0001577526false00015775262024-05-292024-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 29, 2024

C3.AI, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

1400 Seaport Blvd

Redwood City, CA

(Address of Principal Executive Offices)

001-39744

(Commission File Number)

26-3999357

(IRS Employer Identification No.)

94063

(Zip Code)

(650) 503-2200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 per share | | AI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 29, 2024, C3.ai, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal fourth quarter and the full fiscal year ended April 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and Item 9.01 in this Current Report on Form 8-K, including the accompanying Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 8.01 Other Events.

On February 27, 2024, C3.ai, Inc. (the “Company”) filed a lawsuit in the Court of Rome, Italy against Enel Global Services S.r.l. and any involved corporate affiliates (“Enel”). The claims in the suit against Enel include misappropriation of trade secrets under Articles 98 and 99 of the Italian Industrial Property Code and breach of contract. In this action, the Company seeks compensatory damages in the amount of €2.1 billion, equitable and other relief, as well as fees and costs. The Company has also filed a report of criminal misconduct with Italian law enforcement under Article 623 of the Italian Criminal Code. The Company is evaluating other legal venues to fully redress its claims. The Company is considering filing a report of misconduct with federal law enforcement in the United States. Since any legal action is unpredictable, it is difficult to quantify the potential recoveries, associated potential costs, and timeline associated with resolution of this matter. The Company does not assume any obligation to provide regular updates on this legal action.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| C3.ai, Inc. |

| | |

| Dated: May 29, 2024 | | |

| By: | /s/ Thomas M. Siebel |

| | Thomas M. Siebel |

| | Chief Executive Officer and Chairman of the Board of Directors |

C3 AI Announces Fiscal Fourth Quarter and Full Fiscal Year 2024 Financial Results

Increasing Revenue Growth. Raising Guidance.

Growth Accelerates for Fifth Consecutive Quarter, Record Federal Growth

Subscription Revenue for the Fourth Quarter Increased 41% Year-Over-Year

REDWOOD CITY, Calif. — May 29, 2024 — C3.ai, Inc. (“C3 AI,” “C3,” or the “Company”) (NYSE: AI), the Enterprise AI application software company, today announced financial results for its fiscal fourth quarter and full fiscal year ended April 30, 2024.

“We finished a strong quarter and closed out a huge year for C3 AI. This was our fifth consecutive quarter of accelerating revenue growth. Our fourth quarter revenue grew by 20% year-over-year to $86.6 million, exceeding the top end of our guidance. Our full year revenue grew by 16% to $310.6 million, also exceeding the top end of our guidance,” said C3 AI CEO and Chairman Thomas M. Siebel. “Demand for Enterprise AI is intensifying, and our first to market advantage in Enterprise AI positions us well to capitalize on it. Our Enterprise AI applications have been adopted across 19 industries, underscoring increasing market diversity. Our federal revenue grew by more than 100% for the year. The interest we are seeing in our generative AI applications is staggering.”

Fiscal Fourth Quarter 2024 Financial Highlights

•Revenue: Total revenue for the quarter was $86.6 million, an increase of 20% compared to $72.4 million one year ago.

•Subscription Revenue: Subscription revenue for the quarter was $79.9 million, constituting 92% of total revenue, an increase of 41% compared to $56.9 million one year ago.

•Gross Profit: GAAP gross profit for the quarter was $51.6 million, representing a 60% gross margin. Non-GAAP gross profit for the quarter was $60.9 million, representing a 70% non-GAAP gross margin.

•Net Loss per Share: GAAP net loss per share was $(0.59). Non-GAAP net loss per share was $(0.11).

•Cash Reserves: $750.4 million in cash, cash equivalents, and marketable securities.

•Free Cash Flow: Positive free cash flow of $18.8 million.

Full Year Fiscal 2024 Financial Highlights

•Revenue: Total revenue for the fiscal year was $310.6 million, an increase of 16% compared to $266.8 million one year ago.

•Subscription Revenue: Subscription revenue for the fiscal year was $278.1 million, constituting 90% of total revenue, an increase of 21% compared to $230.4 million one year ago.

•Gross Profit: GAAP gross profit for the fiscal year was $178.6 million, representing 57% gross margin. Non-GAAP gross profit was $215.6 million, representing 69% non-GAAP gross margin.

•Net Loss per Share: GAAP net loss per share was $(2.34). Non-GAAP net loss per share was $(0.47).

Business Highlights

C3 AI is leading with Enterprise AI applications. In FY24, 88% of all bookings were driven by application sales and 12% of our bookings were driven by sales of the C3 AI Platform.

•In FY24, the Company closed 191 agreements (an increase of 52% year-over-year) including 123 pilots (an increase of 151% year-over-year).

•In the fourth quarter of FY24, the Company entered into new agreements with ExxonMobil, A.P. Moller-Maersk, General Mills, Quest Diagnostics, Flextronics, BASF Petronas, Worley Limited, Thales Group, the U.S. Navy, the U.S. Intelligence Community, the U.S. National Science Foundation, The Secil Group, Cargill, Nucor Corporation, and Dow, among others.

•In State & Local Government, the Company expanded its engagement with Riverside County in California to include commercial property appraisals and entered into a new agreement with the Pasco County Sheriff’s Office.

•In the fourth quarter of FY24, the Company closed 47 agreements, including 34 new pilots and continued to diversify across industries.

•In the fourth quarter of FY24, our bookings distribution by industry was as follows:

| | | | | |

Federal, Defense and Aerospace | 49.5 | % |

| Oil and Gas | 15.2 | % |

| State and Local Government | 10.8 | % |

| Manufacturing | 6.7 | % |

| Energy and Utilities | 6.0 | % |

| Consumer Packaged Goods | 5.1 | % |

| Professional Services | 4.8 | % |

Agriculture | 0.7 | % |

| Hospitals and Healthcare | 0.6 | % |

| Others | 0.6 | % |

•In the fourth quarter of FY24, our pilot distribution by industry was as follows:

| | | | | |

| Manufacturing | 29.4 | % |

| Federal, Defense and Aerospace | 20.6 | % |

Agriculture | 11.8 | % |

| Chemicals | 8.8 | % |

| Life Sciences | 5.9 | % |

| Oil and Gas | 5.9 | % |

| State and Local Government | 5.9 | % |

| Energy and Utilities | 5.9 | % |

| Logistics and Transportation | 2.9 | % |

| Construction | 2.9 | % |

Customer Success

C3 AI remains the leader in AI-powered predictive maintenance solutions, continuing to deliver significant economic value across industries, with heavy adoption in the Industrial, Manufacturing, and Energy sectors.

•Dow, one of the world's largest chemical manufacturers, is enhancing its predictive maintenance capabilities with C3 AI. Using C3 AI Reliability, Dow reduced steam cracker downtime and is now scaling out C3 AI Reliability to additional sites and assets. Additionally, Dow will install C3 Generative AI on top of C3 AI Reliability to provide equipment operators with AI insights, improve alert responses, and expedite the personnel onboarding process.

“C3 AI is our partner that’s working with us on predictive analytics around [steam] crackers — so a 20% reduction around [steam] cracker downtime, by looking at furnace operations and how that works, is a big outcome that we’re expecting,” said Jim Fitterling, CEO, Dow. “We’ve got it on one [steam] cracker right now and then we’ll look to scale that across the fleet.”

•Holcim, a European leader in sustainable building solutions, started with a C3 AI Reliability production pilot in May 2023 and now has 31 facilities in production, monitoring 3,000 sensors from critical equipment including vertical roller mills.

“C3 AI is playing an important role in Holcim’s digital transformation, providing innovative AI solutions that drive efficiency and sustainability,” said Roze Wesby, Head of Plants of Tomorrow, Holcim. “The collaboration between C3 AI and Holcim has led to advancements in operational efficiency at scale, raising the bar for predictive maintenance in our sites. Thanks to C3 AI’s platforms, Holcim has achieved a step-change in asset lifecycle management; improving our reliability and capacity for our customers, as well as reducing environmental impact.”

•Con Edison, one of the nation’s largest energy companies that delivers electric, gas, and steam power to approximately 10 million customers, uses the C3 AI Platform to improve operational efficiency, public safety, billing performance, customer satisfaction, and energy efficiency. Starting with the advanced metering infrastructure (AMI) project in 2017, Con Edison has worked with C3 AI to build out an Enterprise AI program, including applications to predict meter health issues, optimize and conserve voltage outputs, and quickly detect customer safety concerns.

“The AMI project, the largest in Con Edison’s history, included the deployment of 5.3 million smart meters and resulted in significant benefits such as improved outage management and energy efficiency,” said Tom Magee, General Manager, AMI Operations & Solutions, Con Edison. “The use of AI and machine learning has enhanced public safety, optimized grid operation, and achieved substantial energy savings and emission reductions for customers.”

Federal Growth

•C3 AI’s Federal business had a remarkable year with revenue more than doubling in FY24.

•The Company closed 65 Federal agreements, an increase of 48% year-over-year and made inroads to 10 new Federal organizations.

•In the fourth quarter of FY24, the Company entered into new and expansion agreements with the U.S. Air Force, the U.S. Navy, the U.S. Marine Corps, the U.S. Intelligence Community, the Defense Counterintelligence and Security Agency, the Chief Digital Artificial Intelligence Office, Thales Group, and the National Science Foundation.

•The U.S. Air Force Rapid Sustainment Office (RSO) entered into a renewed agreement, significantly expanding their AI footprint by expanding the capabilities and increasing the number of aircraft and systems monitored on the Predictive Analytics and Decision Assistant (PANDA) application. PANDA, co-developed by the U.S. Air Force and C3 AI, optimizes fleet maintenance, increases aircraft availability, and minimizes downtime. The application, which is the designated U.S. Air Force System of Record for all predictive maintenance projects within the RSO, will now monitor systems on two new aircraft (T-7 and KC-46) and expand to include new systems of three currently monitored aircraft (B-1B, C-5, and KC-135).

“C3 AI’s cutting-edge technology has been a game-changer for the U.S. Air Force, driving unparalleled advancements in predictive analytics and maintenance,” said Jimmy Lawrence, Deputy Program Executive Officer and Deputy Director for the Rapid Sustainment Office, USAF Life Cycle Management Center, USAF Materiel Command, Wright-Patterson Air Force Base, Ohio. “The implementation of C3 AI’s solutions has revolutionized the operational capabilities of the Air Force, leading to significant improvements in aircraft readiness and efficiency.”

•The U.S. Navy entered into a new agreement that builds on the work between C3 AI and the U.S. Air Force on the Crowd-Sourced Flight Data (CSFD) Program and expands it into flight test parametric analysis of electronic emissions on the F-35. The CSFD Program enables the rapid delivery of software-defined warfighter capabilities, decreasing risks to operational forces by discovering and resolving anomalies in fielded weapon systems before those systems are required in combat.

Partner Network

C3 AI’s partners remain a key driver of growth and customer success.

•In FY24, C3 AI closed 115 agreements through its partner network, an increase of 62% year-over-year. This includes 91 agreements with AWS, Google Cloud, and Microsoft Azure.

•The joint 12-month qualified opportunity pipeline with partners increased by 63% year-over-year.

•In the fourth quarter of FY24, partner supported bookings grew by 76% year-over-year with the Company closing 28 agreements through its partner network, including AWS, Baker Hughes, Booz Allen, Google Cloud, and Microsoft.

•The Company deepened its partnership with Fractal and Paradyme to support Version 8 upgrades, customer service engagements, and pilot delivery. These organizations have established dedicated practices around C3 AI and are committed to training over 200 C3 AI–qualified engineers and data scientists in FY25.

C3 Generative AI

The broad applicability of C3 Generative AI is driving the Company into new verticals and accelerating industry diversification.

•In FY24, the Company closed 58 pilot agreements for C3 Generative AI across 15 different industries. The distribution by industry was as follows:

| | | | | |

| Federal, Defense and Aerospace | 20.7 | % |

| Manufacturing | 12.1 | % |

Agriculture | 10.3 | % |

| State and Local Government | 10.3 | % |

| Financial Services | 6.9 | % |

| Chemicals | 5.2 | % |

| Construction | 5.2 | % |

| Consumer Packaged Goods | 5.2 | % |

| Energy and Utilities | 5.2 | % |

| Oil and Gas | 5.2 | % |

| Pharmaceuticals and Life Sciences | 5.2 | % |

| Others | 8.5 | % |

•In the fourth quarter of FY24, the Company closed 13 C3 Generative AI pilots with ExxonMobil, Cargill, Dow, Hunter Engineering, Norfolk Iron & Metal, Revvity, and the National Science Foundation, among others.

•The Company further differentiated C3 Generative AI from other market offerings with:

•Streamlined omni-modal data integration through a visual administrative interface, allowing queries across multiple sources such as Snowflake, Oracle, Databricks tables, and documents in Amazon S3 and Google Cloud.

•Proprietary, fine-tuned large language models (LLMs) for more capable, accurate, and faster structured data queries.

•Automatic support for questions and answers in over 130 languages.

•Dynamic swapping of LLMs and retrievers with a single click, including automatic updates to related retrieval configurations, baseline prompts, and orchestration parameters.

•Advanced support for querying images and data tables embedded in documents.

•Enhanced accuracy with automated topic modeling of data contained in documents.

•Availability of all core product features in air-gapped environments.

•Advanced orchestration for complex queries involving multiple LLMs and retrieval tools.

•Improved C3 Generative AI co-pilot LLM to accelerate the productivity of developers and data scientists on the C3 AI Platform.

Financial Outlook:

We are expecting additional acceleration of C3 AI revenue growth to approximately 23% in FY25. We plan to continue to invest in growth to build a long-term cash generating profitable market leader in Enterprise AI.

The Company’s guidance includes GAAP and non-GAAP financial measures.

The following table summarizes C3 AI’s guidance for the first quarter of fiscal 2025 and full-year fiscal 2025:

| | | | | | | | | | | |

| (in millions) | First Quarter Fiscal 2025 Guidance | | Full Year Fiscal 2025 Guidance |

| Total revenue | $84.0 - $89.0 | | $370.0 - $395.0 |

| Non-GAAP loss from operations | $(22.0) - $(30.0) | | $(95.0) - $(125.0) |

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. We have provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for our historical non-GAAP results included in this press release. Our fiscal year ends April 30, and numbers are rounded for presentation purposes.

Conference Call Details

| | | | | |

| What: | C3 AI Fourth Quarter and Full Fiscal Year 2024 Financial Results Conference Call |

| When: | Wednesday, May 29, 2024 |

| Time: | 2:00 p.m. PT / 5:00 p.m. ET |

| Participant Registration: | https://register.vevent.com/register/BIa4098dae2ede4f80a85f5a3a50b873e3 (live call) |

| Webcast: | https://edge.media-server.com/mmc/p/zjmvtizr (live and replay) |

| |

| |

Investor Presentation Details

An investor presentation providing additional information and analysis can be found at our investor relations page at ir.c3.ai.

Statement Regarding Use of Non-GAAP Financial Measures

The Company reports the following non-GAAP financial measures, which have not been prepared in accordance with generally accepted accounting principles in the United States (GAAP), in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

•Non-GAAP gross profit, non-GAAP gross margin, non-GAAP loss from operations, and non-GAAP net loss per share. Our non-GAAP gross profit, non-GAAP gross margin, non-GAAP loss from operations, and non-GAAP net loss per share exclude the effect of stock-based compensation expense-related charges and employer payroll tax expense related to employee stock-based compensation. We believe the presentation of operating results that exclude these non-cash items provides useful supplemental information to investors and facilitates the analysis of our operating results and comparison of operating results across reporting periods.

•Free cash flow. We believe free cash flow, a non-GAAP financial measure, is useful in evaluating liquidity and provides information to management and investors about our ability to fund future operating needs and strategic initiatives. We calculate free cash flow as net cash provided by (used in) operating activities less purchases of property and equipment and capitalized software development costs. This non-GAAP financial measure may be different than similarly titled measures used by other companies. Additionally, the utility of free cash flow is further limited as it does not represent the total increase or decrease in our cash balances for a given period.

We use these non-GAAP financial measures internally for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. Our presentation of non-GAAP financial measures may not be comparable to similar measures used by other companies. We encourage investors to carefully consider our results under GAAP, as well as our supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand our business. Please see the tables included at the end of this release for the reconciliation of GAAP to non-GAAP financial measures.

Use of Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements regarding our market leadership position, anticipated benefits from our partnerships, financial outlook, our sales and customer opportunity pipeline including our industry diversification, the expected benefits of our offerings (including the potential benefits of our C3 Generative AI offerings), and our business strategies, plans, and objectives for future operations. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including our history of losses and ability to achieve and maintain profitability in the future, our historic dependence on a limited number of existing customers that account for a substantial portion of our revenue, our ability to attract new customers and retain existing customers, market awareness and acceptance of enterprise AI solutions in general and our products in particular, the length and unpredictability of our sales cycles and the time and expense required for our sales efforts. Some of these risks are described in greater detail in our filings with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q for the fiscal quarters ended July 31, 2023, October 31, 2023 and January 31, 2024, and other filings and reports we make with the Securities and Exchange Commission from time to time, including our Form 10-K that will be filed for the fiscal year ended April 30, 2024, although new and unanticipated risks may arise. The future events and trends discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Except to the extent required by law, we do not undertake to update any of these forward-looking statements after the date of this press release to conform these statements to actual results or revised expectations.

About C3.ai, Inc.

C3.ai, Inc. (NYSE:AI) is the Enterprise AI application software company. C3 AI delivers a family of fully integrated products including the C3 AI Platform, an end-to-end platform for developing, deploying, and operating enterprise AI applications and C3 AI Applications, a portfolio of industry-specific SaaS enterprise AI applications that enable the digital transformation of organizations globally, and C3 Generative AI, a suite of domain-specific generative AI offerings for the enterprise.

Investor Contact

ir@c3.ai

C3 AI Public Relations

Edelman

Lisa Kennedy

(415) 914-8336

pr@c3.ai

Source: C3.ai, Inc.

C3.AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Fiscal Year Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | |

Subscription(1) | $ | 79,903 | | | $ | 56,866 | | | $ | 278,104 | | | $ | 230,443 | |

Professional services(2) | 6,687 | | | 15,544 | | | 32,478 | | | 36,352 | |

| Total revenue | 86,590 | | | 72,410 | | | 310,582 | | | 266,795 | |

| Cost of revenue | | | | | | | |

| Subscription | 34,825 | | | 23,872 | | | 128,469 | | | 78,423 | |

| Professional services | 154 | | | 1,036 | | | 3,553 | | | 7,914 | |

| Total cost of revenue | 34,979 | | | 24,908 | | | 132,022 | | | 86,337 | |

| Gross profit | 51,611 | | | 47,502 | | | 178,560 | | | 180,458 | |

| Operating expenses | | | | | | | |

Sales and marketing(3) | 63,247 | | | 51,701 | | | 214,167 | | | 183,121 | |

| Research and development | 50,618 | | | 49,681 | | | 201,365 | | | 210,660 | |

| General and administrative | 20,053 | | | 19,400 | | | 81,370 | | | 77,170 | |

| Total operating expenses | 133,918 | | | 120,782 | | | 496,902 | | | 470,951 | |

| Loss from operations | (82,307) | | | (73,280) | | | (318,342) | | | (290,493) | |

| Interest income | 9,482 | | | 8,230 | | | 40,079 | | | 21,979 | |

Other (expense) income, net | (173) | | | 284 | | | (641) | | | 350 | |

| Loss before provision for income taxes | (72,998) | | | (64,766) | | | (278,904) | | | (268,164) | |

| Provision for income taxes | (71) | | | 190 | | | 792 | | | 675 | |

| Net loss | $ | (72,927) | | | $ | (64,956) | | | $ | (279,696) | | | $ | (268,839) | |

| Net loss per share attributable to Class A and Class B common stockholders, basic and diluted | $ | (0.59) | | | $ | (0.58) | | | $ | (2.34) | | | $ | (2.45) | |

| Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 122,676 | | | 112,746 | | | 119,362 | | | 109,851 | |

(1) Including related party revenue of nil and $19,568 for the three months ended April 30, 2024 and 2023, respectively, and $10,581 and $75,452 for the fiscal years ended April 30, 2024 and 2023, respectively.

(2) Including related party revenue of nil and $8,025 for the three months ended April 30, 2024 and 2023, respectively, and $5,804 and $16,774 for the fiscal years ended April 30, 2024 and 2023, respectively.

(3) Including related party sales and marketing expense of nil and $3,416 for the three months ended April 30, 2024 and 2023, respectively, and $810 and $13,962 for the fiscal years ended April 30, 2024 and 2023, respectively.

C3.AI, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data)

(Unaudited)

| | | | | | | | | | | |

| April 30, 2024 | | April 30, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 167,146 | | | $ | 284,829 | |

Marketable securities | 583,221 | | | 446,155 | |

Accounts receivable, net of allowance of $359 and $359 as of April 30, 2024 and 2023, respectively(1) | 130,064 | | | 134,586 | |

Prepaid expenses and other current assets(2) | 23,963 | | | 23,309 | |

| Total current assets | 904,394 | | | 888,879 | |

| Property and equipment, net | 88,631 | | | 84,578 | |

| Goodwill | 625 | | | 625 | |

| Long-term investments | — | | | 81,418 | |

Other assets, non-current(3) | 44,575 | | | 47,528 | |

| Total assets | $ | 1,038,225 | | | $ | 1,103,028 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

Accounts payable(4) | $ | 11,316 | | | $ | 24,610 | |

| Accrued compensation and employee benefits | 44,263 | | | 46,513 | |

Deferred revenue, current(5) | 37,230 | | | 47,846 | |

Accrued and other current liabilities(6) | 9,526 | | | 17,070 | |

| Total current liabilities | 102,335 | | | 136,039 | |

| Deferred revenue, non-current | 1,732 | | | 4 | |

| Other long-term liabilities | 60,805 | | | 37,320 | |

| Total liabilities | 164,872 | | | 173,363 | |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

Class A common stock, $0.001 par value. 1,000,000,000 shares authorized as of April 30, 2024 and 2023, respectively; 120,205,931 and 110,442,569 shares issued and outstanding as of April 30, 2024 and 2023 respectively | 120 | | | 110 | |

Class B common stock, $0.001 par value; 3,500,000 shares authorized as of April 30, 2024 and 2023, respectively; 3,499,992 and 3,499,992 shares issued and outstanding as of April 30, 2024 and 2023, respectively | 3 | | | 3 | |

| Additional paid-in capital | 1,963,726 | | | 1,740,174 | |

| Accumulated other comprehensive loss | (563) | | | (385) | |

| Accumulated deficit | (1,089,933) | | | (810,237) | |

| Total stockholders’ equity | 873,353 | | | 929,665 | |

| Total liabilities and stockholders’ equity | $ | 1,038,225 | | | $ | 1,103,028 | |

(1) Including amounts from a related party of $74,620 as of April 30, 2023.

(2) Including amounts from a related party of $4,983 as of April 30, 2023.

(3) Including amounts from a related party of $11,279 as of April 30, 2023.

(4) Including amounts due to a related party of $2,200 as of April 30, 2023.

(5) Including amounts from a related party of $249 as of April 30, 2023.

(6) Including amounts due to a related party of $2,448 as of April 30, 2023.

C3.AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Fiscal Year Ended April 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (279,696) | | | $ | (268,839) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | |

| Depreciation and amortization | 12,719 | | | 6,088 | |

| Non-cash operating lease cost | 742 | | | 6,992 | |

| Stock-based compensation expense | 215,761 | | | 216,542 | |

Accretion of discounts on marketable securities......................................................................................................... | (17,214) | | | (4,558) | |

| Other | 98 | | | 249 | |

| Changes in operating assets and liabilities | | | |

Accounts receivable(1) | 4,522 | | | (54,517) | |

Prepaid expenses, other current assets and other assets(2) | 3,208 | | | (576) | |

Accounts payable(3) | (12,883) | | | (22,041) | |

| Accrued compensation and employee benefits | (6,218) | | | 3,193 | |

| Operating lease liabilities | 17,332 | | | 13,641 | |

Other liabilities(4) | 8,155 | | | (10,573) | |

Deferred revenue(5) | (8,888) | | | (1,292) | |

| Net cash used in operating activities | (62,362) | | | (115,691) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (25,256) | | | (70,518) | |

Capitalized software development costs | (2,750) | | | (1,000) | |

| Purchases of investments | (827,901) | | | (745,249) | |

| Maturities and sales of investments | 789,292 | | | 876,713 | |

| Net cash (used in) provided by investing activities | (66,615) | | | 59,946 | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Proceeds from exercise of Class A common stock options | 13,751 | | | 4,468 | |

| Proceeds from issuance of Class A common stock under employee stock purchase plan | 10,763 | | | 3,093 | |

| Taxes paid related to net share settlement of equity awards | (13,220) | | | (6,940) | |

| Net cash provided by financing activities | 11,294 | | | 621 | |

| Net decrease in cash, cash equivalents and restricted cash | (117,683) | | | (55,124) | |

| Cash, cash equivalents and restricted cash at beginning of period | 297,395 | | | 352,519 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 179,712 | | | $ | 297,395 | |

| Cash and cash equivalents | $ | 167,146 | | | $ | 284,829 | |

| | | |

| Restricted cash included in other assets, non-current | 12,566 | | | 12,566 | |

| Total cash, cash equivalents and restricted cash | $ | 179,712 | | | $ | 297,395 | |

| Supplemental disclosure of cash flow information—cash paid for income taxes | $ | 975 | | | $ | 578 | |

| Supplemental disclosures of non-cash investing and financing activities: | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 474 | | | $ | 13,814 | |

| Right-of-use assets obtained in exchange for lease obligations (including remeasurement of right-of-use assets and lease liabilities due to changes in the timing of receipt of lease incentives) | $ | 1,833 | | | $ | (5,589) | |

| Right-of-use assets obtained in exchange for lease obligations arising from lease modifications | $ | — | | | $ | 3,093 | |

| Receivable from exercise of stock options included in prepaid expenses, other current assets and other assets | $ | 3 | | | $ | 61 | |

| Unpaid liabilities related to intangible purchases | $ | — | | | $ | 1,500 | |

| Vesting of early exercised stock options | $ | 507 | | | $ | 1,006 | |

(1)Including changes in related party balances of $12,444 and $38,772 for the fiscal years ended April 30, 2024 and 2023, respectively.

(2)Including changes in related party balances of $(810) and $(4,741) for the fiscal years ended April 30, 2024 and 2023, respectively.

(3)Including changes in related party balances of $248 and $(16,349) for the fiscal years ended April 30, 2024 and 2023, respectively.

(4)Including changes in related party balances of $(2,448) and $(2,510) for the fiscal years ended April 30, 2024 and 2023, respectively.

(5)Including changes in related party balances of $(46) and $117 for the fiscal years ended April 30, 2024 and 2023, respectively.

C3.AI, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except percentages)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Fiscal Year Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of GAAP gross profit to non-GAAP gross profit: | | | | | | | |

| Gross profit on a GAAP basis | $ | 51,611 | | $ | 47,502 | | $ | 178,560 | | $ | 180,458 |

Stock-based compensation expense (1) | 8,828 | | 5,972 | | 35,320 | | 23,637 |

Employer payroll tax expense related to employee stock-based compensation (2) | 493 | | 377 | | 1,736 | | 1,150 |

| Gross profit on a non-GAAP basis | $ | 60,932 | | $ | 53,851 | | $ | 215,616 | | $ | 205,245 |

| | | | | | | |

| | | | | | | |

| Gross margin on a GAAP basis | 60% | | 66% | | 57% | | 68% |

| Gross margin on a non-GAAP basis | 70% | | 74% | | 69% | | 77% |

| | | | | | | |

| Reconciliation of GAAP loss from operations to non-GAAP loss from operations: | | | | | | | |

| Loss from operations on a GAAP basis | $ | (82,307) | | $ | (73,280) | | $ | (318,342) | — | $ | (290,493) |

Stock-based compensation expense (1) | 56,729 | | 48,068 | | 215,761 | | 216,542 |

Employer payroll tax expense related to employee stock-based compensation (2) | 2,173 | | 1,669 | | 7,720 | | 5,877 |

| Loss from operations on a non-GAAP basis | $ | (23,405) | | $ | (23,543) | | $ | (94,861) | | $ | (68,074) |

| | | | | | | |

| Reconciliation of GAAP net loss per share to non-GAAP net loss per share: | | | | | | | |

| | | | | | | |

| Net loss on a GAAP basis | $ | (72,927) | | $ | (64,956) | | $ | (279,696) | | $ | (268,839) |

Stock-based compensation expense (1) | 56,729 | | 48,068 | | 215,761 | | 216,542 |

Employer payroll tax expense related to employee stock-based compensation (2) | 2,173 | | 1,669 | | 7,720 | | 5,877 |

| Net loss on a non-GAAP basis | $ | (14,025) | | $ | (15,219) | | $ | (56,215) | | $ | (46,420) |

| | | | | | | |

| GAAP net loss per share attributable to common stockholders, basic and diluted | $ | (0.59) | | | $ | (0.58) | | | $ | (2.34) | | | $ | (2.45) | |

| Non-GAAP net loss per share attributable to common stockholders, basic and diluted | $ | (0.11) | | | $ | (0.13) | | | $ | (0.47) | | | $ | (0.42) | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | 122,676 | | | 112,746 | | | 119,362 | | | 109,851 | |

(1)Stock-based compensation expense for gross profit and gross margin includes costs of subscription and cost of professional services as follows. Stock-based compensation expense for loss from operations includes total stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Fiscal Year Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of subscription | $ | 8,788 | | | $ | 5,663 | | | $ | 34,032 | | | $ | 21,417 | |

| Cost of professional services | 40 | | | 309 | | | 1,288 | | — | | 2,220 | |

| Sales and marketing | 19,218 | | | 17,214 | | | 71,751 | | — | | 71,389 | |

| Research and development | 19,561 | | | 17,449 | | | 72,036 | | — | | 90,217 | |

| General and administrative | 9,122 | | | 7,433 | | | 36,654 | | — | | 31,299 | |

| Total stock-based compensation expense | $ | 56,729 | | | $ | 48,068 | | | $ | 215,761 | | | $ | 216,542 | |

(2) Employer payroll tax expense related to employee stock-based compensation for gross profit and gross margin includes costs of subscription and cost of professional services as follows. Employer payroll tax expense related to employee stock-based compensation for loss from operations includes total employer payroll tax expense related to employee stock-based compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Fiscal Year Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of subscription | $ | 490 | | | $ | 357 | | | $ | 1,673 | | | $ | 1,003 | |

| Cost of professional services | 3 | | | 20 | | | 63 | | | 147 | |

| Sales and marketing | 642 | | | 604 | | | 2,606 | | | 1,767 | |

| Research and development | 869 | | | 576 | | | 2,839 | | | 2,523 | |

| General and administrative | 169 | | | 112 | | | 539 | | | 437 | |

| Total employer payroll tax expense | $ | 2,173 | | | $ | 1,669 | | | $ | 7,720 | | | $ | 5,877 | |

Reconciliation of free cash flow to the GAAP measure of net cash provided by (used in) operating activities:

The following table below provides a reconciliation of free cash flow to the GAAP measure of net cash provided by (used in) operating activities for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Fiscal Year Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by (used in) operating activities | $ | 21,343 | | | $ | 27,054 | | | $ | (62,362) | | | $ | (115,691) | |

| Less: | | | | | | | |

| Purchases of property and equipment | (2,538) | | | (10,751) | | | (25,256) | | | (70,518) | |

| Capitalized software development costs | — | | | — | | | (2,750) | | | (1,000) | |

| Free cash flow | $ | 18,805 | | | $ | 16,303 | | | $ | (90,368) | | | $ | (187,209) | |

Document and Entity Information

|

May 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 29, 2024

|

| Entity Registrant Name |

C3.AI, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39744

|

| Entity Tax Identification Number |

26-3999357

|

| Entity Address, Address Line One |

1400 Seaport Blvd

|

| Entity Address, City or Town |

Redwood City,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94063

|

| City Area Code |

650

|

| Local Phone Number |

503-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.001 per share

|

| Trading Symbol |

AI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001577526

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

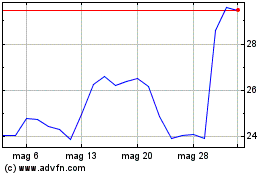

Grafico Azioni C3 AI (NYSE:AI)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni C3 AI (NYSE:AI)

Storico

Da Giu 2023 a Giu 2024