UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest

event reported): June 11, 2024

Alcoa Corporation

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

1-37816 |

81-1789115 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| 201 Isabella Street, Suite 500 |

|

| Pittsburgh, Pennsylvania |

|

15212-5858 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number,

Including Area Code: (412) 315-2900

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

AA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

On June

11, 2024, Alcoa Corporation issued a press release announcing an update on the status and expected timing for completion of the previously

announced acquisition of Alumina Limited. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by

reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

Caution Concerning Forward-Looking Statements

This Current Report on Form 8-K contains statements

that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,”

“anticipates,” “believes,” “could,” “develop,” “endeavors,” “estimates,”

“expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,”

“plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar meaning. All statements

by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the

ability of the parties to complete the proposed transaction; the expected benefits of the proposed transaction, the competitive ability

and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum,

and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating performance (including

our ability to execute on strategies related to environmental, social and governance matters); statements about strategies, outlook, and

business and financial prospects; and statements about capital allocation and return of capital. These statements reflect beliefs and

assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future developments, as

well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not guarantees of

future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict.

Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can

give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated

by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited

to: (1) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction;

(2) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (3) the risk that the proposed

transaction may not be completed in the expected time frame or at all; (4) unexpected costs, charges or expenses resulting from the proposed

transaction; (5) uncertainty of the expected financial performance following completion of the proposed transaction; (6) failure to realize

the anticipated benefits of the proposed transaction; (7) the occurrence of any event that could give rise to termination of the proposed

transaction; (8) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect

the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (9)

the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (10) volatility and declines in aluminum

and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production costs which

are linked to LME or other commodities; (11) the disruption of market-driven balancing of global aluminum supply and demand by non-market

forces; (12) competitive and complex conditions in global markets; (13) our ability to obtain, maintain, or renew permits or approvals

necessary for our mining operations; (14) rising energy costs and interruptions or uncertainty in energy supplies; (15) unfavorable changes

in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (16) our ability to

execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits

from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (17) our ability

to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (18) economic,

political, and social conditions, including the impact of trade policies and adverse industry publicity; (19) fluctuations in foreign

currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (20) changes in

tax laws or exposure to additional tax liabilities; (21) global competition within and beyond the aluminum industry; (22) our ability

to obtain or maintain adequate insurance coverage; (23) disruptions in the global economy caused by ongoing regional conflicts; (24) legal

proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (25) climate change,

climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme weather conditions;

(26) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations; (27) claims,

costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions in

which we operate; (28) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous

substances or other damage; (29) our ability to fund capital expenditures; (30) deterioration in our credit profile or increases in interest

rates; (31) restrictions on our current and future operations due to our indebtedness; (32) our ability to continue to return capital

to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (33) cyber attacks, security breaches,

system failures, software or application vulnerabilities, or other cyber incidents; (34) labor market conditions,

union disputes and other employee relations issues; (35) a decline in the liability discount rate or lower-than-expected investment returns

on pension assets; and (36) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed

transaction, are more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject

to the risks described above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy

and completeness of any of these forward-looking statements and none of the information contained herein should be regarded as a representation

that the forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This Current Report on Form 8-K does not constitute

an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This Current Report on Form 8-K relates to the

proposed transaction. On June 6, 2024, Alcoa filed with the SEC a definitive proxy statement on Schedule 14A (the “Proxy Statement”)

in connection with the proposed transaction. Other documents regarding the proposed transaction may be filed with the SEC. This Current

Report on Form 8-K is not a substitute for the Proxy Statement or any other document that Alcoa may file with the SEC and send to its

stockholders in connection with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be

submitted to Alcoa’s stockholders for their consideration. The Proxy Statement contains important information about Alcoa, the proposed

transaction and related matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed

or to be filed with the SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements

to those documents, because they contain or will contain important information about Alcoa and the proposed transaction. Alcoa’s

stockholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free

of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may

be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other

persons related to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection

with the proposed transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of

Alcoa is set forth in the section entitled “Information about our Executive Officers” included in Alcoa’s annual

report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available

at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm), in the section entitled

“Director Nominees” included in its proxy statement for its 2024 annual meeting of stockholders, which was filed with

the SEC on March 19, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1675149/000119312524071354/d207257ddef14a.htm),

and in the sections entitled “Security Ownership of Certain Beneficial Owners and Management” and “Interests

of Alcoa Executive Officers and Directors in the Transaction” included in the Proxy Statement, which was filed with the SEC

on June 6, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312524156116/d827161ddefm14a.htm). Additional

information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description

of their direct and indirect interests, by security holdings or otherwise, will be included in other relevant materials to be filed with

the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described

in the preceding paragraph.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 11, 2024 |

ALCOA CORPORATION |

|

| |

|

|

|

|

| |

By: |

/s/ Marissa P. Earnest |

|

| |

|

Name: |

Marissa P. Earnest |

|

| |

|

Title: |

Senior Vice President, Chief Governance Counsel and Secretary |

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

| Investor Contact: |

|

Media Contact: |

| Jim Dwyer |

|

Courtney Boone |

| James.Dwyer@alcoa.com |

|

Courtney.Boone@alcoa.com |

Alcoa Provides Update on Transaction

Milestones for Acquisition of Alumina Limited

Australian Court Proceedings Convene Alumina

Limited Shareholder Vote

Independent Expert Report Assesses Transaction

as Fair and Reasonable

PITTSBURGH – June 11, 2024 – Alcoa Corporation (NYSE:

AA or “Alcoa”) today announced that it has reached several key milestones in its acquisition of Alumina Limited (“Alumina”)

and expects the transaction to be completed on or about August 1, 2024, subject to the satisfaction of customary conditions.

The milestones include:

| · | Alcoa filed its definitive proxy statement with the Securities and Exchange

Commission on June 6, 2024, and scheduled the Special Meeting of Shareholders to vote on the transaction for July 16, 2024. |

| · | Alcoa received regulatory approvals from Brazil’s Administrative Council

for Economic Defense (CADE) for the acquisition on May 13, 2024; and the Australian Competition and Consumer Commission, which has indicated

it does not intend to conduct a public review of the transaction. |

| · | Alumina has registered its Scheme Booklet with the Australian Securities and

Investments Commission (ASIC), and the Scheme Booklet will be sent to Alumina shareholders following orders from the Federal Court of

Australia on June 7, 2024, to dispatch the Scheme Booklet and convene a shareholder meeting to conduct a vote. Alumina shareholders are

slated to vote on the acquisition July 18, 2024. The Court also has ordered that a second court hearing, should the Alumina shareholder

vote be successful, will take place on July 22, 2024, to approve the results of the shareholder vote. |

“I am very pleased with the progress our team is making to complete

this value-enhancing transaction with Alumina Limited,” said Alcoa President and CEO William F. (Bill) Oplinger. “Acquiring

Alumina Limited aligns with our long-term strategy to bolster our position as a leading pure play, upstream aluminum company globally.

We are looking forward to realizing the long-term benefits of the transaction to both companies’ shareholders, and broader stakeholders

and communities following the completion.”

The Court proceedings are part of the statutory process in Australia

and are required to convene the Alumina shareholders to vote on the acquisition.

An Independent Expert Report (IER) together with the Scheme Booklet

was publicly released on the ASX on June 11, 2024 (AEST) following registration of the Scheme Booklet with ASIC. The IER states that the

transaction is fair and reasonable and therefore is in the best interests of the Alumina shareholders, in the absence of a superior proposal.

The transaction remains subject to approval by both companies’

shareholders and receipt of approval from Australia’s Foreign Investment Review Board. The transaction is not conditional on due

diligence or financing.

Transaction Website

Associated materials regarding the transaction

are available on the investor relations section of Alcoa’s website at www.alcoa.com as well

as a transaction website at www.strongawacfuture.com.

Advisors

J.P. Morgan Securities LLC and UBS Investment Bank are acting as financial

advisors to Alcoa, and Ashurst and Davis Polk & Wardwell LLP are acting as its legal counsel.

About Alcoa Corporation

Alcoa (NYSE: AA) is a global industry leader in

bauxite, alumina and aluminum products with a vision to reinvent the aluminum industry for a sustainable future. With a values-based approach

that encompasses integrity, operating excellence, care for people and courageous leadership, our purpose is to Turn Raw Potential into

Real Progress. Since developing the process that made aluminum an affordable and vital part of modern life, our talented Alcoans have

developed breakthrough innovations and best practices that have led to greater efficiency, safety, sustainability and stronger communities

wherever we operate.

Dissemination of Company Information

Alcoa intends to make future announcements regarding

company developments and financial performance through its website, www.alcoa.com, as well as through press releases, filings with the

Securities and Exchange Commission, conference calls and webcasts. The Company does not incorporate the information contained on, or accessible

through, its corporate website into this press release.

Forward-Looking Statements

This communication contains statements that relate to future

events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,”

“anticipates,” “believes,” “could,” “develop,” “endeavors,”

“estimates,” “expects,” “forecasts,” “goal,” “intends,”

“may,” “outlook,” “potential,” “plans,” “projects,” “reach,”

“seeks,” “sees,” “should,” “strive,” “targets,” “will,”

“working,” “would,” or other words of similar meaning. All statements by Alcoa Corporation

(“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements of historical

fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the ability of

the parties to complete the proposed transaction; the expected benefits of the proposed transaction; the competitive ability and

position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and

aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating

performance (including our ability to execute on strategies related to environmental, social and governance matters); statements

about strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital.

These statements reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current

conditions, and expected future developments, as well as other factors that management believes are appropriate in the

circumstances. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks,

uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected

in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be

attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due

to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (1) the non-satisfaction or

non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction; (2) the prohibition or

delay of the consummation of the proposed transaction by a governmental entity; (3) the risk that the proposed transaction may not

be completed in the expected time frame or at all; (4) unexpected costs, charges or expenses resulting from the proposed

transaction; (5) uncertainty of the expected financial performance following completion of the proposed transaction; (6) failure to

realize the anticipated benefits of the proposed transaction; (7) the occurrence of any event that could give rise to termination of

the proposed transaction; (8) potential litigation in connection with the proposed transaction or other settlements or

investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense,

indemnification and liability; (9) the impact of global economic conditions on the aluminum industry and aluminum end-use markets;

(10) volatility and declines in aluminum and alumina demand and pricing, including global, regional, and product-specific prices, or

significant changes in production costs which are linked to LME or other commodities; (11) the disruption of market-driven balancing

of global aluminum supply and demand by non-market forces; (12) competitive and complex conditions in global markets; (13) our

ability to obtain, maintain, or renew permits or approvals necessary for our mining operations; (14) rising energy costs and

interruptions or uncertainty in energy supplies; (15) unfavorable changes in the cost, quality, or availability of raw materials or

other key inputs, or by disruptions in the supply chain; (16) our ability to execute on our strategy to be a lower cost,

competitive, and integrated aluminum production business and to realize the anticipated benefits from announced plans, programs,

initiatives relating to our portfolio, capital investments, and developing technologies; (17) our ability to integrate and achieve

intended results from joint ventures, other strategic alliances, and strategic business transactions; (18) economic, political, and

social conditions, including the impact of trade policies and adverse industry publicity; (19) fluctuations in foreign currency

exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (20) changes in tax

laws or exposure to additional tax liabilities; (21) global competition within and beyond the aluminum industry; (22) our ability to

obtain or maintain adequate insurance coverage; (23) disruptions in the global economy caused by ongoing regional conflicts; (24)

legal proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (25)

climate change, climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to

extreme weather conditions; (26) our ability to achieve our strategies or expectations relating to environmental, social, and

governance considerations; (27) claims, costs and liabilities related to health, safety, and environmental laws, regulations, and

other requirements, in the jurisdictions in which we operate; (28) liabilities resulting from impoundment structures, which could

impact the environment or cause exposure to hazardous substances or other damage; (29) our ability to fund capital expenditures;

(30) deterioration in our credit profile or increases in interest rates; (31) restrictions on our current and future operations due

to our indebtedness; (32) our ability to continue to return capital to our stockholders through the payment of cash dividends and/or

the repurchase of our common stock; (33) cyber attacks, security breaches, system failures, software or application vulnerabilities,

or other cyber incidents; (34) labor market conditions, union disputes and other employee relations issues; (35) a decline in the

liability discount rate or lower-than-expected investment returns on pension assets; and (36) the other risk factors discussed in

Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other reports filed by

Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the

proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of

the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new

information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks described

above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy and completeness of

any of these forward-looking statements and none of the information contained herein should be regarded as a representation that the

forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction.

On June 6, 2024, Alcoa filed with the SEC a definitive proxy statement on Schedule 14A (the “Proxy Statement”) in connection

with the proposed transaction. Other documents regarding the proposed transaction may be filed with the SEC. This communication is not

a substitute for the Proxy Statement or any other document that Alcoa may file with the SEC and send to its stockholders in connection

with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be submitted to Alcoa’s

stockholders for their consideration. The Proxy Statement contains important information about Alcoa, the proposed transaction and related

matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed or to be filed with the

SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements to those documents, because

they contain or will contain important information about Alcoa and the proposed transaction.

Alcoa’s stockholders will be able to obtain

a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at the SEC’s website

(www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC

may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and

other persons related to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in

connection with the proposed transaction. Information about the directors and executive officers of Alcoa and their ownership of

common stock of Alcoa is set forth in the section entitled “Information about our Executive Officers” included in

Alcoa’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21,

2024 (and which is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm), in the section entitled

“Director Nominees” included in its proxy statement for its 2024 annual meeting of stockholders, which was filed

with the SEC on March 19, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1675149/000119312524071354/d207257ddef14a.htm),

and in the sections entitled “Security Ownership of Certain Beneficial Owners and Management” and

“Interests of Alcoa Executive Officers and Directors in the Transaction” included in the Proxy Statement, which

was filed with the SEC on June 6, 2024 (and which is available at

https://www.sec.gov/Archives/edgar/data/1675149/000119312524156116/d827161ddefm14a.htm). Additional information regarding the

persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, will be included in other relevant materials to be filed with the SEC in

connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described in

the preceding paragraph.

Additional Media Contacts

Australia

Citadel MAGNUS

Paul Ryan +61 409 296 511

pryan@citadelmagnus.com

United States

Joele Frank, Wilkinson Brimmer Katcher

Sharon Stern / Kaitlin Kikalo / Lyle Weston

Alcoa-jf@joelefrank.com

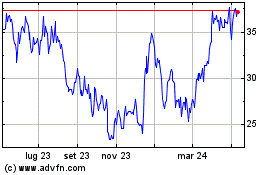

Grafico Azioni Alcoa (NYSE:AA)

Storico

Da Ott 2024 a Nov 2024

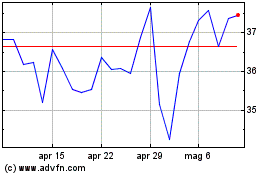

Grafico Azioni Alcoa (NYSE:AA)

Storico

Da Nov 2023 a Nov 2024