NCL Corporation Ltd. Announces Pricing of $315,000,000 of Senior Notes

04 Settembre 2024 - 12:08AM

NCL Corporation Ltd. (“NCLC”), a subsidiary of Norwegian Cruise

Line Holdings Ltd. (NYSE: NCLH), announced today that it has priced

$315.0 million aggregate principal amount of its 6.250% senior

notes due 2030 (the “Notes”), which were offered in a private

offering (the “Notes Offering”) that is exempt from the

registration requirements of the Securities Act of 1933, as amended

(the “Securities Act”).

The offering of the Notes is expected to close

on September 17, 2024, subject to customary closing conditions. We

intend to use the net proceeds from the Notes Offering, together

with cash on hand, to redeem $315.0 million aggregate principal

amount of the 3.625% Senior Notes due 2024 (the “2024 Senior

Notes”), including to pay any accrued and unpaid interest thereon.

The redemption of the 2024 Senior Notes will be conditioned upon

the consummation of the Notes Offering.

The Notes are being offered only to persons

reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act, and outside the

United States, only to non-U.S. investors pursuant to Regulation S.

The Notes will not be registered under the Securities Act or the

securities laws of any state and may not be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements of the Securities Act and applicable

state laws.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any security and shall

not constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale would be unlawful. This

press release also shall not constitute an offer to purchase, a

solicitation of an offer to sell, or notice of redemption with

respect to the 2024 Senior Notes. This press release is being

issued pursuant to and in accordance with Rule 135c under the

Securities Act.

Cautionary Statement Concerning

Forward-Looking Statements

Some of the statements, estimates or projections

contained in this press release are “forward-looking statements”

within the meaning of the U.S. federal securities laws intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical facts contained in this press

release, including statements regarding the Notes Offering and the

use of proceeds therefrom, may be forward-looking statements. Many,

but not all, of these statements can be found by looking for words

like “expect,” “anticipate,” “goal,” “project,” “plan,” “believe,”

“seek,” “will,” “may,” “forecast,” “estimate,” “intend,” “future”

and similar words. Forward-looking statements do not guarantee

future performance and may involve risks, uncertainties and other

factors which could cause our actual results, performance or

achievements to differ materially from the future results,

performance or achievements expressed or implied in those

forward-looking statements. For a discussion of these risks,

uncertainties and other factors, please refer to the factors set

forth under the sections entitled “Risk Factors” and “Cautionary

Statement Concerning Forward-Looking Statements” in our most

recently filed Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q and subsequent filings with the Securities and Exchange

Commission. These factors are not exhaustive and new risks emerge

from time to time. There may be additional risks that we consider

immaterial or which are unknown. Such forward-looking statements

are based on our current beliefs, assumptions, expectations,

estimates and projections regarding our present and future business

strategies and the environment in which we expect to operate in the

future. These forward-looking statements speak only as of the date

made. We expressly disclaim any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statement to reflect any change in our expectations with regard

thereto or any change of events, conditions or circumstances on

which any such statement was based, except as required by law.

Investor Relations & Media

Contact

Sarah Inmon(786)

812-3233InvestorRelations@nclcorp.com

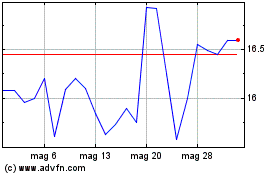

Grafico Azioni Norwegian Cruise Line (NYSE:NCLH)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Norwegian Cruise Line (NYSE:NCLH)

Storico

Da Dic 2023 a Dic 2024