Prelude Therapeutics Announces $25 Million Private Placement

11 Dicembre 2023 - 3:34PM

Prelude Therapeutics Incorporated (Nasdaq: PRLD) (“Prelude” or

the “Company”), a clinical-stage precision oncology company, today

announced a private placement that the Company estimates will

result in gross proceeds of approximately $25 million before

deducting estimated offering expenses payable by the Company.

Proceeds from the private placement will be used to primarily fund

the continued advancement of its SMARCA2 portfolio, for working

capital and general corporate purposes.

The proceeds from this private placement,

combined with current cash and cash equivalents, are expected to be

sufficient to fund the Company’s current operating plan into

2026.

Dr. Kris Vaddi, CEO of Prelude stated, “This

additional funding allows us to further resource our SMARCA2

portfolio by rigorously advancing the clinical development of our

IV molecule, PRT3789, and progressing the oral program into the

clinic. We look forward to providing initial clinical results from

PRT3789 and initiating clinical development of our oral program in

the second half of 2024.”

Terms of the private placement, with certain

institutional accredited investors, include an agreement to

purchase pre-funded warrants of 7,936,759 shares of Prelude’s

common stock at a price of $3.1499 per warrant, each with an

exercise price of $0.0001 per share. The volume-weighted average

trading price of the Company’s common stock over the last five

trading days is $3.04. Prelude will pay no placement fees in

connection with the financing. The closing of the private placement

is subject to customary closing conditions and is expected to occur

on or about December 13, 2023.

The securities in the private placement have not

been registered under the Securities Act of 1933, as amended, or

under any state securities laws and, unless so registered, may not

be offered or sold in the United States except pursuant

to an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and applicable

state securities laws. The Company has agreed to certain

registration rights related to the resale of the shares of common

stock issuable upon the exercise of the pre-funded warrants

purchased in the private placement.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, including,

but not limited to, the timing of the closing of the private

placement, the sufficiency of Prelude’s cash runway into 2026, and

Prelude’s planned use of proceeds. All statements other than

statements of historical fact are statements that could be deemed

forward-looking statements. Although Prelude believes that the

expectations reflected in such forward-looking statements are

reasonable, Prelude cannot guarantee future events, results,

actions, levels of activity, performance or achievements, and the

timing and results of biotechnology development and potential

regulatory approval is inherently uncertain. Forward-looking

statements are subject to risks and uncertainties that may cause

Prelude’s actual activities or results to differ significantly from

those expressed in any forward-looking statement, including risks

and uncertainties related to Prelude’s ability to advance its

product candidates, the receipt and timing of potential regulatory

designations, approvals and commercialization of product

candidates, clinical trial sites and our ability to enroll eligible

patients, supply chain and manufacturing facilities, Prelude’s

ability to maintain and recognize the benefits of certain

designations received by product candidates, the timing and results

of preclinical and clinical trials, Prelude’s ability to fund

development activities and achieve development goals, Prelude’s

ability to protect intellectual property, and other risks and

uncertainties described under the heading “Risk Factors” in

Prelude’s Annual Report on Form 10-K for the year ended December

31, 2022, its Quarterly Reports on Form 10-Q and other documents

that Prelude files from time to time with the Securities and

Exchange Commission. These forward-looking statements speak only as

of the date of this press release, and Prelude undertakes no

obligation to revise or update any forward-looking statements to

reflect events or circumstances after the date hereof.

About Prelude Therapeutics

Prelude Therapeutics is a clinical-stage

precision oncology company developing innovative drug candidates

targeting critical cancer cell pathways. The Company’s diverse

pipeline is comprised of highly differentiated, potentially

best-in-class proprietary small molecule compounds aimed at

addressing clinically validated pathways for cancers with

selectable underserved patients. Prelude’s pipeline includes three

candidates currently in clinical development: PRT3789 an IV

administered, potent and highly selective SMARCA2 degrader,

PRT2527, a potent and highly selective CDK9 inhibitor, PRT3645 a

next generation CDK4/6 inhibitor, and a preclinical oral candidate

targeting SMARCA2. For more information, visit

our website and follow us on LinkedIn.

Investor Contact:Lindsey TrickettVice

President, Investor

Relations240.543.7970ltrickett@preludetx.com

Media Contact:Helen ShikShik Communications

617.510.4373helen@shikcommunications.com

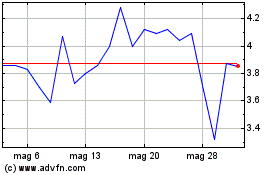

Grafico Azioni Prelude Therapeutics (NASDAQ:PRLD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Prelude Therapeutics (NASDAQ:PRLD)

Storico

Da Mar 2024 a Mar 2025