|

Main Post Office,

P.O. Box 751 |

www.asyousow.org |

Berkeley,

CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: Microsoft Corp

Name of persons relying on exemption: As You Sow®

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

Microsoft Corp (MSFT)

Vote Yes: Item #7 – Report on the Risks of Advanced Technology for Oil and Gas Extraction

Annual Meeting: December 10, 2024

CONTACT: Parker Caswell | pcaswell@asyousow.org

SUMMARY

Immediate and sustained reductions in greenhouse gas (“GHG”)

emissions are required to keep the Paris goal within reach and stave off the most dire economic consequences of climate change.1

Emissions from the combustion of fossil fuels are responsible for three-quarters of global GHG emissions,2 and the International

Energy Agency reports that “no new long lead-time conventional oil and gas projects are required” to meet global energy demand

in a 1.5°C compatible energy transition scenario.3 These findings are reflected in the most recent United Nations Conference

of Parties (COP28) global stocktake, which unambiguously called for a “just, orderly, and equitable” transition away from

fossil fuels.4

Microsoft (“the Company”) identifies itself as a “first

mover” on climate change, asserting that the Company “advocate[s] for the expansion of clean energy solutions around the world.”5

Despite this public-facing positioning and stated commitments, Microsoft has identified fossil fuels as the top growth opportunity for

its artificial intelligence (“AI”), machine learning (“ML”), and cloud computing (collectively “advanced

technology”) services.6,7,8 Reporting by the Atlantic indicates that Microsoft’s partnerships with the fossil fuel

industry “could represent a market opportunity of $35 billion to $75 billion annually” in the coming years.9 Although

Microsoft suggests it limits its advanced technology partnerships to energy companies “who have publicly committed to net zero carbon

targets,”10 the Company does not identify any credible external standard used to evaluate the net zero claims of its

partners. This gap in Microsoft’s policy has left the Company with multiple partnerships with energy companies that lack credible

net zero commitments.11

_____________________________

1 https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_FullVolume.pdf%20

p.20-21

2 https://www.un.org/en/climatechange/science/causes-effects-climate-change

3 https://www.iea.org/reports/the-oil-and-gas-industry-in-net-zero-transitions/executive-summary

4 https://unfccc.int/sites/default/files/resource/cma2023_L17_adv.pdf

p.5

5 https://query.prod.cms.rt.microsoft.com/cms/api/am/binary/RW1lMjE

p.10

6 https://novilabs.com/wp-content/uploads/2020/02/Barclays_Frac-to-the-Future-Oils-Digital-Rebirth_01152020.pdf

p.10

7 https://www.kimberliteresearch.com/single-post/microsoft-is-the-leading-cloud-provider-for-the-oil-gas-industry-2

8 https://eu.boell.org/sites/default/files/2021-04/Artificial%20Intelligence%20and%20Climate%20Change_FINAL_14042021.pdf

p.10

9 https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/

10 https://blogs.microsoft.com/blog/2022/03/10/working-toward-a-net-zero-future-evolving-our-work-with-energy-companies/

11 https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/;

https://www.climateaction100.org/whos-involved/companies/?search_companies=schl&company_sector=All;

https://www.iigcc.org/resources/net-zero-standard-for-oil-gas

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

Despite its stated climate commitments, Microsoft’s continued

sale of advanced technology products to fossil fuel companies that lack credible net zero climate commitments exposes the Company to material,

reputational, operational, and competitive risks and contradicts the Company’s stated sustainability commitments.12

The expansion of advanced technology into fossil fuel exploration and production has been the subject of international outcry13

and has led to publicized staff resignations at Microsoft.14

By selectively reporting on the climate-positive applications of advanced

technologies15 while omitting the climate-related risks of deploying advanced technologies to increase the extraction of fossil

fuels, Microsoft is at risk of greenwashing allegations and reputational damage, further employee upheaval and significant legal consequences.

By identifying the risks associated with these technologies, reporting them to shareholders, and even offering solutions that would limit

associated harms, Microsoft can increase transparency, decrease risk, and provide investors with decision-useful information about the

Company’s exposure to material climate-related risk.

THE RESOLUTION

BE IT RESOLVED: Shareholders request that Microsoft report on

the risks to the Company of providing advanced technology, including artificial intelligence and machine learning tools, to facilitate

new oil and gas development and production.

SUPPORTING STATEMENT: The report should address, at Board

discretion: the Company’s exposure to financial, reputational, and competitive risks, including harm to employee hiring and retention

associated with Microsoft’s deployment of advanced technology to facilitate new oil and gas development and production.

RATIONALE FOR A YES

VOTE

| 1. | Microsoft’s custom advanced technology tools for fossil fuel extraction expose the Company to material financial risks. |

_____________________________

12 https://query.prod.cms.rt.microsoft.com/cms/api/am/binary/RW1lMjE

p.10

13 https://github.com/MSworkers/for.ClimateAction?tab=readme-ov-file;

https://www.globalwitness.org/en/blog/digital-drill-how-big-oil-using-ai-speed-fossil-fuel-extraction/; https://greenpeace.org/usa/reports/oil-in-the-cloud/;

https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/

14 https://grist.org/accountability/microsoft-employees-spent-years-fighting-the-tech-giants-oil-ties-now-theyre-speaking-out/

15 https://blogs.microsoft.com/on-the-issues/2023/11/16/accelerating-sustainability-ai-playbook/

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

| 2. | Microsoft’s advanced technology disclosures are insufficient and do not provide investors with decision-useful information

about the Company’s exposure to risk. |

| 3. | Microsoft lags behind peers, who have more readily addressed the risks of developing artificial intelligence (AI) and machine

learning (ML) tools for fossil fuel extraction. |

DISCUSSION

| 1. | Microsoft’s custom advanced technology tools for fossil fuel extraction expose the Company to material financial risks. |

Reputational Risk

Misalignment with stated sustainability goals, or “greenwashing”

Microsoft’s ties to fossil fuel extraction have already materially

damaged the Company’s reputation. The Company has positioned itself as a leader on climate change and has cultivated a brand image

that centers the Company as a sustainability leader, going so far as to advocate specifically for the clean energy transition.16

This positioning exacerbates the reputational risk posed by Microsoft’s misalignment with its own stated climate goals.

Many of Microsoft’s endorsements of the sustainability benefits

of AI notably fail to recognize that the fossil fuel industry is among its largest customers for Microsoft’s advanced technology

products.17 A Barclay’s report cites Microsoft as identifying the fossil fuel industry “as the #1 growth market”

for its advanced technology products.18 Research has shown that advanced technology deployment in the fossil fuel industry

has the potential to slow the energy transition by increasing the rate at which new reserves are found and produced,19 in direct

opposition to Microsoft’s claims that “the energy sector is turning to AI to accelerate the energy transition.”20

These contradictions are the subject of increasing media scrutiny,21 which risks materially damaging Microsoft’s reputation.

A September 13, 2024, investigation in The Atlantic went as far as to call out “Microsoft’s Hypocrisy on AI”

in the title, 22 while a later report accuses the Company of “secretly selling AI to fossil fuel companies while bragging

about environmental progress.”23

_____________________________

16 https://query.prod.cms.rt.microsoft.com/cms/api/am/binary/RW1lMjE

p.10

17 https://www.microsoft.com/en-us/industry/blog/energy-and-resources/2024/04/30/from-pledge-to-action-enabling-the-multidimensional-energy-transition-with-data-and-ai/;

https://www.microsoft.com/en-us/industry/blog/energy-and-resources/2024/03/13/microsoft-at-ceraweek-2024-power-a-sustainable-future-with-data-and-ai/;

https://blogs.microsoft.com/on-the-issues/2023/11/16/accelerating-sustainability-ai-playbook/

18 https://novilabs.com/wp-content/uploads/2020/02/Barclays_Frac-to-the-Future-Oils-Digital-Rebirth_01152020.pdf

p.10

19 https://eu.boell.org/sites/default/files/2021-04/Artificial%20Intelligence%20and%20Climate%20Change_FINAL_14042021.pdf

p.10

20 https://www.microsoft.com/en-us/industry/blog/energy-and-resources/2023/09/28/the-era-of-ai-transformative-ai-solutions-powering-the-energy-and-resources-industry/

21 https://grist.org/accountability/microsoft-employees-spent-years-fighting-the-tech-giants-oil-ties-now-theyre-speaking-out/;

https://coinmarketcap.com/community/articles/66e5fdef17720037214044af/

22 https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/

23 https://futurism.com/the-byte/microsoft-secret-oil-company-pitches

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

The reputational risk posed to Microsoft by growing accusations of

greenwashing goes far beyond bad press. A 2023 study by the Harvard Business Review found that perceived brand sustainability is a “critical

driver” of consumer sentiment and noted that this trend is especially strong among younger generations, who will soon own the most

purchasing power in the country.24 An earlier Harvard Business Review study sought to quantify the impacts of greenwashing

and found that the damage caused to brands by greenwashing was “economically significant.”25

Recent research has found that the prominence of greenwashing litigation

is growing worldwide and warns that companies should be prepared for increasing reputational, regulatory, and legal risks associated with

misleading statements.26 The article cites situations where “[a] statement… relates to one part of the product

or service but misleads people about the other parts or the overall impact on the environment.” This is a common issue in recent

greenwashing controversies, adding to investor concern about the risks posed by Microsoft’s one-sided and potentially misleading

claims about the positive climate impact of their advanced technology products.27 These recommendations are precisely aligned

with investor concerns regarding Microsoft’s existing disclosures regarding their advanced technology products and further emphasize

the importance of a report on the risks of developing advanced technology for fossil fuel extraction.

Operational Risk

Failure to attract or retain top talent is among the most significant

operational risks

It is widely understood that failure to attract or retain top talent

is among the largest operational risks facing companies today.28 Microsoft’s continued development of custom advanced

technology products for the fossil fuel industry has been the subject of widespread employee outcry29 and has materially damaged

the Company’s ability to hire and retain top talent. In its most recent annual report, Microsoft cites “the ability to attract

and retain talented employees” as a key driver of success. It warns that the Company’s “ability to develop and deliver

successful products and services may be adversely affected” if Microsoft “cannot retain highly skilled workers and key leaders.”30

_____________________________

24 https://hbr.org/2023/09/research-consumers-sustainability-demands-are-rising

25 https://hbr.org/2022/07/how-greenwashing-affects-the-bottom-line

26 https://corpgov.law.harvard.edu/2023/07/24/greenwashing-navigating-the-risk/

27 https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/;

https://unlocked.microsoft.com/sustainability/;

https://www.microsoft.com/en-us/research/project/reducing-ais-carbon-footprint/;

https://blogs.microsoft.com/wp-content/uploads/prod/sites/5/2023/11/Microsoft_Accelerating-Sustainability-with-AI-A-Playbook-1.pdf

28 https://www.aon.com/en/insights/reports/global-risk-management-survey/top-global-risk-4-failure-to-attract-or-retain-top-talent

29 https://github.com/MSworkers/for.ClimateAction?tab=readme-ov-file

30 https://www.sec.gov/Archives/edgar/data/789019/000095017024087843/msft-20240630.htm

p.33

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

This risk has already materialized for Microsoft, with top sustainability

talent leaving the Company over its ties to the fossil fuel industry.31 Recent departures reflect a broader trend, with sustainability

being recognized as a key indicator of employee engagement, retention, and performance.32 An IBM Institute for Business Value

survey found that 71% of employees and job seekers believed that “environmentally sustainable companies are more attractive employers”

and that “nearly half would accept a lower salary” to work for a more sustainable company, further emphasizing the importance

of sustainability for employees.33

Ongoing staff upheaval caused by Microsoft’s incomplete disclosures

regarding the risks of providing custom advanced technology products to the fossil fuel industry is a notable contributor to this crucial

operational risk. To mitigate this material risk factor, the Company should enhance its reporting on the risks of its advanced technology

partnerships with the fossil fuel industry, providing investors, employees, and the public with a clearer picture of the climate-related

risks of advanced technology products.

Reliance on fossil fuels in a low-carbon world

The Company’s growing financial reliance on oil and gas companies

that lack credible net zero commitments exposes it to a large degree of uncertainty and risk related to the changing energy system.

Microsoft has identified cloud computing and advanced technology platforms

as a vital part of the Company’s future and noted growth in these areas as a highlight of its most recent fiscal year.34

While growth in the advanced technology market presents Microsoft with unique opportunities, its deep ties to fossil fuels in this

segment also present a material set of risks. Fossil fuel applications are a key revenue driver for Microsoft’s advanced technology

segment and are projected to remain as such for the foreseeable future.35 By deepening the reliance of its advanced technology

business on fossil fuel companies without legitimate net zero transition plans, Microsoft is tying the profitability of one of its most

important growth opportunities to an industry that faces significant financial disruption in the coming decades,36 including

the potential for major losses associated with stranded assets.37

Microsoft’s use of advanced technology to “model oil and

gas reservoirs and maximize their extraction,” is directly contrary to clear warnings from International Energy Agency (“IEA”),

which identifies fossil fuel expansion projects as “very unhealthy and unwise economic risks”38 if the world is

to achieve its goal of avoiding the worst consequences of climate change. Changing market conditions, innovative new energy technologies,

and growing climate regulations around the world all present material financial risks to the fossil fuel industry, which are passed on

to Microsoft and its shareholders by the Company’s reliance on revenue from oil and gas companies in this advanced technology segment.

Shareholders deserve decision-useful information on their exposure to any material financial risk, and climate-related risks are no exception.

_____________________________

31 https://grist.org/accountability/microsoft-employees-spent-years-fighting-the-tech-giants-oil-ties-now-theyre-speaking-out/

32 https://businessleadershiptoday.com/how-important-sustainability-is-to-employees/

33 https://thecsrjournal.in/ibm-employees-work-environmentally-sustainable-companies-pandemic/

34 https://www.sec.gov/Archives/edgar/data/789019/000095017024087843/msft-20240630.htm

p.15,39

35 https://novilabs.com/wp-content/uploads/2020/02/Barclays_Frac-to-the-Future-Oils-Digital-Rebirth_01152020.pdf

p.9

36 https://www.nature.com/articles/s41558-022-01356-y

37 https://www.nature.com/articles/s41558-022-01356-y

38 https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/;

https://www.theguardian.com/environment/2023/sep/14/fossil-fuel-investment-very-unwise-economic-risk-energy-expert-fatih-birol

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

Physical and economic impacts of climate change

The global energy system must transition away from fossil fuels to

avoid the most dire economic consequences of climate change39 including a cost to the global economy of as much as $38 trillion

per year by 2049.40 Microsoft controls the largest share of the market for advanced technology in fossil fuels,41

which has been identified as a hindrance to the energy transition.42 Microsoft's partnerships with the fossil fuel industry

have the potential to slow the energy transition, increasing the effects of climate change and contributing to the growing climate-related

financial risk facing the global economy. Disruptions from the physical effects of climate change are already causing significant economic

damage,43 and Microsoft’s global business is not insulated from these growing costs. Specifically, Microsoft notes that

climate change may increase operating costs for its cloud-based services and affect the availability and cost of necessary goods and services,

plainly demonstrating the risks posed by the Company’s sale of products that may hinder global efforts to mitigate climate change.

| 2. | Microsoft’s advanced technology disclosures are insufficient and do not provide investors with decision-useful information

about the Company’s exposure to risk. |

Microsoft has a suite of disclosures about the risks of AI, namely

its Responsible AI Transparency Report, which aims to disclose the Company’s efforts to build advanced technology responsibly

and share “how we make decisions about releasing our generative applications.”44 Despite these goals, the report

does not meaningfully address Microsoft’s sale of advanced technology products to the fossil fuel industry.

The most relevant framework for identifying and addressing potential

economic or social harms from the use of Microsoft’s advanced technologies is the Company’s “sensitive use case framework,”

which is said to flag any AI development or deployment scenario that falls into one or more of three categories; “denial of

consequential services,” “risk of harm,” or “infringement on human rights.”45

However, Microsoft’s sensitive uses framework does not include environmental impacts in its considerations and fails to cover

the climate risks presented by AI sufficiently.

_____________________________

39 https://unfccc.int/sites/default/files/resource/cma2023_L17_adv.pdf

p.5, https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_FullVolume.pdf%20 p.20-21

40 https://www.nature.com/articles/s41586-024-07219-0

41 https://www.kimberliteresearch.com/single-post/microsoft-is-the-leading-cloud-provider-for-the-oil-gas-industry-2

42 https://eu.boell.org/sites/default/files/2021-04/Artificial%20Intelligence%20and%20Climate%20Change_FINAL_14042021.pdf

p.10

43 https://www.weforum.org/agenda/2023/10/climate-loss-and-damage-cost-16-million-per-hour/

44 https://query.prod.cms.rt.microsoft.com/cms/api/am/binary/RW1l5BO

p.4

45 https://www.microsoft.com/cms/api/am/binary/RE4pKH5

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

Microsoft’s partnerships with the fossil fuel industry to find

and develop new fossil fuel reserves pose a material risk to global efforts to mitigate climate change,46 which is a direct

contributor to every single one of the categories identified by the Company as sensitive use cases. For example, the physical risks of

climate change have caused a major nationwide insurance crisis. In California alone, insurance companies exiting the state have caused

almost 7% of real estate deals to fall through because buyers were unable to find affordable home insurance.47 Microsoft specifically

identifies insurance as an example of “denial of consequential services” in its sensitive use case framework.48

The World Health Organization projects that climate change will cause more than 250,00 additional deaths per year by 2050,49

a clear example of “risk of harm,” and most notably, the UN Environment Programme calls climate change “one

of the greatest threats to human rights of our generation.”50

Despite the immense evidence showing that climate change is a driver

of every single one of Microsoft’s categories for sensitive use case review, the Company has not mitigated or even sufficiently

reported on the associated risks and damages caused by its sale of advanced technology products to fossil fuel companies without credible

net zero commitments. Microsoft reports that after identifying sensitive use cases, they should be assessed and mitigated, noting that,

at times, projects have been blocked when the Company is unable to “deliver them in a way that upholds our principles.”51

In this case, Microsoft’s sensitive use case process has failed

to flag the risks its fossil fuel-related technology products pose to climate. Delaying the energy transition52 contributes

to the well-established harms of climate change and does not uphold the guiding AI principles set forth by Microsoft. This further establishes

the need for a report on the risks of the Company’s sale of advanced technology products to fossil fuel companies without credible

net zero commitments.

| 3. | Microsoft lags behind peers, who have more readily addressed the risks of developing artificial intelligence (AI) and machine learning

(ML) tools for fossil fuel extraction. |

Microsoft controls the largest portion of the market for advanced technology

fossil fuel tools.53 Yet, peers have made more significant efforts to identify and even mitigate the risks posed by selling

advanced technology products to fossil fuel companies lacking net zero commitments. Most notably, Google, one of Microsoft’s top

competitors in the advanced technology space, has publicly committed that it will not “build custom AI/ML algorithms to facilitate

upstream extraction in the oil and gas industry.”54 This commitment mitigates much of the risk posed to Google and its

shareholders from partnership with the fossil fuel industry and creates a significant gap between the environmental and economic sustainability

of Microsoft and one of its largest rivals.

_____________________________

46 https://www.kimberliteresearch.com/single-post/microsoft-is-the-leading-cloud-provider-for-the-oil-gas-industry-2;

https://eu.boell.org/sites/default/files/2021-04/Artificial%20Intelligence%20and%20Climate%20Change_FINAL_14042021.pdf

p.10

47 https://www.bankrate.com/insurance/homeowners-insurance/carriers-exit-california-home-insurance/

48 https://www.microsoft.com/cms/api/am/binary/RE4pKH5

p.11

49 https://www.who.int/news-room/fact-sheets/detail/climate-change-and-health

50 https://www.unep.org/resources/report/climate-change-and-human-rights

51 https://www.microsoft.com/cms/api/am/binary/RE4pKH5

p. 12

52 https://www.kimberliteresearch.com/single-post/microsoft-is-the-leading-cloud-provider-for-the-oil-gas-industry-2;

https://eu.boell.org/sites/default/files/2021-04/Artificial%20Intelligence%20and%20Climate%20Change_FINAL_14042021.pdf p.10

53 https://novilabs.com/wp-content/uploads/2020/02/Barclays_Frac-to-the-Future-Oils-Digital-Rebirth_01152020.pdf

p.33; https://www.kimberliteresearch.com/single-post/microsoft-is-the-leading-cloud-provider-for-the-oil-gas-industry-2

54 https://onezero.medium.com/google-says-it-will-not-build-custom-a-i-for-oil-and-gas-extraction-72d1f71f42c8

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

RESPONSE TO MICROSOFT

BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION

Contrary to the Board’s argument, Microsoft’s Energy

Principles Lack a Criteria for Evaluating “Net Zero” Partners

The Board opposes the proposal on the basis that Microsoft has published

a set of Energy Principles “specifically designed to guide the company’s work addressing [the energy transition].” The

most relevant of these principles states that "Microsoft may provide technical and engineering resources to develop or co-develop

specialized services for subsurface exploration and extraction of fossil fuels with energy customers who have publicly committed to net

zero carbon targets.” Yet, in describing its program, it states that “Specifically, this includes leveraging Microsoft

technical or engineering resources to develop or co-develop specialized subsurface exploration and extraction services for an energy

customer or providing Microsoft product or service subscriptions at no cost to energy customers who have a net zero carbon target

(covering Scope 1 and Scope 2 emissions) that is set to be attained by 2050 or sooner” (emphasis added).55

Because of this, Microsoft’s announced partnerships with both

ExxonMobil and Chevron56 technically adhere to the Energy Principals, even though neither ExxonMobil nor Chevron has a net

zero commitment that fully meets the criteria set forth by the CA100+ investor alliance’s IIGCC Net Zero Standard for Oil and Gas,57

or by Oxford Net Zero.58 Key amongst the net zero criteria set forth by both standards is the inclusion of Scope 3 emissions,59

which are known to make up as much as 80-95% of oil and gas companies' total emissions profiles.60 Because the Energy Principals

do not require enterprise-wide net zero commitments (Scope 1-3), the principles do not deliver on their intention to accelerate the energy

transition and leave shareholders exposed to material financial risks from partnerships with energy companies that lack credible net zero

commitments.

_____________________________

55 https://blogs.microsoft.com/blog/2022/03/10/working-toward-a-net-zero-future-evolving-our-work-with-energy-companies/

56 https://www.theatlantic.com/technology/archive/2024/09/microsoft-ai-oil-contracts/679804/

57 https://www.climateaction100.org/whos-involved/companies/?search_companies=schl&company_sector=All,

https://www.iigcc.org/resources/net-zero-standard-for-oil-gas

58 https://netzeroclimate.org/policies-for-net-zero/net-zero-principles/

59 https://netzeroclimate.org/policies-for-net-zero/net-zero-principles/;

https://139838633.fs1.hubspotusercontent-eu1.net/hubfs/139838633/Past%20resource%20uploads/IIGCC_Net-Zero-Standard-for-Oil-Gas_April23.pdf

60 https://www.woodmac.com/press-releases/few-oil-and-gas-companies-commit-to-scope-3-net-zero-emissions-as-significant-challenges-remain/

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

Additionally, the Board suggests they oppose the proposal because it

is outside their existing reporting frameworks. That is exactly the problem this proposal addresses. Proponents feel strongly that the

material reputational, legal, and operational risks described above are of material importance to shareholders and, therefore, warrant

transparent and forthright disclosure, regardless of whether they fall within the scope of Microsoft’s current reporting frameworks.

Microsoft’s Partnerships with Energy Companies that Lack Credible

Net Zero Commitments Contribute to Climate Risk, Impacting both Energy Security and the Developing World

The Board’s assertion that economic growth and quality of life

depend on energy is correct. Still, it fails to recognize that the world is quickly moving away from fossil fuel-based energy to renewables.

It further does not address the basis of this proposal, which is risk. Although proponents agree that energy is essential for economic

development, the World Economic Forum’s research has identified climate-related environmental impacts as the top four most

significant risks in the coming decade.61 Since climate change is the largest barrier to achieving a more just and

equitable future, the Company can satisfy its suggested commitment to the developing world by transparently reporting on the risks of

developing fossil fuel technology that will hamper global efforts to transition to a low-carbon economy.

Microsoft’s Suggested “Commitment to Sustainability”

and the Energy Transition is Put at Risk by its Use of Its Technology to Promote New Oil & Gas Development

Finally, the Board recommends against the proposal by suggesting they

are “working hard” to move the world towards a low-carbon energy system. This claim, which is also reflected in Microsoft’s

existing sustainably documents, is directly contrary to the established reality that Microsoft is the largest developer of advanced technology

for the oil and gas industry62 which may hinder the energy transition63 and increase the climate-related risk already

facing Microsoft and the global economy.

CONCLUSION

Vote “Yes” on this Shareholder Proposal #7

To provide investors with transparent and decision-useful information,

Microsoft should report on the material reputational, legal, and operational risks of developing advanced technology products for oil

and gas extraction. We urge a “yes” vote.

--

For questions, please contact Parker Caswell, As You Sow, pcaswell@asyousow.org

_____________________________

61 https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2024.pdf

p.8

62 https://www.kimberliteresearch.com/single-post/microsoft-is-the-leading-cloud-provider-for-the-oil-gas-industry-2

63 https://eu.boell.org/sites/default/files/2021-04/Artificial%20Intelligence%20and%20Climate%20Change_FINAL_14042021.pdf

p.10

|

2024

Proxy Memo

Microsoft Corp | Report on the Risks of Advanced Technology for Oil and Gas Extraction

|

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE,

U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR

MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

10

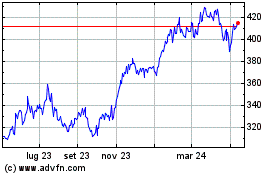

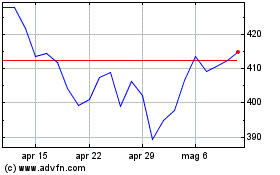

Grafico Azioni Microsoft (NASDAQ:MSFT)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Microsoft (NASDAQ:MSFT)

Storico

Da Dic 2023 a Dic 2024