Visa Expands Its Digital Wallet Capabilities and Availability

12 Febbraio 2024 - 1:00PM

Business Wire

New tokenization and regional expansion deliver

a competitive edge, while accelerating virtual card adoption

Visa (NYSE:V), a global leader in digital payments, announced

extended digital wallet capabilities within Visa Commercial Pay, a

suite of B2B payment solutions built in partnership with Conferma

Pay, the world’s foremost provider of virtual payments technology,

to revolutionize how businesses manage transactions globally.

The innovation enables financial institutions to add virtual

corporate cards into an employees’ digital wallet – including

third-party wallets such as Apple Pay and Google Pay – to enhance

convenience, security and flexibility for corporate users. It

coincides with a significant expansion of Visa Commercial Pay

across the Latin America & Caribbean region, reinforcing Visa’s

commitment to, and leadership in, enabling streamlined, secure and

efficient B2B payments in a locality known for its diverse and

dynamic business landscape.

Visa Commercial Pay includes virtual card B2B payment solutions

developed to improve cashflow for businesses and reduce outdated

manual processes. Since its launch in 2020, it has helped

corporates move away from traditional business payment methods to

more automated and secure processes. Visa’s continued innovation

and leadership in virtual card solutions comes as a recent report

from Juniper Research found that by 2028, global virtual card spend

will have increased by 355%, up from $3.1 trillion in 2023.1

The new and improved Visa Commercial Pay Mobile will provide a

commercial token account with configured payment controls allowing

for an efficient payment experience across both Point of Sale and

CNP payment methods. The transformative approach utilizes advanced

tokenization technology to minimize the risk of fraud and provide a

secure payment environment, while enabling businesses to initiate

transactions seamlessly, enhancing overall financial agility.

“We’re empowering businesses with on-demand and secure payments,

giving them the flexibility and mobility of virtual, mobile

transactions, which is essential in today’s dynamic business

environment,” said Gloria Colgan, Senior Vice President, Global

Product at Visa Commercial Solutions. “Our solutions are designed

to meet the needs of enterprises across the world, and in expanding

to the Latin America & Caribbean region, we’re providing these

businesses with the tools to thrive in an increasingly digital

business landscape. Alongside our partners Conferma Pay, we’re

delighted to be taking our enhanced capabilities to customers

globally.”

Regions Bank will be the first Visa collaborator to roll out the

enhanced digital wallet capability for its Treasury Management

customers. Regions operates in high-growth markets across the

Southeast, the Midwest and Texas, with Commercial Banking clients

including a wide range of employers, each with its own unique

payments and cash-flow needs.

“A superior client experience is at the heart of our value

proposition for business clients,” said David Lapaglia, head of

Commercial Card Product and Strategy for Regions. “Visa Commercial

Pay is the ideal complement to our already-enhanced selection of

products and services. Visa understands financial-service providers

deliver greater value when they give clients more convenience,

along with more intuitive, time-saving solutions. We share in that

vision, and by building on our digital wallet capabilities, Regions

is reinforcing its commitment to helping our business clients grow

and thrive.”

Following its successful launch in the Asia-Pacific, Europe,

Middle East & Africa and North America regions, Visa Commercial

Pay will be available for customers in Latin American &

Caribbean later in 2024.

For more information about Visa Commercial Pay, please email

VisaCommercialPay@visa.com.

About Visa Inc.

Visa (NYSE: V) is a world leader in digital payments,

facilitating transactions between consumers, merchants, financial

institutions and government entities across more than 200 countries

and territories. Our mission is to connect the world through the

most innovative, convenient, reliable and secure payments network,

enabling individuals, businesses and economies to thrive. We

believe that economies that include everyone everywhere, uplift

everyone everywhere and see access as foundational to the future of

money movement. Learn more at Visa.com.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $152 billion in

assets, is a member of the S&P 500 Index and is one of the

nation’s largest full-service providers of consumer and commercial

banking, wealth management, and mortgage products and services.

Regions serves customers across the South, Midwest and Texas, and

through its subsidiary, Regions Bank, operates approximately 1,250

banking offices and more than 2,000 ATMs. Regions Bank is an Equal

Housing Lender and Member FDIC. Additional information about

Regions and its full line of products and services can be found at

www.regions.com.

1

https://www.juniperresearch.com/press/virtual-card-spend-to-reach-13-8tn/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240209399871/en/

David Thum dthum@visa.com

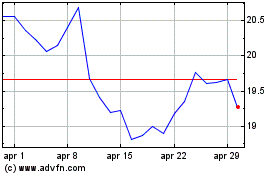

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Dic 2023 a Dic 2024