UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

|

|

| |

☒ |

Soliciting Material Under Rule 14a-12 |

| ALCOA CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

☐ |

Fee paid previously with preliminary materials: |

| |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

On June 6, 2024, Alcoa Corporation

(“Alcoa”) filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) to be used

to solicit proxies to approve the issuance of shares of common stock and non-voting convertible preferred stock of Alcoa in connection

with a proposed transaction to acquire all of the shares of Alumina Limited in an all-stock transaction (the “Transaction”)

at a special meeting of its stockholders.

Item 1: On June 14, 2024,

Alcoa posted updates to the FAQs (the “FAQs”) and the transaction process (the “Transaction Process”) on a website

it launched in connection with the Transaction. A copy of the FAQs and the Transaction Process is filed herewith as Exhibit 1.

Caution Concerning Forward-Looking Statements

This communication contains statements that relate

to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,”

“plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar meaning. All statements

by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the

ability of the parties to complete the proposed transaction; the expected benefits of the proposed transaction, the competitive ability

and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum,

and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating performance (including

our ability to execute on strategies related to environmental, social and governance matters); statements about strategies, outlook, and

business and financial prospects; and statements about capital allocation and return of capital. These statements reflect beliefs and

assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future developments, as

well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not guarantees of

future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict.

Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can

give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated

by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited

to: (1) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction;

(2) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (3) the risk that the proposed

transaction may not be completed in the expected time frame or at all; (4) unexpected costs, charges or expenses resulting from the proposed

transaction; (5) uncertainty of the expected financial performance following completion of the proposed transaction; (6) failure to realize

the anticipated benefits of the proposed transaction; (7) the occurrence of any event that could give rise to termination of the proposed

transaction; (8) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect

the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (9)

the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (10) volatility and declines in aluminum

and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production costs which

are linked to LME or other commodities; (11) the disruption of market-driven balancing of global aluminum supply and demand by non-market

forces; (12) competitive and complex conditions in global markets; (13) our ability to obtain, maintain, or renew permits or approvals

necessary for our mining operations; (14) rising energy costs and interruptions or uncertainty in energy supplies; (15) unfavorable changes

in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (16) our ability to

execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits

from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (17) our ability

to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (18) economic,

political, and social conditions, including the impact of

trade policies and adverse industry

publicity; (19) fluctuations in foreign currency exchange rates and interest rates, inflation and other economic factors in the

countries in which we operate; (20) changes in tax laws or exposure to additional tax liabilities; (21) global competition within

and beyond the aluminum industry; (22) our ability to obtain or maintain adequate insurance coverage; (23) disruptions in the global

economy caused by ongoing regional conflicts; (24) legal proceedings, investigations, or changes in foreign and/or U.S. federal,

state, or local laws, regulations, or policies; (25) climate change, climate change legislation or regulations, and efforts to

reduce emissions and build operational resilience to extreme weather conditions; (26) our ability to achieve our strategies or

expectations relating to environmental, social, and governance considerations; (27) claims, costs and liabilities related to health,

safety, and environmental laws, regulations, and other requirements, in the jurisdictions in which we operate; (28) liabilities

resulting from impoundment structures, which could impact the environment or cause exposure to hazardous substances or other damage;

(29) our ability to fund capital expenditures; (30) deterioration in our credit profile or increases in interest rates; (31)

restrictions on our current and future operations due to our indebtedness; (32) our ability to continue to return capital to our

stockholders through the payment of cash dividends and/or the repurchase of our common stock; (33) cyber attacks, security breaches,

system failures, software or application vulnerabilities, or other cyber incidents; (34) labor market conditions, union disputes and

other employee relations issues; (35) a decline in the liability discount rate or lower-than-expected investment returns on pension

assets; and (36) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the

proposed transaction, are more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any

such forward-looking statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly

any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable

law. Market projections are subject to the risks described above and other risks in the market. Neither Alcoa nor any other person

assumes responsibility for the accuracy and completeness of any of these forward-looking statements and none of the information

contained herein should be regarded as a representation that the forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction.

On June 6, 2024, Alcoa filed with the SEC a definitive proxy statement on Schedule 14A (the “Proxy Statement”) in connection

with the proposed transaction. Other documents regarding the proposed transaction may be filed with the SEC. This communication is not

a substitute for the Proxy Statement or any other document that Alcoa may file with the SEC and send to its stockholders in connection

with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be submitted to Alcoa’s

stockholders for their consideration. The Proxy Statement contains important information about Alcoa, the proposed transaction and related

matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed or to be filed with the

SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements to those documents, because

they contain or will contain important information about Alcoa and the proposed transaction. Alcoa’s stockholders will be able

to obtain a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at the SEC’s

website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may be obtained, without charge,

by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other

persons related to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection

with the proposed transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of

Alcoa is set forth in the section entitled “Information about our Executive Officers” included in Alcoa’s annual

report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available

at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm), in the section entitled

“Director Nominees” included in its proxy statement for its 2024 annual meeting of stockholders, which was filed

with the SEC on March 19, 2024

(and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1675149/000119312524071354/d207257ddef14a.htm),

and in the sections entitled “Security Ownership of Certain Beneficial Owners and Management” and “Interests

of Alcoa Executive Officers and Directors in the Transaction” included in the Proxy Statement, which was filed with the SEC

on June 6, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312524156116/d827161ddefm14a.htm). Additional

information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description

of their direct and indirect interests, by security holdings or otherwise, will be included in other relevant materials to be filed with

the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described

in the preceding paragraph.

Exhibit 1

FAQ

What was announced?

| · | Alcoa entered into a binding Scheme Implementation Deed (the “Agreement”) with Alumina Limited, its minority joint venture

partner in Alcoa World Alumina and Chemicals (AWAC), under which Alcoa will acquire Alumina Limited in an all-scrip, or all-stock, transaction. |

What are the terms of the agreement?

| · | The terms of the Agreement are consistent with the previously agreed and announced transaction process deed (the “Process Deed”). |

| · | The Alumina Limited Board of Directors has recommended that Alumina Limited shareholders vote in favor of the transaction in the absence

of a superior proposal and subject to an independent expert concluding (and continuing to conclude) that the transaction is in the best

interests of Alumina Limited shareholders. The Independent Directors of Alumina Limited’s Board, Managing Director and Chief Executive

Officer intend to vote all shares of Alumina Limited held or controlled by them in favor of the transaction. |

| · | Under the all-scrip, or all-stock transaction, Alumina Limited shareholders would receive consideration of 0.02854 Alcoa shares for

each Alumina Limited share. |

| · | This consideration would imply a value of A$1.15 per Alumina Limited share and represents a premium of 13.1%, based on Alcoa’s

closing share price on the NYSE on February 23, 2024, of $26.52, the last trading day prior to the announcement of the Process Deed.1 |

| · | Upon completion of the Agreement, Alumina Limited shareholders would own 31.25 percent, and Alcoa shareholders would own 68.75 percent

of the combined company.2 |

What is a Scheme Implementation Deed?

| · | A Scheme Implementation Deed is a binding agreement for implementation of a ‘scheme of arrangement’, which is the acquisition

structure being used for the transaction (as is typical in Australian deals that are recommended by the target’s board). It sets

out all of the key terms and conditions whereby Alcoa will acquire Alumina Limited, including obligations on each party to take the necessary

steps to implement the scheme of arrangement. |

| · | The terms of the Scheme Implementation Deed, or the Agreement, are consistent with the previously agreed and announced Process Deed. |

What was amended in the Deed of Amendment and Restatement of the

Scheme Implementation Deed?

| · | Alcoa and Alumina Limited have amended the Scheme Implementation Deed whereby an affiliate of CITIC will receive a small proportion,

approximately 1.5 percent of the pro forma outstanding Alcoa common stock, of its consideration under the scheme of arrangement in non-voting

convertible series A preferred stock (“Alcoa Non-Voting Shares”), instead of Alcoa CDIs. The economic rights of the Alcoa

Non-Voting Shares are generally equivalent to the economic rights of Alcoa CDIs, except that the Alcoa Non-Voting Shares will have a liquidation

preference of US$0.0001 for each share. |

| · | The Alcoa Non-Voting Shares will be issued to enable CITIC to comply with the Bank Holding Company Act of 1956, which prohibits CITIC,

as the owner of certain banking assets in the United States, from holding more than 5% of any class of voting shares in a U.S. public

company, and was the result of cooperative discussions with all parties – including CITIC. |

What are the next steps?

| · | Alcoa intends to move through the transaction closing process in an expeditious manner, including by satisfying customary closing

conditions and receiving the necessary approvals. |

When do you expect to close the transaction?

1

Based on the prevailing AUD / USD exchange rate of 0.656 as of February 23, 2024.

2

Based on fully diluted shares outstanding for Alcoa and Alumina Limited as of February 23, 2024.

| · | We

expect to close the transaction on August 1, 2024, subject to the satisfaction of customary

conditions. |

| · | Learn more about our process to close here <LINK TO TRANSACTION PROCESS PAGE>. |

What are the conditions to complete the transaction?

| · | The closing of the transaction is subject to the satisfaction of customary conditions and remains subject to approval by both companies’

shareholders. |

| · | Alcoa received all required regulatory approvals that are conditions to the closing of the transaction. |

| · | The transaction is not conditional on due diligence or financing. |

| · | Learn more about our process to close here <LINK TO TRANSACTION PROCESS PAGE>. |

When will Alumina Limited shareholders vote on the transaction?

| · | Alumina Limited has registered its Scheme Booklet with the Australian Securities and Investments Commission (ASIC), and the Scheme

Booklet will be sent to Alumina Limited shareholders following orders from the Federal Court of Australia on June 7, 2024, to dispatch

the Scheme Booklet and convene a shareholder meeting to conduct a vote. |

| · | Alumina Limited shareholders are slated to vote on the acquisition July 18. The Court also has ordered that a second court hearing,

should the Alumina Limited shareholder vote be successful, will take place on July 22, 2024 to approve the results of the shareholder

vote. |

| · | An Independent Expert Report (IER) together with the Scheme Booklet was publicly released on the ASX on June 11, 2024 (AEST) following

registration of the Scheme Booklet with ASIC. The IER states that the transaction is fair and reasonable and therefore is in the best

interests of the Alumina Limited shareholders, in the absence of a superior proposal. |

| · | The Court proceedings are part of the statutory process in Australia and are required to convene the Alumina Limited shareholders

to vote on the acquisition. |

When will Alcoa shareholders vote on the transaction?

| · | Alcoa filed its definitive proxy statement with the Securities and Exchange Commission on June 6, 2024, and scheduled the Special

Meeting of Shareholders to vote on the transaction for July 16, 2024. |

What is Alcoa World Alumina and Chemicals (AWAC)? How is it currently

structured?

| · | Alcoa is the sole operator of AWAC, its joint venture with Alumina Limited. |

| · | AWAC consists of a number of affiliated entities that own, operate or have an interest in bauxite mines and alumina refineries in

Australia, Brazil, Spain, Saudi Arabia and Guinea. |

| · | AWAC also has a 55 percent interest in the Portland aluminum smelter in Victoria, Australia. |

| · | Alcoa owns 60 percent and Alumina Limited owns 40 percent of the AWAC entities, respectively, directly or indirectly. |

What are the benefits of the transaction to Alumina shareholders?

| · | This transaction provides Alumina Limited shareholders the opportunity to participate in the upside potential of a stronger, better-capitalized

company with a larger and more diversified portfolio. Alumina Limited shareholders gain access to the benefits of Alcoa’s leading

pure-play upstream aluminum business. |

| · | With ownership of the combined entity, Alumina Limited shareholders will exchange their shares in a non-operating passive investment

vehicle for an ownership position in Alcoa. |

| · | As part of this transition, Alumina Limited shareholders would participate in Alcoa’s capital returns program, including the

current dividend, and would have access to a larger, strong balance sheet that will be better able to fund portfolio actions, maintenance

capital, and growth capital. |

| · | With a centralized management team and strategy, Alcoa will be better positioned to execute operational and strategic decisions on

an accelerated basis. In addition, a simplified corporate structure will result in efficiencies through a reduction in corporate costs. |

Will current Alumina Limited shareholders receive franked dividends

as Alcoa stockholders?

| · | Alumina Limited has not paid any dividends since September of 2022. |

| · | As shareholders in the combined entity, Alumina Limited shareholders will be eligible to participate in Alcoa's capital returns program,

including Alcoa’s current dividend. Alcoa’s most recent quarterly dividend was paid on November 17, 2023 and the next will

be paid on March 21, 2024. Alcoa’s dividend will not be franked. |

| · | Alumina Limited's franking credits will remain with the combined entity and may be utilized for specific purposes in the future. |

What are the benefits of the transaction to Alcoa shareholders?

| · | This transaction is underpinned by strong industrial logic that delivers significant value to Alcoa shareholders. |

| · | The transaction would increase Alcoa’s financial flexibility, enabling more efficient funding and capital allocation decisions,

as well as liability management. |

| · | With a centralized management team and strategy, Alcoa will be better positioned to execute operational and strategic decisions on

an accelerated basis. |

| · | In addition, a simplified corporate structure will result in efficiencies through a reduction in corporate costs. |

How will Alumina Limited shareholders own Alcoa stock? Are Alcoa

CDIs expected to be in the same Australian Stock Exchange (ASX) indices Alumina Limited’s stock was?

| · | As part of the Agreement, Alumina Limited shareholders’ interests in Alcoa shares will generally be delivered in the form of

CDIs that represent a unit of beneficial ownership in a share of Alcoa common stock3,

which allows Alumina Limited shareholders to trade Alcoa common stock via CDIs on the ASX. The depositary and custodian of Alumina Limited’s

ADS program will receive its consideration in Alcoa shares and an affiliate of CITIC will receive a small proportion of its consideration

in non-voting convertible series A preferred stock. |

| · | In order to allow the trading of Alcoa CDIs, Alcoa will apply to establish a secondary listing on the ASX. Alcoa currently expects

the secondary listing to be represented in ASX indices. |

| · | Alcoa sees Australia as an attractive capital market and has committed to maintaining CDIs in Australia for at least 10 years. |

Will Alumina Limited shareholders have an option to own Alcoa CDIs

or Alcoa shares?

| · | In the scheme of arrangement, there will not be an option to elect to receive Alcoa shares rather than Alcoa CDIs as part of the transaction,

prior to the implementation of the scheme of arrangement. Only holders of Alumina ADSs as of the record date of the scheme of arrangement

will receive Alcoa shares in lieu of Alcoa CDIs. |

| · | However, after implementation of the scheme of arrangement, the Alcoa CDIs can be converted (or “transmuted”) into Alcoa

shares and vice versa at any time by contacting the transfer agent/registry for Alcoa shares or Alcoa CDIs (as applicable). |

What is the process for converting Alcoa CDIs into Alcoa shares?

| · | Following implementation of the scheme of arrangement, the Alcoa CDIs can be converted (or “transmuted”) into Alcoa shares

and vice versa at any time by contacting the transfer agent/registry for Alcoa shares or Alcoa CDIs (as applicable). Further details about

this process will be described in the Scheme Booklet to be dispatched by Alumina Limited in connection with the transaction. |

What will happen to the Alumina shares under the Alumina Limited

American Depositary Share program?

3

Each Clearing House Electronic Sub-register System Depositary Interest represents a unit of beneficial ownership in a share of Alcoa

common stock.

| · | The depositary and custodian of Alumina Limited’s American Depositary Share program will receive its consideration in Alcoa

shares instead of Alcoa CDIs. Further details will be provided in the Scheme Booklet to be dispatched by Alumina Limited in connection

with the transaction. |

Is CITIC receiving consideration that is different from other Alumina

shareholders? Will CITIC, on the one hand, and other Alumina shareholders, on the other hand, vote separately on the transaction?

| · | The non-voting convertible series A preferred stock is generally equivalent to the economic rights of the Alcoa CDIs that the other

Alumina Limited shareholders would receive in the scheme of arrangement, except it will have a liquidation preference of US$0.0001 for

each share. |

| · | It is expected that all Alumina shareholders will vote as a single class on the proposed scheme of arrangement at the Alumina Limited

scheme meeting. |

What does a transaction mean for Alcoa or AWAC customers / partners?

| · | Business partner interactions, from negotiations to the delivery of materials, will continue to be managed by Alcoa, and it remains

business as usual. Our customers and other business partners will continue to be a priority. |

| · | With a centralized management team and strategy, Alcoa will be better positioned to execute operational and strategic decisions on

an accelerated basis. |

| · | The acquisition builds on Alcoa’s industry-leading position and reinforces our commitment to the regions we serve, providing

benefits to customers, host communities, and others who rely on the continuing success of our global business. |

What are the benefits for stakeholders as a result of this announcement?

| · | The transaction increases Alcoa’s economic interest in its core business and simplifies governance by acquiring the minority

partner in its AWAC JV, resulting in greater operational flexibility and strategic optionality. |

| · | It also allows Alumina Limited shareholders to participate in the upside potential of a stronger, better-capitalized company with

a larger and more diversified portfolio while offering exposure to Alcoa’s upstream aluminum business. |

| · | This acquisition builds on our commitment to Western Australia, and provides significant benefits to employees, customers, host communities,

and others who rely on the continuing success of our global business. |

What are the terms of the liquidity support?

| · | Under the terms of the Agreement and at Alumina's request, Alcoa has agreed to provide short-term liquidity support to Alumina Limited

to fund equity calls made by the AWAC Joint venture if Alumina Limited’s net debt position exceeds $420 million. |

| · | Based on AWAC's current 2024 cashflow forecast, Alcoa does not expect any support to be required in the 2024 calendar year. |

| · | Subject to certain accelerated repayment triggers, Alumina Limited would be required to pay its equity calls (plus accrued interest)

not later than September 1, 2025 in the event the transaction is not completed. |

When will shares of Alumina Limited cease trading?

| · | The effective date and implementation date of the Scheme will occur in accordance with the timetable set out in the ASX Listing Rules,

following the satisfaction or waiver of all conditions precedent to the Scheme, including receipt of the required approvals from the Alcoa

stockholders, Alumina Limited shareholders, the Australian court, and under the foreign investment laws of Australia and the antitrust

laws of Brazil. |

| · | Further details about the expected timetable of the Scheme will be described in the Scheme Booklet to be dispatched by Alumina Limited

in connection with the transaction. |

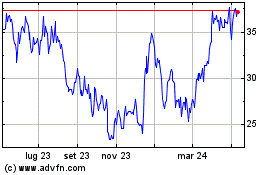

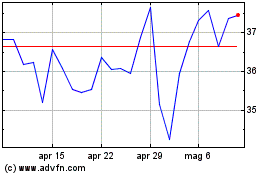

Grafico Azioni Alcoa (NYSE:AA)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Alcoa (NYSE:AA)

Storico

Da Nov 2023 a Nov 2024