Acquisition of Leading Global Asset Manager

Accelerates Growth of MetLife Investment

Management

Strong Strategic and Cultural Fits and

Attractive Financially

MetLife Investment Management (MIM), the institutional asset

management business of MetLife, Inc. (NYSE: MET), today announced

that it has reached a definitive agreement to acquire PineBridge

Investments (PineBridge), a global asset manager with approximately

$100 billion in assets under management,1 from the Pacific Century

Group. The transaction is comprised of $800 million in cash at

closing, $200 million subject to achieving certain 2025 financial

metrics and $200 million subject to a multi-year earnout. The

acquisition excludes PineBridge’s private equity funds group

business and its joint venture in China.

MetLife has established accelerating asset management growth as

a strategic priority as part of the company’s New Frontier

strategy. The acquisition of PineBridge will represent the tactical

advancement of MetLife’s newly rolled out strategy by adding

significant scale to MIM while broadening the firm’s global

offerings and distribution reach. Upon close, MIM’s total assets

under management are expected to increase to over $700 billion.

“The acquisition of PineBridge Investments furthers our ambition

to accelerate growth in asset management,” said MetLife President

and Chief Executive Officer Michel Khalaf. “MetLife Investment

Management is on a good path to grow its business organically,

supplemented by targeted, complementary inorganic growth.”

“This transaction will add substantially to MIM’s already strong

franchise by expanding our public and private credit offerings,

including a robust leveraged finance platform, as well as extending

our global capabilities,” said MetLife Chief Financial Officer and

Head of MetLife Investment Management John McCallion. “We are

excited about these new capabilities and the additional ways MIM

will be able to partner with clients.”

The acquisition will meaningfully expand MIM’s global footprint

with more than half of the client assets being acquired in the

transaction held by investors outside of the U.S., and about

one-third of the assets held in Asia.

The acquisition of PineBridge will also bring to MIM a

collateralized loan obligation platform, a multi-asset business, a

global suite of equity strategies, as well as direct lending and

European real estate businesses – all of which are complementary to

the firm’s existing capabilities.

“This is a pivotal moment for PineBridge as we enter an exciting

new chapter. By integrating MIM’s expansive platform and financial

strength with our active investment expertise across public and

private markets, coupled with our diversified global footprint, we

are poised to enhance our capabilities and elevate the value we

deliver to clients,” said Greg Ehret, Chief Executive Officer,

PineBridge. “We are eager to seize new opportunities and remain

committed to driving long-term success for clients worldwide.”

PineBridge was founded in 1996 as the investment advisory and

asset management business of AIG and was later acquired in 2010 by

Pacific Century Group.

This transaction is targeted to close in 2025, subject to

customary closing conditions, including regulatory approvals. BofA

Securities is serving as financial advisor to MIM, and A&O

Shearman is serving as its legal counsel. J.P. Morgan and Evercore

are serving as financial advisors to PineBridge, and Davis, Polk

& Wardwell is serving as its legal counsel.

Transaction Highlights

Transaction

- Acquiring PineBridge Investments from Pacific Century

Group

- $800 million in cash at closing

- $200 million subject to achieving certain 2025 financial

metrics

- $200 million subject to a multi-year earnout

Strong Strategic Fit

- Advances New Frontier strategic priority to grow asset

management

- Global, scaled institutional public and private credit

investment manager

- Complementary higher yield strategies

- Well-established presence in Asia

Attractive Financially

- Expected neutral to EPS in year 1 and accretive beyond

- High teens expected internal rate of return

- Capital light and source of steady fee income

- Potential expense synergies

Timing

- Expected to close in 2025

- Subject to regulatory approvals and other customary closing

conditions

Presentation materials

Presentation materials with additional information on this

transaction are available on the MetLife Investor Relations web

page

(https://investor.metlife.com/files/doc_presentation/2024/12/MetLife-Investment-Management-to-Acquire-PineBridge-Investments.pdf).

About MetLife Investment Management

MetLife Investment Management, the institutional asset management

business of MetLife, Inc. (NYSE: MET), is a global public fixed

income, private capital and real estate investment manager

providing tailored investment solutions to institutional investors

worldwide. MetLife Investment Management provides public and

private pension plans, insurance companies, endowments, funds and

other institutional clients with a range of bespoke investment and

financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and as of September 30, 2024, had $609.3 billion in total assets

under management. For more information, see the total assets under

management fact sheet for the quarter ended September 30, 2024

available on MetLife’s Investor Relations webpage

(https://investor.metlife.com).

About MetLife MetLife, Inc. (NYSE:

MET), through its subsidiaries and affiliates (“MetLife”), is one

of the world’s leading financial services companies, providing

insurance, annuities, employee benefits and asset management to

help individual and institutional customers build a more confident

future. Founded in 1868, MetLife has operations in more than 40

markets globally and holds leading positions in the United States,

Asia, Latin America, Europe and the Middle East. For more

information, visit https://www.metlife.com.

Forward-Looking Statements The

forward-looking statements in this news release, using words such

as “accelerate,” “accretive,” “expected,” “growth,” “long-term,”

“path to grow,” “poised,” “potential,” “remain,” “seek,”

“targeted,” and “will” are based on assumptions and expectations

that involve risks and uncertainties, including the “Risk Factors”

MetLife, Inc. describes in its U.S. Securities and Exchange

Commission filings. MetLife’s future results could differ, and it

does not undertake any obligation to publicly correct or update any

of these statements.

Endnotes 1 Assets under management

as of Sept. 30, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241223276160/en/

Media Dave Franecki 973-264-7465

Dave.Franecki@metlife.com

Investors John Hall 212-578-7888

John.A.Hall@metlife.com

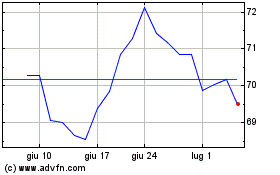

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Dic 2024 a Gen 2025

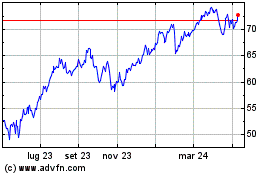

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Gen 2024 a Gen 2025