Salesforce Signs Definitive Agreement to Acquire Own Company

05 Settembre 2024 - 10:35PM

Business Wire

The proposed transaction underscores

Salesforce’s commitment to strengthening data security, privacy,

and compliance across its platform

The #1 AI CRM will enhance its platform with an

industry-leading provider of data protection and data management

services to ensure the availability, security, and compliance of

customer data

Own Company is trusted by nearly 7,000

customers to safeguard mission-critical data

Salesforce (NYSE: CRM), the world's #1 AI CRM, today announced

it has signed a definitive agreement to acquire Own Company, a

leading provider of data protection and data management solutions.

Own empowers organizations to ensure the availability, security,

and compliance of mission-critical data, while unlocking new ways

to gain deeper insights from this data. Under the terms of the

agreement, Salesforce will acquire Own for approximately $1.9

billion in cash, net of the value of the approximately 10% of

outstanding shares currently owned by Salesforce, subject to

customary purchase price adjustments.

"Data security has never been more critical, and Own’s proven

expertise and products will enhance our ability to offer robust

data protection and management solutions to our customers,” said

Steve Fisher, President and GM, Einstein 1 Platform and Unified

Data Services. “This proposed transaction underscores our

commitment to providing secure, end-to-end solutions that protect

our customers’ most valuable data and navigate the shifting

landscape of data security and compliance.”

“We’re excited to join forces with Salesforce, a company that

shares our commitment to data resilience and security,” said Sam

Gutmann, Own CEO. “As digital transformation accelerates, our

mission has expanded from preventing data loss in the cloud to

helping customers protect their data, unlock business insights, and

accelerate AI-driven innovation. Together with Salesforce, we’ll

deliver even greater value for our customers by driving innovation,

securing data, and ensuring compliance in the world’s most complex

and highly regulated industries.”

As a Salesforce AppExchange partner since 2012 and a Salesforce

Ventures portfolio company, Own has grown beyond its initial backup

and recovery offerings, and today is trusted by nearly 7,000

customers to safeguard mission-critical data. The Own Data Platform

provides data archiving, seeding, security, and analytics

capabilities that help customers ensure the availability,

compliance, and security of their mission-critical SaaS data. Own

also helps organizations leverage their historical data to optimize

decision-making and gain a competitive advantage.

Addressing a Growing Need for Data Security

The acquisition comes at a time when customers are increasingly

focused on mitigating data loss due to system failures, human

error, and cyberattacks. The advent of AI has made customers even

more aware of the need to protect and manage access to data. By

investing more deeply in pure cloud-native data protection

solutions, Salesforce aims to accelerate the growth of its Platform

Data Security, Privacy, and Compliance products.

Own’s capabilities will complement Salesforce's existing

offerings, such as Salesforce Backup, Shield, and Data Mask. This

will enable Salesforce to offer a more comprehensive data

protection and loss prevention set of products, further reinforcing

its commitment to providing secure, end-to-end solutions. These

solutions are essential for protecting customers' most valuable

assets—their data—and for deriving the most value from their

historical data by leveraging AI to understand trends and forecast

future growth.

Transaction Details

The transaction is expected to close in the fourth quarter of

Salesforce’s fiscal year 2025, subject to customary closing

conditions, including the receipt of required regulatory approvals.

Based on the expected timing of closing of the transaction, there

is no anticipated change to Salesforce’s fiscal year 2025 financial

guidance, previously announced on August 28, 2024. The transaction

will not impact Salesforce’s capital return program. Salesforce

expects to achieve accretion on a free cash flow basis starting in

the second year following the closing of the transaction and

continuing thereafter.

Forward-Looking Statements

This press release contains forward-looking information related

to Salesforce, Own Company and the acquisition of Own Company by

Salesforce that involves substantial risks, uncertainties and

assumptions that could cause actual results to differ materially

from those expressed or implied by such statements. Forward-looking

statements in this report include, among other things, statements

about the potential benefits of the proposed acquisition and its

lack of impact on previously announced guidance and our capital

return program, Salesforce’s plans, objectives, expectations and

intentions, the financial condition, results of operations and

business of Salesforce and the anticipated timing of the closing of

the proposed acquisition. Risks and uncertainties include, among

other things, risks related to the ability of Salesforce to close

the proposed acquisition on a timely basis or at all; the ability

to realize the anticipated benefits of the proposed acquisition,

including the possibility that the expected benefits from the

proposed acquisition will not be realized within the expected time

period or at all; negative effects of the announcement of the

proposed acquisition on the market price of Salesforce’s common

stock or on the its operating results; transaction costs; unknown

liabilities; the risk of litigation or regulatory actions related

to the proposed acquisition; and the effect of general economic and

market conditions.

Further information on these and other factors that could affect

Salesforce’s financial and other results is included in the reports

on Forms 10-K, 10-Q and 8-K and in other filings Salesforce makes

with the Securities and Exchange Commission from time to time,

including the Salesforce’s most recent Form 10-K. These documents

are available on the SEC Filings section of the Investor Relations

section of Salesforce’s website at www.salesforce.com/investor.

Salesforce assumes no obligation and does not intend to update

these forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905452826/en/

Carolyn Guss cguss@salesforce.com

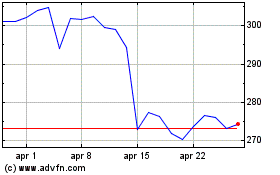

Grafico Azioni Salesforce (NYSE:CRM)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Salesforce (NYSE:CRM)

Storico

Da Dic 2023 a Dic 2024