MetLife, Inc. (NYSE: MET) today announced its second quarter

2024 results.

Second Quarter Results Summary

- Net income of $912 million, or $1.28 per share, compared to net

income of $370 million, or $0.48 per share, in the second quarter

of 2023.

- Adjusted earnings of $1.6 billion, or $2.28 per share, compared

to adjusted earnings of $1.5 billion, or $1.94 per share, in the

second quarter of 2023.

- Book value of $33.30 per share, down 5 percent from $34.92 per

share at June 30, 2023.

- Book value, excluding accumulated other comprehensive income

(AOCI) other than foreign currency translation adjustments (FCTA),

of $53.12 per share, down 1 percent from $53.55 per share at June

30, 2023.

- Return on equity (ROE) of 15.2 percent.

- Adjusted ROE, excluding AOCI other than FCTA, of 17.3

percent.

- Holding company cash and liquid assets of $4.4 billion at June

30, 2024, which is above the target cash buffer of $3.0 - $4.0

billion.

“The excellent second quarter results reflect MetLife's building

business momentum, led by our flagship Group Benefits franchise and

continuing across our set of market-leading businesses,” said

MetLife President and CEO Michel Khalaf. “Our diversification and

ability to generate free cash flow benefits MetLife shareholders

and other stakeholders, positioning us to continue to drive

sustained long-term value.”

Second Quarter 2024 Summary

($ in millions, except per share data)

Three Months Ended

June 30,

2024

2023

Change

Premiums, fees and other revenues

$

13,547

$

13,587

Net investment income

5,205

5,072

3%

Net investment gains (losses)

(421)

(1,039)

Net derivative gains (losses)

(508)

(997)

Total revenues

$

17,823

$

16,623

Adjusted premiums, fees and other

revenues

$

13,523

$

13,594

(1)%

Adjusted premiums, fees and other

revenues, excluding pension risk transfers (PRT)

$

11,771

$

11,570

2%

Market risk benefit remeasurement gains

(losses)

$

182

$

817

Net income (loss)

$

912

$

370

146%

Net income (loss) per share

$

1.28

$

0.48

167%

Adjusted earnings

$

1,628

$

1,492

9%

Adjusted earnings per share

$

2.28

$

1.94

18%

Adjusted earnings, excluding total notable

items

$

1,628

$

1,492

9%

Adjusted earnings, excluding total notable

items per share

$

2.28

$

1.94

18%

Book value per share

$

33.30

$

34.92

(5)%

Book value per share, excluding AOCI other

than FCTA

$

53.12

$

53.55

(1)%

Expense ratio

17.9%

17.7%

Direct expense ratio, excluding total

notable items related to direct expenses and PRT

11.9%

12.2%

Adjusted expense ratio, excluding total

notable items related to adjusted other expenses and PRT

20.6%

20.6%

ROE

15.2%

5.4%

Adjusted ROE, excluding AOCI other than

FCTA

17.3%

14.6%

Adjusted ROE, excluding total notable

items (excludes AOCI other than FCTA)

17.3%

14.6%

Information regarding the non-GAAP and other financial measures

included in this news release and reconciliation of the non-GAAP

financial measures to GAAP measures are in “Non-GAAP and Other

Financial Disclosures” below and in the tables that accompany this

news release.

Supplemental slides for the second quarter of 2024, titled “2Q24

Supplemental Slides” are available on the MetLife Investor

Relations website at https://investor.metlife.com and in the Form

8-K furnished by MetLife to the U.S. Securities and Exchange

Commission in connection with this earnings release. Supplemental

information about MetLife's diversified global investment portfolio

is contained in the "2Q24 - General Account Assets Under Management

Fact Sheet," available on the above-mentioned website.

Total Company Discussion

MetLife reported second quarter 2024 premiums, fees and other

revenues of $13.5 billion, essentially flat compared to the second

quarter of 2023. Adjusted premiums, fees and other revenues were

$13.5 billion, down 1 percent on a reported basis and up 1 percent

on a constant currency basis from the prior-year period.

Net investment income and adjusted net investment income were

$5.2 billion, up 3 percent and up 2 percent, respectively, from the

second quarter of 2023, driven by higher interest rates and higher

variable investment income.

Net investment losses were $421 million, or $333 million after

tax during the quarter, primarily driven by normal trading activity

in the portfolio. Net derivative losses amounted to $508 million,

or $401 million after tax during the quarter, largely driven by the

U.S. dollar strengthening and an increase in long-term interest

rates.

Net income was $912 million, compared to net income of $370

million in the second quarter of 2023. The increase in net income

was primarily driven by higher adjusted earnings in the

current-year period and the impact of net losses in the prior-year

period that were associated with certain required accounting

adjustments from the reinsurance transaction announced in May 2023.

On a per-share basis, net income was $1.28, compared to net income

of $0.48 in the prior-year period.

MetLife reported adjusted earnings of $1.6 billion, up 9 percent

on a reported basis, and up 11 percent on a constant currency

basis, from the second quarter of 2023. On a per-share basis,

adjusted earnings were $2.28, up 18 percent from the prior-year

period.

Adjusted Earnings by Segment Summary

Three Months Ended

June 30, 2024

Segment

Change from prior-year

period (on a reported basis)

Change from prior-year

period (on a constant currency basis)

Group Benefits

43%

Retirement and Income Solutions (RIS)

(2)%

Asia

4%

8%

Latin America

3%

8%

Europe, the Middle East and Africa

(EMEA)

10%

20%

MetLife Holdings

(27)%

Business Discussions

All comparisons of the results for the second quarter of 2024 in

the business discussions that follow are with the second quarter of

2023, unless otherwise noted. There were no notable items in the

second quarter of 2024, as indicated in the notable items table

which follows the Business Discussions section of this release.

GROUP BENEFITS

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$533

$372

43%

Adjusted premiums, fees and other

revenues

$6,210

$6,013

3%

Notable item(s)

$0

$0

- Adjusted earnings were $533 million, up 43 percent,

primarily driven by favorable underwriting, particularly in

life.

- Adjusted premiums, fees and other revenues were $6.2

billion, up 3 percent, primarily driven by solid underlying growth

across most products, including voluntary, partially offset by

higher premiums in the prior-year period related to participating

life contracts. Premiums, fees and other revenues from

participating life contracts can fluctuate with claims

experience.

- Sales were up 11 percent year-to-date, primarily driven

by strong growth in core and voluntary products.

RIS

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$410

$417

(2)%

Adjusted premiums, fees and other

revenues

$2,582

$2,823

(9)%

Adjusted premiums, fees and other

revenues, excluding PRT

$830

$799

4%

Notable item(s)

$0

$0

- Adjusted earnings were $410 million, down 2 percent,

with lower recurring interest margins partially offset by higher

variable investment income and strong volume growth.

- Adjusted premiums, fees and other revenues were $2.6

billion, compared to $2.8 billion in the prior-year period.

- Excluding pension risk transfers, adjusted premiums, fees

and other revenues were $830 million, up 4 percent, driven by

higher institutional annuity sales and growth in UK longevity

reinsurance.

- Sales were up 62 percent year-to-date, driven by UK

longevity reinsurance and sales associated with $3.5 billion in

pension risk transfer deals.

ASIA

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$449

$431

4%

Adjusted earnings (constant currency)

$449

$417

8%

Adjusted premiums, fees and other

revenues

$1,668

$1,727

(3)%

Notable item(s)

$0

$0

Asia general account assets under

management (at amortized cost)

$126,997

$125,266

1%

- Adjusted earnings were $449 million, up 4 percent on a

reported basis, and up 8 percent on a constant currency basis,

driven by favorable underwriting and higher variable investment

income.

- Adjusted premiums, fees and other revenues were $1.7

billion, down 3 percent on a reported basis, and up 5 percent on a

constant currency basis.

- Asia general account assets under management (at amortized

cost) were $127.0 billion, up 5 percent on a constant currency

basis.

- Sales were $630 million, up 4 percent on a constant

currency basis. Growth across most of the region was partially

offset by a decline in Japan relative to strong sales in the

prior-year period.

LATIN AMERICA

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$226

$219

3%

Adjusted earnings (constant currency)

$226

$209

8%

Adjusted premiums, fees and other

revenues

$1,506

$1,385

9%

Notable item(s)

$0

$0

- Adjusted earnings were $226 million, up 3 percent on a

reported basis, and up 8 percent on a constant currency basis,

driven by strong volume growth and favorable underwriting,

partially offset by lower Chilean encaje returns.

- Adjusted premiums, fees and other revenues were $1.5

billion, up 9 percent on a reported basis, and up 12 percent on a

constant currency basis, driven by strong sales and solid

persistency across the region.

- Sales were $395 million, up 22 percent from the

prior-year period on a constant currency basis, with all key

markets contributing across the region.

EMEA

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$77

$70

10%

Adjusted earnings (constant currency)

$77

$64

20%

Adjusted premiums, fees and other

revenues

$621

$582

7%

Notable item(s)

$0

$0

- Adjusted earnings were $77 million, up 10 percent on a

reported basis and up 20 percent on a constant currency basis,

driven by volume growth and higher recurring interest margins,

partially offset by less favorable expense margins.

- Adjusted premiums, fees and other revenues were $621

million, up 7 percent on a reported basis and up 12 percent on a

constant currency basis due to strong sales across the region.

- Sales were $278 million, up 31 percent on a constant

currency basis, with strong growth in Turkey, the Gulf and UK.

METLIFE HOLDINGS

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$153

$211

(27)%

Adjusted premiums, fees and other

revenues

$823

$938

(12)%

Notable item(s)

$0

$0

- Adjusted earnings were $153 million, down 27

percent, primarily as a result of the reinsurance transaction

completed in 2023.

- Adjusted premiums, fees and other revenues were

$823 million, down 12 percent.

CORPORATE & OTHER

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted earnings

$(220)

$(228)

Notable item(s)

$0

$0

- Adjusted loss of $220 million, compared to an adjusted

loss of $228 million in the prior-year period.

INVESTMENTS

($ in millions)

Three Months Ended June

30, 2024

Three Months Ended June

30, 2023

Change

Adjusted net investment income

$5,160

$5,040

2%

- Adjusted net investment income was $5.2 billion, up 2

percent. Recurring investment income was $4.9 billion, compared

with $4.8 billion in the prior-year period, driven by higher

interest rates. Variable investment income was $298 million,

compared to variable investment income of $221 million in the

prior-year period, driven by higher private equity returns.

SECOND QUARTER 2024 NOTABLE ITEMS

($ in millions)

Adjusted Earnings

Three Months Ended June 30,

2024

Notable Items

Group Benefits

RIS

Asia

Latin America

EMEA

MetLife

Holdings

Corporate &

Other

Total

Total notable items

$0

$0

$0

$0

$0

$0

$0

$0

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe and the

Middle East. For more information, visit www.metlife.com.

Conference Call

MetLife will hold its second quarter 2024 earnings conference

call on Thursday, August 1, 2024, from 9-10 a.m. (ET). The

conference call will be available live via the internet. To listen

to the conference call via the internet, click the following link

to register (https://registrations.events/direct/Q4I79508686).

The conference call will be available for replay via telephone

and the internet beginning at 11:00 a.m. (ET) on Thursday, August

1, 2024 until Thursday, August 8, 2024 at 11:59 p.m. (ET). To

listen to a replay of the conference call via telephone, dial

800-770-2030 (U.S.) or 647-362-9199 (outside the U.S.). The

Conference ID for the replay is 79508. To access the replay of the

conference call via the internet, visit the MetLife Investor

Relations webpage (https://investor.metlife.com).

Non-GAAP and Other Financial

Disclosures

Any references in this news release

(except in this section and the tables that accompany this release)

to:

should be read as,

respectively:

(i)

net income (loss);

(i)

net income (loss) available to MetLife,

Inc.’s common shareholders;

(ii)

net income (loss) per share;

(ii)

net income (loss) available to MetLife,

Inc.’s common shareholders per diluted common share;

(iii)

adjusted earnings;

(iii)

adjusted earnings available to common

shareholders;

(iv)

adjusted earnings per share;

(iv)

adjusted earnings available to common

shareholders per diluted common share;

(v)

book value per share;

(v)

book value per common share;

(vi)

book value per share, excluding AOCI other

than FCTA;

(vi)

book value per common share, excluding

AOCI other than FCTA;

(vii)

return on equity; and

(vii)

return on MetLife, Inc.’s common

stockholders’ equity; and

(viii)

adjusted return on equity, excluding AOCI

other than FCTA.

(viii)

adjusted return on MetLife, Inc.’s common

stockholders’ equity, excluding AOCI other than FCTA.

In this news release, MetLife presents certain measures of its

performance on a consolidated and segment basis that are not

calculated in accordance with accounting principles generally

accepted in the United States of America (GAAP). MetLife believes

that these non-GAAP financial measures enhance the understanding

for MetLife and its investors of MetLife's performance by

highlighting the results of operations and the underlying

profitability drivers of the business. Segment-specific financial

measures are calculated using only the portion of consolidated

results attributable to that specific segment.

The following non-GAAP financial measures should not be viewed

as substitutes for the most directly comparable financial measures

calculated in accordance with GAAP:

Non-GAAP financial measures:

Comparable GAAP financial

measures:

(i)

total adjusted revenues;

(i)

total revenues;

(ii)

total adjusted expenses;

(ii)

total expenses;

(iii)

adjusted premiums, fees and other

revenues;

(iii)

premiums, fees and other revenues;

(iv)

adjusted premiums, fees and other

revenues, excluding PRT;

(iv)

premiums, fees and other revenues;

(v)

adjusted net investment income;

(v)

net investment income;

(vi)

adjusted capitalization of deferred policy

acquisition costs (DAC);

(vi)

capitalization of DAC;

(vii)

adjusted earnings available to common

shareholders;

(vii)

net income (loss) available to MetLife,

Inc.’s common shareholders;

(viii)

adjusted earnings available to common

shareholders, excluding total notable items;

(viii)

net income (loss) available to MetLife,

Inc.’s common shareholders;

(ix)

adjusted earnings available to common

shareholders per diluted common share;

(ix)

net income (loss) available to MetLife,

Inc.’s common shareholders per diluted common share;

(x)

adjusted earnings available to common

shareholders, excluding total notable items, per diluted common

share;

(x)

net income (loss) available to MetLife,

Inc.’s common shareholders per diluted common share;

(xi)

adjusted return on equity;

(xi)

return on equity;

(xii)

adjusted return on equity, excluding AOCI

other than FCTA;

(xii)

return on equity;

(xiii)

adjusted return on equity, excluding total

notable items (excludes AOCI other than FCTA);

(xiii)

return on equity;

(xiv)

investment portfolio gains (losses);

(xiv)

net investment gains (losses);

(xv)

derivative gains (losses);

(xv)

net derivative gains (losses);

(xvi)

total MetLife, Inc.’s common stockholders’

equity, excluding AOCI other than FCTA;

(xvi)

total MetLife, Inc.’s stockholders’

equity;

(xvii)

total MetLife, Inc.’s common stockholders’

equity, excluding total notable items (excludes AOCI other than

FCTA);

(xvii)

total MetLife, Inc.’s stockholders’

equity;

(xviii)

book value per common share, excluding

AOCI other than FCTA;

(xviii)

book value per common share;

(xix)

free cash flow of all holding

companies;

(xix)

MetLife, Inc. (parent company only) net

cash provided by (used in) operating activities;

(xx)

adjusted other expenses;

(xx)

other expenses;

(xxi)

adjusted other expenses, net of adjusted

capitalization of DAC;

(xxi)

other expenses, net of capitalization of

DAC;

(xxii)

adjusted other expenses, net of adjusted

capitalization of DAC, excluding total notable items related to

adjusted other expenses;

(xxii)

other expenses, net of capitalization of

DAC;

(xxiii)

adjusted expense ratio;

(xxiii)

expense ratio;

(xxiv)

adjusted expense ratio, excluding total

notable items related to adjusted other expenses and PRT;

(xxiv)

expense ratio;

(xxv)

direct expenses;

(xxv)

other expenses;

(xxvi)

direct expenses, excluding total notable

items related to direct expenses;

(xxvi)

other expenses;

(xxvii)

direct expense ratio; and

(xxvii)

expense ratio; and

(xxviii)

direct expense ratio, excluding total

notable items related to direct expenses and PRT.

(xxviii)

expense ratio.

Any of these financial measures shown on a constant currency

basis reflect the impact of changes in foreign currency exchange

rates and are calculated using the average foreign currency

exchange rates for the current period and applied to the comparable

prior period (“constant currency basis”).

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in this

earnings news release and in this period’s quarterly financial

supplement, which is available at www.metlife.com.

MetLife’s definitions of non-GAAP and other financial measures

discussed in this news release may differ from those used by other

companies:

Adjusted earnings and related measures

- adjusted earnings;

- adjusted earnings available to common shareholders;

- adjusted earnings available to common shareholders on a

constant currency basis;

- adjusted earnings available to common shareholders, excluding

total notable items;

- adjusted earnings available to common shareholders, excluding

total notable items, on a constant currency basis;

- adjusted earnings available to common shareholders per diluted

common share;

- adjusted earnings available to common shareholders on a

constant currency basis per diluted common share;

- adjusted earnings available to common shareholders, excluding

total notable items per diluted common share; and

- adjusted earnings available to common shareholders, excluding

total notable items, on a constant currency basis per diluted

common share.

These measures are used by management to evaluate performance

and allocate resources. Consistent with GAAP guidance for segment

reporting, adjusted earnings and components of, or other financial

measures based on, adjusted earnings are also MetLife’s GAAP

measures of segment performance. Adjusted earnings and other

financial measures based on adjusted earnings are also the measures

by which MetLife senior management’s and many other employees’

performance is evaluated for the purposes of determining their

compensation under applicable compensation plans. Adjusted earnings

and other financial measures based on adjusted earnings allow

analysis of MetLife's performance relative to its business plan and

facilitate comparisons to industry results.

Adjusted earnings is defined as adjusted revenues less adjusted

expenses, net of income tax. Adjusted earnings available to common

shareholders is defined as adjusted earnings less preferred stock

dividends.

Adjusted revenues and adjusted expenses

These financial measures, along with the related adjusted

premiums, fees and other revenues, focus on our primary businesses

principally by excluding the impact of (i) market volatility which

could distort trends, (ii) asymmetrical and non-economic

accounting, and (iii) revenues and costs related to divested

businesses, non-core products and certain entities required to be

consolidated under GAAP. Also, these measures exclude results of

discontinued operations under GAAP.

Market volatility can have a significant impact on MetLife’s

financial results. Adjusted earnings excludes net investment gains

(losses), net derivative gains (losses), market risk benefits

remeasurement gains (losses) and goodwill impairments. Further,

policyholder benefits and claims exclude (i) changes in the

discount rate on certain annuitization guarantees accounted for as

additional liabilities and (ii) market value adjustments.

Asymmetrical and non-economic accounting adjustments are made to

the line items indicated in calculating adjusted earnings:

- Net investment income includes earned income on derivatives and

amortization of premium on derivatives that are hedges of

investments or that are used to replicate certain investments, but

do not qualify for hedge accounting treatment ("Investment hedge

adjustments").

- Other revenues include settlements of foreign currency earnings

hedges and exclude asymmetrical accounting associated with in-force

reinsurance.

- Policyholder benefits and claims excludes (i) amortization of

basis adjustments associated with de-designated fair value hedges

of future policy benefits, (ii) inflation-indexed benefit

adjustments associated with contracts backed by inflation-indexed

investments, (iii) asymmetrical accounting associated with in-force

reinsurance, and (iv) non-economic losses incurred at contract

inception for certain single premium annuity business. These losses

are amortized into adjusted earnings within policyholder benefits

and claims over the estimated lives of the contracts.

- Interest credited to policyholder account balances excludes

amounts associated with periodic crediting rate adjustments based

on the total return of a contractually referenced pool of assets

and other pass-through adjustments and asymmetrical accounting

associated with in-force reinsurance.

Divested businesses are those that have been or will be sold or

exited by MetLife but do not meet the discontinued operations

criteria under GAAP. Divested businesses also include the net

impact of transactions with exited businesses that have been

eliminated in consolidation under GAAP and costs relating to

businesses that have been or will be sold or exited by MetLife that

do not meet the criteria to be included in results of discontinued

operations under GAAP.

Other adjustments are made to the line items indicated in

calculating adjusted earnings:

- Net investment income and interest credited to policyholder

account balances excludes certain amounts related to

contractholder-directed equity securities ("Unit-linked contract

income") and ("Unit-linked contract costs").

- Other revenues include fee revenue on synthetic guaranteed

interest contracts ("GICs") accounted for as freestanding

derivatives.

- Other revenues exclude and other expenses include fees received

in connection with services provided under transition service

agreements.

- Other expenses exclude (i) implementation of new insurance

regulatory requirements and other costs, and (ii) acquisition,

integration and other related costs. Other expenses include (i)

deductions for net income attributable to noncontrolling interests,

and (ii) benefits accrued on synthetic GICs accounted for as

freestanding derivatives.

Adjusted earnings also excludes the recognition of certain

contingent assets and liabilities that could not be recognized at

acquisition or adjusted for during the measurement period under

GAAP business combination accounting guidance.

The tax impact of the adjustments mentioned above are calculated

net of the U.S. or foreign statutory tax rate, which could differ

from MetLife's effective tax rate. Additionally, the provision for

income tax (expense) benefit also includes the impact related to

the timing of certain tax credits, as well as certain tax

reforms.

In addition, adjusted earnings available to common shareholders

excludes the impact of preferred stock redemption premium, which is

reported as a reduction to net income (loss) available to MetLife,

Inc.’s common shareholders.

Investment portfolio gains (losses) and derivative gains

(losses)

These are measures of investment and hedging activity.

Investment portfolio gains (losses) principally excludes amounts

that are reported within net investment gains (losses) but do not

relate to the performance of the investment portfolio, such as

gains (losses) on sales and divestitures of businesses, as well as

investment portfolio gains (losses) of divested businesses.

Derivative gains (losses) principally excludes earned income on

derivatives and amortization of premium on derivatives, where such

derivatives are either hedges of investments or are used to

replicate certain investments, and where such derivatives do not

qualify for hedge accounting. This earned income and amortization

of premium is reported within adjusted earnings and not within

derivative gains (losses).

Return on equity and related measures

- Total MetLife, Inc.’s common stockholders’ equity, excluding

AOCI other than FCTA: total MetLife, Inc.’s common stockholders’

equity, excluding the net unrealized investment gains (losses),

future policy benefits discount rate remeasurement gains (losses),

market risk benefits instrument-specific credit risk remeasurement

gains (losses) and defined benefit plans adjustment components of

AOCI, net of income tax.

- Total MetLife, Inc.’s common stockholders’ equity, excluding

total notable items (excludes AOCI other than FCTA): total MetLife,

Inc.’s common stockholders’ equity, excluding the net unrealized

investment gains (losses), future policy benefits discount rate

remeasurement gains (losses), market risk benefits

instrument-specific credit risk remeasurement gains (losses),

defined benefit plans adjustment components of AOCI, and total

notable items, net of income tax.

- Return on MetLife, Inc.’s common stockholders’ equity: net

income (loss) available to MetLife, Inc.’s common shareholders

divided by MetLife, Inc.’s average common stockholders’

equity.

- Adjusted return on MetLife, Inc.'s common stockholders' equity:

adjusted earnings available to common shareholders divided by

MetLife, Inc.'s average common stockholders' equity.

- Adjusted return on MetLife, Inc.'s common stockholders' equity,

excluding AOCI other than FCTA: adjusted earnings available to

common shareholders divided by MetLife, Inc.'s average common

stockholders' equity, excluding AOCI other than FCTA.

- Adjusted return on MetLife, Inc.'s common stockholders' equity,

excluding total notable items (excludes AOCI other than FCTA):

adjusted earnings available to common shareholders, excluding total

notable items, divided by MetLife, Inc.'s average common

stockholders' equity, excluding total notable items (excludes AOCI

other than FCTA).

The above measures represent a level of equity consistent with

the view that, in the ordinary course of business, MetLife does not

plan to sell most investments for the sole purpose of realizing

gains or losses.

Expense ratio, direct expense ratio, adjusted expense ratio

and related measures

- Expense ratio: other expenses, net of capitalization of DAC,

divided by premiums, fees and other revenues.

- Direct expense ratio: adjusted direct expenses, divided by

adjusted premiums, fees and other revenues. Direct expenses are

comprised of employee-related costs, third-party staffing costs,

and general and administrative expenses.

- Direct expense ratio, excluding total notable items related to

direct expenses and PRT: adjusted direct expenses, excluding total

notable items related to direct expenses, divided by adjusted

premiums, fees and other revenues, excluding PRT.

- Adjusted expense ratio: adjusted other expenses, net of

adjusted capitalization of DAC, divided by adjusted premiums, fees

and other revenues.

- Adjusted expense ratio, excluding total notable items related

to adjusted other expenses and PRT: adjusted other expenses, net of

adjusted capitalization of DAC, excluding total notable items

related to adjusted other expenses, divided by adjusted premiums,

fees and other revenues, excluding PRT.

Asia General account (GA) assets under management (GA AUM)

and related measures

Asia GA AUM is used by MetLife to describe assets in its Asia GA

investment portfolio. Asia GA AUM is stated at estimated fair value

and is comprised of Asia GA total investments, the portion of the

Asia GA investment portfolio classified within assets held-for-sale

and cash and cash equivalents, excluding policy loans,

contractholder-directed equity securities, fair value option

securities, mortgage loans originated for third parties and certain

other invested assets. Mortgage loans, net of mortgage loans

originated for third parties ("net mortgage loans") (including

commercial ("net commercial mortgage loans"), agricultural ("net

agricultural mortgage loans") and residential mortgage loans) and

real estate equity (including real estate and real estate joint

ventures) included in Asia GA AUM (at net asset value, net of

deduction for encumbering debt) have been adjusted from carrying

value to estimated fair value. At the segment level, intersegment

balances (intercompany activity, primarily related to investments

in subsidiaries, that eliminate at the MetLife consolidated level)

are excluded from Asia GA AUM.

Asia GA AUM (at amortized cost) excludes the following

adjustments: (i) unrealized gain (loss) on investments carried at

estimated fair value and (ii) adjustments from carrying value to

estimated fair value on net mortgage loans (including net

commercial mortgage loans, net agricultural mortgage loans and

residential mortgage loans) and real estate and real estate joint

ventures. Asia GA AUM (at amortized cost) is presented net of

related allowance for credit loss.

Statistical sales information:

- Group Benefits: calculated using 10% of single premium deposits

and 100% of annualized full-year premiums and fees from recurring

premium policy sales of all products.

- RIS: calculated using 10% of single premium contracts, on and

off-balance sheet deposits, and the contract value for new UK

longevity reinsurance contracts, and 100% of annualized full-year

premiums and fees only from recurring premium policy sales of

specialized benefit resources and corporate-owned life

insurance.

- Latin America, Asia and EMEA: calculated using 10% of single

premium deposits (mainly from retirement products such as variable

annuity, fixed annuity and pensions), 20% of single premium

deposits from credit insurance and 100% of annualized full-year

premiums and fees from recurring-premium policy sales of all

products (mainly from risk and protection products such as

individual life, accident & health and group).

Sales statistics do not correspond to revenues under GAAP, but

are used as relevant measures of business activity.

The following additional information is relevant to an

understanding of MetLife’s performance results and outlook:

- Volume growth, as discussed in the context of business growth,

is the period over period percentage change in adjusted earnings

available to common shareholders attributable to adjusted premiums,

fees and other revenues and assets under management levels,

applying a model in which certain margins and factors are held

constant. The most significant of such items are underwriting

margins, investment margins, changes in equity market performance,

expense margins and the impact of changes in foreign currency

exchange rates.

- Holding company cash and liquid assets are held by MetLife,

Inc. collectively with other MetLife holding companies and include

cash and cash equivalents, short term investments and publicly

traded securities excluding assets that are pledged or otherwise

committed. Assets pledged or otherwise committed include amounts

received in connection with securities lending, repurchase

agreements, derivatives, regulatory deposits, the collateral

financing arrangement, funding agreements and secured borrowings,

as well as amounts held in the closed block.

- MetLife uses a measure of free cash flow to facilitate an

understanding of its ability to generate cash for reinvestment into

its businesses or use in non-mandatory capital actions. MetLife

defines free cash flow as the sum of cash available at MetLife’s

holding companies from dividends from operating subsidiaries,

expenses and other net flows of the holding companies (including

capital contributions to subsidiaries), and net contributions from

debt to be at or below target leverage ratios. This measure of free

cash flow is prior to capital actions, such as common stock

dividends and repurchases, debt reduction and mergers and

acquisitions. Free cash flow should not be viewed as a substitute

for net cash provided by (used in) operating activities calculated

in accordance with GAAP. The free cash flow ratio is typically

expressed as a percentage of annual adjusted earnings available to

common shareholders.

- Notable items reflect the unexpected impact of events that

affect MetLife’s results, but that were unknown and that MetLife

could not anticipate when it devised its business plan. Notable

items also include certain items regardless of the extent

anticipated in the business plan, to help investors have a better

understanding of MetLife's results and to evaluate and forecast

those results. Notable items represent a positive (negative) impact

to adjusted earnings available to common shareholders.

- We refer to observable forward yield curves as of a particular

date in connection with making our estimates for future results.

The observable forward yield curves at a given time are based on

implied future interest rates along a range of interest rate

durations. This includes the 10-year U.S. Treasury rate which we

use as a benchmark rate to describe longer-term interest rates used

in our estimates for future results.

Forward-Looking Statements

This news release may contain or incorporate by reference

information that includes or is based upon forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements give expectations or

forecasts of future events and do not relate strictly to historical

or current facts. They use words and terms such as “anticipate,”

"are confident," “assume,” “believe,” “continue,” “could,”

“estimate,” “expect,” “if,” “intend,” “likely,” “may,” “plan,”

“potential,” “project,” “should,” “will,” “would,” and other words

and terms of similar meaning or that are otherwise tied to future

periods or future performance, in each case in all derivative

forms. They include statements relating to future actions,

prospective services or products, future performance or results of

current and anticipated services or products, future sales efforts,

future expenses, the outcome of contingencies such as legal

proceedings, and future trends in operations and financial

results.

Many factors determine the results of MetLife, Inc., its

subsidiaries and affiliates, and they involve unpredictable risks

and uncertainties. Our forward-looking statements depend on our

assumptions, our expectations, and our understanding of the

economic environment, but they may be inaccurate and may change.

MetLife, Inc. does not guarantee any future performance. Our

results could differ materially from those MetLife, Inc. expresses

or implies in forward-looking statements. The risks, uncertainties

and other factors identified in MetLife, Inc.’s filings with the

U.S. Securities and Exchange Commission, and others, may cause such

differences. These factors include:

(1)

economic condition difficulties, including

risks relating to interest rates, credit spreads, declining equity

or debt markets, real estate, obligors and counterparties,

government default, currency exchange rates, derivatives, climate

change, public health and terrorism and security;

(2)

global capital and credit market

adversity;

(3)

credit facility inaccessibility;

(4)

financial strength or credit ratings

downgrades;

(5)

unavailability, unaffordability, or

inadequate reinsurance, including reinsurance risks that arise from

reinsurers' credit risk, and the potential shortfall or failure of

risk mitigants to protect against such risks;

(6)

statutory life insurance reserve financing

costs or limited market capacity;

(7)

legal, regulatory, and supervisory and

enforcement policy changes;

(8)

changes in tax rates, tax laws or

interpretations;

(9)

litigation and regulatory

investigations;

(10)

unsuccessful efforts to meet all

environmental, social, and governance standards or to enhance our

sustainability;

(11)

MetLife, Inc.’s inability to pay dividends

and repurchase common stock;

(12)

MetLife, Inc.’s subsidiaries’ inability to

pay dividends to MetLife, Inc.;

(13)

investment defaults, downgrades, or

volatility;

(14)

investment sales or lending

difficulties;

(15)

collateral or derivative-related

payments;

(16)

investment valuations, allowances, or

impairments changes;

(17)

claims or other results that differ from

our estimates, assumptions, or models;

(18)

global political, legal, or operational

risks;

(19)

business competition;

(20)

technological changes;

(21)

catastrophes;

(22)

climate changes or responses to it;

(23)

deficiencies in our closed block;

(24)

goodwill or other asset impairment, or

deferred income tax asset allowance;

(25)

impairment of VOBA, value of distribution

agreements acquired or value of customer relationships

acquired;

(26)

product guarantee volatility, costs, and

counterparty risks;

(27)

risk management failures;

(28)

insufficient protection from operational

risks;

(29)

failure to protect confidentiality and

integrity of data or other cybersecurity or disaster recovery

failures;

(30)

accounting standards changes;

(31)

excessive risk-taking;

(32)

marketing and distribution

difficulties;

(33)

pension and other postretirement benefit

assumption changes;

(34)

inability to protect our intellectual

property or avoid infringement claims;

(35)

acquisition, integration, growth,

disposition, or reorganization difficulties;

(36)

Brighthouse Financial, Inc. separation

risks;

(37)

MetLife, Inc.’s Board of Directors

influence over the outcome of stockholder votes through the voting

provisions of the MetLife Policyholder Trust; and

(38)

legal- and corporate governance-related

effects on business combinations.

MetLife, Inc. does not undertake any obligation to publicly

correct or update any forward-looking statement if MetLife, Inc.

later becomes aware that such statement is not likely to be

achieved. Please consult any further disclosures MetLife, Inc.

makes on related subjects in subsequent reports to the U.S.

Securities and Exchange Commission.

MetLife, Inc.

GAAP Interim Condensed

Consolidated Statements of Operations

(In millions)

For the Three Months

Ended

June 30,

2024

2023

Revenues

Premiums

$

11,628

$

11,678

Universal life and investment-type product

policy fees

1,281

1,288

Net investment income

5,205

5,072

Other revenues

638

621

Net investment gains (losses)

(421

)

(1,039

)

Net derivative gains (losses)

(508

)

(997

)

Total revenues

17,823

16,623

Expenses

Policyholder benefits and claims

11,485

11,809

Policyholder liability remeasurement

(gains) losses

(10

)

(16

)

Market risk benefit remeasurement (gains)

losses

(182

)

(817

)

Interest credited to policyholder account

balances

2,000

1,933

Policyholder dividends

148

151

Amortization of DAC and VOBA

499

479

Amortization of negative VOBA

(6

)

(6

)

Interest expense on debt

257

256

Other expenses, net of capitalization of

DAC

2,430

2,404

Total expenses

16,621

16,193

Income (loss) before provision for income

tax

1,202

430

Provision for income tax expense

(benefit)

249

22

Net income (loss)

953

408

Less: Net income (loss) attributable to

noncontrolling interests

7

6

Net income (loss) attributable to MetLife,

Inc.

946

402

Less: Preferred stock dividends

34

32

Net income (loss) available to MetLife,

Inc.'s common shareholders

$

912

$

370

See footnotes on last page.

MetLife, Inc.

(In millions, except per share

data)

For the Three Months

Ended

June 30,

2024

2023

Reconciliation to Adjusted Earnings

Available to Common Shareholders

Earnings Per Weighted

Average

Common Share Diluted

(1)

Earnings Per Weighted

Average Common Share Diluted (1)

Net income (loss) available to MetLife,

Inc.'s common shareholders

$

912

$

1.28

$

370

$

0.48

Adjustments from net income (loss)

available to common shareholders to adjusted earnings available to

common shareholders:

Less: Net investment gains (losses)

(421

)

(0.59

)

(1,039

)

(1.35

)

Net derivative gains (losses)

(508

)

(0.71

)

(997

)

(1.30

)

Market risk benefit remeasurement gains

(losses)

182

0.25

817

1.06

Premiums

—

—

—

—

Universal life and investment-type product

policy fees

—

—

—

—

Net investment income

45

0.06

32

0.04

Other revenues

24

0.03

(7

)

(0.01

)

Policyholder benefits and claims and

policyholder dividends

(73

)

(0.10

)

(30

)

(0.03

)

Policyholder liability remeasurement

(gains) losses

—

—

—

—

Interest credited to policyholder account

balances

(219

)

(0.30

)

(291

)

(0.37

)

Capitalization of DAC

—

—

—

—

Amortization of DAC and VOBA

—

—

—

—

Amortization of negative VOBA

—

—

—

—

Interest expense on debt

—

—

—

—

Other expenses

(9

)

(0.01

)

(20

)

(0.03

)

Goodwill impairment

—

—

—

—

Provision for income tax (expense)

benefit

270

0.38

419

0.54

Add: Net income (loss) attributable to

noncontrolling interests

7

0.01

6

0.01

Preferred stock redemption premium

—

—

—

—

Adjusted earnings available to common

shareholders

1,628

2.28

1,492

1.94

Less: Total notable items (2)

—

—

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

1,628

$

2.28

$

1,492

$

1.94

Adjusted earnings available to common

shareholders on a constant currency basis

$

1,628

$

2.28

$

1,462

$

1.90

Adjusted earnings available to common

shareholders, excluding total notable items, on a constant currency

basis (2)

$

1,628

$

2.28

$

1,462

$

1.90

Weighted average common shares outstanding

- diluted

714.7

769.6

See footnotes on last page.

MetLife, Inc.

(In millions)

For the Three Months

Ended

June 30,

2024

2023

Premiums, Fees and Other

Revenues

Premiums, fees and other revenues

$

13,547

$

13,587

Less: Adjustments to premiums, fees and

other revenues:

Asymmetrical and non-economic

accounting

35

—

Other adjustments

(11

)

(7

)

Divested businesses

—

—

Adjusted premiums, fees and other

revenues

$

13,523

$

13,594

Adjusted premiums, fees and other

revenues, on a constant currency basis

$

13,523

$

13,384

Less: PRT

1,752

2,024

Adjusted premiums, fees and other

revenues, excluding PRT, on a constant currency basis

$

11,771

$

11,360

Net Investment Income

Net investment income

$

5,205

$

5,072

Less: Adjustments to net investment

income

Investment hedge adjustments

(172

)

(263

)

Unit-linked contract income

219

296

Other adjustments

(2

)

(1

)

Divested businesses

—

—

Adjusted net investment income

$

5,160

$

5,040

Revenues and Expenses

Total revenues

$

17,823

$

16,623

Less: Adjustments to total revenues:

Net investment gains (losses)

(421

)

(1,039

)

Net derivative gains (losses)

(508

)

(997

)

Investment hedge adjustments

(172

)

(263

)

Asymmetrical and non-economic

accounting

35

—

Unit-linked contract income

219

296

Other adjustments

(13

)

(8

)

Divested businesses

—

—

Total adjusted revenues

$

18,683

$

18,634

Total expenses

$

16,621

$

16,193

Less: Adjustments to total expenses:

Market risk benefit remeasurement (gains)

losses

(182

)

(817

)

Goodwill impairment

—

—

Asymmetrical and non-economic

accounting

166

64

Market volatility

(88

)

(44

)

Unit-linked contract costs

214

301

Other adjustments

5

11

Divested businesses

4

9

Total adjusted expenses

$

16,502

$

16,669

See footnotes on last page.

MetLife, Inc.

(In millions, except per share

and ratio data)

For the Three Months

Ended

June 30,

2024

2023

Expense Detail and Ratios

Reconciliation of Capitalization of DAC

to Adjusted Capitalization of DAC

Capitalization of DAC

$

(683

)

$

(729

)

Less: Divested businesses

—

—

Adjusted capitalization of DAC

$

(683

)

$

(729

)

Reconciliation of Other Expenses to

Adjusted Other Expenses

Other expenses

$

3,113

$

3,133

Less: Other adjustments

5

11

Less: Divested businesses

4

9

Adjusted other expenses

$

3,104

$

3,113

Other Detail and Ratios

Other expenses, net of capitalization of

DAC

$

2,430

$

2,404

Premiums, fees and other revenues

$

13,547

$

13,587

Expense ratio

17.9

%

17.7

%

Direct expenses

$

1,397

$

1,415

Less: Total notable items related to

direct expenses (2)

—

—

Direct expenses, excluding total notable

items related to direct expenses (2)

$

1,397

$

1,415

Adjusted other expenses

$

3,104

$

3,113

Adjusted capitalization of DAC

(683

)

(729

)

Adjusted other expenses, net of adjusted

capitalization of DAC

2,421

2,384

Less: Total notable items related to

adjusted other expenses (2)

—

—

Adjusted other expenses, net of adjusted

capitalization of DAC, excluding total notable items related to

adjusted other expenses (2)

$

2,421

$

2,384

Adjusted premiums, fees and other

revenues

$

13,523

$

13,594

Less: PRT

1,752

2,024

Adjusted premiums, fees and other

revenues, excluding PRT

$

11,771

$

11,570

Direct expense ratio

10.3

%

10.4

%

Direct expense ratio, excluding total

notable items related to direct expenses and PRT (2)

11.9

%

12.2

%

Adjusted expense ratio

17.9

%

17.5

%

Adjusted expense ratio, excluding total

notable items related to adjusted other expenses and PRT (2)

20.6

%

20.6

%

See footnotes on last page.

MetLife, Inc.

(In millions, except per share

data)

June 30,

Equity Details

2024

2023

Total MetLife, Inc.'s stockholders'

equity

$

27,252

$

30,261

Less: Preferred stock

3,818

3,818

MetLife, Inc.'s common stockholders'

equity

23,434

26,443

Less: Net unrealized investment gains

(losses), net of income tax

(19,088

)

(16,800

)

Future policy benefits discount rate

remeasurement gain (losses), net of income tax

6,606

3,919

Market risk benefits instrument-specific

credit risk remeasurement gains (losses), net of income tax

(73

)

108

Defined benefit plans adjustment, net of

income tax

(1,396

)

(1,331

)

Total MetLife, Inc.'s common stockholders'

equity, excluding AOCI other than FCTA

37,385

40,547

Less: Accumulated year-to-date total

notable items (2)

—

—

Total MetLife, Inc.'s common stockholders'

equity, excluding total notable items (excludes AOCI other than

FCTA) (2)

$

37,385

$

40,547

June 30,

Book Value (3)

2024

2023

Book value per common share

$

33.30

$

34.92

Less: Net unrealized investment gains

(losses), net of income tax

(27.12

)

(22.19

)

Future policy benefits discount rate

remeasurement gain (losses), net of income tax

9.38

5.18

Market risk benefits instrument-specific

credit risk remeasurement gains (losses), net of income tax

(0.10

)

0.14

Defined benefit plans adjustment, net of

income tax

(1.98

)

(1.76

)

Book value per common share, excluding

AOCI other than FCTA

$

53.12

$

53.55

Common shares outstanding, end of period

(4)

703.8

757.2

For the Three Months

Ended

June 30, (5)

Return on Equity

2024

2023

Return on MetLife, Inc.'s:

Common stockholders' equity

15.2

%

5.4

%

Adjusted return on MetLife, Inc.'s:

Common stockholders' equity

27.0

%

21.8

%

Common stockholders' equity, excluding

AOCI other than FCTA

17.3

%

14.6

%

Common stockholders' equity, excluding

total notable items (excludes AOCI other than FCTA) (2)

17.3

%

14.6

%

For the Three Months

Ended

June 30,

Average Common Stockholders'

Equity

2024

2023

Average common stockholders' equity

$

24,076

$

27,410

Average common stockholders' equity,

excluding AOCI other than FCTA

$

37,704

$

40,976

Average common stockholders' equity,

excluding total notable items (excludes AOCI other than FCTA)

(2)

$

37,704

$

40,976

See footnotes on last page.

MetLife, Inc.

Adjusted Earnings Available to

Common Shareholders

(In millions)

For the Three Months

Ended

June 30,

2024

2023

Group Benefits (6):

Adjusted earnings available to common

shareholders

$

533

$

372

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

533

$

372

Adjusted premiums, fees and other

revenues

$

6,210

$

6,013

Retirement & Income Solutions (6):

Adjusted earnings available to common

shareholders

$

410

$

417

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

410

$

417

Adjusted premiums, fees and other

revenues

$

2,582

$

2,823

Less: PRT

1,752

2,024

Adjusted premiums, fees and other

revenues, excluding PRT

$

830

$

799

Asia:

Adjusted earnings available to common

shareholders

$

449

$

431

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

449

$

431

Adjusted earnings available to common

shareholders on a constant currency basis

$

449

$

417

Adjusted earnings available to common

shareholders, excluding total notable items, on a constant currency

basis (2)

$

449

$

417

Adjusted premiums, fees and other

revenues

$

1,668

$

1,727

Adjusted premiums, fees and other

revenues, on a constant currency basis

$

1,668

$

1,591

Latin America:

Adjusted earnings available to common

shareholders

$

226

$

219

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

226

$

219

Adjusted earnings available to common

shareholders on a constant currency basis

$

226

$

209

Adjusted earnings available to common

shareholders, excluding total notable items, on a constant currency

basis (2)

$

226

$

209

Adjusted premiums, fees and other

revenues

$

1,506

$

1,385

Adjusted premiums, fees and other

revenues, on a constant currency basis

$

1,506

$

1,339

See footnotes on last page.

MetLife, Inc.

Adjusted Earnings Available to

Common Shareholders (Continued)

(In millions)

For the Three Months

Ended

June 30,

2024

2023

EMEA:

Adjusted earnings available to common

shareholders

$

77

$

70

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

77

$

70

Adjusted earnings available to common

shareholders on a constant currency basis

$

77

$

64

Adjusted earnings available to common

shareholders, excluding total notable items, on a constant currency

basis (2)

$

77

$

64

Adjusted premiums, fees and other

revenues

$

621

$

582

Adjusted premiums, fees and other

revenues, on a constant currency basis

$

621

$

554

MetLife Holdings (6):

Adjusted earnings available to common

shareholders

$

153

$

211

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

153

$

211

Adjusted premiums, fees and other

revenues

$

823

$

938

Corporate & Other (6):

Adjusted earnings available to common

shareholders

$

(220

)

$

(228

)

Less: Total notable items (2)

—

—

Adjusted earnings available to common

shareholders, excluding total notable items (2)

$

(220

)

$

(228

)

Adjusted premiums, fees and other

revenues

$

113

$

126

See footnotes on last page.

MetLife, Inc.

For the Three Months

Ended

June 30,

2024

2023

Variable investment income (post-tax,

in millions) (7)

Group Benefits

$

3

$

4

RIS

64

29

Asia

99

84

Latin America

2

4

EMEA

—

—

MetLife Holdings

46

41

Corporate & Other

21

13

Total variable investment income

$

235

$

175

See footnotes on last page.

MetLife, Inc.

June 30, 2024

Cash & Capital (8), (9) (in

billions)

Holding Companies Cash & Liquid

Assets

$

4.4

Footnotes

(1)

Adjusted earnings available to common

shareholders, excluding total notable items, per diluted common

share is calculated on a standalone basis and may not equal (i)

adjusted earnings available to common shareholders per diluted

common share, less (ii) total notable items per diluted common

share.

(2)

Notable items reflect the unexpected

impact of events that affect MetLife’s results, but that were

unknown and that MetLife could not anticipate when it devised its

business plan. Notable items also include certain items regardless

of the extent anticipated in the business plan, to help investors

have a better understanding of MetLife's results and to evaluate

and forecast those results. Notable items can affect MetLife’s

results either positively or negatively.

(3)

Book values exclude $3,818 million of

equity related to preferred stock at both June 30, 2024 and

2023.

(4)

There were share repurchases of

approximately $0.9 billion for the three months June 30, 2024.

There were share repurchases of approximately $270 million in July

2024.

(5)

Annualized using quarter-to-date

results.

(6)

Results on a constant currency basis are

not included as constant currency impact is not significant.

(7)

Assumes a 21% tax rate.

(8)

The total U.S. statutory adjusted capital

is expected to be approximately $18.0 billion at June 30, 2024,

down 2% from March 31, 2024. This balance includes MetLife, Inc.'s

principal U.S. insurance subsidiaries, excluding American Life

Insurance Company.

(9)

The expected Japan solvency margin ratio

as of June 30, 2024 is approximately 670%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731511071/en/

For Media: Dave Franecki (973) 264-7465,

Dave.Franecki@metlife.com For Investors: John Hall (212) 578-7888,

John.A.Hall@metlife.com

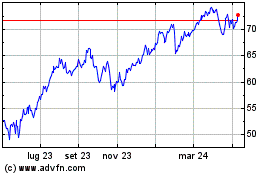

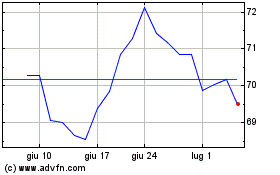

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Dic 2023 a Dic 2024