New MetLife Study: Majority of Plan Sponsors Concerned about the Impact of Market Volatility on Near-Retirees and Retirees

23 Luglio 2024 - 3:00PM

Business Wire

As macroeconomic uncertainty continues, the impact of market

volatility is a key consideration for today’s workforce and

retirees as they manage their retirement savings. Plan sponsors

recognize this and share their concern as MetLife’s Stable Value

Study, launched today, finds 69% of plan sponsors are concerned

about the impact of market volatility on those within 10 years of

retirement and 61% are concerned about the impact on retirees.

Stable Value funds are a capital preservation option designed

specifically for, and available only within, qualified defined

contribution (DC) plans and offer safety and stability for both

plan participants and retirees.

“Stable Value has a nearly 50-year history as a capital

preservation option in DC plans and provides protection against

market volatility in uncertain environments,” says Tom Schuster,

senior vice president and head of Stable Value and Investment

Products with MetLife. “This is essential for those participants

near or at retirement looking for earnings stability and liquidity,

along with a guarantee of principal and interest.”

Stable Value: A DC Plan Mainstay

Stable Value remains a popular capital preservation option among

plans sponsors, with 82% of DC plan sponsors currently offering

these funds. The Study found that the large majority of plan

sponsors (87%) have offered stable value for more than a year, and

66% have offered this solution for at least three years.

Eighty-four percent of plan sponsors say stable value was

recommended by their DC plan’s investment or financial advisor.

Eight in 10 advisors (76%) say the top reason for recommending

stable value is that it historically offers better returns than

money market or other capital preservation options.

“Plan sponsors and advisors recognize and appreciate stable

value’s long-term historical performance across all market cycles,”

says Schuster. “Because of this compelling track record, stable

value remains a popular choice and its outlook is strong.”

According to the Study, a majority of plan sponsors and advisors

(83% and 84%, respectively) view stable value as a good capital

preservation option for their plans because of its long-term

historical performance versus money market funds. An overwhelming

majority of plan sponsors, 95%, and advisors, 92%, say stable value

funds are valuable to participants seeking a safe haven, especially

those who are interested in maintaining their principal.

Stable Value and Target Date Funds

As target date funds (TDFs) remain popular within DC plans, a

critical consideration is whether participant savings in these

funds are adequately protected from market volatility. The Study

found that more than a third of plan sponsors, 37%, are considering

adopting strategies to manage volatility but only 12% of plan

sponsors to date have implemented these strategies, which may range

from the diversification of asset classes to the addition of

investment options.

“The good news is that there are new solutions available in the

market that apply the volatility smoothing principles of stable

value to TDFs,” says Warren Howe, national director, Stable Value

Markets. “These solutions allow plan sponsors to optimize the

risk/return profile of their TDFs by either lowering volatility

while maintaining returns or enhancing returns while maintaining

volatility.”

When presented with an example of the first approach—the TDF

provider delivers comparable returns, net of fees, while reducing

volatility by approximately 40% for certain vintages—the Study

found that 95% of plan sponsors would be interested in this option,

with 97% of advisors expressing interest. Plan sponsors and

advisors were also presented with a second option—the TDF provider

generates net returns four times more than the cost associated with

delivering those incremental returns while keeping volatility

constant (e.g., 60 basis points enhanced net returns for a cost of

15 basis points). The Study found 94% of plan sponsors would be

interested in this option while 95% of advisors are interested.

“Plan sponsors can apply these strategies to custom TDFs to

reduce the fund’s volatility, particularly for participants who are

near or in retirement,” says Howe. “By doing so, they can create

better retirement outcomes.”

About the Study

MetLife commissioned Greenwald Research to conduct surveys of

plan sponsors and advisors between February 26 and March 21, 2024.

A total of 238 interviews were completed among plan sponsors who

offer a 401(k), 457 or 403(b) plan. Assets under management for

plans included in the study ranged from under $10 million to over

$1 billion. Each respondent had to work for a company that offers a

DC plan with TDFs or target risk options, offer a capital

preservation option, and have at least a moderate amount of

influence over decisions regarding stable value or related funds

for their company’s DC plan(s). Online surveys were also completed

by 50 DC plan advisors who have worked as a plan advisor for at

least three years and have clients with DC plans that currently

offer capital preservation options. To read the full report, visit

http://metlife.com/svstudy2024.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe and the

Middle East. For more information, visit www.metlife.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723056918/en/

MetLife Contact: Judi Mahaney jmahaney@metlife.com

646-238-4655

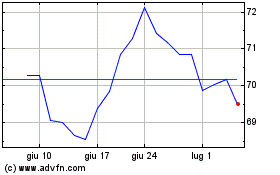

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Gen 2025 a Feb 2025

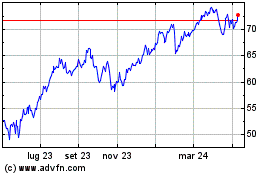

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Feb 2024 a Feb 2025