false

0001748790

0001748790

2024-09-04

2024-09-04

0001748790

amcr:OrdinarySharesParValue0.01PerShareMember

2024-09-04

2024-09-04

0001748790

amcr:Sec1.125GuaranteedSeniorNotesDue2027Member

2024-09-04

2024-09-04

0001748790

amcr:Sec5.450GuaranteedSeniorNotesDue2029Member

2024-09-04

2024-09-04

0001748790

amcr:Sec3.950GuaranteedSeniorNotesDue2032Member

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 4, 2024

AMCOR

PLC

(Exact

name of registrant as specified in its charter)

| Jersey |

001-38932 |

98-1455367 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 83 Tower Road North |

|

| Warmley, Bristol |

|

| United Kingdom |

BS30 8XP |

| (Address of principal executive offices) |

(Zip Code) |

+44 117 9753200

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

|

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

Shares, par value $0.01 per share |

|

AMCR |

|

New

York Stock Exchange |

| 1.125%

Guaranteed Senior Notes Due 2027 |

|

AUKF/27 |

|

New

York Stock Exchange |

| 5.450%

Guaranteed Senior Notes Due 2029 |

|

AMCR/29 |

|

New

York Stock Exchange |

| 3.950% Guaranteed Senior Notes Due 2032 |

|

AMCR/32 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As

previously disclosed, on March 19, 2024, Amcor plc (the “Company”) announced that Peter Konieczny, the

Company’s then-current Chief Commercial Officer, would become Interim Chief Executive

Officer (the “Interim CEO”) and carry the title of principal executive officer, effective April 15, 2024. On September 4,

2024, after a robust internal and external search, the Board of Directors (the “Board”) of the Company appointed Mr. Konieczny

as the Chief Executive Officer of the Company, effective immediately. It is also intended that Mr. Konieczny will become a director

nominee to be included in the Company’s definitive proxy statement for its 2024 annual general meeting of shareholders, expected

to be held in November 2024. The Board has taken action to increase the size of the Board to reflect the addition of Mr. Konieczny

as a director, with such increase to be effective immediately prior to the Company’s 2024 annual general meeting of shareholders.

Mr. Konieczny,

59, has been employed by Amcor or its predecessors since 2010. He served as Interim CEO from April 2024 to the present; Chief Commercial

Officer from September 2020 to April 2024; President, Amcor Flexibles, Europe,

Middle East & Africa and Latin America between 2019 and September 2020; President, Amcor Flexibles Europe, Middle East &

Africa between 2015 and 2019; and President, Amcor Specialty Cartons between 2010 and 2015. Prior to Amcor, he had five years of experience

in the packaging industry as President of Silgan White Cap, a global organization specializing in metal and plastic closures for the food

and beverage industries. He held business group Managing Director and Chief Finance Officer positions in the heavy industrial equipment

industry and has been a management consultant with McKinsey & Company.

Mr. Konieczny

is a party to an employment agreement with the Company, dated September 17, 2009 (the “Original Employment Agreement”),

which was supplemented by a letter agreement, dated March 16, 2024 (the “Interim CEO Letter Agreement”), that set forth

employment and compensation terms relating to his role as Interim CEO, and which incorporated certain terms of the Original Employment

Agreement.

On September 4, 2024,

in connection with Mr. Konieczny’s appointment to the role of Chief Executive Officer (the “CEO”), he entered into

a letter agreement with the Company, dated as of such date (the “CEO Letter Agreement”), that sets forth employment and compensation

terms relating to his role as the CEO, and which incorporates certain terms of the Original Employment Agreement. The CEO Letter Agreement

confirms that Mr. Konieczny will report to the Board in his role as CEO. Further pursuant to the terms of the CEO Letter Agreement,

Mr. Konieczny will continue to receive an annualized base salary of CHF 1,580,190. He

will continue to participate in the Company’s Management Incentive Plan (the “MIP”) with an incentive opportunity at

the target percentage of 120% of base salary and payouts ranging from 0 to 180% of base salary based on individual and Company performance.

Mr. Konieczny will continue to participate in the Company’s Equity Management Incentive Plan (the “EMIP”), with

an annual grant valued at 50% of the cash MIP payout paid to him and delivered in the form of time-based restricted share units (“RSUs”).

He will also continue to participate in the Company’s Long-Term Incentive Plan with grants made to him based on a grant date fair

value of 250% of his base salary. The restricted share unit grant provided to Mr. Konieczny under the Company’s Senior Executive

Retention Share Plan upon his appointment as Interim CEO will continue unchanged. The CEO Letter Agreement supersedes and cancels the

Interim CEO Letter Agreement.

If

the Company were to terminate Mr. Konieczny without cause (as defined in his Original Employment Agreement), or if Mr. Konieczny

terminates his employment as a good leaver (as defined in the CEO Letter Agreement), each while he is serving as CEO, then he would be

entitled to (1) 12 months of base salary as severance pay; (2) any MIP payment (including any portion due under the EMIP) previously

earned at the time of termination, paid entirely in cash; (3) a pro-rated portion of the MIP award earned (including any portion

due under the EMIP) for the performance period during which the termination occurs, paid entirely in cash; (4) the vesting in full

of all outstanding RSUs granted to him under the EMIP within 30 days after the employment termination date, and the vesting in full of

the restricted share units granted to him at the time he became Interim CEO within 30 days following cessation of active employment; and

(5) any other equity awards for which he has completed one-half of the performance or vesting period as of the termination date will

continue to vest according to their terms on a pro-rated basis. Further, Mr. Konieczny’s restrictive covenants under his Original

Employment Agreement will be extended to 12 months (the “restraint period”) following termination of employment, and the definition

of restraint area as relates to his restrictive covenants is modified to mean all regions in which the Company operates a material

business as at the date of termination of his employment. The Company will pay to Mr. Konieczny during the restraint period an annual

compensation payable monthly in the amount of 100% of his base salary, reduced in proportion to other salary received by him during the

restraint period, unless the Company determines to waive the restrictive covenants.

There are no transactions

since the beginning of the Company’s last fiscal year in which the Company is a participant and in which Mr. Konieczny

or any members of his immediate family have any interest that are required to be reported under Item 404(a) of Regulation S-K. No

family relationships exist between Mr. Konieczny and any of the Company’s directors

or executive officers. The appointment of Mr. Konieczny was not pursuant to any arrangement

or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

The

foregoing descriptions of the CEO Letter Agreement, the Interim CEO Letter Agreement and the Original Employment Agreement are not complete

and are in summary form only, and are qualified in their entirety by reference to the full text of the CEO Letter Agreement, the Interim

CEO Letter Agreement and the Original Employment Agreement, which are filed as Exhibits 10.1, 10.2 and 10.3 to this Current Report on

Form 8-K, respectively. A copy of the press release announcing the appointment of Mr. Konieczny to the role of CEO is

filed as Exhibit 99.1 to this Current Report on Form 8- K.

Item 9.01. Financial Statements and Exhibits.

| |

Exhibit Index |

| |

|

| Exhibit No. |

Description |

| 10.1 |

CEO Letter Agreement between Amcor plc, Amor Group GmbH, and Peter Konieczny, dated as of September 4, 2024* |

| 10.2 |

Interim

CEO Letter Agreement between Amcor plc and Peter Konieczny, dated as of March 16, 2024 (incorporated by reference to Exhibit 10.3

to Amcor plc’s Current Report on Form 8-K filed on March 19, 2024)* |

| 10.3 |

Employment

Agreement between Amcor Limited and Peter Konieczny, dated as of September 17, 2009 (incorporated by reference to Exhibit 10.6

to Amcor plc’s Registration Statement on Form S-4 filed on March 12, 2019)* |

| 99.1 |

Press Release of Amcor plc, dated September 4, 2024 |

| 104 |

Cover Page Interactive Data File. The cover page XBRL tags are embedded within the inline XBRL document. |

* This exhibit is a management contract or compensatory

plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

|

AMCOR PLC |

| |

|

|

|

| Date |

September 4, 2024 |

/s/ Damien Clayton |

| |

|

Name: |

Damien Clayton |

| |

|

Title: |

Company Secretary |

Exhibit 10.1

| Strictly Private and Confidential |

|

August 30, 2024

Peter Konieczny

-- delivered electronically --

Appointment as Chief Executive Officer (“CEO”)

Dear PK,

We are pleased to provide this letter confirming

your appointment as CEO of Amcor plc (the “Company”). The terms set forth in your Employment Agreement with Amcor Group GmbH

("Amcor CH") dated September 17, 2009, as amended (the “Employment Agreement”) will be amended as described

below. The letter dated March 16, 2024 outlining the terms of your appointment as interim CEO ("Interim CEO Letter") is

hereby cancelled and superseded in its entirety by this letter agreement.

| 1. | Position. As CEO, you will have responsibilities as determined by the Board of Directors of the

Company (the “Board”). Your duties and responsibilities are subject to change depending on the needs of the Company and/or

Amcor CH. You will report to the Board. |

2. Compensation.

| a. | Your annualized base salary will be CHF 1,580,190 (as may be increased from time to time, the "Base

Salary"). |

| b. | You will continue to participate in the Management Incentive Plan (the “MIP”) with an incentive

opportunity at target of 120% of your Base Salary with payouts ranging from 0% to 180% based on individual and company performance. |

| c. | You will continue to participate in the Equity Management Incentive Plan (the “EMIP”) with

an annual grant valued at 50% of the cash MIP paid to you and delivered in the form of time-based restricted share units (RSUs). |

| d. | You will continue to participate in the Long Term Incentive Plan (the “LTIP”) based on a grant

date fair value equal to 250% of your Base Salary. |

| e. | The restricted share unit grant provided to you under the Senior Executive Retention Share Plan (“SERSP”)

upon your appointment as interim CEO will continue unchanged. |

| f. | Except as otherwise set out herein, the terms of the MIP, EMIP, LTIP and SERSP are described in the relevant

governing documents, including the 2019 Omnibus Management Share Plan, and may be modified by Amcor from time to time. |

| 3. | Minimum shareholding policy. You will be required to hold 3x your annual Base Salary as Amcor shares,

in accordance with the Minimum Shareholding Policy. |

4. Termination

Without Cause or as a Good Leaver.

| a. | If Amcor CH terminates your employment pursuant to Section 10 (2) of the Employment Agreement

[Termination on Notice – Company] ("Termination without Cause") while you are serving as CEO, the Company agrees to treat

your outstanding incentive plan participation and benefits as set out below (in lieu of the treatment provided by the terms of such plan)

and provide the following compensation: |

| i. | If the termination occurs after the completion of a performance period under the MIP but prior to the

date the amount due thereunder has been paid, then assuming a payment has been earned based on the achievement of the performance goals

for the period, the Company will pay you the entire amount earned under the MIP (including any portion due under the Equity Management

Incentive Plan ("EMIP")) at the same time as other executives receive their MIP payments, but any portion earned under the EMIP

will also be paid in cash; |

| ii. | With respect to the MIP performance period in which your termination occurs, the Company will pay you

the MIP payment earned, if any, based on the achievement of the performance goals, at the same time as other executives receive their

MIP payments, but your entire amount earned under the MIP (including any portion due under the EMIP) will be pro-rated to reflect the

number of completed months during the performance period that you were actively employed, and such amount will be paid in cash; |

| iii. | Your outstanding restricted stock units (“RSUs”) granted under the EMIP will become vested

in full within 30 days after your employment termination date; |

| iv. | Your outstanding 170,000 RSUs with a vesting period that continues through to February 2026 will

become fully vested within 30 days following cessation of active employment; |

| v. | Any other equity awards for which you have completed one-half of the performance or vesting period as

of the date you cease to be actively employed, will continue to vest according to their terms as if you had continued in active employment,

except that upon the vesting date, the amount vested will be pro-rated to reflect the number of completed months of employment during

the performance or vesting period that you were actively employed. In addition, any stock options that become vested after you cease active

employment may be exercised for ninety (90) days following the vesting date for such stock options. Except as described herein, the terms

and conditions of any equity award will continue to apply without change. |

| b. | Upon termination as a Good Leaver (as defined below), the Company will make the same payments, and will

treat your equity/incentive awards and benefits in the same manner, as if you had been terminated by Amcor CH without “Cause”

(i.e. as if there had been a “Termination without Cause”) as described in Section 4a above. For the purposes hereof,

you shall be considered a Good Leaver in the following circumstances (each, a "Good Leaver Event"): |

| i. | a material change to your authority, duties, or responsibilities without your written consent (not including

any temporary reduction in authority during any period of mental or physical incapacity); or |

| ii. | a reduction in your annual Base Salary or participation level or opportunity in any bonus or other incentive

compensation plan or program of the Company. |

In order to terminate as a Good Leaver,

you must provide written notice to Amcor CH of the existence of a particular Good Leaver Event within 60 days of its initial existence

or you having learned of the existence of a Good Leaver Event. Amcor CH and the Company shall have 30 days following the receipt of your

notice regarding the occurrence of a Good Leaver Event ("Cure Period") within which to remedy the Good Leaver Event. If Amcor

CH and the Company fail to remedy the Good Leaver Event within the 30 day Cure Period ("Failure to Cure"), then you may serve

notice as Good Leaver as soon as you learn of the Failure to Cure, in which case you shall continue to perform work until the last day

of the Cure Period and thereafter be exempted from your obligation to perform work as of the expiry of the Cure Period (subject to Amcor

CH waiving the notice period in accordance with Section 4c below).

| c. | In the event of termination under paragraphs a or b above, Amcor CH commits to (i) waiving any notice

period you are otherwise required to satisfy while paying you the equivalent of 12 months' Base Salary or (ii) release you from your

obligation to perform work while continuing to pay your full compensation during the notice period. Amcor CH further commits to entering

into a termination agreement to reflect such waiver and/or release from your obligation to perform work and the pertaining payment obligations

of Amcor CH as set out in this paragraph c if and when necessary. |

5. Restrictions.

The following changes will apply to Section 18 of your Employment Agreement:

| a. | As agreed upon your appointment as interim CEO, the definition of “Restraint Period” is amended

to read “means 12 months”. |

| b. | The definition of “Restraint Area” is amended to read “means all regions in which the

Company operates a material business as at the date of termination of your employment”. |

| c. | Section 18 (3) of the Employment Agreement shall be

amended to read as follows: |

“During the Restraint Period, the Company (or Amcor CH) shall

pay you an annual compensation payable in monthly equal instalments in the amount of 100% of the annual base salary you have earned at

the time your employment ceases. The compensation shall be reduced in proportion to other salary received by you during the Restraint

Period. To the extent permitted under applicable laws, you shall inform the Company at its discretion at any time about your income during

the Restraint Period and to disclose your respective employer. The Company may at any time waive the restrictions in this Clause 18 in

writing by observing a notice period of three months; in such event, the obligation of the Company to pay compensation shall lapse after

expiry of the notice period.”

Except as set forth above, all of the terms of

your Employment Agreement will continue to apply, including but not limited to the confidentiality obligations contained therein. Please

sign below to indicate your acceptance of the terms described in this letter, including the amendments made to your Employment Agreement.

| For Amcor plc |

|

| |

|

| /s/ Graeme Liebelt |

|

| Graeme Liebelt, Chairman |

|

| For Amcor Group GmbH |

|

| |

|

| /s/ Dalina Gjunkshi |

|

| Dalina Gjunkshi, Managing Director |

|

| Agreed to this September 4, 2024 |

|

| |

|

| By: |

/s/ Peter Konieczny |

|

| Peter Konieczny |

|

Exhibit 99.1

Amcor appoints Peter Konieczny as Chief Executive

Officer

ZURICH, September 4, 2024 – Amcor (NYSE: AMCR; ASX:

AMC), a global leader in developing and producing responsible packaging solutions, today announced that its Board of Directors has appointed

Peter Konieczny as Chief Executive Officer (CEO). Mr. Konieczny has served as Interim CEO since April 2024. The Board also intends

to nominate him as a director for election at the Company’s Annual Meeting of Shareholders which is expected to be held in November 2024.

Amcor Chairman, Mr. Graeme Liebelt said: “Peter has demonstrated

exceptional leadership in every role he has held during his career at Amcor, including as Interim CEO where he has led the Company through

a period of strengthening financial performance and set the business up for further progress. The Board and I are confident Peter is the

right person to lead Amcor, and we look forward to working with him to build on the strong foundation the Company has established over

many years.”

Mr. Konieczny said: “I am honored and grateful for the opportunity

to lead Amcor as Chief Executive Officer. Amcor is an outstanding Company with highly talented people, a strong sense of purpose, a proven

culture of execution and most importantly, significant growth potential."

“The business finished fiscal 2024 well with strong earnings

growth, giving us confidence that momentum in the underlying business will continue to build in fiscal 2025 and beyond. Together with

our continued commitment to safety, customer success and disciplined capital allocation, I believe Amcor is very well positioned

to deliver industry leading value for our customers, our shareholders and the environment.”

About Peter Konieczny

Mr. Konieczny has been a member of the Amcor Global Management

Team since 2010 and was appointed Interim Chief Executive Officer in April 2024. Between September 2020 and April 2024,

Mr. Konieczny served as Chief Commercial Officer (CCO), where he oversaw global category and product management, Sustainability,

R&D and Procurement while maintaining responsibility for the Amcor Flexibles Latin America business. He also served as President,

Amcor Flexibles, Europe, Middle East & Africa and Latin America between 2019 and 2020, President, Amcor Flexibles Europe, Middle

East & Africa between 2015 and 2019, and President, Amcor Specialty Cartons between 2010 and 2015. Prior to Amcor, he had five

years of experience in the packaging industry as President of Silgan White Cap, a global organization specializing in metal and plastic

closures for the food and beverage industries. He held business group Managing Director and Chief Finance Officer positions in the heavy

industrial equipment industry and has been a management consultant with McKinsey & Company.

About Amcor

Amcor is a global leader in developing and producing responsible packaging

solutions across a variety of materials for food, beverage, pharmaceutical, medical, home and personal-care, and other products. Amcor

works with leading companies around the world to protect products, differentiate brands, and improve supply chains. The Company offers

a range of innovative, differentiating flexible and rigid packaging, specialty cartons, closures and services. The company is focused

on making packaging that is increasingly recyclable, reusable, lighter weight and made using an increasing amount of recycled content.

In fiscal year 2024, 41,000 Amcor people generated $13.6 billion in annual sales from operations that span 212 locations in 40 countries.

NYSE: AMCR; ASX: AMC

www.amcor.com I LinkedIn I Facebook I YouTube

Contact Information

| Investors |

|

|

|

|

| |

|

|

|

|

| Tracey

Whitehead |

|

Damien

Bird |

|

Damon

Wright |

| Global

Head of Investor Relations |

|

Vice

President Investor Relations Asia Pacific |

|

Vice

President Investor Relations North America |

| Amcor |

|

Amcor |

|

Amcor |

| +61

408 037 590 |

|

+61

481 900 499 |

|

+1

224 313 7141 |

| tracey.whitehead@amcor.com |

|

damien.bird@amcor.com |

|

damon.wright@amcor.com |

| |

|

|

|

|

| Media

- Australia |

|

Media

- Europe |

|

Media

- North America |

| |

|

|

|

|

| James

Strong |

|

Ernesto

Duran |

|

Julie

Liedtke |

| Managing

Director |

|

Head

of Global Communications |

|

Director,

Media Relations |

| Sodali &

Co |

|

Amcor

|

|

Amcor |

| +61

448 881 174 |

|

+41

78 698 69 40 |

|

+1

847 204 2319 |

| james.strong@sodali.com |

|

ernesto.duran@amcor.com

|

|

julie.liedtke@amcor.com |

Cautionary Statement Regarding Forward-Looking Statements

This document contains certain statements that are “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements are generally identified with words like “believe,” “expect,” “target,” “project,”

“may,” “could,” “would,” “approximately,” “possible,” “will,”

“should,” “intend,” “plan,” “anticipate,” "commit," “estimate,”

“potential,” "ambitions," “outlook,” or “continue,” the negative of these words, other terms

of similar meaning, or the use of future dates. Such statements are based on the current expectations of the management of Amcor and are

qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could differ materially from

those currently anticipated due to a number of risks and uncertainties. Neither Amcor nor any of its respective directors, executive officers,

or advisors provide any representation, assurance, or guarantee that the occurrence of the events expressed or implied in any forward-looking

statements will actually occur. Risks and uncertainties that could cause actual results to differ from expectations include, but are not

limited to: changes in consumer demand patterns and customer requirements in numerous industries; the loss of key customers, a reduction

in their production requirements or consolidation among key customers; significant competition in the industries and regions in which

we operate; an inability to expand our current business effectively through either organic growth, including product innovation, investments

or acquisitions; challenging global economic conditions, impacts of operating internationally; price fluctuations or shortages in the

availability of raw materials, energy, and other inputs which could adversely affect our business; production, supply, and commercial

risks, including counterparty credit risks, which may be exacerbated in times of economic volatility; pandemics, epidemics, or other disease

outbreaks; an inability to attract, motivate and retain our skilled workforce and manage key transitions; labor disputes and an inability

to renew collective bargaining agreements at acceptable terms; physical impact of climate change; cybersecurity risks, which could disrupt

our operations or risk of loss of our sensitive business information; failures or disruptions in our information technology systems which

could disrupt our operations, compromise customer, employee, supplier and other data; a significant increase in our indebtedness or a

downgrade in our credit rating could reduce our operating flexibility and increase our borrowing costs and negatively affect our financial

condition and results of operations; rising interest rates that increase our borrowing costs on our variable rate indebtedness and could

have other negative impacts; foreign exchange rate risk; a significant write-down of goodwill and/or intangible assets; a failure to maintain

an effective system of internal control over financial reporting; inability of our insurance policies, including our use of a captive

insurance company, to provide adequate protection against all of the risks we face; an inability to defend our intellectual property rights

or intellectual property infringement claims against us; litigation, including product liability claims or litigation related to Environmental,

Social, and Governance ("ESG") matters or regulatory developments; increasing scrutiny and changing expectations from investors,

customers, suppliers and governments with respect to our ESG practices and commitments resulting in additional costs or exposure to additional

risks; changing ESG disclosure regulations including climate-related rules; changing environmental, health, and safety laws; changes in

tax laws or changes in our geographic mix of earnings; and other risks and uncertainties identified from time to time in Amcor’s

filings with the U.S. Securities and Exchange Commission (the “SEC”), including without limitation, those described under

Item 1A. “Risk Factors” of Amcor’s annual report on Form 10-K for the fiscal year ended June 30, 2023 and

any subsequent quarterly reports on Form 10-Q. You can obtain copies of Amcor’s filings with the SEC for free at the SEC’s

website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and Amcor assumes no obligation,

and disclaims any obligation to update any forward-looking statements, or any other information in this communication, as a result of

new information, future developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent, except as

expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

v3.24.2.u1

Cover

|

Sep. 04, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 04, 2024

|

| Entity File Number |

001-38932

|

| Entity Registrant Name |

AMCOR

PLC

|

| Entity Central Index Key |

0001748790

|

| Entity Tax Identification Number |

98-1455367

|

| Entity Incorporation, State or Country Code |

Y9

|

| Entity Address, Address Line One |

83 Tower Road North

|

| Entity Address, City or Town |

Warmley, Bristol

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

BS30 8XP

|

| Country Region |

+44

|

| City Area Code |

117

|

| Local Phone Number |

9753200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Ordinary Shares, par value $0.01 per share[Member] |

|

| Title of 12(b) Security |

Ordinary

Shares, par value $0.01 per share

|

| Trading Symbol |

AMCR

|

| Security Exchange Name |

NYSE

|

| 1.125% Guaranteed Senior Notes Due 2027 [Member] |

|

| Title of 12(b) Security |

1.125%

Guaranteed Senior Notes Due 2027

|

| Trading Symbol |

AUKF/27

|

| Security Exchange Name |

NYSE

|

| 5.450% Guaranteed Senior Notes Due 2029 [Member] |

|

| Title of 12(b) Security |

5.450%

Guaranteed Senior Notes Due 2029

|

| Trading Symbol |

AMCR/29

|

| Security Exchange Name |

NYSE

|

| Sec 3. 950 Guaranteed Senior Notes Due 2032 [Member] |

|

| Title of 12(b) Security |

3.950% Guaranteed Senior Notes Due 2032

|

| Trading Symbol |

AMCR/32

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_OrdinarySharesParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec1.125GuaranteedSeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec5.450GuaranteedSeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec3.950GuaranteedSeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

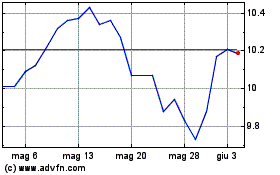

Grafico Azioni Amcor (NYSE:AMCR)

Storico

Da Dic 2024 a Gen 2025

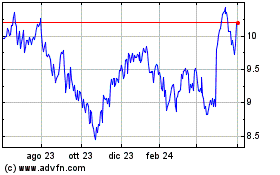

Grafico Azioni Amcor (NYSE:AMCR)

Storico

Da Gen 2024 a Gen 2025