MetLife Investment Management Closes $1.2 Billion Private Equity Partners Fund II Through Managed Transaction

08 Luglio 2024 - 2:15PM

Business Wire

New fund extends MIM’s private equity platform

for institutional investors

MetLife Investment Management (MIM), the institutional asset

management business of MetLife, Inc. (NYSE: MET), today announced

the launch of its second private equity fund for institutional

clients in concert with the closing of approximately $1.2 billion

in commitments to a new MIM-managed fund-of-funds.

The new fund, MetLife Investment Private Equity Partners II,

purchased a portfolio of approximately $860 million of private

equity and equity co-investment interests with funded and unfunded

commitments totaling $975 million from MetLife affiliates as part

of a managed secondary sale transaction anchored by funds managed

by Lexington Partners L.P., which served as lead investor.

“MIM continues to expand its client solutions with this new

fund, which leverages our deep private equity investment

capabilities and further demonstrates our leadership in investing

in private markets,” said John McCallion, MetLife’s chief financial

officer and head of MetLife Investment Management. “The strong

long-term performance of our private equity investments drove the

creation of this differentiated investment solution.”

MIM syndicated a portion of the transaction to other

unaffiliated institutional clients. MIM intends to deploy

approximately $250 million on behalf of the fund on new private

equity opportunities.

The portfolio of assets acquired by the fund consists of nearly

50 private equity and equity co-investments diversified globally.

The sale follows strong returns for the MetLife general account’s

private equity portfolio, which held $14.3 billion in private

equity assets as of March 31, 2024.

“We are thrilled to partner with MIM on this innovative

transaction,” said Wil Warren, partner and president of Lexington

Partners. “MIM Private Equity Partners II represents a

high-quality, diversified portfolio which we believe stands out in

today’s secondary market, and we look forward to working with MIM

on this investment going forward.”

MIM’s private equity team has deployed over $20.0 billion of

alternative investments between 2010 and 2023. Evercore served as

advisor to MIM for this transaction.

About MetLife Investment Management

MetLife Investment Management, the institutional asset management

business of MetLife, Inc. (NYSE: MET), is a global public fixed

income, private capital and real estate investment manager

providing tailored investment solutions to institutional investors

worldwide. MetLife Investment Management provides public and

private pension plans, insurance companies, endowments, funds and

other institutional clients with a range of bespoke investment and

financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and as of March 31, 2024, had $593.7 billion in total assets under

management.1

About MetLife MetLife, Inc. (NYSE:

MET), through its subsidiaries and affiliates (“MetLife”), is one

of the world’s leading financial services companies, providing

insurance, annuities, employee benefits and asset management to

help individual and institutional customers build a more confident

future. Founded in 1868, MetLife has operations in more than 40

markets globally and holds leading positions in the United States,

Asia, Latin America, Europe and the Middle East. For more

information, visit www.metlife.com.

About Lexington Partners Lexington

Partners is one of the world’s largest and most successful managers

of secondary private equity and co-investment funds. Lexington

helped pioneer the development of the institutional secondary

market over 30 years ago and created one of the first independent,

discretionary co-investment programs 26 years ago. Lexington has

total capital in excess of $76 billion and has acquired over 5,000

interests through more than 1,000 transactions. Lexington’s global

team is strategically located in major centers for private equity

and alternative asset investing across North America, Europe, Asia,

and Latin America. Lexington is the global secondary private equity

and co-investments specialist investment manager of Franklin

Templeton. Additional information can be found at

www.lexingtonpartners.com.

Forward-Looking Statements The

forward-looking statements in this news release, using words such

as “continue,” “intend,” “going forward” and “seek,” are based on

assumptions and expectations that involve risks and uncertainties,

including the “Risk Factors” MetLife, Inc. describes in its U.S.

Securities and Exchange Commission filings. MetLife’s future

results could differ, and it does not undertake any obligation to

publicly correct or update any of these statements.

Endnotes 1Total assets under

management is comprised of all MetLife general account and separate

account assets and unaffiliated/third party assets, at estimated

fair value, managed by MIM. See MetLife’s total assets under

management fact sheet for the quarter ended March 31, 2024 for

further information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240708915514/en/

For Media: Dave Franecki +1 (973) 264-7465

dave.franecki@metlife.com

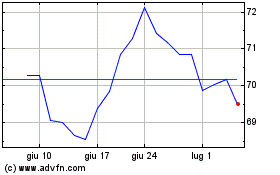

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Gen 2025 a Feb 2025

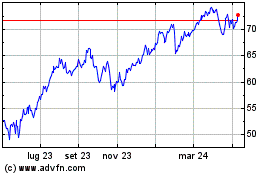

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Feb 2024 a Feb 2025