UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM S-8 REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

____________________

Markel Group Inc.

(Exact name of registrant as specified in its charter)

____________________

| | | | | | | | |

| Virginia | | 54-1959284 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

4521 Highwoods Parkway

Glen Allen, Virginia | | 23060-6148 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Costa Farms, LLC 401(k) Plan

(Full title of the plan)

Richard R. Grinnan

Senior Vice President, Chief Legal Officer and Secretary

4521 Highwoods Parkway

Glen Allen, Virginia 23060-6148

(804) 747-0136

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financing accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

EXPLANATORY NOTE

This Registration Statement on Form S-8, filed by Markel Group Inc., a Virginia corporation (the Registrant), registers 10,000 of the Registrant’s common shares, no par value per share, that may be acquired under the Costa Farms, LLC 401(k) Plan (the plan), plus an indeterminate amount of participation interests to be offered or sold pursuant to the plan. The plan sponsor, Costa Farms, LLC, is an indirect, majority-owned subsidiary of the Registrant. The Registrant’s common shares acquired under the plan will be purchased on behalf of the plan by an unaffiliated, third-party plan administrator, solely in open market transactions.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information called for in Part I of Form S-8 is not being filed with or included in this Form S-8 (by incorporation by reference or otherwise) in accordance with the rules and regulations of the Securities and Exchange Commission (the SEC, or the Commission). The documents containing the information called for in Part I of Form S-8, along with the information incorporated by reference under Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus for the Registration Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| | | | | |

| Item 3. | Incorporation of Documents by Reference. |

The following documents of the Registrant filed with the Commission are incorporated in this Registration Statement by reference:

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), after the date of this Registration Statement but prior to the filing of a post-effective amendment which indicates that all securities offered hereunder have been sold or which deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents.

| | | | | |

| Item 4. | Description of Securities. |

Not Applicable.

| | | | | |

| Item 5. | Interests of Named Experts and Counsel. |

Not Applicable.

| | | | | |

| Item 6. | Indemnification of Directors and Officers. |

Virginia law provides that, unless limited by its articles of incorporation, a corporation must indemnify a director or officer who was wholly successful, on the merits or otherwise, in the defense of any proceeding to which the director or officer was a party because the director or officer is or was a director or officer of the corporation against expenses incurred by the director or officer in connection with the proceeding.

Virginia law permits a corporation to indemnify, after a determination has been made that indemnification of the director or officer is permissible in the circumstances because the director or officer has met the following standard of conduct, an

individual made a party to a proceeding because the director or officer is or was a director or officer against liability incurred in the proceeding if the director or officer:

•conducted himself or herself in good faith;

•believed in the case of conduct in his or her official capacity with the corporation, that his or her conduct was in its best interests and in all other cases that his or her conduct was at least not opposed to its best interests; and

•in the case of any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful.

A Virginia corporation, however, may not indemnify a director or officer (i) in connection with a proceeding by or in the right of the corporation, except for expenses incurred in connection with the proceeding if it is determined that director or officer has met the relevant standard of conduct or (ii) in connection with any other proceeding charging improper personal benefit to the director or officer, whether or not involving action in the director’s or officer’s official capacity, in which the director or officer was adjudged liable on the basis that personal benefit was improperly received by the director or officer.

In addition, Virginia law permits a corporation to make any further indemnity, including indemnity with respect to a proceeding by or in the right of the corporation, and to make additional provision for advances and reimbursement of expenses, to any director or officer that may be authorized by the articles of incorporation or any bylaw made by the shareholders or any resolution adopted by the shareholders, except an indemnity against the director or officer’s willful misconduct or a knowing violation of the criminal law.

The Registrant’s articles of incorporation provide mandatory indemnification of directors and officers to the full extent permitted by Virginia law and for permissive indemnification of employees and agents to the same extent.

The Registrant maintains directors’ and officers’ liability insurance which may provide indemnification, including indemnification against liabilities under the Securities Act of 1933, to the Registrant’s directors and officers in certain circumstances.

Limitations on Director Liability

Virginia law provides that a director is not liable to the corporation, its shareholders, or any person asserting rights on behalf of the corporation or its shareholders for liabilities arising from a breach of, or failure to perform, any duty resulting solely from the director’s status as director, unless the person asserting liability proves that the breach or failure to perform was in violation of the director’s duty to discharge the director’s duties as a director, including the director’s duties as a member of a committee, in accordance with the director’s good faith business judgment of the best interests of the corporation, provided, that the director, unless the director has knowledge or information concerning the matter in question that makes reliance unwarranted, is entitled to rely on information, opinions, reports or statements, including financial statements and other financial data, if prepared or presented by:

•one or more officers or employees of the corporation whom the director believes, in good faith, to be reliable and competent in the matters presented;

•legal counsel, public accountants, or other persons as to matters the director believes, in good faith, are within the person's professional or expert competence; or

•a committee of the board of directors of which the director is not a member if the director believes, in good faith, that the committee merits confidence.

In addition, Virginia law provides that in any proceeding brought by or in the right of a corporation or brought by or on behalf of shareholders of the corporation, the damages assessed against a director or an officer arising out of a single transaction, occurrence or course of conduct shall not exceed the lesser of:

•the monetary amount, including the elimination of liability, specified in the articles of incorporation or, if approved by the shareholders, in the bylaws; or

•the greater of $100,000 or the amount of cash compensation received by the officer or director from the corporation during the twelve months immediately preceding the act or omission for which liability was imposed.

The Registrant’s articles of incorporation provide for the elimination of liability of directors and officers in every instance permitted under Virginia law. The liability of a director or an officer is not limited if the director or officer engaged in willful misconduct or a knowing violation of the criminal law or of any federal or state securities law, including any claim of unlawful insider trading or manipulation of the market for any security.

| | | | | |

| Item 7. | Exemption from Registration Claimed. |

Not Applicable.

The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (1)(i) and (1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(5) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in

the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Henrico, Commonwealth of Virginia, on November 15, 2024.

| | | | | | | | |

| MARKEL GROUP INC. |

| | |

| By: | | /s/ Brian J. Costanzo |

| | | Brian J. Costanzo

Chief Financial Officer |

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on November 15, 2024.

| | | | | |

| Signature | Title |

/s/ Steven A. Markel* Steven A. Markel | Chairman of the Board, Director |

/s/ Thomas S. Gayner Thomas S. Gayner | Chief Executive Officer, Director (Principal Executive Officer) |

/s/ Brian J. Costanzo Brian J. Costanzo | Chief Financial Officer

(Principal Financial Officer) |

/s/ Meade P. Grandis Meade P. Grandis | Chief Accounting Officer and Controller (Principal Accounting Officer) |

/s/ Mark M. Besca* Mark M. Besca | Director |

/s/ Lawrence A. Cunningham* Lawrence A. Cunningham | Director |

/s/ Greta J. Harris* Greta J. Harris | Director |

/s/ Morgan E. Housel* Morgan E. Housel | Director |

/s/ Diane Leopold* Diane Leopold | Director |

/s/ Anthony F. Markel* Anthony F. Markel | Director |

/s/ Harold L. Morrison, Jr* Harold L. Morrison, Jr. | Director |

/s/ Michael O'Reilly* Michael O'Reilly | Director |

/s/ A. Lynne Puckett* A. Lynne Puckett | Director |

*By: /s/ Richard R. Grinnan

Name: Richard R. Grinnan

Title: Attorney-in-Fact

Pursuant to the requirements of the Securities Act of 1933, the plan administrator of the Costa Farms, LLC 401(k) Plan has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Miami-Dade, State of Florida, on November 15, 2024.

| | | | | | | | |

| COSTA FARMS, LLC, as plan administrator of the |

| COSTA FARMS, LLC 401(k) PLAN |

| | |

| By: | | /s/ Arianna Cabrera de Oña |

| | | Arianna Cabrera de Oña SVP, Chief People Officer and General Counsel |

S-8

S-8

EX-FILING FEES

0001096343

MARKEL GROUP INC.

Fees to be Paid

0001096343

2024-11-15

2024-11-15

0001096343

1

2024-11-15

2024-11-15

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

MARKEL GROUP INC.

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Shares, with no par value

|

Other

|

10,000

|

$

1,656.655

|

$

16,566,550.00

|

0.0001531

|

$

2,536.34

|

|

Total Offering Amounts:

|

|

$

16,566,550.00

|

|

$

2,536.34

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

2,536.34

|

|

1

|

Note 1.a: Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the Securities Act), this registration statement on Form S-8 (the Registration Statement) also covers such indeterminate amount of additional securities that may be offered or sold pursuant to the terms of the Costa Farms, LLC 401(k) Plan that provide for a change in the amount or type of securities being offered or sold to prevent dilution as a result of stock splits, stock dividends or similar transactions. In addition, pursuant to Rule 416(c) under the Securities Act, this Registration Statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plan described above.

Note 1.b: Proposed Maximum Offering Price per Unit is estimated pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, solely for the purpose of calculating the registration fee, based on the average of the high and low prices per share of the Registrant's Common Shares on the New York Stock Exchange as of a specified date (November 8, 2024) within five business days of the date of filing of this Registration Statement.

|

|

|

| | | | | | | | | | | |

| | | Exhibit 23 |

KPMG LLP

Suite 2000

1021 East Cary Street

Richmond, VA 23219-4023 | | |

Consent of Independent Registered Public Accounting Firm

We consent to the use of our reports dated February 23, 2024, with respect to the consolidated financial statements of Markel Group Inc. and subsidiaries, and the effectiveness of internal control over financial reporting, incorporated herein by reference.

/s/ KPMG LLP

Richmond, Virginia

November 15, 2024

KPMG LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee.

POWER OF ATTORNEY

The undersigned officers and directors of Markel Group Inc. (the Company) hereby appoint Thomas S. Gayner, Michael R. Heaton, Richard R. Grinnan and Brian J. Costanzo (each with full power to act alone), as their true and lawful attorneys-in-fact, and grant unto each of them the authority in their name and on their behalf to execute and file (individually and in the capacity stated below) any documents relating to the filing of any Registration Statement on Form S-8, and the registration by the Company of 10,000 of the Registrant's common shares, no par value, that may be acquired under the Costa Farms, LLC 401(k) Plan (the Plan), and any and all amendments (including post-effective amendments) or supplements thereto, with all exhibits and documents required to be filed in connection therewith. The undersigned further grants unto each of them full power and authority to perform each and every act necessary in order to accomplish the foregoing registration as fully as the undersigned might do.

IN WITNESS WHEREOF, each of the undersigned has signed this power of attorney this 13th day of November, 2024.

| | | | | |

/s/ Thomas S. Gayner Thomas S. Gayner, Chief Executive Officer and Director (Principal Executive Officer) | /s/ Morgan E. Housel Morgan E. Housel, Director |

/s/ Brian J. Costanzo Brian J. Costanzo, Chief Financial Officer (Principal Financial Officer) | /s/ Diane Leopold Diane Leopold, Director |

/s/ Meade P. Grandis Meade P. Grandis, Chief Accounting Officer and Controller (Principal Accounting Officer) | /s/ Anthony F. Markel Anthony F. Markel, Director |

/s/ Steven A. Markel Steven A. Markel, Chairman of the Board and Director | /s/ Harold L. Morrison, Jr. Harold L. Morrison, Jr., Director |

/s/ Mark M. Besca Mark M. Besca, Director | /s/ Michael O’Reilly Michael O’Reilly, Director |

/s/ Lawrence A. Cunningham Lawrence A. Cunningham, Director | /s/ A. Lynne Puckett A. Lynne Puckett, Director |

/s/ Greta J. Harris Greta J. Harris, Director | |

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings - Offering: 1

|

Nov. 15, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Shares, with no par value

|

| Amount Registered | shares |

10,000

|

| Proposed Maximum Offering Price per Unit |

1,656.655

|

| Maximum Aggregate Offering Price |

$ 16,566,550.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 2,536.34

|

| Offering Note |

Note 1.a: Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the Securities Act), this registration statement on Form S-8 (the Registration Statement) also covers such indeterminate amount of additional securities that may be offered or sold pursuant to the terms of the Costa Farms, LLC 401(k) Plan that provide for a change in the amount or type of securities being offered or sold to prevent dilution as a result of stock splits, stock dividends or similar transactions. In addition, pursuant to Rule 416(c) under the Securities Act, this Registration Statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plan described above.

Note 1.b: Proposed Maximum Offering Price per Unit is estimated pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, solely for the purpose of calculating the registration fee, based on the average of the high and low prices per share of the Registrant's Common Shares on the New York Stock Exchange as of a specified date (November 8, 2024) within five business days of the date of filing of this Registration Statement.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

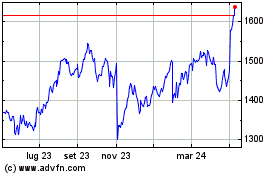

Grafico Azioni Markel (NYSE:MKL)

Storico

Da Nov 2024 a Dic 2024

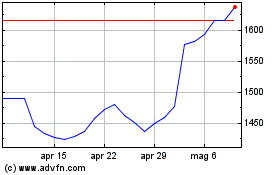

Grafico Azioni Markel (NYSE:MKL)

Storico

Da Dic 2023 a Dic 2024