Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

03 Luglio 2023 - 10:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

|

Filed by the Registrant

Filed by the Registrant |

|

☐ Filed by a Party other than the Registrant |

|

|

|

| Check the appropriate

box: |

|

☐ |

|

Preliminary Proxy

Statement |

|

☐ |

|

CONFIDENTIAL, FOR USE OF THE

COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

|

☐ |

|

Definitive Proxy

Statement |

|

|

|

Definitive Additional

Materials |

|

☐ |

|

Soliciting Material Pursuant to

§240.14a-12 |

McKESSON CORPORATION

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

| Payment of Filing Fee

(Check the appropriate box): |

|

|

|

No fee

required. |

|

☐ |

|

Fee paid previously with

preliminary materials. |

|

☐ |

|

Fee computed on table in

exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Summer Governance Roadshow ----------- 2023 Annual Meeting of

Shareholders

Advancing Health Outcomes for All Strength in Distribution 45M+ 99.9%

pharmaceutical order accuracy in North America prescription deliveries 275,000+ customers served with medical-surgical products per year Leading Technology Superior Specialty Assets distributor Differentiation in community US Oncology Research has

played a role in >100 oncology and Connected to payers FDA-approved cancer therapies specialty representing 94% of U.S. Supported >3,500 specialty practices with 170 therapies prescription volume cancer and rare/complex disease medications and

Access to research data from supportive therapies >2.5M records including >80 oncology indications Biopharma Services Supported Network of More than 650 biopharma brands served 95% 900,000+ providers of therapeutic Increased value to biopharma

and enabled >$8B in and over 50,000 areas prescription savings pharmacies 2

Delivering on Our Strategic Vision (1) Our Strategic Priorities FY23

Highlights Focus on People and Culture We continue to invest in our employees through our three-pillar employee value proposition: Care, Meaning, and Belonging $277B Total Revenue Expand Oncology and Biopharma Platforms Meaningful progress on

expanding our oncology and biopharma platforms through recent strategic investments Drive Sustainable Core Growth $5.2B $3.9B Continuously evaluating how to drive efficiencies in core businesses, Cash Returned to Operating Cash Flow so that they

continue to grow and generate Free Cash Flow Shareholders Evolve and Grow the Portfolio An ongoing process as we ensure our resources and investments are focused on strategic growth areas (1) Reported on May 8, 2023. 3

Governance and Engagement Highlights Focus on Good Corporate Governance

2022-23 Engagement Focus Areas Leading Board & Governance Practices Board Oversight and • Independent Board Chair Human Capital and Diversity Refreshment • Annual Board and Committee evaluation process Director Skills and Diversity

Sustainability Reporting • Policy requiring directors with over 12 years of tenure to offer to resign annually • Policies on other public company board service Corporate Governance Lobbying Expenditures and Practices and Policies

Activities • Mandatory retirement age • Pay for performance alignment • No poison pill Inclusion of Sustainability Recognition of Near-term • Robust board and senior management Priority Areas in Climate Change Targets by

succession planning process Compensation * SBTi * • Effective shareholder engagement program • Robust shareholder engagement program * Indicates new in FY 23 4

���� Proposal 1: Election of 11 Directors for a

One -Year Term Our Experienced and Diverse Board Our directors exhibit a mix of skills, experience, backgrounds, and perspectives Skills and Experience Board Overview Highlights 6 Diversity Donald R. Knauss Brian S. Tyler Richard H. Carmona Dominic

J. Caruso W. Roy Dunbar James H. Hinton Directors with Risk Ret. Chairman & CEO, Chief Executive Chief of Health Ret. EVP & CFO, Ret. CEO & Operating Partner, Management & Compliance 6 out of 11 director Clorox Officer, McKesson

Innovations, Canyon Johnson & Johnson Chairman, Network Welsh Carson Experience nominees are women or Ranch & Former Solutions Anderson & Stowe CT, F persons of color Surgeon General of Independent Chair the US as of Apr. 2022 CT, C A*,

C A, G C, F 8 Joined Oct. 2014 Joined Apr. 2019 Joined Sept. 2021 Joined Sept. 2018 Joined Apr. 2022 Joined Jan. 2022 Directors with Healthcare Industry Experience Independent Directors 10 out of 11 director nominees are independent 6 Directors with

Sustainability & Bradley E. Lerman Linda Mantia Maria Martinez Susan R. Salka Kathleen Wilson- Human Capital Experience Thompson EVP & General Ret. SVP & COO, EVP & COO, Cisco Ret. CEO & President, Board Refreshment Counsel,

Starbucks Manulife Financial Systems AMN Healthcare Ret. EVP & Global Services CHRO, Walgreens Boots Alliance 11 At least 1 new director joined Directors with Senior our Board each year from A, C* CT*, G F, G* A, F* CT, G Executive Leadership

2018 to 2022: Joined Sept. 2018 Joined Oct. 2020 Joined Oct. 2019 Joined Oct. 2014 Joined Jan. 2022 Experience New Chair in 2022 * = Committee Chair A = Audit CT = Compensation G = Governance C = Compliance F = Finance & Talent &

Sustainability 5 Committee composition as of July 1, 2023

���� Proposal 3: Advisory Vote on Executive

Compensation Overview of FY23 Compensation Program Building on the strong support for our say-on-pay, and incorporating feedback we heard from shareholders, the Committee introduced consideration of the Company’s performance in key

sustainability priority areas Performance FY2023 FY23 CEO Compensation Mix Pay Element Metric Rationale Target Pay Payouts Base Salary Attracts and retains high-performing executives by Base Salary — — -- providing market-competitive

fixed pay MIP 8% (Annual RSUs Rewards operational performance and profitability; Cash) Adjusted EPS (Equity) 15% important driver of share price valuation and 92% (50%) shareholder expectations 31% At-Risk Adjusted Operating Rewards focus on

operational performance and Compensation 100% — 175% PSUs Management Profit profitability; important driver of share price valuation of Base Salary (Equity) Incentive Plan 200% of (25%) and shareholder expectations (annual cash Target 46% Free

Cash Flow Rewards generating cash to invest in growth and return incentive) (25%) capital to shareholders; important valuation metric «New for FY 2023: Discretionary Ensures sustainability priorities are aligned with Sustainability Priority

Downward- FY23 Other NEOs Compensation Mix business strategic objectives and Company purpose Areas Only Modifier Base Salary 3-Year Cumulative Measures long-term earnings power, drives returns for Adjusted EPS the Company and directly correlates to

share price RSUs 18% (50%) performance (Equity) MIP Performance Stock Encourages leaders to make sound investments that Units 3-Year Average ROIC 60% of Target 200% of (Annual 25% generate returns for shareholders; important valuation 82% (long-term

equity (25%) LTI Value Target Cash) metric At-Risk 19% incentive) PSUs Compensation MCK TSR vs. (Equity) Rewards share price performance relative to Comparator Group comparator group over time 38% (25%) Restricted Stock 40% of Target Units —

Directly aligns with value delivered to shareholders -- LTI Value (long-term equity) 6

���� Proposal 5: Shareholder Ratification of

Termination Pay We Recommend Against the Shareholder Proposal The policy is unnecessary given McKesson already has an effective cash severance policy, and would restrict our ability to effectively design competitive compensation packages McKesson

Already Has An Effective Policy To Seek Shareholder Approval of Cash Severance • The Company already has a more tailored and appropriate policy in place to seek shareholder approval for any future arrangement with an executive officer or any

other participant designated by the Compensation and Talent Committee whereby the present value of cash severance exceeds 2.99 times the sum of the participant’s base salary and target bonus The Proposal Discourages the Use of Long-Term

Incentive Awards • Equity-based incentive awards that link our performance to shareholders’ interests and which are heavily weighted in our executive compensation would be discouraged by this proposal, which would include the value of

accelerated equity vesting in severance calculations The Proposal Restricts Our Ability to Design Competitive Compensation Packages • Top candidates would likely be unwilling have their equity compensation subjected to a shareholder vote and

may instead seek employment elsewhere, including at our competitors McKesson Already Provides Sufficient Opportunities for Shareholder Input • We maintain an annual Say-on-Pay vote, allowing our shareholders to provide feedback on all

executive compensation policies, as well as a robust year-round shareholder engagement program Your Board recommends a vote AGAINST this proposal 7

We Request Your Support at the 2023 Annual Meeting The Board asks that you

vote FOR all management proposals and AGAINST the shareholder proposal Management Proposals 1 Election of 11 Directors for a One-Year Term FOR ���� Ratification of Appointment of Deloitte & Touche as Independent

Registered Public Accounting Firm for 2 FOR ���� Fiscal Year 2024 3 Advisory Vote on Executive Compensation FOR ���� 4 Advisory Vote on the Frequency of the Advisory Vote on Executive

Compensation ONE YEAR Shareholder Proposal 6 Shareholder Proposal on Ratification of Termination Pay AGAINST ���� 8

Appendix: McKesson’s Response to 2022 Shareholder Proposal

2022 Shareholder Proposal: Rule 10b5-1 Trading Plans Th e Company enhanced

its policies and procedures for pre-arranged trading plans in response to 2022 shareholder vote and SEC rulemaking 2022 shareholder proposal failed to win enough votes to recommend that McKesson file Form 8-K whenever section 16 insiders adopt,

modify or cancel a Rule 10b5-1 trading plan • The proposal would have caused McKesson to submit disclosure not generally required of public companies New SEC rules adopted in December 2022 require quarterly disclosure when section 16 insiders

adopt, modify or cancel any trading plan • SEC rules continue to not require Form 8-K reporting • SEC rules also enhance Form 4 reporting with check box for transactions under Rule 10b5-1 plans McKesson implemented an updated

Pre-arranged Trading Plan Policy and associated written procedures that apply to all employees • Policy and procedures comply with SEC rules, with additional requirements for section 16 insiders • McKesson discourages plan modification

or cancellation for any reason, and such action requires approval by securities legal counsel McKesson section 16 insiders continue to promptly disclose details of Rule 10b5-1 plan transactions, including plan adoption date, on their Form 4s

10

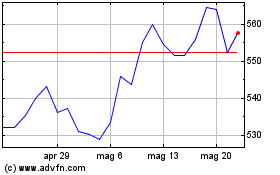

Grafico Azioni McKesson (NYSE:MCK)

Storico

Da Apr 2024 a Mag 2024

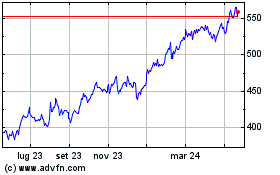

Grafico Azioni McKesson (NYSE:MCK)

Storico

Da Mag 2023 a Mag 2024