Phunware, Inc. (“Phunware” or the “Company”) (NASDAQ: PHUN), a

leader in enterprise cloud solutions for mobile applications,

announces its financial results for the quarter ended September 30,

2024.

Financial Highlights

- Steady progress in reducing net loss; Net loss from continuing

operations was $2.8 million, or ($0.25) per share, for Q3 2024, as

compared to a net loss of $13.7 million, or ($5.72) per share, for

Q3 20231

- Net cash used in operating activities from continued operations

was $10.4 million for Q3 2024, as compared to $14.6 million for Q3

2023

- Year-to-date software and subscription bookings up 300% over

prior year

- Cash and cash equivalents as of September 30, 2024 was $35.5

million

- Subsequent to the end the third quarter and based on proceeds

from the Company’s use of the at-the-market (ATM) financing

facility, the Company’s cash and cash equivalents as of November 6,

2024 was approximately $110 million.

1 Based on 11.1

million weighted average shares outstanding as of September 30,

2024 and 2.4 million weighted shares outstanding as of September

30, 2023. Basic and diluted shares outstanding are the same

and all figures reflect the effectuation of a 50:1 reverse stock

split in February 2024

Recent Business Highlights

- Issued a Letter to Stockholders

- Appointed Stephen Chen as Interim CEO following the retirement

of former CEO Mike Snavely

- Appointed global technology and AI leader Rahul Mewawalla as

Chairman of the Board

- Signed a term sheet to acquire a controlling interest in

MyCanvass, LLC, which is currently indirectly majority owned and

controlled by Campaign Nucleus, a SaaS platform company founded by

Brad Parscale

Phunware Interim CEO Stephen Chen commented, “As

we look ahead, Phunware’s future direction is centered on

innovation that empowers both enterprises and public sector

entities to navigate the complexities of the digital age with

confidence and security. We are committed to helping companies and

federal agencies unlock the potential of AI in ways that support

their operational goals while safeguarding their proprietary data.

Our secure, localized AI frameworks will give our partners the

tools to apply generative AI without compromising control over

sensitive information. This approach reflects our dedication to

being a trusted ally across corporate and federal landscapes,

enabling sectors from healthcare and finance to national security

to leverage advanced capabilities that meet the highest standards

of security and compliance.

“Our expanded focus includes developing and

delivering AI-driven platforms that make real-time, on-demand

coordination and engagement accessible to organizations of all

sizes, allowing them to scale their efforts and achieve targeted

outcomes efficiently. Phunware’s commitment aligns with our broader

vision of supporting secure and transformative digital solutions

that meet the unique needs of government and corporate clients

alike. In the coming years, Phunware will continue to lead with

data integrity, operational excellence, and customer-centricity,

empowering our partners to achieve sustainable success in an era

where digital trust is paramount. Lastly, our CFO, Troy Reisner,

has made the decision step down from his position and depart

Phunware by November 30, 2024. I would like to thank Troy for his

service to Phunware and acknowledge his pivotal role in leading the

financial side of our Company, including our capital markets

programs, during his tenure and we wish him the best,” Mr. Chen

concluded.

Third Quarter 2024 Earnings Conference

Call

Phunware management will host a live conference

call today at 4:30 p.m. ET to review financial results and provide

an update on corporate developments. Following management’s formal

remarks, there will be a question-and-answer session.

To listen to the conference call, interested

parties within the U.S. should dial 1-888-506-0062 (domestic) or

973-528-0011 (international). All callers should dial in

approximately 10 minutes prior to the scheduled start time and use

Participant Access Code 704558 to be joined into the Phunware

conference call.

The conference call will also be available

through a live webcast that can be accessed at Phunware 3Q24

Earnings Webcast. A webcast earnings call replay will be

available approximately one hour after the live call until November

7, 2025 with this same weblink.

A telephonic replay of the call will be

available until November 21, 2024 by dialing 1-877-481-4010 (or

919-882-2331 for international callers) and using replay access

code 51482.

About Phunware

Phunware, Inc. (NASDAQ: PHUN) is an enterprise software company

specializing in mobile app solutions with integrated intelligent

capabilities. We provide businesses with the tools to create,

implement, and manage custom mobile applications, analytics,

digital advertising, and location-based services. Phunware is

transforming mobile engagement by delivering scalable,

personalized, and data-driven mobile app experiences.

Phunware’s mission is to achieve unparalleled connectivity and

monetization through widespread adoption of Phunware mobile

technologies, leveraging brands, consumers, partners, digital asset

holders, and market participants. Phunware is poised to expand its

software products and services audience through its new platform,

utilize and monetize its patents and other intellectual property,

and reintroduce its digital asset ecosystem for existing holders

and new market participants.

For more information on Phunware, please visit www.phunware.com.

To better understand and leverage generative AI and Phunware’s

mobile app technologies, visit https://ai.phunware.com/advocacy

Safe Harbor / Forward-Looking Statements

This press release includes forward-looking statements. All

statements other than statements of historical facts contained in

this press release, including statements regarding our future

results of operations and financial position, business strategy and

plans, and our objectives for future operations, are

forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “expose,” “intend,”

“may,” “might,” “opportunity,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar

expressions that convey uncertainty of future events or outcomes

are intended to identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. For example, Phunware is using forward-looking

statements when it discusses the proposed offering and the timing

and terms of such offering and its intended use of proceeds from

such offering should it occur.

The forward-looking statements contained in this press release

are based on our current expectations and beliefs concerning future

developments and their potential effects on us. Future developments

affecting us may not be those that we have anticipated. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control) and other assumptions that

may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described under the heading “Risk

Factors” in our filings with the SEC, including our reports on

Forms 10-K, 10-Q, 8-K and other filings that we make with the SEC

from time to time. Should one or more of these risks or

uncertainties materialize, or should any of our assumptions prove

incorrect, actual results may vary in material respects from those

projected in these forward-looking statements. We undertake no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws. These

risks and others described under “Risk Factors” in our SEC filings

may not be exhaustive.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future

performance and that our actual results of operations, financial

condition and liquidity, and developments in the industry in which

we operate may differ materially from those made in or suggested by

the forward-looking statements contained in this press release. In

addition, even if our results or operations, financial condition

and liquidity, and developments in the industry in which we operate

are consistent with the forward-looking statements contained in

this press release, those results or developments may not be

indicative of results or developments in subsequent periods.

Investor Relations Contact:

Chris Tyson, Executive Vice PresidentMZ Group - MZ North

America949-491-8235 PHUN@mzgroup.uswww.mzgroup.us

Phunware Media Contact:

Joe McGurk, Managing Director 917-259-6895PHUN@mzgroup.us

Financial Tables Follow

|

Phunware, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(In thousands, except share and per share

information) |

| |

| |

September 30, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

| Assets: |

(Unaudited) |

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

35,537 |

|

|

$ |

3,934 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $118

and $86 as of September 30, 2024 and December 31, 2023,

respectively |

|

1,078 |

|

|

|

550 |

|

|

Digital currencies |

|

19 |

|

|

|

75 |

|

|

Prepaid expenses and other current assets |

|

3,133 |

|

|

|

374 |

|

|

Current assets of discontinued operation |

|

- |

|

|

|

28 |

|

|

Total current assets |

|

39,767 |

|

|

|

4,961 |

|

|

Property and equipment, net |

|

27 |

|

|

|

40 |

|

|

Right-of-use asset |

|

943 |

|

|

|

1,451 |

|

|

Other assets |

|

276 |

|

|

|

276 |

|

| Total assets |

$ |

41,013 |

|

|

$ |

6,728 |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

4,776 |

|

|

$ |

7,836 |

|

|

Accrued expenses |

|

3,005 |

|

|

|

437 |

|

|

Lease liability |

|

339 |

|

|

|

629 |

|

|

Deferred revenue |

|

1,153 |

|

|

|

1,258 |

|

|

PhunCoin subscription payable |

|

1,202 |

|

|

|

1,202 |

|

|

Debt |

|

- |

|

|

|

4,936 |

|

|

Current liabilities of discontinued operation |

|

- |

|

|

|

205 |

|

|

Total current liabilities |

|

10,475 |

|

|

|

16,503 |

|

|

|

|

|

|

|

|

| Deferred revenue |

|

713 |

|

|

|

651 |

|

| Lease liability |

|

700 |

|

|

|

1,031 |

|

| Total liabilities |

|

11,888 |

|

|

|

18,185 |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders' equity

(deficit) |

|

|

|

|

|

|

Common stock, $0.0001 par

value; 1,000,000,000 shares

authorized; 11,748,780 shares issued

and 11,738,650 shares outstanding as of September 30,

2024; and 3,861,578 shares issued

and 3,851,448 shares outstanding as of December 31,

2023 |

|

1 |

|

|

|

- |

|

|

Treasury stock at cost; 10,130 shares as of September 30, 2024 and

December 31, 2023 |

|

(502 |

) |

|

|

(502 |

) |

|

Additional paid-in capital |

|

340,731 |

|

|

|

292,467 |

|

|

Accumulated other comprehensive loss |

|

(418 |

) |

|

|

(418 |

) |

|

Accumulated deficit |

|

(310,687 |

) |

|

|

(303,004 |

) |

|

Total stockholders' equity (deficit) |

|

29,125 |

|

|

|

(11,457 |

) |

| Total liabilities and

stockholders' equity (deficit) |

$ |

41,013 |

|

|

$ |

6,728 |

|

| |

|

|

|

|

|

|

|

|

Phunware, Inc. |

|

Condensed Consolidated Statements of Operations and

Comprehensive Loss |

|

(In thousands, except share and per share

information) |

|

(Unaudited) |

| |

| |

Three Months Ended |

|

|

Nine Months Ended |

|

| |

September 30, |

|

|

September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net revenues |

$ |

665 |

|

|

$ |

1,252 |

|

|

$ |

2,597 |

|

|

$ |

3,892 |

|

| Cost of revenues |

|

343 |

|

|

|

621 |

|

|

|

1,281 |

|

|

|

2,651 |

|

| Gross profit |

|

322 |

|

|

|

631 |

|

|

|

1,316 |

|

|

|

1,241 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

619 |

|

|

|

839 |

|

|

|

1,671 |

|

|

|

2,837 |

|

|

General and administrative |

|

2,281 |

|

|

|

2,985 |

|

|

|

7,051 |

|

|

|

11,397 |

|

|

Research and development |

|

612 |

|

|

|

1,042 |

|

|

|

1,592 |

|

|

|

4,023 |

|

|

Impairment of goodwill |

|

- |

|

|

|

9,043 |

|

|

|

- |

|

|

|

9,043 |

|

|

Total operating expenses |

|

3,512 |

|

|

|

13,909 |

|

|

|

10,314 |

|

|

|

27,300 |

|

| Operating loss |

|

(3,190 |

) |

|

|

(13,278 |

) |

|

|

(8,998 |

) |

|

|

(26,059 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(10 |

) |

|

|

(264 |

) |

|

|

(126 |

) |

|

|

(1,354 |

) |

|

Interest income |

|

381 |

|

|

|

- |

|

|

|

760 |

|

|

|

- |

|

|

Gain (loss) on extinguishment of debt |

|

- |

|

|

|

(237 |

) |

|

|

535 |

|

|

|

(237 |

) |

|

Gain on sale of digital currencies |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,310 |

|

|

Other income, net |

|

59 |

|

|

|

62 |

|

|

|

146 |

|

|

|

497 |

|

| Total other income

(expense) |

|

430 |

|

|

|

(439 |

) |

|

|

1,315 |

|

|

|

4,216 |

|

| Loss before taxes |

|

(2,760 |

) |

|

|

(13,717 |

) |

|

|

(7,683 |

) |

|

|

(21,843 |

) |

| Income tax expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net loss from continuing

operations |

|

(2,760 |

) |

|

|

(13,717 |

) |

|

|

(7,683 |

) |

|

|

(21,843 |

) |

| Net loss from discontinued

operation |

|

- |

|

|

|

(5,262 |

) |

|

|

- |

|

|

|

(7,929 |

) |

| Net loss |

|

(2,760 |

) |

|

|

(18,979 |

) |

|

|

(7,683 |

) |

|

|

(29,772 |

) |

| Other comprehensive loss

(income) |

|

|

|

|

|

|

|

|

|

|

|

| Cumulative translation

adjustment |

|

- |

|

|

|

(37 |

) |

|

|

- |

|

|

|

9 |

|

| Comprehensive loss |

$ |

(2,760 |

) |

|

$ |

(19,016 |

) |

|

$ |

(7,683 |

) |

|

$ |

(29,763 |

) |

| Net loss from continuing

operations per share, basic and diluted |

$ |

(0.25 |

) |

|

$ |

(5.72 |

) |

|

$ |

(0.88 |

) |

|

$ |

(9.98 |

) |

| Net loss from discontinued

operations per share, basic and diluted |

$ |

- |

|

|

$ |

(2.19 |

) |

|

$ |

- |

|

|

$ |

(3.62 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used

to compute net loss per share, basic and diluted |

|

11,104,174 |

|

|

|

2,398,873 |

|

|

|

8,755,908 |

|

|

|

2,188,101 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phunware, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In thousands) |

|

(Unaudited) |

| |

| |

Nine Months Ended |

|

| |

September 30, |

|

| |

2024 |

|

|

2023 |

|

| Operating

activities |

|

|

|

|

|

|

Net loss |

$ |

(7,683 |

) |

|

$ |

(29,772 |

) |

|

Net loss from discontinued operation |

|

- |

|

|

|

(7,929 |

) |

|

Net loss from continuing operations |

|

(7,683 |

) |

|

|

(21,843 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Gain on sale of digital assets |

|

- |

|

|

|

(5,310 |

) |

|

Gain (loss) on extinguishment of debt |

|

(535 |

) |

|

|

237 |

|

|

Impairment of goodwill |

|

- |

|

|

|

9,043 |

|

|

Stock based compensation |

|

1,532 |

|

|

|

3,662 |

|

|

Other adjustments |

|

653 |

|

|

|

1,383 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(561 |

) |

|

|

(189 |

) |

|

Prepaid expenses and other assets |

|

(2,759 |

) |

|

|

198 |

|

|

Accounts payable and accrued expenses |

|

(457 |

) |

|

|

(349 |

) |

|

Lease liability payments |

|

(560 |

) |

|

|

(761 |

) |

|

Deferred revenue |

|

(43 |

) |

|

|

(625 |

) |

|

Net cash used in operating activities from continued

operations |

|

(10,413 |

) |

|

|

(14,554 |

) |

|

Net cash used in operating activities from discontinued

operations |

|

(177 |

) |

|

|

(1,315 |

) |

|

Net cash used in operating activities |

|

(10,590 |

) |

|

|

(15,869 |

) |

| Investing

activities |

|

|

|

|

|

|

Proceeds received from sale of digital currencies |

|

- |

|

|

|

15,390 |

|

|

Net cash provided by investing activities - continuing

operations |

|

- |

|

|

|

15,390 |

|

|

Net cash used in investing activities - discontinued operation |

|

- |

|

|

|

(7 |

) |

|

Net cash provided by investing activities |

|

- |

|

|

|

15,383 |

|

| Financing

activities |

|

|

|

|

|

|

Payments on borrowings |

|

- |

|

|

|

(5,056 |

) |

|

Proceeds from sales of common stock, net of issuance costs |

|

42,193 |

|

|

|

6,879 |

|

|

Proceeds from exercise of options to purchase common stock |

|

- |

|

|

|

58 |

|

|

Payments on stock repurchases |

|

- |

|

|

|

(502 |

) |

|

Net cash provided by financing activities |

|

42,193 |

|

|

|

1,379 |

|

|

|

|

|

|

|

|

|

Effect of exchange rate on cash |

|

- |

|

|

|

9 |

|

|

Net increase in cash and restricted cash |

|

31,603 |

|

|

|

902 |

|

|

Cash and cash equivalents at the beginning of the period |

|

3,934 |

|

|

|

1,955 |

|

|

Cash and cash equivalents at the end of the period |

$ |

35,537 |

|

|

$ |

2,857 |

|

| |

|

|

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

| Interest paid |

$ |

22 |

|

|

$ |

1,140 |

|

| Income taxes paid |

$ |

40 |

|

|

$ |

- |

|

| Supplemental disclosures of non-cash financing

activities: |

|

|

|

|

|

|

Issuance of common stock upon conversion of the 2022 Promissory

Note |

$ |

4,505 |

|

|

$ |

800 |

|

|

Issuance of common stock for payment of bonuses and consulting

fees |

$ |

35 |

|

|

$ |

379 |

|

|

Non-cash exchange of digital assets |

$ |

- |

|

|

$ |

557 |

|

|

Issuance of common stock under the 2018 Employee Stock Purchase

Plan, previously accrued |

$ |

- |

|

|

$ |

47 |

|

| |

|

|

|

|

|

|

|

Non-GAAP Financial Measures and

Reconciliation

Non-GAAP financial measures should be considered in addition to,

not as a substitute for, or superior to, financial measures

calculated in accordance with GAAP. They are not measurements of

our financial performance under GAAP and should not be considered

as alternatives to revenue or net loss, as applicable, or any other

performance measures derived in accordance with GAAP and may not be

comparable to other similarly titled measures of other businesses.

Our non-GAAP financial measures have limitations as analytical

tools and should not be considered in isolation or as a substitute

for analysis of our operating results as reported under GAAP. Some

of these limitations include: (i) non-cash compensation is and will

remain a key element of our overall long-term incentive

compensation package, although we exclude it as an expense when

evaluating its ongoing operating performance for a particular

period, (ii) our non-GAAP financial measures do not reflect the

impact of certain charges resulting from matters we consider not to

be indicative of ongoing operations, and (iii) other companies in

our industry may calculate our non-GAAP financial measures

differently than we do, limiting their usefulness as comparative

measures.

We compensate for these limitations to our non-GAAP financial

measures by relying primarily on our GAAP results and using our

non-GAAP financial measures only for supplemental purposes. Our

non-GAAP financial measures include adjustments for items that may

not occur in future periods. However, we believe these adjustments

are appropriate because the amounts recognized can vary

significantly from period to period, do not directly relate to the

ongoing operations of our business and complicate comparisons of

our internal operating results and operating results of other peer

companies over time. Each of the normal recurring adjustments and

other adjustments described in this paragraph help management with

a measure of our operating performance over time by removing items

that are not related to day-to-day operations or are non-cash

expenses.

|

Reconciliation of GAAP to Non-GAAP Financial

Measures |

| (In thousands) |

| |

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net loss from continuing operations |

|

$ |

(2,760 |

) |

|

$ |

(13,717 |

) |

|

$ |

(7,683 |

) |

|

$ |

(21,843 |

) |

|

Add back: Depreciation |

|

|

4 |

|

|

|

21 |

|

|

|

12 |

|

|

|

63 |

|

|

Add back: Interest expense |

|

|

10 |

|

|

|

264 |

|

|

|

126 |

|

|

|

1,354 |

|

|

Less: Interest income |

|

|

(381 |

) |

|

|

- |

|

|

|

(760 |

) |

|

|

- |

|

| EBITDA |

|

|

(3,127 |

) |

|

|

(13,432 |

) |

|

|

(8,305 |

) |

|

|

(20,426 |

) |

|

Add back: Stock-based compensation |

|

|

242 |

|

|

|

838 |

|

|

|

1,532 |

|

|

|

3,662 |

|

|

Add back/less: Loss (gain) on extinguishment of debt |

|

|

- |

|

|

|

237 |

|

|

|

(535 |

) |

|

|

237 |

|

|

Add back: Impairment of goodwill |

|

|

- |

|

|

|

9,043 |

|

|

|

- |

|

|

|

9,043 |

|

|

Less: Gain on sale of digital assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,310 |

) |

| Adjusted EBITDA |

|

$ |

(2,885 |

) |

|

$ |

(3,314 |

) |

|

$ |

(7,308 |

) |

|

$ |

(12,794 |

) |

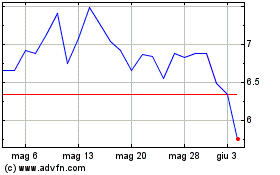

Grafico Azioni Phunware (NASDAQ:PHUN)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Phunware (NASDAQ:PHUN)

Storico

Da Nov 2023 a Nov 2024