The Walt Disney Company (NYSE: DIS) today reported earnings for

its fourth quarter and full year ended September 28, 2024.

Financial Results for the Quarter and

Full Year:

- Revenues increased 6% for Q4 to $22.6 billion from $21.2

billion in the prior-year quarter, and 3% for the year to $91.4

billion from $88.9 billion in the prior year.

- Income before income taxes declined 6% to $0.9 billion in Q4

from $1.0 billion in the prior-year quarter and increased 59% for

the year to $7.6 billion from $4.8 billion in the prior year.

- Diluted earnings per share (EPS) for Q4 increased 79% to $0.25

from $0.14 in the prior-year quarter, and for the year more than

doubled to $2.72 from $1.29 in the prior year.

Key Points:

- We achieved strong 23% growth in total segment operating

income([1]) for Q4 and 21% for the year, and 39% growth in adjusted

EPS(1) to $1.14 from $0.82 for Q4 and 32% to $4.97 from $3.76 for

the year.

- Entertainment segment operating income improved significantly,

to $1.1 billion, up $0.8 billion in Q4 versus the prior-year

quarter.

- Entertainment DTC delivered 14% ad revenue growth in Q4,

contributing to $253 million in operating income, and our combined

DTC streaming businesses improved their profitability in Q4, with

operating income(1) of $321 million.

- We ended the quarter with 174 million Disney+ Core and Hulu

subscriptions, and more than 120 million Disney+ Core paid

subscribers, an increase of 4.4 million over the prior

quarter.

- Pixar’s Inside Out 2 and Marvel’s Deadpool & Wolverine

broke numerous box office records and helped drive $316 million in

operating income at Content Sales/Licensing and Other in Q4.

- Sports segment operating income was $0.9 billion, a decline of

$0.1 billion compared to the prior-year quarter. Domestic ESPN

advertising revenue in Q4 grew 7% versus the prior-year

quarter.

- The Experiences segment had record revenue and operating income

for the full year. In Q4, Experiences revenue increased $0.1

billion, or 1%, and operating income of $1.7 billion was a decline

of $0.1 billion, or 6% compared to the prior-year quarter. Domestic

Parks & Experiences operating income increased in Q4, on

comparable attendance to the prior-year quarter, driven by higher

guest spending, partially offset by higher expenses and costs

related to new guest offerings driven by Disney Cruise Line.

International Parks & Experiences operating income declined in

Q4.

(1)

Diluted EPS excluding certain items (also

referred to as adjusted EPS), total segment operating income and

DTC streaming businesses operating income are non-GAAP financial

measures. The most comparable GAAP measures are diluted EPS, income

before income taxes and segment operating income for the

Entertainment segment and Sports segment, respectively. See the

discussion on pages 18 through 22 for how we define and calculate

these measures and a quantitative reconciliation thereof to the

most directly comparable GAAP measures.

Guidance and Outlook:

- We are confident in the long-term prospects for the business

and believe we are well positioned for growth.

- Fiscal 2025:

- High-single digit adjusted EPS(1) growth compared to fiscal

2024

- Approximately $15 billion in cash provided by operations

- Approximately $8 billion of capital expenditures

- Target dividend growth that tracks our earnings growth

- Targeting $3 billion in stock repurchases

- Entertainment: Double digit percentage segment operating income

growth compared to fiscal 2024, weighted to the first half of the

year

- Entertainment DTC operating income increase of approximately

$875 million versus fiscal 2024, which includes a comparison to an

adverse impact of our India DTC business of approximately $200

million on fiscal 2024 Entertainment DTC results

- Modest decline in Q1 Disney+ Core subscribers versus Q4

- Q1 Content Sales/Licensing and Other operating income

relatively in-line with Q4

- Sports: 13% segment operating income growth compared to fiscal

2024 on a reported basis. Adjusting for the impact of our India

business on Sports’ fiscal 2024 results, operating income is

expected to decrease approximately 10%

- Experiences: 6% to 8% segment operating income growth compared

to fiscal 2024, weighted to the second half of the year

- Q1 operating income adversely impacted by approximately $130

million due to Hurricanes Helene and Milton and approximately $90

million due to Disney Cruise Line pre-launch costs

- Fiscal 2026(2):

- Double digit adjusted EPS(1) growth

- Double digit growth in cash provided by operations

- When comparing to our fiscal 2025 guide, we expect:

- Entertainment: Double digit percentage segment operating income

growth; 10% operating margin for our Entertainment SVOD DTC

businesses (excluding our Hulu Live DMVPD service)(1)

- Sports: Low single digit percentage segment operating income

growth

- Experiences: High single digit percentage segment operating

income growth

- Fiscal 2027:

- Double digit adjusted EPS(1) growth

(1)

Diluted EPS excluding certain items (also

referred to as adjusted EPS) is a non-GAAP financial measure.

Operating margin for Entertainment SVOD DTC businesses (excluding

our Hulu Live DMVPD service) is calculated as operating income

divided by revenue. Operating income for Entertainment SVOD DTC

businesses (excluding our Hulu Live DMVPD service) is a non-GAAP

financial measure. The most comparable GAAP measures to these

non-GAAP measures are diluted EPS and Entertainment segment

operating income, respectively. See the discussion on pages 18

through 22 for how we define and calculate these measures and why

the Company is not providing forward-looking quantitative

reconciliations of diluted EPS excluding certain items and

operating income (and related margin) for our Entertainment SVOD

DTC businesses (excluding our Hulu Live DMVPD service) to the most

comparable GAAP measures.

(2)

Fiscal 2026 includes a 53rd week and these

segment operating income growth rates exclude the expected benefit

of the extra week.

Message From Our CEO:

“This was a pivotal and successful year for The Walt Disney

Company, and thanks to the significant progress we’ve made, we have

emerged from a period of considerable challenges and disruption

well positioned for growth and optimistic about our future,” said

Robert A. Iger, Chief Executive Officer, The Walt Disney Company.

“Our solid performance in the fiscal fourth quarter reflected the

success of our strategic efforts to improve quality, innovation,

efficiency, and value creation. In Q4 we saw one of the best

quarters in the history of our film studio, improved profitability

in our streaming businesses, a record-breaking 60 Emmy Awards for

the company, the continued power of live sports, and the unveiling

of an impressive collection of new projects coming to our

Experiences segment. As a result of our strategies and our focus on

managing our businesses for both the near- and long-term, we are

differentiating ourselves from traditional competitors, leveraging

the deepest and broadest set of entertainment assets in the

industry to drive attractive returns and further advance our

goals.”

SUMMARIZED FINANCIAL RESULTS

The following table summarizes fourth quarter and full year

results for fiscal 2024 and 2023:

Quarter Ended

Year Ended

($ in millions, except per share

amounts)

Sept. 28, 2024

Sept. 30, 2023

Change

Sept. 28, 2024

Sept. 30, 2023

Change

Revenues

$

22,574

$

21,241

6

%

$

91,361

$

88,898

3

%

Income before income taxes

$

948

$

1,007

(6

)%

$

7,569

$

4,769

59

%

Total segment operating income(1)

$

3,655

$

2,976

23

%

$

15,601

$

12,863

21

%

Diluted EPS

$

0.25

$

0.14

79

%

$

2.72

$

1.29

>100 %

Diluted EPS excluding certain items(1)

$

1.14

$

0.82

39

%

$

4.97

$

3.76

32

%

Cash provided by operations

$

5,518

$

4,802

15

%

$

13,971

$

9,866

42

%

Free cash flow(1)

$

4,029

$

3,428

18

%

$

8,559

$

4,897

75

%

(1)

Total segment operating income,

diluted EPS excluding certain items and free cash flow are non-GAAP

financial measures. The most comparable GAAP measures are income

before income taxes, diluted EPS and cash provided by operations,

respectively. See the discussion on pages 18 through 22 for how we

define and calculate these measures and a reconciliation thereof to

the most directly comparable GAAP measures.

SUMMARIZED SEGMENT FINANCIAL RESULTS

The following table summarizes fourth quarter and full year

segment revenue and operating income for fiscal 2024 and 2023:

Quarter Ended

Year Ended

($ in millions)

Sept. 28, 2024

Sept. 30, 2023

Change

Sept. 28, 2024

Sept. 30, 2023

Change

Revenues:

Entertainment

$

10,829

$

9,524

14

%

$

41,186

$

40,635

1

%

Sports

3,914

3,910

—

%

17,619

17,111

3

%

Experiences

8,240

8,160

1

%

34,151

32,549

5

%

Eliminations(2)

(409

)

(353

)

(16

)%

(1,595

)

(1,397

)

(14

)%

Total revenues

$

22,574

$

21,241

6

%

$

91,361

$

88,898

3

%

Segment operating income:

Entertainment

$

1,067

$

236

>100 %

$

3,923

$

1,444

>100 %

Sports

929

981

(5

)%

2,406

2,465

(2

)%

Experiences

1,659

1,759

(6

)%

9,272

8,954

4

%

Total segment operating income(1)

$

3,655

$

2,976

23

%

$

15,601

$

12,863

21

%

(1)

Total segment operating income is

a non-GAAP financial measure. The most comparable GAAP measure is

income before income taxes. See the discussion on pages 18 through

22.

(2)

Reflects fees paid by Hulu to

ESPN and the Entertainment linear networks business for the right

to air their networks on Hulu Live and fees paid by ABC Network and

Disney+ to ESPN to program certain sports content on ABC Network

and Disney+.

DISCUSSION OF FOURTH QUARTER SEGMENT RESULTS

Entertainment

Revenue and operating income for the Entertainment segment are

as follows:

Quarter Ended

Change

Year Ended

($ in millions)

Sept. 28, 2024

Sept. 30, 2023

Sept. 28, 2024

Sept. 30, 2023

Change

Revenues:

Linear Networks

$

2,461

$

2,628

(6

)%

$

10,692

$

11,701

(9

)%

Direct-to-Consumer

5,783

5,036

15

%

22,776

19,886

15

%

Content Sales/Licensing and Other

2,585

1,860

39

%

7,718

9,048

(15

)%

$

10,829

$

9,524

14

%

$

41,186

$

40,635

1

%

Operating income (loss):

Linear Networks

$

498

$

805

(38

)%

$

3,452

$

4,119

(16

)%

Direct-to-Consumer

253

(420

)

nm

143

(2,496

)

nm

Content Sales/Licensing and Other

316

(149

)

nm

328

(179

)

nm

$

1,067

$

236

>100 %

$

3,923

$

1,444

>100 %

The increase in Entertainment operating income in the current

quarter compared to the prior-year quarter was due to improved

results at Direct-to-Consumer and Content Sales/Licensing and

Other, partially offset by a decrease at Linear Networks.

Linear Networks

Linear Networks revenues and operating income are as

follows:

Quarter Ended

Change

($ in millions)

September 28, 2024

September 30, 2023

Revenue

Domestic

$

1,997

$

2,099

(5

)%

International

464

529

(12

)%

$

2,461

$

2,628

(6

)%

Operating income

Domestic

$

347

$

529

(34

)%

International

52

114

(54

)%

Equity in the income of investees

99

162

(39

)%

$

498

$

805

(38

)%

Domestic

Domestic operating income in the current quarter decreased

compared to the prior-year quarter due to:

- Higher marketing costs primarily resulting from more season

premieres in the current quarter reflecting the impact of guild

strikes in the prior-year quarter

- Lower affiliate revenue primarily attributable to fewer

subscribers including the impact of the non-renewal of carriage of

certain networks by an affiliate, partially offset by higher

effective rates

- A decline in advertising revenue resulting from a decrease in

impressions reflecting lower average viewership, partially offset

by higher rates

- Programming and production costs were comparable to the

prior-year quarter as higher average cost programming at ABC

Network, in part due to the impact of guild strikes in the

prior-year quarter, was largely offset by lower average cost

programming at our cable channels

International

The decrease in International operating income was attributable

to:

- Lower affiliate revenue primarily due to a decline in effective

rates and fewer subscribers

- Higher marketing costs

Equity in the Income of

Investees

Income from equity investees decreased due to lower income from

A+E Television Networks (A+E) attributable to decreases in

affiliate and advertising revenue.

Direct-to-Consumer

Direct-to-Consumer revenues and operating income (loss) are as

follows:

Quarter Ended

Change

($ in millions)

September 28, 2024

September 30, 2023

Revenue

$

5,783

$

5,036

15

%

Operating income (loss)

$

253

$

(420

)

nm

The improvement in operating results in the current quarter

compared to the prior-year quarter was due to:

- Subscription revenue growth attributable to higher effective

rates due to increases in retail pricing and subscriber growth,

partially offset by an unfavorable foreign exchange impact

- An increase in advertising revenue due to higher impressions,

partially offset by lower rates

- Lower marketing costs at Disney+

- Higher technology and distribution costs

- An increase in programming and production costs reflecting:

- Higher subscriber-based fees for programming the Hulu Live TV

service attributable to rate increases

- Lower costs for non-sports content attributable to a decrease

at Disney+, partially offset by an increase at Hulu

Key Metrics - Fourth Quarter of Fiscal

2024 Comparison to Third Quarter of Fiscal 2024

In addition to revenue, costs and operating income, management

uses the following key metrics(1) to analyze trends and evaluate

the overall performance of our Disney+ and Hulu direct-to-consumer

(DTC) product offerings, and we believe these metrics are useful to

investors in analyzing the business. The following tables and

related discussion are on a sequential quarter basis.

Paid subscribers at:

(in millions)

September 28, 2024

June 29, 2024

Change

Disney+

Domestic (U.S. and Canada)

56.0

54.8

2

%

International (excluding Disney+

Hotstar)

66.7

63.5

5

%

Disney+ Core(2)

122.7

118.3

4

%

Disney+ Hotstar

35.9

35.5

1

%

Hulu

SVOD Only

47.4

46.7

1

%

Live TV + SVOD

4.6

4.4

5

%

Total Hulu(2)

52.0

51.1

2

%

Average Monthly Revenue Per Paid Subscriber for the quarter

ended:

September 28, 2024

June 29, 2024

Change

Disney+

Domestic (U.S. and Canada)

$

7.70

$

7.74

(1

)%

International (excluding Disney+

Hotstar)

6.95

6.78

3

%

Disney+ Core

7.30

7.22

1

%

Disney+ Hotstar

0.78

1.05

(26

)%

Hulu

SVOD Only

12.54

12.73

(1

)%

Live TV + SVOD

95.82

96.11

—

%

(1)

See discussion on page 17—DTC

Product Descriptions and Key Definitions

(2)

Total may not equal the sum of

the column due to rounding

Domestic Disney+ average monthly revenue per paid subscriber

decreased from $7.74 to $7.70 due to a higher mix of subscribers to

ad-supported and wholesale offerings, partially offset by higher

advertising revenue.

International Disney+ (excluding Disney+ Hotstar) average

monthly revenue per paid subscriber increased from $6.78 to $6.95

due to higher retail pricing, partially offset by a higher mix of

subscribers to ad-supported and wholesale offerings and an

unfavorable foreign exchange impact.

Disney+ Hotstar average monthly revenue per paid subscriber

decreased from $1.05 to $0.78 due to lower advertising revenue.

Hulu SVOD Only average monthly revenue per paid subscriber

decreased from $12.73 to $12.54 primarily due to a higher mix of

subscribers to multi-product offerings and lower advertising

revenue.

Content Sales/Licensing and Other

Content Sales/Licensing and Other revenues and operating income

(loss) are as follows:

Quarter Ended

Change

($ in millions)

September 28, 2024

September 30, 2023

Revenue

$

2,585

$

1,860

39

%

Operating income (loss)

$

316

$

(149

)

nm

The improvement in operating results was primarily due to higher

theatrical distribution results reflecting the strong performance

of Inside Out 2 and Deadpool & Wolverine in the current

quarter. The prior-year quarter included Haunted Mansion.

Sports

Sports revenues and operating income (loss) are as follows:

Quarter Ended

Change

($ in millions)

September 28, 2024

September 30, 2023

Revenue

ESPN

Domestic

$

3,492

$

3,455

1

%

International

364

363

—

%

3,856

3,818

1

%

Star India

58

92

(37

)%

$

3,914

$

3,910

—

%

Operating income (loss)

ESPN

Domestic

$

936

$

987

(5

)%

International

(40

)

(34

)

(18

)%

896

953

(6

)%

Star India

20

12

67

%

Equity in the income of investees

13

16

(19

)%

$

929

$

981

(5

)%

Domestic ESPN

The decrease in domestic ESPN operating results in the current

quarter compared to the prior-year quarter was due to:

- Higher programming and production costs attributable to an

increase in college football rights costs and higher production

costs, partially offset by lower NFL rights costs as a result of

airing one fewer game in the current quarter

- Lower affiliate revenue due to fewer subscribers, partially

offset by higher effective rates

- Advertising revenue growth reflecting increases in rates and

sponsorship revenue, partially offset by lower average

viewership

- Growth in subscription revenue due to higher effective rates

attributable to an increase in retail pricing

Key Metrics - Fourth Quarter of Fiscal

2024 Comparison to Third Quarter of Fiscal 2024

In addition to revenue, costs and operating income, management

uses the following key metrics(1) to analyze trends and evaluate

the overall performance of our ESPN+ DTC product offering, and we

believe these metrics are useful to investors in analyzing the

business. The following table and related discussion are on a

sequential quarter basis.

September 28, 2024

June 29, 2024

Change

Paid subscribers at: (in millions)

25.6

24.9

3

%

Average Monthly Revenue Per Paid

Subscriber for the quarter ended:

$

5.94

$

6.23

(5

)%

(1)

See discussion on page 17—DTC

Product Descriptions and Key Definitions

The decrease in ESPN+ average monthly revenue per paid

subscriber was due to lower advertising revenue and a higher mix of

subscribers to wholesale and multi-product offerings.

Experiences

Experiences revenues and operating income are as follows:

Quarter Ended

Change

($ in millions)

September 28, 2024

September 30, 2023

Revenue

Parks & Experiences

Domestic

$

5,521

$

5,384

3

%

International

1,583

1,665

(5

)%

Consumer Products

1,136

1,111

2

%

$

8,240

$

8,160

1

%

Operating income

Parks & Experiences

Domestic

$

847

$

808

5

%

International

299

441

(32

)%

Consumer Products

513

510

1

%

$

1,659

$

1,759

(6

)%

Domestic Parks and Experiences

The increase in operating income at our domestic parks and

experiences reflected:

- Guest spending growth attributable to increases in per capita

guest spending at our theme parks and cruise line

- Lower sales of Disney Vacation Club units

- Higher costs primarily due to inflation, new guest offerings,

increased technology spending and higher operations support costs,

partially offset by the comparison to depreciation in the

prior-year quarter related to the closure of Star Wars: Galactic

Starcruiser

International Parks and

Experiences

International parks and experiences’ operating results decreased

compared to the prior-year quarter due to:

- Lower volumes attributable to declines in attendance

- An increase in costs primarily due to new guest offerings and

higher depreciation

- A decrease in guest spending due to lower theme park per capita

guest spending, partially offset by an increase in per room

spending at our resorts

OTHER FINANCIAL INFORMATION

DTC Streaming Businesses

Revenue and operating income (loss) for our combined DTC

streaming businesses, which consist of the Direct-to-Consumer line

of business at the Entertainment segment and ESPN+ at the Sports

segment, are as follows:

Quarter Ended

Change

Year Ended

($ in millions)

Sept. 28, 2024

Sept. 30, 2023

Sept. 28, 2024

Sept. 30, 2023

Change

Revenue

$

6,296

$

5,553

13

%

$

24,938

$

21,926

14

%

Operating income (loss) (1)

$

321

$

(387

)

nm

$

134

$

(2,612

)

nm

(1)

DTC streaming businesses operating income

(loss) is not a financial measure defined by GAAP. The most

comparable GAAP measures are segment operating income for the

Entertainment segment and Sports segment. See the discussion on

page 22 for how we define and calculate this measure and a

reconciliation of it to the most directly comparable GAAP

measures.

Corporate and Unallocated Shared

Expenses

Corporate and unallocated shared expenses increased $115 million

for the quarter, from $293 million to $408 million, driven by

increased professional fees and compensation costs.

Restructuring and Impairment

Charges

Restructuring and impairment charges were as follows:

Quarter Ended

($ in millions)

September 28, 2024

September 30, 2023

Impairments:

Goodwill(1)

$

584

$

721

Retail assets

328

—

Star India

210

—

Content(2)

187

137

Equity investments

165

141

Severance

69

22

$

1,543

$

1,021

(1)

In the current quarter, goodwill

impairment related to our general entertainment linear networks. In

the prior-year quarter, goodwill impairments related to our general

entertainment and international sports linear networks.

(2)

In the current and prior-year

quarters, content impairments related to strategic changes in our

approach to content curation.

Interest Expense, net

Interest expense, net was as follows:

Quarter Ended

($ in millions)

September 28, 2024

September 30, 2023

Change

Interest expense

$

(532

)

$

(501

)

(6

)%

Interest income, investment income and

other

171

219

(22

)%

Interest expense, net

$

(361

)

$

(282

)

(28

)%

The increase in interest expense was primarily due to lower

capitalized interest.

The decrease in interest income, investment income and other

reflected the impact of lower cash and cash equivalent balances,

partially offset by lower investment losses and a favorable

comparison of pension and postretirement benefit costs, other than

service cost.

Equity in the Income of

Investees

Equity in the income of investees was as follows:

Quarter Ended

($ in millions)

September 28, 2024

September 30, 2023

Change

Amounts included in segment results:

Entertainment

$

97

$

158

(39

)%

Sports

13

16

(19

)%

A+E gain(1)

—

56

(100

)%

Amortization of TFCF Corporation (TFCF)

intangible assets related to an equity investee

(3

)

(3

)

—

%

Equity in the income of investees

$

107

$

227

(53

)%

(1)

Restructuring and impairment

charges included the impact of a content license agreement

termination with A+E, which generated a gain at A+E. The Company’s

50% interest in this gain was $56 million (A+E gain) in the

prior-year quarter.

Income from equity investees decreased $120 million, to $107

million from $227 million, due to lower income from A+E.

Income Taxes

The effective income tax rate was as follows:

Quarter Ended

September 28, 2024

September 30, 2023

Income before income taxes

$

948

$

1,007

Income tax expense

384

313

Effective income tax rate

40.5

%

31.1

%

The increase in effective income tax rate was due to the impact

from adjustments related to prior years and an unfavorable impact

from higher non-tax deductible impairments in the current quarter

compared to the prior-year quarter. Adjustments related to prior

years were favorable in the prior-year quarter and unfavorable in

the current quarter.

Noncontrolling Interests

Net income attributable to noncontrolling interests was as

follows:

Quarter Ended

($ in millions)

September 28, 2024

September 30, 2023

Change

Net income attributable to noncontrolling

interests

$

(104

)

$

(430

)

76

%

The decrease in net income attributable to noncontrolling

interests was due to the comparison to the accretion of NBC

Universal’s interest in Hulu in the prior-year quarter as we had

accreted to the full guaranteed redemption value by December 2023.

The decrease was also due to lower results at Shanghai Disney

Resort and National Geographic.

Net income attributable to noncontrolling interests is

determined on income after royalties and management fees, financing

costs and income taxes, as applicable.

FULL YEAR CASH FLOW

Cash from Operations

Cash provided by operations and free cash flow were as

follows:

Year Ended

($ in millions)

September 28, 2024

September 30, 2023

Change

Cash provided by operations

$

13,971

$

9,866

$

4,105

Investments in parks, resorts and other

property

(5,412

)

(4,969

)

(443

)

Free cash flow(1)

$

8,559

$

4,897

$

3,662

(1)

Free cash flow is not a financial measure

defined by GAAP. The most comparable GAAP measure is cash provided

by operations. See the discussion on pages 18 through 22.

Cash provided by operations increased $4.1 billion to $14.0

billion in the current year from $9.9 billion in the prior year

driven by:

- Lower film and television production spending and the timing of

payments for sports rights

- Collateral receipts related to our hedging program in the

current year compared to collateral payments in the prior year

- Higher operating income at Entertainment

- A payment in the prior year related to the termination of

content licenses in fiscal 2022

- Higher cash tax payments in fiscal 2024 compared to fiscal

2023. Fiscal 2023 U.S. federal and California state tax payments

were deferred and paid in fiscal 2024 pursuant to relief provided

by the Internal Revenue Service and California State Board of

Equalization as a result of 2023 winter storms in California. In

addition, a portion of fiscal 2024 U.S. federal and Florida state

taxes was paid in fiscal 2024 and the remainder has been deferred

to fiscal 2025 pursuant to relief provided by the Internal Revenue

Service and Florida Department of Revenue as a result of 2024

hurricanes in Florida.

Capital Expenditures

Investments in parks, resorts and other property were as

follows:

Year Ended

($ in millions)

September 28, 2024

September 30, 2023

Entertainment

$

977

$

1,032

Sports

10

15

Experiences

Domestic

2,710

2,203

International

949

822

Total Experiences

3,659

3,025

Corporate

766

897

Total investments in parks, resorts and

other property

$

5,412

$

4,969

Capital expenditures increased to $5.4 billion from $5.0 billion

due to higher spend on cruise ship fleet expansion and new

attractions at the Experiences segment, partially offset by lower

spend on Corporate facilities.

Depreciation Expense

Depreciation expense was as follows:

Year Ended

($ in millions)

September 28, 2024

September 30, 2023

Entertainment

$

681

$

669

Sports

39

73

Experiences

Domestic

1,744

2,011

International

726

669

Total Experiences

2,470

2,680

Corporate

244

204

Total depreciation expense

$

3,434

$

3,626

THE WALT DISNEY COMPANY CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (unaudited; $ in millions,

except per share data)

Quarter Ended

Year Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Revenues

$

22,574

$

21,241

$

91,361

$

88,898

Costs and expenses

(19,829

)

(19,158

)

(79,447

)

(79,906

)

Restructuring and impairment charges

(1,543

)

(1,021

)

(3,595

)

(3,892

)

Other income (expense), net

—

—

(65

)

96

Interest expense, net

(361

)

(282

)

(1,260

)

(1,209

)

Equity in the income of investees

107

227

575

782

Income before income taxes

948

1,007

7,569

4,769

Income taxes

(384

)

(313

)

(1,796

)

(1,379

)

Net income

564

694

5,773

3,390

Net income attributable to noncontrolling

interests

(104

)

(430

)

(801

)

(1,036

)

Net income attributable to The Walt Disney

Company (Disney)

$

460

$

264

$

4,972

$

2,354

Earnings per share attributable to

Disney:

Diluted

$

0.25

$

0.14

$

2.72

$

1.29

Basic

$

0.25

$

0.14

$

2.72

$

1.29

Weighted average number of common and

common equivalent shares outstanding:

Diluted

1,819

1,833

1,831

1,830

Basic

1,814

1,831

1,825

1,828

THE WALT DISNEY COMPANY CONDENSED

CONSOLIDATED BALANCE SHEETS (unaudited; $ in millions,

except per share data)

September 28, 2024

September 30, 2023

ASSETS

Current assets

Cash and cash equivalents

$

6,002

$

14,182

Receivables, net

12,729

12,330

Inventories

2,022

1,963

Content advances

2,097

3,002

Other current assets

2,391

1,286

Total current assets

25,241

32,763

Produced and licensed content costs

32,312

33,591

Investments

4,459

3,080

Parks, resorts and other property

Attractions, buildings and equipment

76,674

70,090

Accumulated depreciation

(45,506

)

(42,610

)

31,168

27,480

Projects in progress

4,728

6,285

Land

1,145

1,176

37,041

34,941

Intangible assets, net

10,739

13,061

Goodwill

73,326

77,067

Other assets

13,101

11,076

Total assets

$

196,219

$

205,579

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and other accrued

liabilities

$

21,070

$

20,671

Current portion of borrowings

6,845

4,330

Deferred revenue and other

6,684

6,138

Total current liabilities

34,599

31,139

Borrowings

38,970

42,101

Deferred income taxes

6,277

7,258

Other long-term liabilities

10,851

12,069

Commitments and contingencies

Redeemable noncontrolling interests

—

9,055

Equity

Preferred stock

—

—

Common stock, $0.01 par value, Authorized

– 4.6 billion shares, Issued – 1.9 billion shares at September 28,

2024 and 1.8 billion shares at September 30, 2023

58,592

57,383

Retained earnings

49,722

46,093

Accumulated other comprehensive loss

(3,699

)

(3,292

)

Treasury stock, at cost, 47 million shares

at September 28, 2024 and 19 million shares at September 30,

2023

(3,919

)

(907

)

Total Disney Shareholders’ equity

100,696

99,277

Noncontrolling interests

4,826

4,680

Total equity

105,522

103,957

Total liabilities and equity

$

196,219

$

205,579

THE WALT DISNEY COMPANY CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited; $ in

millions)

Year Ended

September 28, 2024

September 30, 2023

OPERATING ACTIVITIES

Net income

$

5,773

$

3,390

Depreciation and amortization

4,990

5,369

Impairments of goodwill, produced and

licensed content and other assets

3,511

3,128

Net (gain)/loss on investments

5

(166

)

Deferred income taxes

(821

)

(1,346

)

Equity in the income of investees

(575

)

(782

)

Cash distributions received from equity

investees

437

720

Net change in produced and licensed

content costs and advances

1,046

(1,908

)

Equity-based compensation

1,366

1,143

Pension and postretirement medical cost

amortization

(96

)

4

Other, net

(52

)

137

Changes in operating assets and

liabilities

Receivables

(565

)

358

Inventories

(42

)

(183

)

Other assets

265

(201

)

Accounts payable and other liabilities

156

(1,142

)

Income taxes

(1,427

)

1,345

Cash provided by operations

13,971

9,866

INVESTING ACTIVITIES

Investments in parks, resorts and other

property

(5,412

)

(4,969

)

Proceeds from sales of investments

105

458

Purchase of investments

(1,506

)

—

Other, net

(68

)

(130

)

Cash used in investing activities

(6,881

)

(4,641

)

FINANCING ACTIVITIES

Commercial paper borrowings (payments),

net

1,532

(191

)

Borrowings

132

83

Reduction of borrowings

(3,064

)

(1,675

)

Dividends

(1,366

)

—

Repurchases of common stock

(2,992

)

—

Contributions from noncontrolling

interests

9

735

Acquisition of redeemable noncontrolling

interests

(8,610

)

(900

)

Other, net

(929

)

(776

)

Cash used in financing activities

(15,288

)

(2,724

)

Impact of exchange rates on cash, cash

equivalents and restricted cash

65

73

Change in cash, cash equivalents and

restricted cash

(8,133

)

2,574

Cash, cash equivalents and restricted

cash, beginning of year

14,235

11,661

Cash, cash equivalents and restricted

cash, end of year

$

6,102

$

14,235

DTC PRODUCT DESCRIPTIONS AND KEY

DEFINITIONS

Product offerings

In the U.S., Disney+, ESPN+ and Hulu SVOD Only are each offered

as a standalone service or as part of various multi-product

offerings. Hulu Live TV + SVOD includes Disney+ and ESPN+. Disney+

is available in more than 150 countries and territories outside the

U.S. and Canada. In India and certain other Southeast Asian

countries, the service is branded Disney+ Hotstar. In certain Latin

American countries prior to July 2024, we offered Disney+ as well

as Star+, a general entertainment SVOD service, which was available

on a standalone basis or together with Disney+ (Combo+). At the end

of June 2024, we merged these services into a single Disney+

product offering. Depending on the market, our services can be

purchased on our websites or through third-party platforms/apps or

are available via wholesale arrangements.

Paid subscribers

Paid subscribers reflect subscribers for which we recognized

subscription revenue. Certain product offerings provide the option

for an extra member to be added to an account (extra member

add-on). These extra members are not counted as paid subscribers.

Subscribers cease to be a paid subscriber as of their effective

cancellation date or as a result of a failed payment method.

Subscribers to multi-product offerings in the U.S. are counted as a

paid subscriber for each of the Company's services included in the

multi-product offering and subscribers to Hulu Live TV + SVOD are

counted as one paid subscriber for each of the Hulu Live TV + SVOD,

Disney+ and ESPN+ services. In Latin America prior to July 2024, if

a subscriber had either the standalone Disney+ or Star+ service or

subscribed to Combo+, the subscriber was counted as one Disney+

paid subscriber. Subscribers include those who receive an

entitlement to a service through wholesale arrangements, including

those for which the service is available to each subscriber of an

existing content distribution tier. When we aggregate the total

number of paid subscribers across our DTC streaming services, we

refer to them as paid subscriptions.

International Disney+ (excluding Disney+

Hotstar)

International Disney+ (excluding Disney+ Hotstar) includes the

Disney+ service outside the U.S. and Canada.

Average Monthly Revenue Per Paid

Subscriber

Hulu and ESPN+ average monthly revenue per paid subscriber is

calculated based on the average of the monthly average paid

subscribers for each month in the period. The monthly average paid

subscribers is calculated as the sum of the beginning of the month

and end of the month paid subscriber count, divided by two. Disney+

average monthly revenue per paid subscriber is calculated using a

daily average of paid subscribers for the period. Revenue includes

subscription fees, advertising (excluding revenue earned from

selling advertising spots to other Company businesses), premium and

feature add-on revenue and extra member add-on revenue but excludes

Pay-Per-View revenue. Advertising revenue generated by content on

one DTC streaming service that is accessed through another DTC

streaming service by subscribers to both streaming services is

allocated between both streaming services. The average revenue per

paid subscriber is net of discounts on offerings that carry more

than one service. Revenue is allocated to each service based on the

relative retail or wholesale price of each service on a standalone

basis. Hulu Live TV + SVOD revenue is allocated to the SVOD

services based on the wholesale price of the Hulu SVOD Only,

Disney+ and ESPN+ multi-product offering. In general, wholesale

arrangements have a lower average monthly revenue per paid

subscriber than subscribers that we acquire directly or through

third-party platforms.

NON-GAAP FINANCIAL

MEASURES

This earnings release presents diluted EPS excluding certain

items (also referred to as adjusted EPS), total segment operating

income, free cash flow and DTC streaming businesses operating

income (loss). This earnings release also presents forward-looking

operating margin for Entertainment SVOD DTC businesses (excluding

our Hulu Live DMVPD service), which is calculated as operating

income divided by revenue. Diluted EPS excluding certain items,

total segment operating income, free cash flow, DTC streaming

businesses operating income (loss) and operating income for

Entertainment SVOD DTC businesses (excluding our Hulu Live DMVPD

service) are important financial measures for the Company but are

not financial measures defined by GAAP.

These measures should be reviewed in conjunction with the most

comparable GAAP financial measures and are not presented as

alternative measures of diluted EPS, income before income taxes,

cash provided by operations, Entertainment and Sports segment

operating income (loss) or Entertainment segment operating income

as determined in accordance with GAAP. Diluted EPS excluding

certain items, total segment operating income, free cash flow, DTC

streaming businesses operating income (loss) and operating income

(and related margin) for Entertainment SVOD DTC businesses

(excluding our Hulu Live DMVPD service) as we have calculated them

may not be comparable to similarly titled measures reported by

other companies.

Our definitions and calculations of diluted EPS excluding

certain items, total segment operating income, free cash flow and

DTC streaming businesses operating income (loss), as well as

quantitative reconciliations of each of these measures to the most

directly comparable GAAP financial measure, are provided below. In

addition, our definition of operating income (and related margin)

for Entertainment SVOD DTC businesses (excluding our Hulu Live

DMVPD service) is provided below.

The Company is not providing the forward-looking measure for

diluted EPS or Entertainment segment operating income (and related

margin), which are the most directly comparable GAAP measures to

diluted EPS excluding certain items and operating income (and

related margin) for Entertainment SVOD DTC businesses (excluding

our Hulu Live DMVPD service), respectively, or quantitative

reconciliations of forward-looking diluted EPS excluding certain

items and operating income (and related margin) for our

Entertainment SVOD DTC businesses (excluding our Hulu Live DMVPD

service) to those most directly comparable GAAP measures. The

Company is unable to predict or estimate with reasonable certainty

the ultimate outcome of certain significant items required for such

GAAP measures without unreasonable effort. Information about other

adjusting items that is currently not available to the Company

could have a potentially unpredictable and significant impact on

future GAAP financial results.

Diluted EPS excluding certain

items

The Company uses diluted EPS excluding (1) certain items

affecting comparability of results from period to period and (2)

amortization of TFCF and Hulu intangible assets, including purchase

accounting step-up adjustments for released content, to facilitate

the evaluation of the performance of the Company’s operations

exclusive of these items, and these adjustments reflect how senior

management is evaluating segment performance.

The Company believes that providing diluted EPS exclusive of

certain items impacting comparability is useful to investors,

particularly where the impact of the excluded items is significant

in relation to reported earnings and because the measure allows for

comparability between periods of the operating performance of the

Company’s business and allows investors to evaluate the impact of

these items separately.

The Company further believes that providing diluted EPS

exclusive of amortization of TFCF and Hulu intangible assets

associated with the acquisition in 2019 is useful to investors

because the TFCF and Hulu acquisition was considerably larger than

the Company’s historic acquisitions with a significantly greater

acquisition accounting impact.

The following table reconciles reported diluted EPS to diluted

EPS excluding certain items for the fourth quarter:

($ in millions except EPS)

Pre-Tax Income/

Loss

Tax Benefit/

Expense(1)

After-Tax Income/

Loss(2)

Diluted

EPS(3)

Change vs. prior-year period

Quarter Ended September 28, 2024

As reported

$

948

$

(384

)

$

564

$

0.25

79

%

Exclude:

Restructuring and impairment

charges(4)

1,543

(172

)

1,371

0.73

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs(5)

395

(92

)

303

0.16

Excluding certain items

$

2,886

$

(648

)

$

2,238

$

1.14

39

%

Quarter Ended September 30, 2023

As reported

$

1,007

$

(313

)

$

694

$

0.14

Exclude:

Restructuring and impairment

charges(4)

965

(57

)

908

0.50

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs(5)

429

(100

)

329

0.18

Excluding certain items

$

2,401

$

(470

)

$

1,931

$

0.82

(1)

Tax benefit/expense is determined

using the tax rate applicable to the individual item.

(2)

Before noncontrolling interest

share.

(3)

Net of noncontrolling interest

share, where applicable. Total may not equal the sum of the column

due to rounding.

(4)

Charges for the current quarter

included impairments of goodwill ($584 million), assets at our

retail business ($328 million), Star India ($210 million), content

($187 million) and equity investments ($165 million), and severance

costs ($69 million). Charges for the prior-year quarter included

impairments of goodwill ($721 million), an equity investment ($141

million) and licensed content ($137 million) and severance costs

($22 million), net of the A+E gain ($56 million).

(5)

For the current quarter,

intangible asset amortization was $326 million, step-up

amortization was $66 million and amortization of intangible assets

related to a TFCF equity investee was $3 million. For the

prior-year quarter, intangible asset amortization was $361 million,

step-up amortization was $65 million and amortization of intangible

assets related to a TFCF equity investee was $3 million.

The following table reconciles reported diluted EPS to diluted

EPS excluding certain items for the year:

($ in millions except EPS)

Pre-Tax Income/

Loss

Tax Benefit/

Expense(1)

After-Tax Income/

Loss(2)

Diluted

EPS(3)

Change vs. prior year

Year Ended September 28, 2024:

As reported

$

7,569

$

(1,796

)

$

5,773

$

2.72

>100 %

Exclude:

Restructuring and impairment

charges(4)

3,595

(293

)

3,302

1.78

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs(5)

1,677

(391

)

1,286

0.68

Other expense(6)

65

(11

)

54

0.03

Income Tax Reserve Adjustments

—

(418

)

(418

)

(0.23

)

Excluding certain items

$

12,906

$

(2,909

)

$

9,997

$

4.97

32

%

Year Ended September 30, 2023:

As reported

$

4,769

$

(1,379

)

$

3,390

$

1.29

Exclude:

Restructuring and impairment

charges(4)

3,836

(717

)

3,119

1.69

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs(5)

1,998

(465

)

1,533

0.82

Other income, net(6)

(96

)

13

(83

)

(0.05

)

Excluding certain items

$

10,507

$

(2,548

)

$

7,959

$

3.76

(1)

Tax benefit/expense is determined

using the tax rate applicable to the individual item.

(2)

Before noncontrolling interest

share.

(3)

Net of noncontrolling interest

share, where applicable. Total may not equal the sum of the column

due to rounding.

(4)

Charges for the current year

included impairments of Star India ($1,545 million), goodwill

($1,287 million), assets at our retail business ($328 million),

content ($187 million) and equity investments ($165 million), and

severance costs ($83 million). Charges for the prior year included

content impairments ($2,577 million), severance costs ($357

million), impairments of goodwill ($721 million) and an equity

investment ($141 million), and costs related to exiting our

businesses in Russia ($69 million), net of the A+E gain ($56

million).

(5)

For the current year, intangible

asset amortization was $1,394 million, step-up amortization was

$271 million and amortization of intangible assets related to a

TFCF equity investee was $12 million. For the prior year,

intangible asset amortization was $1,547 million, step-up

amortization was $439 million and amortization of intangible assets

related to a TFCF equity investee was $12 million.

(6)

For the current year, other

expense was due to a charge related to a legal ruling ($65

million). For the prior year, other income, net was due to a gain

on our investment in DraftKings ($169 million), partially offset by

a charge related to a legal ruling ($101 million).

Total segment operating income

The Company evaluates the performance of its operating segments

based on segment operating income, and management uses total

segment operating income (the sum of segment operating income from

all of the Company’s segments) as a measure of the performance of

operating businesses separate from non-operating factors. The

Company believes that information about total segment operating

income assists investors by allowing them to evaluate changes in

the operating results of the Company’s portfolio of businesses

separate from non-operational factors that affect net income, thus

providing separate insight into both operations and other factors

that affect reported results.

The following table reconciles income before income taxes to

total segment operating income:

Quarter Ended

Year Ended

($ in millions)

Sept. 28, 2024

Sept. 30, 2023

Change

Sept. 28, 2024

Sept. 30, 2023

Change

Income before income taxes

$

948

$

1,007

(6

)%

$

7,569

$

4,769

59

%

Add (subtract):

Corporate and unallocated shared

expenses

408

293

(39

)%

1,435

1,147

(25

)%

Restructuring and impairment charges

1,543

965

(60

)%

3,595

3,836

6

%

Other (income) expense, net

—

—

—

%

65

(96

)

nm

Interest expense, net

361

282

(28

)%

1,260

1,209

(4

)%

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs

395

429

8

%

1,677

1,998

16

%

Total segment operating income

$

3,655

$

2,976

23

%

$

15,601

$

12,863

21

%

Free cash flow

The Company uses free cash flow (cash provided by operations

less investments in parks, resorts and other property), among other

measures, to evaluate the ability of its operations to generate

cash that is available for purposes other than capital

expenditures. Management believes that information about free cash

flow provides investors with an important perspective on the cash

available to service debt obligations, make strategic acquisitions

and investments and pay dividends or repurchase shares.

The following table presents a summary of the Company’s

consolidated cash flows:

Quarter Ended

Year Ended

($ in millions)

Sept. 28, 2024

Sept. 30, 2023

Sept. 28, 2024

Sept. 30, 2023

Cash provided by operations

$

5,518

$

4,802

$

13,971

$

9,866

Cash used in investing activities

(1,978

)

(1,382

)

(6,881

)

(4,641

)

Cash used in financing activities

(3,566

)

(597

)

(15,288

)

(2,724

)

Impact of exchange rates on cash, cash

equivalents and restricted cash

79

(101

)

65

73

Change in cash, cash equivalents and

restricted cash

53

2,722

(8,133

)

2,574

Cash, cash equivalents and restricted

cash, beginning of period

6,049

11,513

14,235

11,661

Cash, cash equivalents and restricted

cash, end of period

$

6,102

$

14,235

$

6,102

$

14,235

The following table reconciles the Company’s consolidated cash

provided by operations to free cash flow:

Quarter Ended

Year Ended

($ in millions)

Sept. 28, 2024

Sept. 30, 2023

Change

Sept. 28, 2024

Sept. 30, 2023

Change

Cash provided by operations

$

5,518

$

4,802

$

716

$

13,971

$

9,866

$

4,105

Investments in parks, resorts and other

property

(1,489

)

(1,374

)

(115

)

(5,412

)

(4,969

)

(443

)

Free cash flow

$

4,029

$

3,428

$

601

$

8,559

$

4,897

$

3,662

DTC Streaming Businesses

The Company uses combined DTC streaming businesses operating

income (loss) because it believes that this measure allows

investors to evaluate the performance of its portfolio of streaming

businesses and track progress against the Company’s goal of

reaching profitability at its combined streaming businesses.

The following tables reconcile Entertainment and Sports segment

operating income (loss) to the DTC streaming businesses operating

income (loss):

Quarter Ended

September 28, 2024

September 30, 2023

($ in millions)

Entertainment

Sports

DTC Streaming Businesses

Entertainment

Sports

DTC Streaming Businesses

Linear Networks

$

498

$

861

$

805

$

948

DTC streaming businesses

(Direct-to-Consumer and ESPN+ businesses)

253

68

$

321

(420

)

33

$

(387

)

Content Sales/Licensing and Other

316

—

(149

)

—

Segment operating income

$

1,067

$

929

$

236

$

981

Year Ended

September 28, 2024

September 30, 2023

Entertainment

Sports

DTC Streaming Businesses

Entertainment

Sports

DTC Streaming Businesses

Linear Networks

$

3,452

$

2,415

$

4,119

$

2,581

DTC streaming businesses

(Direct-to-Consumer and ESPN+ businesses)

143

(9

)

$

134

(2,496

)

(116

)

$

(2,612

)

Content Sales/Licensing and Other

328

—

(179

)

—

Segment operating income

$

3,923

$

2,406

$

1,444

$

2,465

Operating Income for Entertainment SVOD

DTC businesses (excluding our Hulu Live DMVPD service)

Operating income for Entertainment SVOD DTC businesses

(excluding our Hulu Live DMVPD service) consists of operating

income for the Direct-to-Consumer line of business at the

Entertainment segment less our Hulu Live DMVPD service.

The Company uses operating income (and related margin) for

Entertainment SVOD DTC businesses (excluding our Hulu Live DMVPD

service) as a measure of the performance of our Entertainment SVOD

direct-to-consumer services separate from our Hulu Live DMVPD

service, which we believe assists investors by allowing them to

evaluate the performance of these SVOD direct-to-consumer

services.

FORWARD-LOOKING STATEMENTS

Certain statements and information in this earnings release may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding our expectations, beliefs, plans, financial

prospects, trends or outlook and guidance; financial or performance

estimates and expectations (including estimated or expected

revenues, earnings, operating income, cash position and margins)

and expected drivers; direct-to-consumer prospects, including

expectations for subscriber growth; timing, availability or nature

of our offerings; future capital expenditures and investments,

including opportunities for growth and expansion; future capital

allocation, including dividends and share repurchases; value of our

intellectual property, content offerings, businesses and assets;

business and other plans; strategic priorities and initiatives;

consumer sentiment, behavior or demand and other statements that

are not historical in nature. Any information that is not

historical in nature included in this earnings release is subject

to change. These statements are made on the basis of management’s

views and assumptions regarding future events and business

performance as of the time the statements are made. Management does

not undertake any obligation to update these statements.

Actual results may differ materially from those expressed or

implied. Such differences may result from actions taken by the

Company, including restructuring or strategic initiatives

(including capital investments, asset acquisitions or dispositions,

new or expanded business lines or cessation of certain operations),

our execution of our business plans (including the content we

create and IP we invest in, our pricing decisions, our cost

structure and our management and other personnel decisions), our

ability to quickly execute on cost rationalization while preserving

revenue, the discovery of additional information or other business

decisions, as well as from developments beyond the Company’s

control, including:

- the occurrence of subsequent events;

- deterioration in domestic and global economic conditions or

failure of conditions to improve as anticipated;

- deterioration in or pressures from competitive conditions,

including competition to create or acquire content, competition for

talent and competition for advertising revenue;

- consumer preferences and acceptance of our content, offerings,

pricing model and price increases, and corresponding subscriber

additions and churn, and the market for advertising sales on our

DTC streaming services and linear networks;

- health concerns and their impact on our businesses and

productions;

- international, political or military developments;

- regulatory and legal developments;

- technological developments;

- labor markets and activities, including work stoppages;

- adverse weather conditions or natural disasters; and

- availability of content.

Such developments may further affect entertainment, travel and

leisure businesses generally and may, among other things, affect

(or further affect, as applicable):

- our operations, business plans or profitability, including

direct-to-consumer profitability;

- demand for our products and services;

- the performance of the Company’s content;

- our ability to create or obtain desirable content at or under

the value we assign the content;

- the advertising market for programming;

- taxation; and

- performance of some or all Company businesses either directly

or through their impact on those who distribute our products.

Additional factors are set forth in the Company’s most recent

Annual Report on Form 10-K, including under the captions “Risk

Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and “Business,” quarterly

reports on Form 10-Q, including under the captions “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” and subsequent filings with the

Securities and Exchange Commission.

The terms “Company,” “we,” and “our” are used in this report to

refer collectively to the parent company and the subsidiaries

through which our various businesses are actually conducted.

PREPARED EARNINGS REMARKS AND CONFERENCE CALL

INFORMATION

In conjunction with this release, The Walt Disney Company will

post prepared management remarks (Executive Commentary) at

www.disney.com/investors and will host

a conference call today, November 14, 2024, at 8:30 AM EST/5:30 AM

PST via a live Webcast. To access the Webcast go to www.disney.com/investors. The corresponding

earnings presentation and webcast replay will also be available on

the site.

([1]) Diluted EPS excluding certain items (also referred to as

adjusted EPS), total segment operating income and DTC streaming

businesses operating income are non-GAAP financial measures. The

most comparable GAAP measures are diluted EPS, income before income

taxes and segment operating income for the Entertainment segment

and Sports segment, respectively. See the discussion on pages 18

through 22 for how we define and calculate these measures and a

quantitative reconciliation thereof to the most directly comparable

GAAP measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114719290/en/

David Jefferson Corporate Communications 818-560-4832

Carlos Gomez Investor Relations 818-560-1933

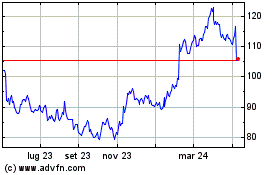

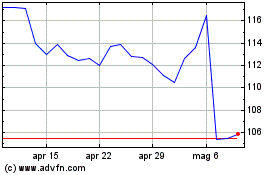

Grafico Azioni Walt Disney (NYSE:DIS)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Walt Disney (NYSE:DIS)

Storico

Da Nov 2023 a Nov 2024