UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to

Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of February 2025

Commission

File Number 001-11444

| MAGNA INTERNATIONAL INC. |

| (Exact Name of Registrant as specified in its Charter) |

| |

| 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1 |

| (Address of principal executive office) |

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F o Form 40-F

x

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

MAGNA INTERNATIONAL INC. |

| |

|

|

|

| |

|

|

(Registrant) |

| |

|

|

|

| Date: |

February 27, 2025 |

|

|

| |

|

|

|

| |

|

|

By: |

/s/ “Bassem Shakeel” |

| |

|

|

|

Bassem A. Shakeel, |

| |

|

|

|

Vice-President, Associate General Counsel and Corporate Secretary |

EXHIBITS

Exhibit 99.1

MAGNA INTERNATIONAL INC.

Management's Discussion and Analysis

of Results of Operations and Financial Position

Unless otherwise noted, all amounts in this Management's

Discussion and Analysis of Results of Operations and Financial Position ["MD&A"] are in U.S. dollars and all tabular amounts

are in millions of U.S. dollars, except per share figures, which are in U.S. dollars. When we use the terms "we", "us",

"our" or "Magna", we are referring to Magna International Inc. and its subsidiaries and jointly controlled entities,

unless the context otherwise requires.

This MD&A should be read in conjunction with

the audited consolidated financial statements for the year ended December 31, 2024 included in our 2024 Annual Report to Shareholders.

This MD&A may contain statements that are

forward looking. Refer to the "Forward-Looking Statements" section in this MD&A for a more detailed discussion of our use

of forward-looking statements.

This MD&A has been prepared as at February 26,

2025.

HIGHLIGHTS

INDUSTRY PRODUCTION ENVIRONMENT

| · | Global

light vehicle production in 2024 was largely unchanged from 2023, with North America and

Europe declining 1% and 4%, respectively, while China increased 5%. |

SALES & EARNINGS

| · | Total

sales were essentially unchanged at $42.8 billion in 2024 compared to 2023. Factors positively impacting sales included

the launch of new programs, the acquisition of Veoneer Active Safety ["Veoneer AS"],

the negative impact of the UAW labour strikes during 2023, higher engineering revenue, and

the net favourable impact of commercial items. These were largely offset by lower production

on certain programs, the end of production on certain programs, lower complete vehicle assembly

volumes and the net weakening of foreign currencies against the U.S. dollar. |

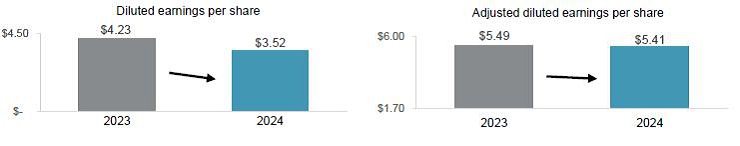

| · | Diluted

earnings per share were $3.52 and Adjusted diluted earnings per share(1) were

$5.41 in 2024. |

| · | Adjusted

diluted earnings per share declined modestly compared to 2023, primarily reflecting higher

interest costs and a higher income tax rate, partially offset by higher Adjusted EBIT. |

| · | Adjusted

EBIT was higher, reflecting net favourable commercial items negotiated largely as a result

of lower than anticipated volumes on certain new electric vehicle programs, the impact of

operational excellence activities and productivity and efficiency improvements, and lower

net engineering costs. These factors were partially offset by reduced earnings on lower assembly

volumes, and higher production input costs net of customer recoveries. |

CASH & INVESTMENTS

| · | Cash

generated from operating activities was $3.6 billion, compared to $3.1 billion in 2023, largely

reflecting an increase in cash generated from operating assets and liabilities. |

| · | We continued

to invest in our business, including $2.2 billion for fixed assets and $617 million in investment

and other asset spending. |

| · | We returned

$746 million to shareholders in 2024 through $539 million in dividends and $207 million in

share repurchases. |

| · | During

the fourth quarter, our Board of Directors increased our quarterly dividend to $0.485 per

share, our 15th consecutive year of dividend increases. |

| · | We raised

$725 million in the form of Senior Notes to refinance $750 million in Senior Notes that came due

in 2024. |

STRATEGIC UPDATES

| · | Utilizing

our strong innovation pipeline, we won substantial additional business across our portfolio,

including: |

| · | an

800-volt dedicated hybrid drive system for a China-based OEM; |

| · | reconfigurable

seating business for a China-based OEM; |

| · | hot-stamping

business using advanced materials for a Japan-based OEM; |

| · | advanced

interior cabin sensing systems for three OEMs; and |

| · | high-performance

eDrive system business for a North America-based OEM. |

| · | a

2024 Automotive News PACE award for our integrated driver and occupant monitoring system;

and |

| · | two

2024 Automotive New PACEpilot Innovations to Watch, an award which acknowledges post-pilot,

pre-commercial innovations in the automotive and future mobility space, for our EcoSphere™

100% Melt-Recyclable Foam and Trim and Modular & Scalable Active Grille Shutter Assembly. |

1 Adjusted diluted earnings per share

is a Non-GAAP financial measure. Refer to the section "Use of Non-GAAP Measures".

Magna International Inc. Annual Report 2024 1

OVERVIEW

OUR BUSINESS(2)

Magna is more than one of the world’s largest

suppliers in the automotive space. We are a mobility technology company built to innovate, with a global, entrepreneurial-minded team

of over 170,000(3) employees across 341 manufacturing operations and 106 product development, engineering and sales centres

spanning 28 countries. With 65+ years of expertise, our ecosystem of interconnected products combined with our complete vehicle expertise

uniquely positions us to advance mobility in an expanded transportation landscape. For further information about Magna (NYSE:MGA; TSX:MG),

please visit www.magna.com or follow us on social.

FORWARD-LOOKING STATEMENTS

Certain statements in this MD&A may constitute

"forward-looking information" or "forward-looking statements" (collectively, "forward-looking statements").

Any such forward-looking statements are intended to provide information about management's current expectations and plans and may not

be appropriate for other purposes. Forward-looking statements may include financial and other projections, as well as statements regarding

our future plans, strategic objectives or economic performance, or the assumptions underlying any of the foregoing, and other statements

that are not recitations of historical fact. We use words such as "may", "would", "could", "should",

"will", "likely", "expect", "anticipate", "assume", "believe", "intend",

"plan", "aim", "forecast", "outlook", "project", "potential", "estimate",

"target" and similar expressions suggesting future outcomes or events to identify forward-looking statements.

Forward-looking statements are based on information

currently available to us and are based on assumptions and analyses made by us in light of our experience and our perception of historical

trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

While we believe we have a reasonable basis for making any such forward-looking statements, they are not a guarantee of future performance

or outcomes. Whether actual results and developments conform to our expectations and predictions is subject to a number of risks, assumptions,

and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict, including the risk factors

which are described later in this MD&A.

INDUSTRY TRENDS

Our operating results are primarily dependent

on the levels of North American, European, and Chinese car and light truck production by our customers. While we supply systems and components

to every major original equipment manufacturer ["OEM"], we do not supply systems and components for every vehicle, nor is the

value of our content consistent from one vehicle to the next. As a result, customer and program mix relative to market trends, as well

as the value of our content on specific vehicle production programs, are also important drivers of our results.

Ordinarily, OEM production volumes are aligned

with vehicle sales levels and are affected by changes in such levels. Aside from vehicle sales levels, production volumes are typically

impacted by a range of factors, including: general economic and political conditions; labour disruptions; free trade arrangements; tariffs;

relative currency values; commodities prices; supply chains and infrastructure; availability and relative cost of skilled labour; regulatory

considerations, including those related to environmental emissions and safety standards; and other factors.

Overall vehicle sales levels are significantly

affected by changes in consumer confidence levels, which may in turn be impacted by consumer perceptions and general trends related to

the job, housing, and stock markets, as well as other macroeconomic and political factors. Other factors which typically impact vehicle

sales levels and thus production volumes include: vehicle affordability; interest rates and/or availability of credit; fuel and energy

prices; relative currency values; considerations related to vehicle propulsion, safety, and other technologies or features; government

subsidies to consumers for the purchase of low- and zero-emission vehicles; and other factors.

During 2024, the primary industry trends impacting

us were program cancellations, deferrals and reductions in production volumes, related mainly to North American EV programs in 2024.

We continue to implement a business strategy which is rooted in our best assessment as to the rate and direction of change in the automotive

industry. Our short and medium-term operational success, as well as our ability to create long-term value through our business strategy,

are subject to a number of risks and uncertainties which are discussed later in this MD&A.

2 Manufacturing operations, product

development, engineering and sales centres include certain operations accounted for under the equity method.

3 Number of employees includes over

158,000 employees at our wholly owned or controlled entities and over 12,000 employees at operations accounted for under the equity method.

2 Magna International Inc. Annual Report 2024

USE OF NON-GAAP FINANCIAL MEASURES

In addition to results presented in accordance

with accounting principles generally accepted in the United States of America ["U.S. GAAP"], this report includes the use of

Adjusted earnings before interest and taxes ["Adjusted EBIT"], Adjusted EBIT as a percentage of sales, Adjusted diluted earnings

per share, and Adjusted Return on Invested Capital [collectively, the "Non-GAAP Measures"]. We believe these Non-GAAP financial

measures provide additional information that is useful to investors in understanding our underlying performance and trends through the

same financial measures employed by our management. Readers should be aware that Non-GAAP Measures have no standardized meaning under

U.S. GAAP and accordingly may not be comparable to the calculation of similar measures by other companies. We believe that Adjusted EBIT,

Adjusted EBIT as a percentage of sales, Adjusted diluted earnings per share and Adjusted Return on Invested Capital provide useful information

to our investors for measuring our operational performance as they exclude certain items that are not reflective of ongoing operating

profit and facilitate a comparison with prior periods. The presentation of any Non-GAAP Measures should not be considered in isolation

or as a substitute for our related financial results prepared in accordance with U.S. GAAP. Non-GAAP financial measures are presented

together with the most directly comparable U.S. GAAP financial measure, and a reconciliation to the most directly comparable U.S. GAAP

financial measure, can be found in the "Non-GAAP Financial Measures Reconciliation" section of this MD&A.

RESULTS OF OPERATIONS

AVERAGE FOREIGN EXCHANGE

| | |

2024 | | |

2023 | |

Change | |

| 1 Canadian dollar

equals U.S. dollars | |

| 0.730 | | |

| 0.742 | |

| - |

2 | % |

| 1 euro equals U.S. dollars | |

| 1.082 | | |

| 1.082 | |

| |

— | |

| 1 Chinese renminbi equals U.S.

dollars | |

| 0.139 | | |

| 0.141 | |

| - |

2 | % |

The preceding table reflects the average foreign

exchange rates between the most common currencies in which we conduct business and our U.S. dollar reporting currency.

The results of operations for which the functional

currency is not the U.S. dollar are translated into U.S. dollars using the average exchange rates for the relevant period. Throughout

this MD&A, reference is made to the impact of translation of foreign operations on reported U.S. dollar amounts where relevant.

Our results can also be affected by the impact

of movements in exchange rates on foreign currency transactions (such as raw material purchases or sales denominated in foreign currencies).

However, as a result of hedging programs employed by us, foreign currency transactions in the current period have not been fully impacted

by movements in exchange rates. We record foreign currency transactions at the hedged rate where applicable.

Finally, foreign exchange gains and losses on

revaluation and/or settlement of monetary items denominated in a currency other than an operation's functional currency impact reported

results. These gains and losses are recorded in selling, general and administrative expense.

LIGHT VEHICLE PRODUCTION

VOLUMES

Our operating results are mostly dependent on

light vehicle production in the regions reflected in the table below:

Light Vehicle Production Volumes (thousands

of units)

| | |

2024 | | |

2023 | |

Change | |

| North America | |

| 15,518 | | |

|

15,614 | |

|

- |

1 | % |

| Europe | |

| 16,878 | | |

|

17,637 | |

|

- |

4 | % |

| China | |

| 30,702 | | |

|

29,227 | |

|

+ |

5 | % |

| Other | |

| 26,885 | | |

|

27,715 | |

|

- |

3 | % |

| Global | |

| 89,983 | | |

|

90,193 | |

|

|

— | |

Magna International Inc. Annual Report 2024 3

RESULTS OF OPERATIONS –

FOR THE YEAR ENDED DECEMBER 31, 2024

SALES

Sales were substantially unchanged at $42.84

billion for 2024 compared to $42.80 billion for 2023. Factors positively impacting sales include:

| · | the

launch of new programs during or subsequent to 2023; |

| · | the net impact of acquisitions

and divestitures, during 2023 and 2024, which increased sales by $468 million; |

| · | the negative impact of the

UAW labour strikes, which negatively impacted 2023 sales by approximately $325 million; |

| · | higher engineering revenue; |

| · | commercial items in 2024 and

2023, which had a net favourable impact on a year-over-year basis; and |

| · | customer price increases to

partially recover certain higher production input costs. |

These factors were partially offset by:

| · | lower

production on certain programs; |

| · | the end of production of certain

programs; |

| · | lower complete vehicle assembly

volumes, including the end of production of the BMW 5-Series and Jaguar E-Pace; |

| · | the net weakening of foreign

currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $151 million;

and |

| · | customer price concessions. |

COST OF GOODS SOLD

| | |

| 2024 | | |

| 2023 | | |

| Change | |

| Material | |

$ | 25,991 | | |

$ | 26,309 | | |

$ | (318 | ) |

| Direct labour | |

| 3,127 | | |

| 3,164 | | |

| (37 | ) |

| Overhead | |

| 7,919 | | |

| 7,712 | | |

| 207 | |

| Cost of goods sold | |

$ | 37,037 | | |

$ | 37,185 | | |

$ | (148 | ) |

Cost of goods sold decreased $148 million to $37.04 billion for 2024

compared to $37.19 billion for 2023, primarily due to:

| · | a decrease

in material, direct labour and overhead costs associated with lower sales in our Complete

Vehicles segment, which has a higher material content compared to our consolidated average; |

| · | lower material, direct labour

and overhead associated with lower production sales on certain programs; |

| · | productivity and efficiency

improvements, including lower costs at certain underperforming facilities; |

| · | the net weakening of foreign

currencies against the U.S. dollar, which decreased reported U.S. dollar costs of goods sold

by $123 million; |

| · | lower net engineering costs,

including spending related to our electrification and active safety business; and |

| · | commercial items in 2024 and

2023, which had a net favourable impact on a year-over-year basis, including the negative

impact of a settlement with a supplier during the fourth quarter of 2024. |

These factors were partially offset by:

| · | acquisitions,

net of divestitures, during or subsequent to 2023; |

| · | higher production input costs

net of customer recoveries, including labour, partially offset by lower prices for certain

commodities; |

| · | an increase in material, direct

labour and overhead costs associated with higher engineering sales; |

| · | the negative impact of the

UAW labour strikes during 2023; |

| · | an increase in net warranty

costs of $61 million; and |

| · | higher restructuring costs. |

4 Magna International Inc. Annual Report 2024

SELLING, GENERAL AND

ADMINISTRATIVE ["SG&A"]

SG&A expense increased $11 million to $2.06

billion for 2024 compared to $2.05 billion for 2023, primarily as a result of:

| · | higher

labour and benefit costs; |

| · | higher

pre-operating costs incurred at new facilities; |

| · | higher

restructuring costs; and |

| · | acquisitions,

net of divestitures, during or subsequent to 2023. |

These factors were partially offset by:

| · | lower

provisions against certain accounts receivable and other balances; |

| · | lower legal fees, including

costs incurred during 2023 due to the acquisition of Veoneer AS and financing activities; |

| · | the net weakening of foreign

currencies against the U.S. dollar, which decreased SG&A by $12 million; |

| · | a gain on the sale of an equity

method investment during the first quarter of 2024; |

| · | higher net transactional foreign

exchange gains in 2024 compared to 2023; and |

| · | lower incentive compensation. |

DEPRECIATION

Depreciation increased $74 million to $1.51 billion

for 2024 compared to $1.44 billion for 2023, primarily due to increased capital deployed at new and existing facilities including to

support the launch of programs, and acquisitions, net of divestitures, during or subsequent to 2023, partially offset by the end of production

of certain programs and the net weakening of foreign currencies against the U.S. dollar, which decreased depreciation by $5 million.

AMORTIZATION OF ACQUIRED

INTANGIBLE ASSETS

Amortization of acquired intangible assets increased

$24 million to $112 million for 2024 compared to $88 million for 2023 primarily due to the acquisition of Veoneer AS during the second

quarter of 2023.

INTEREST EXPENSE, NET

During 2024, we recorded net interest expense

of $211 million compared to $156 million for 2023. The $55 million increase was primarily a result of interest expense on higher short-term

borrowings, Senior Notes issued during 2023 and 2024 at higher interest rates than the Senior Notes repaid during 2023 and 2024, and

the Term Loan entered into during 2023. These factors were partially offset by higher interest income earned on cash and investments

due to higher interest rates.

EQUITY INCOME

Equity income decreased $11 million to $101 million

for 2024 compared to $112 million for 2023, primarily as a result of reduced earnings due to unfavourable product mix and lower sales

at certain equity-accounted entities. These factors were partially offset by commercial items in 2024 and 2023, which had a favourable

impact on a year-over-year basis.

OTHER EXPENSE, NET

| | |

| 2024 | | |

| 2023 | |

| Impacts

related to Fisker (1) | |

$ | 198 | | |

$ | 110 | |

| Restructuring

activities (2) | |

| 187 | | |

| 148 | |

| Long-lived

asset impairments (3) | |

| 79 | | |

| — | |

| Investments

(4) | |

| 9 | | |

| 91 | |

| Gain

on business combination (5) | |

| (9 | ) | |

| — | |

| Veoneer

Active Safety Business transaction costs (6) | |

| — | | |

| 23 | |

| Operations

in Russia (7) | |

| — | | |

| 16 | |

| Other

expense, net | |

$ | 464 | | |

$ | 388 | |

| (1) | Impacts related to Fisker |

| | |

| 2024 | | |

| 2023 | |

| Impairment

and supplier related settlements | |

$ | 330 | | |

$ | — | |

| Fisker warrants | |

| 33 | | |

| 110 | |

| Recognition

of deferred revenue | |

| (196 | ) | |

| — | |

| Restructuring | |

| 31 | | |

| — | |

| | |

$ | 198 | | |

$ | 110 | |

Magna International Inc. Annual Report 2024 5

During 2024, Fisker filed for Chapter

11 bankruptcy protection in the United States and for similar protection in Austria. As a result during 2024, we recorded impairment

charges on our Fisker related assets, as well as charges for supplier settlements and restructurings. In the course of such bankruptcy

proceedings, during the third quarter of 2024 our manufacturing agreement for the Fisker Ocean SUV was terminated and as a result, we

recognized $196 million of previously deferred revenue related to our Fisker warrants.

Impairment and supplier related

settlements

During 2024, we recorded a $279 million

[$219 million after tax] impairment charge on our Fisker related assets including production receivables, inventory, fixed assets and

other capitalized expenditures. We recorded an additional $51 million [$38 million after tax] of charges in connection with impairments

and supplier settlements. For 2024, charges related to impairments, purchase obligations and supplier settlements totaled $330 million

[$257 million after tax]. The following table summarizes the net asset impairments and supplier settlements for the year ended December 31,

2024 by segment:

| |

|

|

Body

Exteriors &

Structures |

|

|

Power

&

Vision |

|

|

Seating

Systems |

|

|

Complete

Vehicles |

|

|

Total |

|

| Accounts receivable |

|

$ |

3 |

|

$ |

4 |

|

$ |

2 |

|

$ |

14 |

|

$ |

23 |

|

| Inventories |

|

|

5 |

|

|

52 |

|

|

8 |

|

|

2 |

|

|

67 |

|

| Other assets, net |

|

|

— |

|

|

54 |

|

|

— |

|

|

90 |

|

|

144 |

|

| Fixed assets, net |

|

|

1 |

|

|

49 |

|

|

5 |

|

|

3 |

|

|

58 |

|

| Other accrued liabilities |

|

|

(5 |

) |

|

— |

|

|

— |

|

|

(10 |

) |

|

(15 |

) |

| Operating lease right-of-use assets |

|

|

1 |

|

|

— |

|

|

1 |

|

|

— |

|

|

2 |

|

| |

|

|

5 |

|

|

159 |

|

|

16 |

|

|

99 |

|

|

279 |

|

| Supplier settlements |

|

|

4 |

|

|

41 |

|

|

6 |

|

|

— |

|

|

51 |

|

| |

|

$ |

9 |

|

$ |

200 |

|

$ |

22 |

|

$ |

99 |

|

$ |

330 |

|

Fisker warrants

In 2020, Fisker issued 19.5 million

penny warrants to us to purchase common stock in connection with our agreements with Fisker for platform sharing, engineering and manufacturing

of the Fisker Ocean SUV. These warrants vested during 2021 and 2022 based on specified milestones and were marked to market each quarter.

During 2024, we recorded a $33 million

[$25 million after tax] impairment charge on these warrants reducing the value of the warrants to nil. During 2023, we had revaluation

losses of $110 million [$83 million after tax] on these warrants.

Recognition of deferred revenue

When the warrants were issued and

the vesting provisions realized, we recorded offsetting amounts to deferred revenue within other accrued liabilities and other long-term

liabilities and a portion of this deferred revenue was previously recognized in income in prior years as performance obligations were

satisfied. During the third quarter of 2024, the agreement for manufacturing of the Fisker Ocean SUV was terminated, and we recognized

the remaining $196 million of deferred revenue in income.

Restructuring

During 2024, we recorded restructuring

charges of $31 million [$24 million after tax] in our Complete Vehicles segment in connection with our Fisker related assembly operations.

| (2) | Restructuring activities |

We recorded restructuring charges related to

significant plant closures and consolidations primarily in Europe and to a lesser extent in North America.

| | |

| 2024 | | |

| 2023 | |

| Power & Vision | |

$ | 104 | | |

$ | 117 | |

| Complete Vehicles | |

| 55 | | |

| — | |

| Body Exteriors & Structures | |

| 28 | | |

| 31 | |

| Other expense, net | |

| 187 | | |

| 148 | |

| Tax effect | |

| (28 | ) | |

| (24 | ) |

| Net loss attributable to Magna | |

$ | 159 | |

| $ |

124 | |

6 Magna International Inc. Annual Report 2024

| (3) | Long-lived asset impairments |

During 2024, we recorded impairment

charges of $79 million [$79 million after tax] on fixed assets, right of use assets and intangible assets at two European lighting facilities

in our Power & Vision segment.

| |

|

|

2024 |

|

|

|

2023 |

|

| Non-cash impairment charge (i) |

|

$ |

13 |

|

|

$ |

90 |

|

| Revaluation of public and private equity investments |

|

|

13 |

|

|

|

1 |

|

| Revaluation of public company warrants (ii) |

|

|

(17 |

) |

|

|

— |

|

| Other expense, net |

|

|

9 |

|

|

|

91 |

|

| Tax effect |

|

|

3 |

|

|

|

(1 |

) |

| Net loss attributable to Magna |

|

$ |

12 |

|

|

$ |

90 |

|

| (i) | The non-cash impairment charge relates

to the impairment of a private equity investment. |

| (ii) | The revaluation of Fisker warrants previously presented within Revaluation of public company

warrants has been reclassified to Impacts related to Fisker. |

| (5) | Gain on business combination |

During 2024, we acquired a business

in our Body Exteriors & Structures segment for $5 million, resulting in a bargain purchase gain of $9 million [$9 million after

tax].

| (6) | Veoneer Active Safety Business transaction costs |

During 2023, we incurred $23 million

[$22 million after tax] of transaction costs relating to our acquisition of the Veoneer Active Safety Business ["Veoneer AS"].

Refer to Note 7, "Business Combinations", to the consolidated financial statements included in this Report.

During 2023, we completed the sale

of all of our investments in Russia which resulted in a loss of $16 million [$16 million after tax] including a net cash outflow of $23

million.

INCOME FROM OPERATIONS

BEFORE INCOME TAXES

Income from operations before income taxes was

$1.54 billion for 2024 compared to $1.61 billion for 2023. The $64 million decrease was a result of the following changes, each as discussed

above:

| | |

2024 | | |

2023 | | |

Change | |

| Sales | |

$ | 42,836 | | |

$ | 42,797 | | |

$ | 39 | |

| | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 37,037 | | |

| 37,185 | | |

| (148 | ) |

| Depreciation | |

| 1,510 | | |

| 1,436 | | |

| 74 | |

| Amortization of acquired intangible assets | |

| 112 | | |

| 88 | | |

| 24 | |

| Selling, general & administrative | |

| 2,061 | | |

| 2,050 | | |

| 11 | |

| Interest expense, net | |

| 211 | | |

| 156 | | |

| 55 | |

| Equity income | |

| (101 | ) | |

| (112 | ) | |

| 11 | |

| Other expense, net | |

| 464 | | |

| 388 | | |

| 76 | |

| Income from operations before income taxes | |

$ | 1,542 | | |

$ | 1,606 | | |

$ | (64 | ) |

Magna International Inc. Annual Report 2024 7

INCOME TAXES

| | |

2024 | | |

2023 | |

| Income taxes as reported | |

$ | 446 | | |

| 28.9 | % | |

$ | 320 | | |

| 19.9 | % |

| Tax effect on Other expense, net and Amortization of acquired

intangible assets | |

| 85 | | |

| (3.8 | ) | |

| 70 | | |

| (1.2 | ) |

| Adjustments to Deferred Tax Valuation Allowances | |

| (51 | ) | |

| (2.4 | ) | |

| 47 | | |

| 2.3 | |

| | |

$ | 480 | | |

| 22.7 | % | |

$ | 437 | | |

| 21.0 | % |

During 2024 we increased the valuation allowance

against certain deferred tax assets in Austria, which was partially offset by the release of certain valuation allowances in Spain, Czechia

and Brazil. In 2023, we released valuation allowances against certain deferred tax assets in Brazil and the United States ["Adjustments

to Deferred Tax Valuation Allowances"].

Excluding the tax effect on Other expense, net

and Amortization of acquired intangible assets, as well as the Adjustments to Deferred Tax Valuation Allowances our effective income

tax rate increased to 22.7% for 2024 compared to 21.0% for 2023 primarily due to unfavourable foreign exchange adjustments recognized

for U.S. GAAP purposes. This was partially offset by favourable changes in our reserves for uncertain tax positions.

INCOME ATTRIBUTABLE

TO NON-CONTROLLING INTERESTS

Income attributable to non-controlling interests

was $87 million for 2024 compared to $73 million for 2023. This $14 million increase was primarily due to higher net income at our non-wholly

owned operations in China.

NET INCOME ATTRIBUTABLE

TO MAGNA INTERNATIONAL INC.

Net income attributable to Magna International

Inc. was $1.01 billion for 2024 compared to $1.21 billion for 2023. This $204 million decrease was as a result of an increase in income

taxes of $126 million, a decrease in income from operations before income taxes of $64 million and an increase in income attributable

to non-controlling interests of $14 million.

EARNINGS PER SHARE

| | | |

2024 | |

2023 | |

% Change | |

| Earnings per Common Share | | |

| |

| |

| |

| Basic | | |

$ | 3.52 | |

$ | 4.24 | |

|

- |

17 | % |

| Diluted | | |

$ | 3.52 | |

$ | 4.23 | |

|

- |

17 | % |

| Weighted average number of Common Shares outstanding

(millions) | | |

| | |

| | |

|

| |

| Basic | | |

| 286.8 | |

| 286.2 | |

|

— | |

| Diluted | | |

| 286.9 | |

| 286.6 | |

|

— | |

| Adjusted diluted earnings per share | | |

$ | 5.41 | |

$ | 5.49 | |

|

- |

1 | % |

Diluted earnings per share was $3.52 for 2024

compared to $4.23 for 2023. The $0.71 decrease was as a result of lower net income attributable to Magna International Inc., as discussed

above.

Other expense, net, and the Amortization of acquired

intangible assets, each after tax, and Adjustments to Deferred Tax Valuation Allowances negatively impacted diluted earnings per share

by $1.89 in 2024 and $1.26 in 2023, respectively. Adjusted diluted earnings per share, as reconciled in the "Non-GAAP Financial

Measures Reconciliation" section, was $5.41 for 2024 compared to $5.49 for 2023, a decrease of $0.08.

8 Magna International Inc. Annual Report 2024

NON-GAAP PERFORMANCE MEASURES

- FOR THE YEAR ENDED DECEMBER 31, 2024

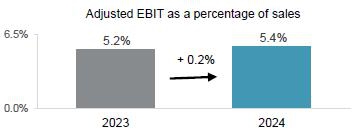

ADJUSTED EBIT AS A PERCENTAGE

OF SALES

The table below shows the change in Magna's Sales

and Adjusted EBIT by segment and the impact each segment's changes have on Magna's Adjusted EBIT as a percentage of sales for 2024 compared

to 2023:

| | |

Sales | | |

Adjusted

EBIT | |

| Adjusted

EBIT

as a percentage

of sales | |

| 2023 | |

$ | 42,797 | | |

$ | 2,238 | |

|

5.2 | % |

| Increase (decrease) related to: | |

| | | |

| | |

|

| |

| Body Exteriors & Structures | |

| (512 | ) | |

| (21 | ) |

|

— | |

| Power & Vision | |

| 1,086 | | |

| 142 | |

|

+ |

0.2 | % |

| Seating Systems | |

| (247 | ) | |

| 5 | |

|

— | |

| Complete Vehicles | |

| (352 | ) | |

| 6 | |

|

+ |

0.1 | % |

| Corporate and Other | |

| 64 | | |

| (41 | ) |

|

- |

0.1 | % |

| 2024 | |

$ | 42,836 | | |

$ | 2,329 | |

|

5.4 | % |

Adjusted EBIT as a percentage of sales increased

to 5.4% for 2024 compared to 5.2% for 2023 primarily due to:

| · | commercial

items in 2024 and 2023, which had a net favourable impact on a year-over-year basis, including

the negative impact of a settlement with a supplier during the fourth quarter of 2024; |

| · | productivity and efficiency

improvements, including lower costs at certain underperforming facilities; |

| · | the negative impact of the

UAW labour strikes during 2023; and |

| · | lower net engineering costs,

including spending related to our electrification and active safety business. |

These factors were offset by:

| · | higher

production input costs net of customer recoveries, including labour, partially offset by

lower prices for certain commodities; |

| · | reduced earnings on lower

assembly volumes; |

| · | reduced earnings on lower

sales; |

| · | higher net warranty costs; |

| · | acquisitions, net of divestitures,

during and subsequent to 2023; and |

| · | higher restructuring costs. |

Magna International Inc. Annual Report 2024 9

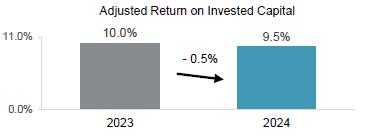

ADJUSTED RETURN ON INVESTED

CAPITAL

Adjusted Return on Invested Capital decreased

to 9.5% for 2024 compared to 10.0% for 2023 as a result of higher Average Invested Capital partially offset by an increase in Adjusted

After-tax operating profits.

Average Invested Capital increased $1.11 billion

to $18.88 billion for 2024 compared to $17.77 billion for 2023, primarily due to:

| · | average

investment in fixed assets in excess of average depreciation expense on fixed assets; and |

| · | acquisitions, net of divestitures,

during or subsequent to 2023. |

These factors were partially offset by:

| · | impairments

and restructuring related to Fisker during 2024; |

| · | a decrease in average operating

assets and liabilities; |

| · | the net weakening of foreign

currencies against the U.S. dollar; and |

| · | lower net investments in public

and private equity companies and public company warrants. |

10 Magna International Inc. Annual Report 2024

SEGMENT ANALYSIS

We are a global automotive supplier that has

complete vehicle engineering and contract manufacturing expertise, as well as product capabilities which include body, chassis, exterior,

seating, powertrain, active driver assistance, electronics, mechatronics, mirrors, lighting and roof systems.

Our reporting segments are: Body Exteriors &

Structures; Power & Vision; Seating Systems; and Complete Vehicles.

| | |

Sales | | |

Adjusted EBIT | |

| | |

2024 | | |

2023 | | |

Change | | |

2024 | | |

2023 | | |

Change | |

| Body Exteriors & Structures | |

$ | 16,999 | | |

$ | 17,511 | | |

$ | (512 | ) | |

$ | 1,283 | | |

$ | 1,304 | | |

$ | (21 | ) |

| Power & Vision | |

| 15,391 | | |

| 14,305 | | |

| 1,086 | | |

| 810 | | |

| 668 | | |

| 142 | |

| Seating Systems | |

| 5,800 | | |

| 6,047 | | |

| (247 | ) | |

| 223 | | |

| 218 | | |

| 5 | |

| Complete Vehicles | |

| 5,186 | | |

| 5,538 | | |

| (352 | ) | |

| 130 | | |

| 124 | | |

| 6 | |

| Corporate and Other | |

| (540 | ) | |

| (604 | ) | |

| 64 | | |

| (117 | ) | |

| (76 | ) | |

| (41 | ) |

| Total reportable segments | |

$ | 42,836 | | |

$ | 42,797 | | |

$ | 39 | | |

$ | 2,329 | | |

$ | 2,238 | | |

$ | 91 | |

BODY EXTERIORS & STRUCTURES

| | |

2024 | | |

2023 | | |

Change | |

| Sales | |

$ | 16,999 | | |

$ | 17,511 | | |

$ | (512 | ) | |

| - 3 | % |

| Adjusted EBIT | |

$ | 1,283 | | |

$ | 1,304 | | |

$ | (21 | ) | |

| - 2 | % |

| Adjusted EBIT as a percentage of sales | |

| 7.5 | % | |

| 7.4 | % | |

| | | |

| + 0.1 | % | |

Sales – Body Exteriors & Structures

Sales decreased 3% or $512 million to $17.00

billion for 2024 compared to $17.51 billion for 2023, primarily due to:

| · | the

end of production of certain programs, including the: |

| · | Dodge

Charger; |

| · | Chevrolet

Bolt EV; |

| · | Ford

Edge; and |

| · | Chevrolet

Camaro; |

| · | lower production on certain programs; |

| · | divestitures during 2024, which decreased sales by $146

million; |

| · | the net weakening of foreign

currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $58 million;

and |

| · | net customer price concessions. |

These factors were partially offset by:

| · | the

launch of programs during or subsequent to 2023, including the: |

| · | Ford

F-Series Super Duty; |

| · | Chevrolet

Silverado EV and GMC Sierra EVs; |

| · | GMC

Hummer EV SUV; and |

| · | Chevrolet

Equinox & Blazer EVs; |

| · | the

negative impact of the UAW labour strikes, which negatively impacted 2023 sales by approximately

$200 million; and |

| · | commercial items in 2024 and

2023, which had a net favourable impact on a year-over-year basis. |

Magna International Inc. Annual Report 2024 11

Adjusted EBIT and Adjusted EBIT as a percentage

of sales – Body Exteriors & Structures

Adjusted EBIT decreased $21 million to $1,283

million for 2024 compared to $1,304 million for 2023 while Adjusted EBIT as a percentage of sales increased to 7.5% from 7.4%. Adjusted

EBIT was lower primarily as a result of reduced earnings on lower sales. Excluding the impact of lower sales, Adjusted EBIT and Adjusted

EBIT as a percentage of sales were higher primarily due to:

| · | commercial items in 2024 and 2023, which

had a net favourable impact on a year-over-year basis; |

| · | productivity and efficiency improvements,

including lower costs at certain underperforming facilities; |

| · | the negative impact of the UAW labour

strikes during 2023; and |

| · | higher net transactional foreign exchange

gains in 2024 compared to 2023. |

These factors were partially offset by:

| · | higher production input costs net of customer

recoveries, primarily for labour; |

| · | supply chain premiums, partially as a

result of a supplier bankruptcy; |

| · | higher restructuring costs; |

| · | higher net warranty costs of $12 million;

and |

| · | provisions related to the insolvency of

two Chinese OEMs during 2024. |

POWER &

VISION

| | |

2024 | | |

2023 | | |

Change | |

| Sales | |

$ | 15,391 | | |

$ | 14,305 | | |

$ | 1,086 | | |

+ | 8 | % |

| Adjusted EBIT | |

$ | 810 | | |

$ | 668 | | |

$ | 142 | | |

+ | 21 | % |

| Adjusted EBIT as a percentage of sales | |

| 5.3 | % | |

| 4.7 | % | |

| | | |

+ | 0.6 | % |

Sales – Power & Vision

Sales increased 8% or $1.09 billion to $15.39

billion for 2024 compared to $14.31 billion for 2023, primarily due to:

| · | the launch of programs during or subsequent

to 2023, including the: |

| · | Chevrolet Equinox & Blazer

EVs; and |

| · | acquisitions, net of divestitures, during

or subsequent to 2023, which increased sales by $614 million; |

| · | the negative impact of the UAW labour

strikes, which negatively impacted 2023 sales by approximately $80 million; and |

| · | customer price increases to partially

recover certain higher production input costs. |

12 Magna International Inc. Annual Report 2024

These factors were partially offset by:

| · | lower production on certain programs; |

| · | the end of production of particular programs,

including the: |

| · | the net weakening of foreign currencies

against the U.S. dollar, which decreased reported U.S. dollar sales by $84 million; and |

| · | net customer price concessions. |

Adjusted EBIT and Adjusted EBIT as a percentage

of sales – Power & Vision

Adjusted EBIT increased $142 million to $810

million for 2024 compared to $668 million for 2023 and Adjusted EBIT as a percentage of sales increased to 5.3% from 4.7%. These increases

were primarily as a result of:

| · | increased earnings on higher sales, including

improved margins from operational excellence and cost initiatives; |

| · | commercial items in 2024 and 2023, which

had a net favourable impact on a year-over-year basis, including the negative impact of a

settlement with a supplier during the fourth quarter of 2024; |

| · | lower net engineering costs, including

spending related to our electrification and active safety businesses; and |

| · | the negative impact of the UAW labour

strikes during 2023. |

These factors were partially offset by:

| · | higher net warranty costs of $46 million; |

| · | lower tooling contribution; |

| · | higher production input costs net of customer

recoveries, primarily for labour; and |

| · | acquisitions, net of divestitures, during

or subsequent to 2023. |

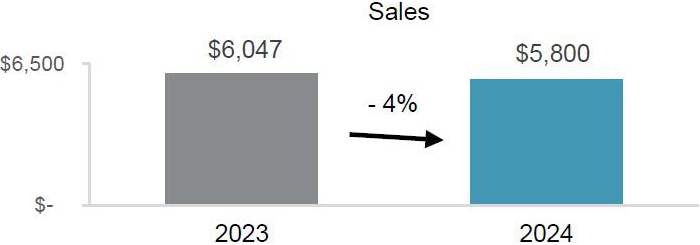

SEATING

SYSTEMS

| | |

2024 | | |

2023 | | |

Change | |

| Sales | |

$ | 5,800 | | |

$ | 6,047 | | |

$ | (247 | ) | |

- | 4 | % |

| Adjusted EBIT | |

$ | 223 | | |

$ | 218 | | |

$ | 5 | | |

+ | 2 | % |

| Adjusted EBIT as a percentage of sales | |

| 3.8 | % | |

| 3.6 | % | |

| | | |

+ | 0.2 | % |

Magna International Inc. Annual Report 2024 13

Sales – Seating Systems

Sales decreased 4% or $247 million to $5.80 billion

for 2024 compared to $6.05 billion for 2023, primarily due to:

| · | the end of production of certain programs,

including the: |

| · | lower production on certain programs,

including the Jeep Grand Cherokee; |

| · | the net weakening of foreign currencies

against the U.S. dollar, which decreased reported U.S. dollar sales by $18 million; and |

| · | net customer price concessions. |

These factors were partially offset by:

| · | the launch of programs during or subsequent

to 2023, including the: |

| · | customer price increases to partially

recover certain higher production input costs; and |

| · | the negative impact of the UAW labour

strikes, which negatively impacted 2023 sales by approximately $45 million. |

Adjusted EBIT and Adjusted EBIT as a percentage

of sales – Seating Systems

Adjusted EBIT increased $5 million to $223 million

for 2024 compared to $218 million for 2023 and Adjusted EBIT as a percentage of sales increased to 3.8% from 3.6%. These increases were

primarily due to:

| · | commercial items in 2024 and 2023, which

had a net favourable impact on a year-over-year basis; |

| · | lower net foreign exchange losses, primarily

due to the weakening in 2023 of the Argentine peso against the U.S. dollar; and |

| · | the negative impact of the UAW labour

strikes during 2023. |

These factors were partially offset by:

| · | reduced earnings on lower sales; |

| · | provisions related to the insolvency of

a Chinese OEM during 2024; and |

| · | higher restructuring costs. |

14 Magna International Inc. Annual Report 2024

COMPLETE

VEHICLES

| | |

2024 | | |

2023 | | |

Change | |

| Complete

Vehicle Assembly Volumes (thousands

of units)(i) | |

| 71.9 | | |

| 105.1 | | |

| (33.2 | ) | |

- | 32 | % |

| Sales | |

$ | 5,186 | | |

$ | 5,538 | | |

$ | (352 | ) | |

- | 6 | % |

| Adjusted EBIT | |

$ | 130 | | |

$ | 124 | | |

$ | 6 | | |

+ | 5 | % |

| Adjusted EBIT as a percentage of sales | |

| 2.5 | % | |

| 2.2 | % | |

| | | |

+ | 0.3 | % |

| (i) | Vehicles

produced at our Complete Vehicle operations are included in Europe Light Vehicle Production

volumes. |

Sales – Complete Vehicles

Sales decreased 6% or $352 million to $5.19 billion

for 2024 compared to $5.54 billion for 2023 and assembly volumes decreased 32%. The decrease in sales is substantially a result of lower

assembly volumes, including the end of production of the BMW 5-Series and Jaguar E-Pace. The impact of lower assembly volumes was

partially offset by:

| · | higher engineering revenue; |

| · | commercial items during 2024 and 2023,

which had a net favourable impact on a year-over-year basis; |

| · | customer price increases to partially

recover certain higher production input costs; and |

| · | a $9 million increase in reported U.S.

dollar sales as a result of the strengthening of the euro against the U.S. dollar. |

Adjusted EBIT and Adjusted EBIT as a percentage

of sales – Complete Vehicles

Adjusted EBIT increased $6 million to $130 million

for 2024 compared to $124 million for 2023 while Adjusted EBIT as a percentage of sales increased to 2.5% from 2.2%. These increases

were primarily due to:

| · | commercial items in 2024 and 2023, which

had a net favourable impact on a year-over-year basis; |

| · | higher engineering margins on higher engineering

sales; |

| · | lower restructuring costs; and |

| · | lower launch, engineering and other costs. |

These factors were partially offset by:

| · | reduced earnings on lower assembly volumes;

and |

| · | higher production input costs net of customer

recoveries, primarily for labour. |

Magna International Inc. Annual Report 2024 15

CORPORATE AND OTHER

Adjusted EBIT was a loss of $117 million for

2024 compared to a loss of $76 million for 2023. The $41 million decrease was primarily the result of:

| · | net transactional foreign exchange losses

in 2024 compared to net transactional foreign exchange gains in 2023; |

| · | increased investments in research, development

and new mobility; |

| · | a decrease in fees received from our divisions;

and |

| · | higher costs to accelerate operational

excellence activities. |

These factors were partially offset by:

| · | lower incentive compensation; and |

| · | a gain on the sale of an equity-method

investment during 2024. |

16 Magna International Inc. Annual Report 2024

FINANCIAL CONDITION, LIQUIDITY

AND CAPITAL RESOURCES

OPERATING

ACTIVITIES

| | |

2024 | | |

2023 | | |

Change | |

| Net income | |

$ | 1,096 | | |

$ | 1,286 | | |

| | |

| Items not involving current cash flows | |

| 1,857 | | |

| 1,642 | | |

| | |

| | |

| 2,953 | | |

| 2,928 | | |

$ | 25 | |

| Changes in operating assets and liabilities | |

| 681 | | |

| 221 | | |

| 460 | |

| Cash provided from operating activities | |

$ | 3,634 | | |

$ | 3,149 | | |

$ | 485 | |

Cash provided from operating activities

Comparing 2024 to 2023, cash provided from operating

activities increased $485 million primarily as a result of:

| · | a $1.18 billion increase in cash received

from customers; |

| · | a $122 million decrease in cash taxes;

and |

| · | higher dividends received from equity

investments of $30 million. |

These factors were partially offset by:

| · | a $588 million increase in cash paid for

materials and overhead; |

| · | a $202 million increase in cash paid for

labour; and |

| · | a $53 million increase in cash interest

paid. |

Changes in operating assets and liabilities

During 2024, we generated $681 million from operating

assets and liabilities primarily consisting of:

| · | a $478 million decrease in tooling investment

for current and upcoming program launches; |

| · | a $369 million increase in other accrued

liabilities; |

| · | a $186 million decrease in production

and other receivables; and |

| · | a $96 million increase in taxes payable. |

These factors were partially offset by:

| · | a $271 million decrease in accounts payable; |

| · | a $143 million increase in production

inventory; and |

| · | a $35 million increase in prepaids and

other. |

Magna International Inc. Annual Report 2024 17

INVESTING

ACTIVITIES

| | |

2024 | | |

2023 | | |

Change | |

| Fixed asset additions | |

$ | (2,178 | ) | |

$ | (2,500 | ) | |

| | |

| Increase in investments, other assets and intangible assets | |

| (617 | ) | |

| (562 | ) | |

| | |

| Increase in public and private equity

investments | |

| (12 | ) | |

| (11 | ) | |

| | |

| Fixed assets, investments, other assets and intangible assets

additions | |

| (2,807 | ) | |

| (3,073 | ) | |

| | |

| Proceeds from dispositions | |

| 219 | | |

| 122 | | |

| | |

| Net cash inflow (outflow) from disposal of facilities | |

| 82 | | |

| (48 | ) | |

| | |

| Acquisitions | |

| (86 | ) | |

| (1,504 | ) | |

| | |

| Cash used for investing activities | |

$ | (2,592 | ) | |

$ | (4,503 | ) | |

$ | 1,911 | |

Cash used for investing activities in 2024 was

$1.91 billion lower compared to 2023. The change between 2024 and 2023 was primarily due to the acquisition of Veoneer AS during the

second quarter of 2023, a $322 million decrease in cash used for fixed assets, higher proceeds from dispositions during 2024, primarily

related to the sale of an equity method investment during the first quarter of 2024, and the net cash inflow from the disposal of our

Body Exteriors & Structures operations in India during the third quarter of 2024. These factors were partially offset by a $55

million increase in cash used for investments, other assets and intangible assets.

FINANCING

ACTIVITIES

| | |

2024 | | |

2023 | | |

Change | |

| Issues of debt | |

$ | 778 | | |

$ | 2,083 | | |

| | |

| Issue of Common Shares on exercise of stock options | |

| 30 | | |

| 20 | | |

| | |

| Contributions to subsidiaries by non-controlling interests | |

| — | | |

| 11 | | |

| | |

| Tax withholdings on vesting of equity awards | |

| (8 | ) | |

| (11 | ) | |

| | |

| Dividends paid to non-controlling interest | |

| (46 | ) | |

| (74 | ) | |

| | |

| (Decrease) increase in short-term borrowings | |

| (182 | ) | |

| 487 | | |

| | |

| Repurchase of Common Shares | |

| (207 | ) | |

| (13 | ) | |

| | |

| Dividends paid | |

| (539 | ) | |

| (522 | ) | |

| | |

| Repayments of debt | |

| (815 | ) | |

| (644 | ) | |

| | |

| Cash (used for) provided from financing

activities | |

$ | (989 | ) | |

$ | 1,337 | | |

$ | (2,326 | ) |

During 2024, we issued the following Senior Notes

[the "Senior Notes"]:

| | |

| |

Amount in USD at | |

|

| | |

Settlement Date | |

Issuance Date | |

Maturity Date |

| $400 million Senior Notes at 5.05% | |

March 14, 2024 | |

|

$397 million | |

March 14, 2029 |

| Cdn$450 million Senior Notes at 4.800% | |

May 30, 2024 | |

|

$328 million | |

May 30, 2029 |

Net cash proceeds received from the Senior Notes

issuances was $725 million, which were issued for general corporate purposes, including the repayment of debt that matured in June 2024.

The Senior Notes are unsecured obligations and

do not include any financial covenants. We may redeem the Senior Notes in whole or in part at any time, and from time to time, at specified

redemption prices determined in accordance with the terms of the indenture governing the Senior Notes. Refer to Note 16, "Debt"

of our audited consolidated financial statements for the year ended December 31, 2024.

18 Magna International Inc. Annual Report 2024

Short-term borrowings decreased $182 million

in 2024 primarily due to our increase in cash from operating activities enabling us to repay notes under the euro-commercial paper program

and U.S. commercial paper program.

During 2024, we repurchased 4.7 million Common

Shares under normal course issuer bids for aggregate cash consideration of $207 million.

Cash dividends paid per Common Share were $1.90

for 2024 compared to $1.84 for 2023.

FINANCING

RESOURCES

| | |

2024 | | |

2023 | | |

Change | |

| Liabilities | |

| | | |

| | | |

| | |

| Short-term borrowings | |

$ | 271 | | |

$ | 511 | | |

| | |

| Long-term debt due within one year | |

| 708 | | |

| 819 | | |

| | |

| Current portion of operating lease

liabilities | |

| 293 | | |

| 399 | | |

| | |

| Long-term debt | |

| 4,134 | | |

| 4,175 | | |

| | |

| Operating lease

liabilities | |

| 1,662 | | |

| 1,319 | | |

| | |

| | |

$ | 7,068 | | |

$ | 7,223 | | |

$ | (155 | ) |

Financial liabilities decreased $155 million

to $7.07 billion as at December 31, 2024 primarily as a result of the repayment of $750 million in Senior Notes during the second

quarter of 2024, and the repayment of notes under the euro-commercial paper program and U.S. commercial paper program. These decreases

were partially offset by the issuance of $400 million of Senior Notes during the first quarter of 2024, and the issuance of Cdn$450 million

of Senior Notes during the second quarter of 2024.

CASH

RESOURCES

In 2024, our cash resources remain substantially

unchanged at $1.2 billion, primarily as a result of cash provided from operating activities being substantially offset by cash used for

investing and financing activities, as discussed above. In addition to our cash resources at December 31, 2024, we had term and

operating lines of credit totaling $4.1 billion, of which $3.3 billion was unused and available.

On March 28, 2024, we amended our $2.7 billion

syndicated revolving credit facility, including to extend the maturity date from June 24, 2028 to June 25, 2029. As of December 31,

2024, we have no amounts outstanding under this credit facility.

On May 10, 2024, we amended our $800 million

364-day syndicated revolving credit facility, including to extend the maturity date from June 24, 2024 to June 24, 2025. As

of December 31, 2024, we have not borrowed any funds under this credit facility.

MAXIMUM

NUMBER OF SHARES ISSUABLE

The following table presents the maximum number

of shares that would be outstanding if all of the outstanding options at February 26, 2025 were exercised:

| Common Shares | |

| 281,688,546 | |

| Stock options (i) | |

| 5,905,458 | |

| | |

| 287,594,004 | |

| (i) | Options to purchase Common Shares

are exercisable by the holder in accordance with the vesting provisions and upon payment

of the exercise price as may be determined from time to time pursuant to our stock option

plans. |

Magna International Inc. Annual Report 2024 19

CONTRACTUAL

OBLIGATIONS

A purchase obligation is defined as an agreement

to purchase goods or services that is enforceable and legally binding on us and that specifies all significant terms, including: fixed

or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. Consistent

with our customer obligations, substantially all of our purchases are made under purchase orders with our suppliers which are requirements

based and accordingly do not specify minimum quantities. Other long-term liabilities are defined as long-term liabilities that are recorded

on our consolidated balance sheet. Based on this definition, the following table includes only those contracts which include fixed or

minimum obligations.

At December 31, 2024, we had contractual

obligations requiring annual payments as follows:

| | |

2025 | | |

2026-

2027 | | |

2028-

2029 | | |

Thereafter | | |

Total | |

| Operating leases | |

$ | 379 | | |

$ | 631 | | |

$ | 494 | | |

$ | 1,006 | | |

$ | 2,510 | |

| Long-term debt | |

| 709 | | |

| 1,060 | | |

| 1,021 | | |

| 2,072 | | |

| 4,862 | |

| Unconditional purchase obligations: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Materials and services | |

| 3,064 | | |

| 1,042 | | |

| 903 | | |

| 830 | | |

| 5,839 | |

| Capital | |

| 956 | | |

| 192 | | |

| 33 | | |

| 18 | | |

| 1,199 | |

| Total contractual obligations | |

$ | 5,108 | | |

$ | 2,925 | | |

$ | 2,451 | | |

$ | 3,926 | | |

$ | 14,410 | |

Our unfunded obligation with respect to employee

future benefit plans, which have been actuarially determined, was $478 million at December 31, 2024. These obligations are as follows:

| | |

| | |

Retirement | | |

Termination and | | |

| |

| | |

Pension | | |

Medical | | |

Long-term Service | | |

| |

| | |

Liability | | |

Liability | | |

Arrangements | | |

Total | |

| Projected benefit obligation | |

$ | 475 | | |

$ | 17 | | |

$ | 391 | | |

$ | 883 | |

| Less plan assets at fair value | |

| (405 | ) | |

| — | | |

| — | | |

| (405 | ) |

| Ending funded status – Plan deficit | |

$ | 70 | | |

$ | 17 | | |

$ | 391 | | |

$ | 478 | |

Foreign Currency Activities

Our North American operations negotiate sales

contracts with OEMs for payment in U.S. dollars, Canadian dollars and Mexican pesos. Materials and equipment are purchased in various

currencies depending upon competitive factors, including relative currency values. Our North American operations use labour and materials

which are paid for in U.S. dollars, Canadian dollars and Mexican pesos. Our Mexican operations generally use the U.S. dollar as the functional

currency.

Our European operations negotiate sales contracts

with OEMs for payment principally in euros. Our European operations' material, equipment and labour are principally paid for in euros

and U.S. dollars.

Our Asian operations negotiate sales contracts

with OEMs for payment principally in Chinese renminbi. Our Asian operations' material, equipment and labour are paid for principally

in Chinese renminbi.

We employ hedging programs, primarily through

the use of foreign exchange forward contracts, in an effort to manage our foreign exchange exposure, which arises when manufacturing

facilities have committed to the delivery of products for which the selling price or material purchases have been quoted in foreign currencies

and for labour in countries where the local currency is not the divisions' functional currency. These commitments represent our contractual

obligations to deliver products over the duration of the product programs, which can last a number of years. The amount and timing of

the forward contracts will be dependent upon a number of factors, including anticipated production delivery schedules and anticipated

production costs, which may be paid in the foreign currency. Despite these measures, significant long-term fluctuations in relative currency

values, in particular a significant change in the relative values of the U.S. dollar, Canadian dollar, euro, Chinese renminbi or Mexican

peso, could have an adverse effect on our profitability and financial condition (as discussed throughout this MD&A).

20 Magna International Inc. Annual Report 2024

NON-GAAP

FINANCIAL MEASURES RECONCILIATION

The reconciliation of Non-GAAP financial

measures is as follows:

ADJUSTED

EBIT

| | |

2024 | | |

2023 | |

| Net income | |

$ | 1,096 | | |

$ | 1,286 | |

| Add : | |

| | | |

| | |

| Amortization of acquired intangible

assets | |

| 112 | | |

| 88 | |

| Interest expense, net | |

| 211 | | |

| 156 | |

| Other expense, net | |

| 464 | | |

| 388 | |

| Income

taxes | |

| 446 | | |

| 320 | |

| Adjusted

EBIT | |

$ | 2,329 | | |

$ | 2,238 | |

ADJUSTED

EBIT AS A PERCENTAGE OF SALES

| | |

2024 | | |

2023 | |

| Sales | |

$ | 42,836 | | |

$ | 42,797 | |

| Adjusted

EBIT | |

$ | 2,329 | | |

$ | 2,238 | |

| Adjusted

EBIT as a percentage of sales | |

| 5.4 | % | |

| 5.2 | % |

ADJUSTED

DILUTED EARNINGS PER SHARE

| | |

2024 | | |

2023 | |

| Net income attributable

to Magna International Inc. | |

$ | 1,009 | | |

$ | 1,213 | |

| Add (deduct): | |

| | | |

| | |

| Amortization

of acquired intangible assets | |

| 112 | | |

| 88 | |

| Other

expense, net | |

| 464 | | |

| 388 | |

| Tax

effect on Amortization of acquired intangible assets and Other expense, net | |

| (85 | ) | |

| (70 | ) |

| Adjustments

to Deferred Tax Valuation Allowances | |

| 51 | | |

| (47 | ) |

| Adjusted net income attributable

to Magna International Inc. | |

$ | 1,551 | | |

$ | 1,572 | |

| Diluted

weighted average number of Common Shares outstanding during the period (millions) | |

| 286.9 | | |

| 286.6 | |

| Adjusted diluted earnings

per share | |

$ | 5.41 | | |

$ | 5.49 | |

Magna International Inc. Annual Report 2024 21

ADJUSTED

RETURN ON INVESTED CAPITAL

Adjusted Return

on Invested Capital is calculated as Adjusted After-tax operating profits divided by Average Invested Capital for the period. Average

Invested Capital for the twelve month period is averaged on a five-fiscal quarter basis.

| | |

2024 | | |

2023 | |

| Net Income | |

$ | 1,096 | | |

$ | 1,286 | |

| Add (deduct): | |

| | | |

| | |

| Interest expense, net | |

| 211 | | |

| 156 | |

| Amortization of acquired intangible

assets | |

| 112 | | |

| 88 | |

| Other

expense, net | |

| 464 | | |

| 388 | |

| Tax effect

on Interest expense, net, Amortization of acquired intangible assets and Other expense, net | |

| (133 | ) | |

| (102 | ) |

| Adjustments

to Deferred Tax Valuation Allowances | |

| 51 | | |

| (47 | ) |

| Adjusted

After-tax operating profits | |

$ | 1,801 | | |

$ | 1,769 | |

| | |

2024 | | |

2023 | |

| Total Assets | |

$ | 31,039 | | |

$ | 32,255 | |

| Excluding: | |

| | | |

| | |

| Cash and

cash equivalents | |

| (1,247 | ) | |

| (1,198 | ) |

| Deferred

tax assets | |

| (819 | ) | |

| (621 | ) |

| Less Current Liabilities | |

| (12,097 | ) | |

| (13,234 | ) |

| Excluding: | |

| | | |

| | |

| Short-term

borrowing | |

| 271 | | |

| 511 | |

| Long-term

debt due within one year | |

| 708 | | |

| 819 | |

| Current

portion of operating lease liabilities | |

| 293 | | |

| 399 | |

| Invested

Capital | |

$ | 18,148 | | |

$ | 18,931 | |

| | |

2024 | | |

2023 | |

| Adjusted

After-tax operating profits | |

$ | 1,801 | | |

$ | 1,769 | |

| Average Invested Capital | |

$ | 18,875 | | |

$ | 17,771 | |

| Adjusted

Return on Invested Capital | |

| 9.5 | % | |

| 10.0 | % |

SUBSEQUENT

EVENT

NORMAL COURSE ISSUER BID

Subsequent to

December 31, 2024, we purchased 1,187,382 Common Shares for cancellation and 92,928 Common Shares to satisfy

stock-based compensation awards each under our existing normal course issuer bid for cash consideration of $51 million.

22 Magna International Inc. Annual Report 2024

SIGNIFICANT ACCOUNTING POLICIES

AND CRITICAL ACCOUNTING ESTIMATES

Our significant accounting policies are more fully

described in Note 2, "Significant Accounting Policies", to the consolidated financial statements included in this Report. The

preparation of the audited consolidated financial statements requires management to make estimates and assumptions that affect the reported

amounts of assets, liabilities, revenues and expenses and the related disclosure of contingent assets and liabilities, as of the date

of the consolidated financial statements. These estimates and assumptions are based on our historical experience, and various other assumptions

we believe to be reasonable in the circumstances. Since these estimates and assumptions are subject to an inherent degree of uncertainty,

actual results in these areas may differ significantly from our estimates.

We believe the following critical accounting policies

and estimates affect the more subjective or complex judgements and estimates used in the preparation of our consolidated financial statements

and accompanying notes. Management has discussed the development and selection of the following critical accounting policies with the

Audit Committee of the Board of Directors, and the Audit Committee has reviewed our disclosure relating to critical accounting policies

in this MD&A.

revenue

recognition - complete vehicle assembly arrangements

Our complete vehicle assembly contracts with customers

are complex and often include promises to transfer multiple products and services, some of which may be implicitly contracted. Each good

or service is evaluated to determine whether it represents a distinct performance obligation, and whether it should be characterized as

revenue or as a reimbursement of costs incurred. The total transaction price is then allocated to the distinct performance obligations

based on the expected cost plus a margin approach and recognized as revenue.

Additionally, as the terms of our complete vehicle

assembly contracts with customers differ with respect to the ownership of components related to the assembly process, we must determine

whether we are acting as principal in these arrangements, or acting as an agent in which case the revenue recognized would principally

reflect the assembly fee.

Significant interpretation and judgment is sometimes

required to determine the appropriate accounting for these contracts including: (i) combining contracts that may impact the allocation

of the transaction price between products and services; (ii) determining whether performance obligations are considered distinct

and are required to be accounted for separately or combined; and (iii) the allocation of the transaction price to each distinct performance

obligation and determining when to recognize revenue.

Impairment

Assessments – goodwilL, long-lived assetS, AND EQUITY METHOD INVESTMENTS

We review goodwill at the reporting unit level

for impairment in the fourth quarter of each year or more frequently if events or changes in circumstances indicate that goodwill might

be impaired. Goodwill impairment is assessed by comparing the fair value of a reporting unit to the underlying carrying value of the reporting

unit's net assets, including goodwill. If a reporting unit's carrying amount exceeds its fair value, an impairment is recognized based

on that difference. The fair value of a reporting unit is determined using the estimated discounted future cash flows of the reporting

unit.

In addition to our review of goodwill, we evaluate

fixed assets and other long-lived assets for impairment whenever indicators of impairment exist. Indicators of impairment include the

bankruptcy of a significant customer, or the early termination, loss, renegotiation of the terms of, significant volume decrease in, or

delay in the implementation of, any significant production contract. If the sum of the undiscounted future cash flows expected to result

from the assets, without interest charges, is less than the carrying amount of the assets, an asset impairment may be recognized in the

consolidated financial statements. The amount of impairment to be recognized is calculated as the difference between the fair value and

carrying amount of the asset.

As of December 31, 2024, we had equity method

investments of $794 million. We monitor our investments for indicators of other-than-temporary declines in value on an ongoing basis in

accordance with U.S. GAAP. If we determine that an other-than-temporary decline in value has occurred, we recognize an impairment loss,

which is measured as the difference between the book value and the fair value of the investment. Fair value is generally determined using

an income approach based on discounted cash flows.

We believe that the impairment assessments for

goodwill, long-lived assets, and equity method investments contain "critical accounting estimates" because: (i) they are

subject to significant measurement uncertainty and are susceptible to change, which could materially impact our assessment for fair value,

as management is required to make forward-looking assumptions regarding the impact of improvement plans on current operations, in-sourcing

and other new business opportunities, program pricing and cost assumptions on current and future business, the timing of new program launches

and future forecasted production volumes, the appropriate discount rates (based on a weighted average cost of capital ranging from 11%

to 16% at December 31, 2024); and (ii) any resulting impairment loss could have a material impact on our consolidated net income

and on the amount of assets reported in our consolidated balance sheet.

Magna International Inc. Annual Report 2024 23

Warranty

We record product warranty costs, which include

product liability and recall costs. Under most customer agreements, we only account for existing or probable claims on product default

issues when amounts related to such issues are probable and reasonably estimable. For certain products, we record an estimate of future

warranty-related costs based on the terms of the specific customer agreements and/or the Company's warranty experience.

Product liability and recall provisions are established

based on our best estimate of the amounts necessary to settle existing claims. These estimates typically require assumptions from management

regarding: the number of units that may be returned; the cost of the product being replaced; labour to remove and replace the defective

part; and the customer's administrative costs relating to the recall. In making this estimate, judgement is also required as to the ultimate

negotiated sharing of the cost between us, the customer and, in some cases a supplier. Where applicable, insurance recoveries related

to such provisions are also recorded.

We monitor warranty activity on an ongoing basis

and revise our best estimate as necessary. Due to the uncertainty and potential volatility of the factors contributing to developing estimates

of the amounts necessary to settle existing claims, actual product liability costs could be materially different from our best estimate.

Income

Taxes

The determination of tax liabilities involves

dealing with uncertainties in the application of complex tax laws. Significant judgement and estimates are required in determining our