The European Equity Fund, Inc. (NYSE: EEA) and The New Germany

Fund, Inc. (NYSE: GF) (each, a “Fund,” and collectively, the

“Funds”) each announced today that its Board of Directors declared

the distributions set forth below. GF’s and EEA’s total

distributions will be paid in cash to the stockholders of record as

of May 24, 2024.

Details for each Fund’s distributions are as follows:

Declaration- 05/14/2024

Ex-Date- 05/23/2024

Record- 05/24/2024

Payable- 06/04/2024

Fund

Ticker

Net Investment Income per

Share

Short-Term Capital Gains per

Share

Long-Term Capital Gains per

Share

Total Distribution per

Share

The European Equity Fund, Inc.

EEA

$0.0376

$0.0000

$0.0000

$0.0376

The New Germany Fund, Inc. .

GF

$0.0239

$0.0000

$0.0000

$0.0239

For more information on each Fund, including

the most recent month-end performance, visit www.dwsfunds.com or

call (800) 349-4281.

The European Equity Fund, Inc. is diversified and primarily

focuses its investments in equity securities of issuers domiciled

in Europe, thereby increasing its vulnerability to developments in

that region.

The New Germany Fund, Inc. is diversified, and primarily

focuses its investments in Germany, thereby increasing its

vulnerability to developments in that country.

Investing in foreign securities, particularly of emerging

markets, presents certain risks, such as currency fluctuations,

political and economic changes, and market risks. Any fund that

concentrates in a particular segment of the market or a particular

geographical region will generally be more volatile than a fund

that invests more broadly.

War, terrorism, sanctions, economic uncertainty, trade

disputes, public health crises and related geopolitical events have

led, and, in the future, may lead to significant disruptions in US

and world economies and markets, which may lead to increased market

volatility and may have significant adverse effects on the Funds

and their investments.

The European Union, the United States and other countries

have imposed sanctions on Russia in response to Russian military

and other actions in recent years. These sanctions have adversely

affected Russian individuals, issuers and the Russian economy.

Russia, in turn, has imposed sanctions targeting Western

individuals, businesses and products. The various sanctions have

adversely affected, and may continue to adversely affect, not only

the Russian economy, but also the economies of many countries in

Europe, including countries in Central and Eastern Europe. The

continuation of current sanctions or the imposition of additional

sanctions may materially adversely affect the value of the Funds’

portfolios.

Closed-end funds, unlike open-end funds, are not continuously

offered. There is a one-time public offering and once issued,

shares of closed-end funds are sold in the open market through a

stock exchange. Shares of closed-end funds frequently trade at a

discount to net asset value. The price of the fund’s shares is

determined by a number of factors, several of which are beyond the

control of the fund. Therefore, the fund cannot predict whether its

shares will trade at, below or above net asset value.

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

Certain statements contained in this release may be

forward-looking in nature. These include all statements relating to

plans, expectations, and other statements that are not historical

facts and typically use words like “expect,” “anticipate,”

“believe,” “intend,” and similar expressions. Such statements

represent management’s current beliefs, based upon information

available at the time the statements are made, with regard to the

matters addressed. All forward-looking statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed in, or implied by, such statements.

Management does not undertake any obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise. The following factors,

among others, could cause actual results to differ materially from

forward-looking statements: (i) the effects of adverse changes in

market and economic conditions; (ii) legal and regulatory

developments; and (iii) other additional risks and uncertainties,

including public health crises (including the recent pandemic

spread of the novel coronavirus), war, terrorism, trade disputes

and related geopolitical events.

Past performance is no guarantee of future results.

NOT FDIC/ NCUA INSURED • MAY LOSE VALUE • NO BANK

GUARANTEE NOT A DEPOSIT • NOT INSURED BY ANY FEDERAL

GOVERNMENT AGENCY

DWS Distributors, Inc. 222 South Riverside Plaza Chicago,

IL 60606-5808 www.dws.com Tel (800) 621-1148 © 2024 DWS Group GmbH

& Co. KGaA. All rights reserved

The brand DWS represents DWS Group GmbH & Co. KGaA and any

of its subsidiaries such as DWS Distributors, Inc. which offers

investment products or DWS Investment Management Americas, Inc. and

RREEF America L.L.C. which offer advisory services. (R-101018

-1) (05/24)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514950686/en/

For additional information:

DWS Press Office (212) 454-4500 Shareholder Account Information

(800) 294-4366 DWS Closed-End Funds (800) 349-4281

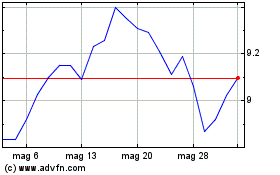

Grafico Azioni European Equity (NYSE:EEA)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni European Equity (NYSE:EEA)

Storico

Da Nov 2023 a Nov 2024