Survey Shows More Parents Looking for

Children to Financially Contribute; Parents More Likely to Fund

Based on Major

The fourth annual survey from Discover Student Loans reveals

that the vast majority of parents continue to see the importance of

their child obtaining a college education, yet fewer are planning

to help pay for it compared to just three years ago – down from 81

percent in 2013 to 75 percent in 2015.

“Parents want their children to earn a college degree; however,

paying for that education can be difficult. Nearly a quarter of

parents surveyed said they cannot afford to help pay for any of

their child’s college education,” said Andrew Hopkins, vice

president of Discover Student Loans. “There are many resources and

tools available to help guide financial decisions and to ensure

responsible borrowing. It’s critical that students are made aware

of and maximize scholarships, grants and other free financial aid.

Student loans can help bridge the gap between the cost of education

and free financial aid.”

When asked how much responsibility their child should have in

paying for college, nearly half of parents, 46 percent, said their

children should fund at least some of the cost, while 45 percent of

parents said they expect their child to pay for most or all of

their education.

To cover college expenses, more parents anticipate that their

child will use student loans compared to three years ago. This

year, 54 percent of parents said their child is planning to take

out student loans, as compared to 50 percent in 2013.

Parents are Becoming More Price

Conscious

The price of college appears to be affecting the decision making

process when choosing schools. Forty-eight percent of parents said

they were limiting which college their child attended based on

price, an increase from 44 percent in 2014.

Parents also are considering additional ways to further reduce

college costs. They ranked attending a public versus private

university or a community college as the most effective options to

keep expenses in check.

“Parents are starting to take note of the increasing cost of a

college education and thinking of ways to reduce the overall cost

of attendance,” said Hopkins. “Not only is it important to look at

the sticker price for a school, but families also should consider

books, meals and transportation as additional essentials when

determining the bottom line.”

Parents Want College Majors to Lead to

Jobs

Parents increasingly are looking at the likelihood of finding

employment and future earning potential when thinking about their

child’s choice of major. In fact, 44 percent said they were more

likely to fund their child’s education if they majored in a field

that has a higher likelihood of employment, an increase from 33

percent in 2014.

When asked whether earning potential or choice of major is more

or less important to their child’s education, 47 percent of parents

in 2015 said earning potential was more important as compared to 40

percent in 2014. Only 19 percent said that earning potential was

less important than the choice of a college major, a decrease from

32 percent in 2012.

While parents consider how college majors will impact employment

and earning potential, they also continue to worry about how debt

from student loans may impact their child’s buying power

post-graduation.

To further explore the costs of college and understand why a

college degree is worth the investment, visit

https://www.discover.com/student-loans/college-planning/degree-investment.html.

For more information about Discover Student Loans, please visit

https://www.discover.com/student-loans/.

About the Survey

The Discover national survey of 1,000 adults who have children

16 to 18 years old who are planning to attend college was conducted

April 8-12, 2015, by Rasmussen Reports, an independent survey

research firm (http://www.rasmussenreports.com). The margin of

sampling error was +/-3 percentage points with a 95 percent level

of confidence.

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The company issues the Discover card, America's cash rewards

pioneer, and offers private student loans, personal loans, home

loans, checking and savings accounts, certificates of deposit and

money market accounts through its direct banking business. It

operates the Discover Network, with millions of merchant and cash

access locations; PULSE, one of the nation's leading ATM/debit

networks; and Diners Club International, a global payments network

with acceptance in more than 185 countries and territories. For

more information, visit www.discover.com/company.

National survey of 1000 adults with

children 16 to 18 years old who have children planning on going to

college

Conducted April 8-12, 2015 By Rasmussen Reports Margin of

sampling error: +/- 3 percentage points with a 95 percent level of

confidence Commissioned by Discover Student Loans 2015

2014 2013 2012

How important is college to your child’s future? 81%

85% 87% 81% Very important 14% 11% 11% 14% Somewhat important 3% 3%

1% 3% Not very important 0% 1% 0% 1% Not at all important 0% 0% 0%

1% Not sure

2015 2014 2013 2012

Beyond tuition, how knowledgeable do you

feel about the entire cost of a college education? 46% 48% 49%

48% Very knowledgeable 39% 42% 39% 39% Somewhat knowledgeable 12%

8% 9% 11% Not very knowledgeable 3% 2% 3% 2% Not at all

knowledgeable 1% 0% 0% 1% Not sure

2015 2014 2013 2012

Will you be

helping your child pay for his/her college education? 75% 77%

81% 74% Yes 16% 16% 12% 15% No 9% 7% 8% 11% Not sure

2015

2014

2013 2012

How worried are you about having enough money to help

pay for your child’s college education? 45% 44% 47% 47% Very

worried 33% 30% 32% 28% Somewhat worried 15% 18% 15% 17% Not very

worried 6% 7% 6% 6% Not at all worried 1% 1% 0% 1% Not sure

2015 2014 2013

2012

How much of your child’s education can you afford? 24%

21% 21% 24% None of it 31% 30% 29% 29% Up to 25% 18% 19% 18% 15% Up

to 50% 8% 11% 12% 10% Up to 75% 9% 11% 11% 13% All of it 10% 8% 9%

10% Not sure

2015 2014 2013 2012

Where will most of the money come

from to pay for your child’s college education? 12% 11% 11% 12%

529 savings plan 25% 29% 27% 24% Family savings 29% 29% 29% 28%

Student loans 5% 5% 6% 5% A second job 3% 2% 3% 3% 2nd mortgage or

refinance 3% 6% 4% 4% Retirement funds 13% 10% 12% 13% Some other

source 9% 7% 10% 11% Not sure

2015

2014

2013

How knowledgeable are you on the difference between federal

and private loans? * 29% 30% 29% Very knowledgeable 37% 40% 39%

Somewhat knowledgeable 26% 22% 24% Not very knowledgeable 7% 7% 6%

Not at all knowledgeable 2% 1% 1% Not sure

2015 2014 2013

Is your child planning to use student

loans to pay for their college education? * 54% 52% 50% Yes 26%

28% 32% No 20% 20% 18% Not sure

2015 2014*** 2013

Does your

child plan to use federal student loans, private loans or a

combination of both? * 38% 38% 32% Federal loans 5% 3% 4%

Private loans 47% 48% 54% A combination of both 9% 11% 10% Not sure

2015 2014

2013 2012

Which do you consider the most reliable source of information on paying for

college?

7% 7% 6% 7% Guidance counselors in high school 43% 44% 47% 47%

Financial aid offices of colleges 4% 3% 3% 3% Banks and other

lenders 14% 14% 13% 11% Personal financial advisors 7% 9% 8% 6%

Friends and family 6% 6% 7% 6% The Internet 9% 8% 8% 8% Some other

source 11% 9% 9% 11% Not sure

2015 2014 2013 2012

How much responsibility

should your child have in paying for their education? 15% 15%

13% 12% All of it 30% 32% 29% 27% Most of it 46% 43% 48% 48% Some

of it 7% 8% 7% 10% None of it 3% 2% 3% 3% Not sure

2015 2014 2013

If you are taking out loans in your

child’s name, does your child understand how much debt they will

graduate with? * 39% 42% 40% Fully understands 32% 32% 32%

Somewhat understands 14% 14% 15% Doesn’t understand 15% 12% 13% Not

sure 2015

2014 2013 2012

If your child had to rely on student loans or

other types of loans for college, how likely are you to help them

pay back the loans? * 25% 24% 25% 22% Very likely 33% 28% 33%

33% Somewhat likely 28% 30% 25% 28% Not very likely 11% 12% 13% 13%

Not at all likely 4% 6% 4% 4% Not sure

2015 2014 2013 2012

Is earning

potential after graduation more or less important to your child’s

education than his or her major?* 47% 40% 42% 38% More

important 19% 21% 22% 32% Less important 27% 30% 31% 21% About as

important 7% 9% 5% 10% Not sure

2015 2014

2013

Are you limiting your child’s college choice based on

price?* 48% 44% 49% Yes 41% 48% 40% No 11% 9% 11% Not sure

2015 2014 2013

Are you more likely

to help fund your child’s education if they major in a field that

has a higher likelihood of them landing a job? * 44% 33% 42%

Yes 43% 53% 44% No 13% 14% 14% Not sure

2015 2014***

How worried are you that student loan

debt may affect your child’s ability to buy a house, car or some

other large purchase after graduation? ** 58% 55% Very worried

25% 30% Somewhat worried 14% 12% Not very worried 3% 3% Not at all

worried 0% 0% Not sure

2015****

When thinking about the options to reduce the cost of college

for your child, which of the following do you think is most

effective? **** 29% Attending a community college 33% Attending

a public university versus a private university 1% Deferring

college for a year 12% Having your child live at home while

attending college 14% Working part-time while attending college 11%

Not sure * not asked in 2012 ** not asked in 2012 or 2013

*** answered by 544 respondents who said their child was planning

to use student loans to pay for their college education **** not

asked in 2012, 2013 or 2014

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150608006741/en/

Discover Financial ServicesRob

Weiss224-405-6304robertweiss@discover.com

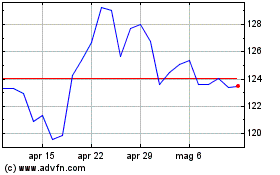

Grafico Azioni Discover Financial Servi... (NYSE:DFS)

Storico

Da Giu 2024 a Lug 2024

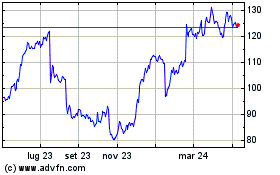

Grafico Azioni Discover Financial Servi... (NYSE:DFS)

Storico

Da Lug 2023 a Lug 2024