false

0000909494

0000909494

2025-02-13

2025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 13, 2025

TUCOWS INC

(Exact Name of Registrant Specified in Charter)

| |

Pennsylvania

(State or Other

Jurisdiction of

Incorporation)

|

0-28284

(Commission File

Number)

|

23-2707366

(IRS Employer

Identification No.)

|

|

|

96 Mowat Avenue, Toronto, Ontario, Canada

|

|

M6K 3M1

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (416) 535-0123

| |

Not Applicable |

|

| |

(Former Name or Former Address, if Changed Since Last Report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

TCX

|

|

NASDAQ

|

Item 2.02. Results of Operations and Financial Condition.

On February 13, 2025 Tucows Inc., a Pennsylvania corporation (the “Company”), issued a press release reporting its financial results for the fourth quarter and full year ended December 31, 2024. A copy of such press release is filed herewith as Exhibit 99.1.

The information in this report and the exhibit is furnished to, and not filed with, the Securities and Exchange Commission and shall not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TUCOWS INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ivan Ivanov

|

|

|

|

|

Ivan Ivanov |

|

|

|

|

Chief Financial Officer

|

|

Dated: February 14, 2025

Exhibit 99.1

Tucows delivers on 2024 Adjusted EBITDA guidance

and fourth consecutive year of revenue growth

TORONTO, February 13, 2025 – Tucows Inc. (NASDAQ:TCX, TSX:TC), a global internet services leader, today reported its unaudited financial results for the fourth quarter and full year ended December 31, 2024. All figures are in U.S. dollars.

“Tucows closed 2024 with strong operating revenue growth for the fourth consecutive year, showing the resilience of our business,” said Elliot Noss, Tucows President and CEO. “Adjusted EBITDA for the year reached the top of our guidance range, driven in large part by Ting’s improved results. While Q4 profitability was affected by an annual impairment charge for Ting and restructuring costs associated with workforce reductions, these were one-time impacts. Excluding these charges, we are seeing meaningful improvements across our key financial metrics as we continue to optimize revenue and cost efficiencies. Additionally, we made further progress in deleveraging the business, using cash flow from Wavelo and Tucows Domains to reduce our syndicated debt.”

Financial Results

Consolidated net revenue for the fourth quarter of 2024 increased 7.1% to $93.1 million from $87.0 million for the fourth quarter of 2023, driven primarily by year-over-year revenue gains from Ting and Tucows Domains.

Gross profit for the fourth quarter of 2024 increased 19% to $21.2 million from $17.8 million from the fourth quarter of 2023. The increase in gross profit was due primarily driven by year-over-year gains from the Ting and Domains businesses.

Net loss for the fourth quarter of 2024 was $45.3 million, or a loss of $4.11 per share, compared with net loss of $23.4 million, or a loss of $2.14 per share, for the fourth quarter of 2023. The increased loss was primarily a result of one-time impairment in Ting and restructuring charges, as well as increased interest expense. Excluding impairment, restructuring items and other transition costs, Adjusted net income1 (loss) and Adjusted EPS1 in Q4 2024 are ($15.8 million) and ($1.43) per share compared to Q4 2023 Adjusted net income1 (loss) of ($22.4 million) and Adjusted EPS1 of ($2.05) per share.

Adjusted EBITDA1 for the fourth quarter of 2024 increased 403% to $12.8 million from $2.6 million for the fourth quarter of 2023. The year-over-year increase was primarily due to growth of revenues from Domains and Ting, and cost management in the Ting business.

Cash equivalents, restricted cash and restricted cash equivalents at the end of the fourth quarter of 2024 were $73.2 million compared with $91.1 million at the end of the third quarter of 2024 and $92.7 million at the end of the fourth quarter of 2023.

Summary Financial Results

(In Thousands of US Dollars, except Per Share data)

| |

|

3 Months ended December 31

|

|

|

12 Months ended December 31

|

|

| |

|

2024

(unaudited)

|

|

|

2023

(unaudited)

|

|

|

% Change

(unaudited)

|

|

|

2024

(unaudited)

|

|

|

2023

(unaudited)

|

|

|

% Change

(unaudited)

|

|

|

Net Revenues

|

|

|

93,098 |

|

|

|

86,958 |

|

|

|

7 |

% |

|

|

362,275 |

|

|

|

339,337 |

|

|

|

7 |

% |

|

Gross Profit

|

|

|

21,224 |

|

|

|

17,821 |

|

|

|

19 |

% |

|

|

83,030 |

|

|

|

66,667 |

|

|

|

25 |

% |

|

Income Earned on Sale of Transferred Assets, net

|

|

|

3,244 |

|

|

|

4,062 |

|

|

|

(20 |

)% |

|

|

13,978 |

|

|

|

17,033 |

|

|

|

(18 |

)% |

|

Net Income (Loss)

|

|

|

(45,287 |

) |

|

|

(23,374 |

) |

|

|

(94 |

)% |

|

|

(112,672 |

) |

|

|

(96,197 |

) |

|

|

(17 |

)% |

|

Adjusted Net Income (Loss)¹

|

|

|

(15,775 |

) |

|

|

(22,382 |

) |

|

|

30 |

% |

|

|

(76,817 |

) |

|

|

(74,779 |

) |

|

|

(3 |

)% |

|

Basic earnings (Loss) per common share

|

|

|

(4.11 |

) |

|

|

(2.14 |

) |

|

|

(92 |

)% |

|

|

(10.27 |

) |

|

|

(8.85 |

) |

|

|

(16 |

)% |

|

Adjusted Basic earnings (Loss) per common share¹

|

|

|

(1.43 |

) |

|

|

(2.05 |

) |

|

|

30 |

% |

|

|

(6.98 |

) |

|

|

(6.86 |

) |

|

|

(2 |

)% |

|

1.

|

Non-GAAP financial measures are described below and reconciled to GAAP measures in the accompanying tables.

|

Summary of Revenues, Gross Profit and Adjusted EBITDA

(In Thousands of US Dollars)

| |

|

Revenue

|

|

|

Gross Profit

|

|

|

Adj. EBITDA¹

|

|

| |

|

3 Months ended December 31

|

|

|

3 Months ended December 31

|

|

|

3 Months ended December 31

|

|

| |

|

2024 (unaudited)

|

|

|

2023 (unaudited)

|

|

|

2024 (unaudited)

|

|

|

2023 (unaudited)

|

|

|

2024 (unaudited)

|

|

|

2023 (unaudited)

|

|

|

Ting Internet Services:

|

|

|

Fiber Internet Services

|

|

|

15,749 |

|

|

|

13,821 |

|

|

|

10,995 |

|

|

|

7,881 |

|

|

|

(1,468 |

) |

|

|

(12,366 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wavelo Platform Services:

|

|

|

Platform Services

|

|

|

9,888 |

|

|

|

9,545 |

|

|

|

9,368 |

|

|

|

9,214 |

|

|

|

3,679 |

|

|

|

2,604 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tucows Domain Services:

|

|

|

Wholesale

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domain Services

|

|

|

50,586 |

|

|

|

48,279 |

|

|

|

9,967 |

|

|

|

9,968 |

|

|

|

|

|

|

|

|

|

|

Value Added Services

|

|

|

5,480 |

|

|

|

4,184 |

|

|

|

4,981 |

|

|

|

3,661 |

|

|

|

|

|

|

|

|

|

|

Total Wholesale

|

|

|

56,066 |

|

|

|

52,463 |

|

|

|

14,948 |

|

|

|

13,629 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail

|

|

|

9,608 |

|

|

|

9,348 |

|

|

|

5,393 |

|

|

|

5,229 |

|

|

|

|

|

|

|

|

|

|

Total Tucows Domain

Services

|

|

|

65,674 |

|

|

|

61,811 |

|

|

|

20,341 |

|

|

|

18,858 |

|

|

|

11,633 |

|

|

|

10,794 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate:

|

|

|

Mobile Services and Eliminations

|

|

|

1,787 |

|

|

|

1,781 |

|

|

|

(2,052 |

) |

|

|

(501 |

) |

|

|

(995 |

) |

|

|

1,522 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Network Expenses:

|

|

|

Network, other costs

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(5,989 |

) |

|

|

(7,584 |

) |

|

|

n/a |

|

|

|

n/a |

|

|

Network, depreciation of property and equipment

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(10,536 |

) |

|

|

(9,533 |

) |

|

|

n/a |

|

|

|

n/a |

|

|

Network, amortization of intangible assets

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(366 |

) |

|

|

(371 |

) |

|

|

n/a |

|

|

|

n/a |

|

|

Network, impairment

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(537 |

) |

|

|

(143 |

) |

|

|

n/a |

|

|

|

n/a |

|

|

Total Network Expenses

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(17,428 |

) |

|

|

(17,631 |

) |

|

|

n/a |

|

|

|

n/a |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

93,098 |

|

|

|

86,958 |

|

|

|

21,224 |

|

|

|

17,821 |

|

|

|

12,849 |

|

|

|

2,554 |

|

1 Non-GAAP financial measures are described below and reconciled to GAAP measures in the accompanying tables.

Notes:

1. Tucows reports all financial information required in conformity with United States generally accepted accounting principles (GAAP).

Along with this information, to assist financial statement users in an assessment of our historical performance, the Company discloses non-GAAP financial measures in press releases and on investor conference calls and related events, as the Company believes that the non-GAAP information enhances investors' overall understanding of our financial performance, and should be read in addition to, rather than instead of, the financial statements prepared in accordance with GAAP.

Non-GAAP financial measures do not reflect a comprehensive system of accounting and may differ from non-GAAP financial measures with the same or similar captions that are used by other companies and/or analysts and may differ from period to period. The Company endeavors to compensate for these limitations by providing the relevant disclosure of the items excluded in the calculation of Adjusted EBITDA to net income based on U.S. GAAP; Adjusted net income to GAAP net income; and adjusted basic earnings per share to GAAP basic earnings per share, which should be considered when evaluating the Company's results. Tucows strongly encourages investors to review its financial information in its entirety and not to rely on a single financial measure.

Adjusted EBITDA

The Company believes that the provision of this supplemental non-GAAP measure allows investors to evaluate the operational and financial performance of the Company’s core business using similar evaluation measures to those used by management. The Company uses Adjusted EBITDA to measure its performance and prepare its budgets. Since Adjusted EBITDA is a non-GAAP financial performance measure, the Company’s calculation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies; and should not be considered in isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with GAAP. Because Adjusted EBITDA is calculated before certain recurring cash charges, including interest expense and taxes, and is not adjusted for capital expenditures or other recurring cash requirements of the business, it should not be considered as a liquidity measure.

The Company’s Adjusted EBITDA definition excludes depreciation, impairment and loss on disposition of property and equipment, amortization of intangible assets, income tax provision, interest expense (net), stock-based compensation, asset impairment, gains and losses from unrealized foreign currency transactions, loss on debt extinguishment and costs that are not indicative of on-going performance (profitability), including acquisition and transition costs. Gains and losses from unrealized foreign currency transactions removes the unrealized effect of the change in the mark-to-market values on outstanding unhedged foreign currency contracts, as well as the unrealized effect from the translation of monetary accounts denominated in non-U.S. dollars to U.S. dollars.

The following table reconciles net income (loss) to Adjusted EBITDA (in thousands of US dollars):

| |

|

3 Months ended December 31

|

|

|

12 Months ended December 31

|

|

| |

|

2024

(unaudited)

|

|

|

2023

(unaudited)

|

|

|

2024

(unaudited)

|

|

|

2023

(unaudited)

|

|

|

Net income (Loss) for the period

|

|

|

(45,287 |

) |

|

|

(23,374 |

) |

|

|

(112,672 |

) |

|

|

(96,197 |

) |

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (recovery) for income taxes

|

|

|

1,918 |

|

|

|

(1,316 |

) |

|

|

7,986 |

|

|

|

(6,873 |

) |

|

Depreciation of property and equipment

|

|

|

10,637 |

|

|

|

9,661 |

|

|

|

40,323 |

|

|

|

36,431 |

|

|

Impairment of property and equipment

|

|

|

21,074 |

|

|

|

143 |

|

|

|

21,979 |

|

|

|

4,822 |

|

|

Amortization of intangible assets

|

|

|

1,208 |

|

|

|

2,728 |

|

|

|

5,297 |

|

|

|

10,829 |

|

|

Interest expense, net

|

|

|

13,748 |

|

|

|

12,651 |

|

|

|

51,275 |

|

|

|

41,771 |

|

|

Loss on debt extinguishment

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

14,680 |

|

|

Stock-based compensation

|

|

|

1,638 |

|

|

|

1,528 |

|

|

|

7,021 |

|

|

|

8,134 |

|

|

Unrealized loss (gain) on foreign exchange revaluation of foreign denominated monetary assets and liabilities

|

|

|

(525 |

) |

|

|

(316 |

) |

|

|

(168 |

) |

|

|

(62 |

) |

|

Acquisition and transition costs*

|

|

|

8,438 |

|

|

|

849 |

|

|

|

13,876 |

|

|

|

1,916 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

|

12,849 |

|

|

|

2,554 |

|

|

|

34,917 |

|

|

|

15,451 |

|

* Acquisition and transition costs represent transaction-related expenses and transitional expenses. Expenses include severance or transitional costs associated with department, operational or overall company restructuring efforts, including geographic alignments.

Adjusted Net Income and Adjusted Basic Earnings Per Common Share (Adjusted EPS)

The Company believes that the provision of this supplemental non-GAAP measure allows investors to best evaluate our operating results and understand the operating trends of our core business without the effect of acquisition and transition costs, impairment expenses and losses on extinguishment of debt. Acquisition and transition costs represent transaction-related expenses and transitional expenses. Expenses include severance or transitional costs associated with department, operational or overall company restructuring efforts, including geographic alignments. Since adjusted net income and adjusted EPS are non-GAAP financial performance measures, the Company’s calculation of adjusted net income and adjusted EPS may not be comparable to other similarly titled measures of other companies; and should not be considered in isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with GAAP.

The Company’s adjusted net income and adjusted EPS definitions exclude from the calculation of reported GAAP net income and GAAP EPS, the effect of the following items: impairment of property and expenses, acquisition and transition costs (including restructuring charges) and loss on debt extinguishment.

The following table reconciles adjusted net income and adjusted EPS to GAAP net income (In thousands of US dollars, except Per Share data):

| |

|

3 Months ended December 31

|

|

|

12 Months ended December 31

|

|

| |

|

2024 (unaudited)

|

|

|

2023 (unaudited)

|

|

|

2024 (unaudited)

|

|

|

2023 (unaudited)

|

|

|

Net Income (Loss) for the period

|

|

|

(45,287 |

) |

|

|

(23,374 |

) |

|

|

(112,672 |

) |

|

|

(96,197 |

) |

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on debt extinguishment

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

14,680 |

|

|

Acquisition and transition costs*

|

|

|

8,438 |

|

|

|

849 |

|

|

|

13,876 |

|

|

|

1,916 |

|

|

Impairment of property and equipment

|

|

|

21,074 |

|

|

|

143 |

|

|

|

21,979 |

|

|

|

4,822 |

|

|

Adjusted Net Income (Loss)¹ for the period

|

|

|

(15,775 |

) |

|

|

(22,382 |

) |

|

|

(76,817 |

) |

|

|

(74,779 |

) |

|

Adjusted Basic Earnings (Loss) Per Common Share¹

|

|

|

(1.43 |

) |

|

|

(2.05 |

) |

|

|

(7.00 |

) |

|

|

(6.88 |

) |

* Acquisition and transition costs represent transaction-related expenses and transitional expenses. Expenses include severance or transitional costs associated with department, operational or overall company restructuring efforts, including geographic alignments.

Management Commentary

Concurrent with the dissemination of its quarterly financial results news release at 5:05 p.m. ET on Thursday, February 13, 2025, management’s pre-recorded audio commentary (and transcript), discussing the quarter and outlook for the Company will be posted to the Tucows website at http://www.tucows.com/investors/financials.

Following management’s prepared commentary, for the subsequent seven days, until Thursday, February 20, 2025, shareholders, analysts and prospective investors can submit questions to Tucows’ management at ir@tucows.com. Management will post responses to questions in an audio recording and transcript to the Company’s website athttp://www.tucows.com/investors/financials, on Tuesday, March 4, 2025, at approximately 5 p.m. ET. All questions will receive a response, however, questions of a more specific nature may be responded to directly.

About Tucows

Tucows helps connect more people to the benefit of internet access through communications service technology, domain services, and fiber-optic internet infrastructure. Ting (https://ting.com) delivers fixed fiber Internet access with outstanding customer support. Wavelo (https://wavelo.com) is a telecommunications software suite for service providers that simplifies the management of mobile and internet network access; provisioning, billing and subscription; developer tools; and more. Tucows Domains (https://tucowsdomains.com) manages approximately 25 million domain names and millions of value-added services through a global reseller network of over 35,000 web hosts and ISPs. Hover (https://hover.com) makes it easy for individuals and small businesses to manage their domain names and email addresses. More information can be found on Tucows’ corporate website (https://tucows.com).

Tucows, Ting, Wavelo, and Hover are registered trademarks of Tucows Inc. or its subsidiaries.

This release includes forward-looking statements as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding our expectations regarding our future financial results and, including, without limitation, our expectations regarding our ability to realize synergies from the Enom acquisition and our expectation for growth of Ting Internet. These statements are based on management’s current expectations and are subject to a number of uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Information about other potential factors that could affect Tucows’ business, results of operations and financial condition is included in the Risk Factors sections of Tucows’ filings with the Securities and Exchange Commission. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. All forward-looking statements are based on information available to Tucows as of the date they are made. Tucows assumes no obligation to update any forward-looking statements, except as may be required by law.

Contact:

Monica Webb

Vice President, Investor Relations

647.898.9924

mwebb@tucows.com

v3.25.0.1

Document And Entity Information

|

Feb. 13, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TUCOWS INC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 13, 2025

|

| Entity, Incorporation, State or Country Code |

PA

|

| Entity, File Number |

0-28284

|

| Entity, Tax Identification Number |

23-2707366

|

| Entity, Address, Address Line One |

96 Mowat Avenue

|

| Entity, Address, City or Town |

Toronto

|

| Entity, Address, State or Province |

ON

|

| Entity, Address, Country |

CA

|

| Entity, Address, Postal Zip Code |

M6K 3M1

|

| City Area Code |

416

|

| Local Phone Number |

535-0123

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TCX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000909494

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

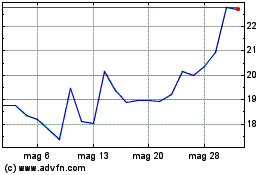

Grafico Azioni Tucows (NASDAQ:TCX)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Tucows (NASDAQ:TCX)

Storico

Da Mar 2024 a Mar 2025