors

because they provide a basis for meaningful period-to-period

comparisons of the Company’s ongoing operating results, including

results of operations against investor and analyst financial

models, which helps identify trends in the Company’s underlying

business and provides a better understanding of how management

plans and measures the Company’s underlying business.

The Company has not provided a reconciliation of its forward

outlook for non-GAAP operating margin with its forward-looking GAAP

operating margin in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company

is unable, without unreasonable efforts, to quantify share-based

compensation expense, which is excluded from our non-GAAP operating

margin, as it requires additional inputs such as the number of

shares granted and market prices that are not ascertainable due to

the volatility of the Company’s share price. Additionally, a

significant portion of the Company’s operations are in foreign

countries and the transactional currencies are primarily Euros and

British pound sterling and the Company is not able to predict

fluctuations in those currencies without unreasonable efforts. The

Company expects these items may have a potentially significant

impact on future GAAP financial results.

We define free cash flow as net cash provided by operating

activities, less cash used for purchases of property and equipment.

We define free cash flow margin as free cash flow as a percentage

of revenue. In addition to the reasons stated above, we believe

that free cash flow is useful to investors as a liquidity measure

because it measures our ability to generate or use cash in excess

of our capital investments in property and equipment in order to

enhance the strength of our balance sheet and further invest in our

business and potential strategic initiatives. A limitation of the

utility of free cash flow as a measure of our liquidity is that it

does not represent the total increase or decrease in our cash

balance for the period. We use free cash flow in conjunction with

traditional U.S. GAAP measures as part of our overall assessment of

our liquidity, including the preparation of our annual operating

budget and quarterly forecasts and to evaluate the effectiveness of

our business strategies. There are a number of limitations related

to the use of free cash flow as compared to net cash provided by

operating activities, including that free cash flow includes

capital expenditures, the benefits of which are realized in periods

subsequent to those when expenditures are made. We may refer to

certain financial metrics on a Last Twelve Months (“LTM”) basis.

LTM figures represent the sum of the most recently reported four

fiscal quarters and are used to provide a view of the company's

financial performance over the past year.

Mitek encourages investors to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures,

which it includes in press releases announcing quarterly financial

results, including this press release, and not to rely on any

single financial measure to evaluate Mitek’s business.

MITEK SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended December

31,

2024

2023

Revenue

Software and hardware

$

11,985

$

15,980

Services and other

25,269

20,937

Total revenue

37,254

36,917

Operating costs and expenses

Cost of revenue—software and hardware

(exclusive of depreciation & amortization)

67

40

Cost of revenue—services and other

(exclusive of depreciation & amortization)

5,877

5,494

Selling and marketing

9,695

9,856

Research and development

8,323

8,874

General and administrative

11,901

15,538

Amortization and acquisition-related

costs

3,657

3,983

Restructuring costs

808

48

Total operating costs and expenses

40,328

43,833

Operating income (loss)

(3,074

)

(6,916

)

Interest expense

2,398

2,263

Other income (expense), net

563

1,642

Income (loss) before income taxes

(4,909

)

(7,537

)

Income tax benefit (provision)

297

1,744

Net income (loss)

$

(4,612

)

$

(5,793

)

Net income (loss) per share—basic

$

(0.10

)

$

(0.13

)

Net income (loss) per share—diluted

$

(0.10

)

$

(0.13

)

Shares used in calculating net loss per

share—basic and diluted

45,195

46,294

Shares used in calculating net loss per

share—diluted

45,195

46,294

MITEK SYSTEMS, INC.

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(amounts in thousands except

share data)

December 31, 2024

September 30, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

90,617

$

93,456

Short-term investments

30,591

36,884

Accounts receivable, net

32,348

31,682

Contract assets, current portion

15,588

15,818

Prepaid expenses

5,054

4,514

Other current assets

2,639

2,697

Total current assets

176,837

185,051

Long-term investments

16,667

11,410

Property and equipment, net

2,418

2,564

Right-of-use assets

2,653

4,662

Goodwill and intangible assets

172,508

185,711

Deferred income tax assets

19,272

19,145

Contract assets, non-current portion

3,897

3,620

Other non-current assets

1,707

1,590

Total assets

$

395,959

$

413,753

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

4,983

$

7,236

Accrued payroll and related taxes

7,544

10,324

Accrued liabilities

508

424

Accrued interest payable

498

205

Value added tax payables

1,768

1,222

Deferred revenue, current portion

21,694

21,231

Lease liabilities, current portion

639

805

Other current liabilities

912

700

Total current liabilities

38,546

42,147

Convertible senior notes

145,706

143,601

Deferred revenue, non-current portion

692

753

Lease liabilities, non-current portion

2,317

4,230

Deferred income tax liabilities

3,642

3,889

Other non-current liabilities

4,139

4,332

Total liabilities

195,042

198,952

Stockholders’ equity:

Preferred stock, $0.001 par value,

1,000,000 shares authorized, none issued and outstanding

—

—

Common stock, $0.001 par value,

120,000,000 shares authorized, 45,211,865 and 44,998,939 issued and

outstanding, as of December 31, 2024 and September 30, 2024,

respectively

45

45

Additional paid-in capital

251,967

247,326

Accumulated other comprehensive loss

(12,950

)

(2,302

)

Accumulated deficit

(38,145

)

(30,268

)

Total stockholders’ equity

200,917

214,801

Total liabilities and stockholders’

equity

$

395,959

$

413,753

MITEK SYSTEMS, INC.

DISAGGREGATION OF REVENUE BY

PRODUCT AND TYPE

(Unaudited)

(amounts in thousands)

Three Months Ended December

31,

2024

2023

Deposits

Deposits software and hardware

Software

$

11,097

$

14,048

Hardware

—

—

Total deposits software and hardware

11,097

14,048

Deposits services

SaaS

2,221

1,355

Maintenance

5,685

5,495

Professional services and other

282

179

Total deposits services

8,188

7,029

Total deposits revenue

$

19,285

$

21,077

Identity

Identity software and hardware

Software

$

888

$

1,913

Hardware

—

19

Total identity software and hardware

888

1,932

Identity services

SaaS

16,207

12,898

Maintenance

425

600

Professional services and other

449

410

Total identity services

17,081

13,908

Total identity revenue

$

17,969

$

15,840

Consolidated results

Total software and hardware

Software

$

11,985

$

15,961

Hardware

—

19

Total software and hardware

11,985

15,980

Total services

SaaS

18,428

14,253

Maintenance

6,110

6,095

Professional services and other

731

589

Total services

25,269

20,937

Total revenue

$

37,254

$

36,917

MITEK SYSTEMS, INC.

NON-GAAP GROSS PROFIT

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended December

31,

2024

2023

Software and hardware

Revenue

$

11,985

$

15,980

Cost of revenue (exclusive of depreciation

and amortization)

67

40

Depreciation and amortization

1,190

1,136

GAAP gross profit for software and

hardware

10,728

14,804

Depreciation and amortization

1,190

1,136

Non-GAAP gross profit for software and

hardware

$

11,918

$

15,940

GAAP gross margin for software and

hardware

89.5

%

92.6

%

Non-GAAP gross margin for software and

hardware

99.4

%

99.7

%

Services and other

Services and other revenue

$

25,269

$

20,937

Cost of revenue (exclusive of depreciation

and amortization)

5,877

5,494

Depreciation and amortization

2,131

2,106

GAAP gross profit for services and

other

17,261

13,337

Depreciation and amortization

2,131

2,106

Stock-based compensation expense

161

129

Non-GAAP gross profit for services and

other

$

19,553

$

15,572

GAAP gross margin for services and

other

68.3

%

63.7

%

Non-GAAP gross margin for services and

other

77.4

%

74.4

%

Consolidated results

Total revenue

$

37,254

$

36,917

Cost of revenue (exclusive of depreciation

and amortization)

5,944

5,534

Depreciation and amortization

3,321

3,242

GAAP gross profit

27,989

28,141

Depreciation and amortization

3,321

3,242

Stock-based compensation expense

161

129

Non-GAAP gross profit

$

31,471

$

31,512

GAAP gross margin

75.1

%

76.2

%

Non-GAAP gross margin

84.5

%

85.4

%

MITEK SYSTEMS, INC.

NON-GAAP OPERATING EXPENSE

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended December

31,

2024

2023

Selling and marketing

$

9,695

$

9,856

Non-GAAP adjustments:

Stock-based compensation expense

974

820

Non-GAAP selling and marketing

$

8,721

$

9,036

Research and development

$

8,323

$

8,874

Non-GAAP adjustments:

Stock-based compensation expense

1,124

1,041

Non-GAAP research and

development

$

7,199

$

7,833

General and administrative

$

11,901

$

15,538

Non-GAAP adjustments:

Stock-based compensation expense

2,206

1,440

Litigation and other legal costs(1)

233

2,169

Executive transition costs

494

209

Non-recurring audit fees

867

1,638

Enterprise risk, portfolio positioning and

other related costs(2)

—

996

Non-GAAP general and

administrative

$

8,101

$

9,086

Total Non-GAAP operating

expense

$

24,021

$

25,955

(1)

During the three month periods ended December 31, 2024 and 2023,

our legal team used third party legal experts to perform and

provide advice regarding a variety of activities including

intellectual property litigation matters and risk analysis and in

providing support for customers in their litigation, matters and

options related to getting our SEC filings current, the process for

a potential delisting from the Nasdaq Capital Market, ongoing

litigation support, and various other projects.

(2)

During the three months ended December 31, 2023, we used three

third party experts to evaluate our product portfolio positioning,

competitive landscape, enterprise risk and other related

analyses.

MITEK SYSTEMS, INC.

GAAP NET INCOME TO ADJUSTED

EBITDA RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended December

31,

2024

2023

GAAP net income (loss)

$

(4,612

)

$

(5,793

)

Add:

Income tax (benefit) provision

(297

)

(1,744

)

Other (income) expense, net

(563

)

(1,642

)

Interest Expense

2,398

2,263

GAAP operating income (loss)

$

(3,074

)

$

(6,916

)

Non-GAAP Adjustments

Depreciation and amortization

$

395

$

391

Amortization of intangibles

3,657

3,848

Net changes in estimated fair value of

acquisition-related contingent consideration

—

136

Litigation and other legal costs(1)

233

2,169

Executive transition costs

494

209

Stock-based compensation expense

4,465

3,430

Non-recurring audit fees

867

1,638

Enterprise risk, portfolio positioning and

other related costs(2)

—

996

Restructuring costs(3)

808

48

Adjusted EBITDA

$

7,845

$

5,949

Total revenue

$

37,254

$

36,917

Adjusted EBITDA margin

21

%

16

%

(1)

During the three month periods ended December 31, 2024 and 2023,

our legal team used third party legal experts to perform and

provide advice regarding a variety of activities including

intellectual property litigation matters and risk analysis and in

providing support for customers in their litigation, matters and

options related to getting our SEC filings current, the process for

a potential delisting from the Nasdaq Capital Market, ongoing

litigation support, and various other projects.

(2)

During the three months ended December 31, 2023, we used three

third party experts to evaluate our product portfolio positioning,

competitive landscape, enterprise risk and other related

analyses.

(3)

Restructuring costs consist of employee severance obligations

and other related costs. Restructuring costs were $0.8 million in

the three months ended December 31, 2024 and were related to

expenses incurred to relocate employees and a restructuring that

occurred in the first quarter of fiscal 2025. Restructuring costs

were $48,000 in the three months ended December 31, 2023.

MITEK SYSTEMS, INC.

NON-GAAP NET INCOME

RECONCILIATION

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended December

31,

2024

2023

Net income (loss)

$

(4,612

)

$

(5,793

)

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles(1)

3,657

3,848

Net changes in estimated fair value of

acquisition-related contingent consideration(1)

—

136

Litigation and other legal costs(2)

233

2,169

Executive transition costs

494

209

Stock-based compensation expense

4,465

3,430

Non-recurring audit fees

867

1,638

Enterprise risk, portfolio positioning and

other related costs(3)

—

996

Restructuring costs(4)

808

48

Amortization of debt discount and issuance

costs

2,147

1,970

Income tax effect of pre-tax

adjustments

(1,919

)

(2,967

)

Cash tax difference(5)

493

641

Non-GAAP net income

$

6,633

$

6,325

Non-GAAP income per share—basic

$

0.15

$

0.14

Non-GAAP income per

share—diluted

$

0.15

$

0.14

Shares used in calculating non-GAAP net

income per share—basic

45,195

46,294

Shares used in calculating non-GAAP net

income per share—diluted

45,195

46,294

(1)

December 31, 2023 amounts reflect reclassifications to conform

to the current year presentation.

(2)

During the three month periods ended December 31, 2024 and 2023,

our legal team used third party legal experts to perform and

provide advice regarding a variety of activities including

intellectual property litigation matters and risk analysis and in

providing support for customers in their litigation, matters and

options related to getting our SEC filings current, the process for

a potential delisting from the Nasdaq Capital Market, ongoing

litigation support, and various other projects.

(3)

During the three months ended December 31, 2023, we used three

third party experts to evaluate our product portfolio positioning,

competitive landscape, enterprise risk and other related

analyses.

(4)

Restructuring costs consist of employee severance obligations

and other related costs. Restructuring costs were $0.8 million in

the three months ended December 31, 2024 and were related to

expenses incurred to relocate employees and a restructuring that

occurred in the first quarter of fiscal 2025. Restructuring costs

were $48,000 in the three months ended December 31, 2023.

(5)

The Company’s non-GAAP net income is calculated using a cash tax

rate of 15% in fiscal 2025 and 9% in fiscal 2024. The estimated

cash tax rate is the estimated annual tax payable on the Company’s

tax returns as a percentage of estimated annual non-GAAP pre-tax

net income. The Company uses an estimated cash tax rate to adjust

for the historical variation in the effective book tax rate

associated with the reversal of valuation allowances, and the

utilization of research and development tax credits which currently

have an overall effect of reducing taxes payable. The Company

believes that the cash tax rate provides a more transparent view of

the Company’s operating results. The Company’s effective tax rate

used for the purposes of calculating GAAP net income for fiscal

2025 and 2024 was 6% and 23%, respectively.

MITEK SYSTEMS, INC.

NON-GAAP FREE CASH FLOW

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three months ended

Twelve months ended December

31, 2024

March 31, 2024

June 30, 2024

September 30, 2024

December 31, 2024

Net cash provided by (used in)

operating activities

$

7,064

$

12,985

$

21,102

$

565

$

41,716

Less:

Purchases of property and equipment,

net

(483

)

(431

)

(283

)

(335

)

(1,532

)

Free Cash Flow

$

6,581

$

12,554

$

20,819

$

230

$

40,184

Three months ended

Twelve months ended December

31, 2023

March 31, 2023

June 30, 2023

September 30, 2023

December 31, 2023

Net cash provided by (used in)

operating activities

$

6,301

$

16,552

$

3,473

$

(9,463

)

$

16,863

Less:

Purchases of property and equipment,

net

(218

)

(284

)

(378

)

(241

)

(1,121

)

Free Cash Flow

$

6,083

$

16,268

$

3,095

$

(9,704

)

$

15,742

STOCK-BASED COMPENSATION

EXPENSE

(Unaudited)

(amounts in thousands)

Three Months Ended December

31,

2024

2023

Cost of revenue

$

161

$

129

Selling and marketing

974

820

Research and development

1,124

1,041

General and administrative

2,206

1,440

Total stock-based compensation

expense

$

4,465

$

3,430

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210278856/en/

Investor Contact: Todd Kehrli or Jim Byers

PondelWilkinson, Inc. tkehrli@pondel.com jbyers@pondel.com

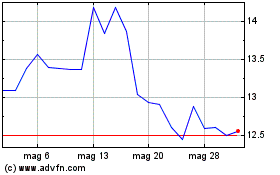

Grafico Azioni Mitek Systems (NASDAQ:MITK)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Mitek Systems (NASDAQ:MITK)

Storico

Da Feb 2024 a Feb 2025