Franklin Templeton Completes Reorganization of ClearBridge All Cap Growth ESG ETF (CACG) into ClearBridge Large Cap Growth ESG ETF (LRGE)

15 Giugno 2024 - 1:00AM

Business Wire

LRGE invests in growth companies with positive

ESG attributes that can thrive through varying market

environments

Franklin Templeton today announced it has completed the

reorganization of ClearBridge All Cap Growth ESG ETF (CACG) into

ClearBridge Large Cap Growth ESG ETF (LRGE).

The reorganization involved the transfer of substantially all of

CACG’s assets, net of any liabilities, to LRGE in exchange for

shares of LRGE and cash in lieu of fractional shares (if any).

Shareholders of CACG received shares of LRGE priced at the net

asset value (and cash in lieu of fractional shares, if any)

equivalent to the aggregate net asset value of the value of their

investment in CACG as of the close of business on June 14, 2024.

The reorganization had been approved by each fund’s boards of

trustees on February 29, 2024, and did not require the approval of

shareholders.

LRGE seeks long-term capital appreciation through investing in

large capitalization companies that meet its environmental, social

and governance (ESG) criteria with the potential for high future

earnings growth.

About ClearBridge Investments

With $188 billion in assets under management as of March 31,

2024, ClearBridge Investments is a leading global equity manager

committed to delivering long-term results through authentic active

management, offering investment solutions that emphasize

differentiated, bottom-up stock selection to move clients forward.

The firm integrates ESG considerations into its fundamental,

bottom-up research and stock selection process across all

strategies. Owned by Franklin Templeton, ClearBridge operates with

investment independence from headquarters in New York and offices

in Baltimore, Calgary, Fort Lauderdale, London, San Mateo and

Sydney.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

May 31, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

All investments involve risks, including possible loss of

principal. Equity securities are subject to price fluctuation

and possible loss of principal. Large-capitalization

companies may fall out of favor with investors based on market

and economic conditions. Investments are subject to growth risk and

potentially negative effects from currency exchange rates, foreign

taxation and differences in auditing and other financial standards.

Investments are subject to special risks, including currency

fluctuations and social, economic and political uncertainties,

which could increase volatility. The managers’ environmental,

social and governance (ESG) strategies may limit the types and

number of investments available and, as a result, may forgo

favorable market opportunities or underperform strategies that are

not subject to such criteria. There is no guarantee that the

strategy’s ESG directives will be successful or will result in

better performance. These and other risks are discussed in the

fund’s prospectus.

Before investing, carefully consider a fund’s investment

objectives, risks, charges and expenses. You can find this and

other information in a prospectus, or summary prospectus, if

available, at www.franklintempleton.com. Please read

it carefully.

Franklin Distributors, LLC. Member FINRA/SIPC. ClearBridge

Investments, LLC, and Franklin Distributors, LLC, are Franklin

Templeton affiliated companies.

Copyright © 2024. Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240614474599/en/

Franklin Templeton Corporate Communications: Lisa Tibbitts, +1

(904) 942-4451, lisa.tibbitts@franklintempleton.com

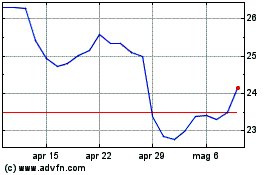

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Ott 2024 a Nov 2024

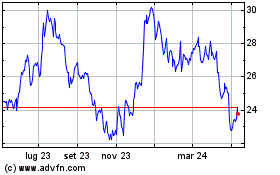

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Nov 2023 a Nov 2024