Raises Fiscal Year 2024 Outlook on Key

Metrics

SharkNinja, Inc. (“SharkNinja” or the “Company”) (NYSE: SN), a

global product design and technology company, today announced its

financial results for the first quarter ended March 31, 2024.

Highlights for the First Quarter 2024 as compared to the

First Quarter 2023

- Net sales increased 24.7% to $1,066.2 million and Adjusted Net

Sales increased 27.6% to $1,066.2 million.

- Gross margin and Adjusted Gross Margin increased 260 and 210

basis points, respectively.

- Net income increased 25.9% to $109.6 million. Adjusted Net

Income increased 24.8% to $148.6 million

- Adjusted EBITDA increased 29.5% to $230.5 million, or 21.6% of

Adjusted Net Sales.

“SharkNinja is off to a strong start in 2024 with outstanding

business performance and balanced growth in the first quarter,

while driving continued momentum into the second quarter. We are

gaining share in our existing product categories and geographies,

we have a robust pipeline of innovative products in new categories,

and we see significant opportunity to grow in international

markets. Based on the strength of our performance so far, we are

raising our full year outlook. Looking forward, we are confident in

the power of our three-pillar growth strategy to deliver

sustainable, profitable long-term growth and shareholder value,”

said Mark Barrocas, Chief Executive Officer.

Three Months Ended March 31, 2024

Net sales increased 24.7% to $1,066.2 million, compared to

$855.3 million during the same period last year. Adjusted Net Sales

increased 27.6% to $1,066.2 million, compared to $835.6 million

during the same period last year, or 26.1% on a constant currency

basis. The increase in net sales and Adjusted Net Sales resulted

from growth in each of our four major product categories of Food

Preparation Appliances, Cooking and Beverage Appliances, Cleaning

Appliances and Other, which includes beauty and home

environment..

- Cleaning Appliances net sales increased by $7.1 million, or

1.7%, to $421.9 million, compared to $414.9 million in the prior

year quarter. Adjusted Net Sales of Cleaning Appliances increased

by $23.4 million, or 5.9%, from $398.5 million to $421.9 million,

driven by the extractor and robotics sub-categories.

- Cooking and Beverage Appliances net sales increased by $73.0

million, or 28.4%, to $329.6 million, compared to $256.7 million in

the prior year quarter. Adjusted Net Sales of Cooking and Beverage

Appliances increased by $74.4 million, or 29.2%, from $255.2

million to $329.6 million, driven by growth in Europe, specifically

in the United Kingdom, where we strengthened our leading market

position. Our global growth was also supported by the success of

the outdoor grill and outdoor oven across both the US and European

markets.

- Food Preparation Appliances net sales increased by $87.2

million, or 74.0%, to $205.0 million, compared to $117.8 million in

the prior year quarter. Adjusted Net Sales of Food Preparation

Appliances increased by $89.0 million, or 76.7%, from $116.1

million to $205.0 million, driven by strong sales of our ice cream

makers and compact blenders, specifically our portable

blenders.

- Net sales and Adjusted Net Sales in the Other category

increased by $43.7 million, or 66.4%, to $109.6 million, compared

to $65.9 million in the prior year quarter, primarily driven by

continued strength of haircare products within the beauty category,

increased sales in the air purifier sub-category resulting from

product innovations, and the successful new product launch of our

FlexBreeze fans.

Gross profit increased 31.5% to $526.6 million, or 49.4% of net

sales, compared to $400.5 million, or 46.8% of net sales, in the

first quarter of 2023. Adjusted Gross Profit increased 33.2% to

$541.7 million, or 50.8% of Adjusted Net Sales, compared to $406.8

million, or 48.7% of Adjusted Net Sales in the first quarter of

2023. The increase in gross margin and Adjusted Gross Margin of 260

and 210 basis points, respectively, was primarily driven by

continued supply chain tailwinds and cost optimization efforts.

Research and development expenses increased 18.5% to $69.6

million, or 6.5% of net sales, compared to $58.7 million, or 6.9%

of net sales, in the prior year quarter. This increase was

primarily driven by incremental personnel-related expenses of $8.7

million driven by increased headcount to support new product

categories and new market expansion, and includes an increase of

$3.3 million in share-based compensation.

Sales and marketing expenses increased 41.1% to $214.6 million,

or 20.1% of net sales, compared to $152.1 million, or 17.8% of net

sales, in the first quarter of 2023. This increase was primarily

attributable to increases of $26.4 million in advertising-related

expenses; an increase of $19.0 million in delivery and distribution

costs driven by higher volumes, particularly in our DTC business;

and $14.1 million in personnel-related expenses to support new

product launches and expansion into new markets, which includes an

incremental $2.5 million of share-based compensation.

General and administrative expenses increased 30.5% to $87.5

million, or 8.2% of net sales, compared to $67.1 million, or 7.8%

of net sales, in the prior year quarter. This increase was

primarily driven by an increase in personnel-related expenses of

$15.9 million, primarily due to a $12.8 million increase in

share-based compensation; an increase of $8.4 million in legal

fees; an increase of $5.3 million in professional and consulting

fees; offset by a decrease in transaction costs related to the

separation and distribution from JS Global and secondary offering

of $17.1 million.

Operating income increased 26.3% to $154.9 million, or 14.5% of

net sales, compared to $122.6 million, or 14.3% of net sales,

during the prior year quarter. Adjusted Operating Income increased

26.9% to $202.2 million, or 19.0% of Adjusted Net Sales, compared

to $159.3 million, or 19.1% of Adjusted Net Sales, in the first

quarter of 2023.

Net income increased 25.9% to $109.6 million, or 10.3% of net

sales, compared to $87.1 million, or 10.2% of net sales, in the

prior year quarter. Net income per diluted share increased 23.8% to

$0.78, compared to $0.63 in the prior year quarter.

Adjusted Net Income increased 24.8% to $148.6 million, or 13.9%

of Adjusted Net Sales, compared to $119.0 million, or 14.2% of

Adjusted Net Sales, in the prior year quarter. Adjusted Net Income

per diluted share increased 23.3% to $1.06, compared to $0.86 in

the prior year quarter.

Adjusted EBITDA increased 29.5% to $230.5 million, or 21.6% of

Adjusted Net Sales, compared to $178.0 million, or 21.3% of

Adjusted Net Sales in the prior year quarter.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents decreased to $131.9 million, compared

to $154.1 million as of December 31, 2023.

Inventories increased 7.2% to $750.0 million, compared to $699.7

million as of December 31, 2023.

Total debt, excluding unamortized deferred financing costs, was

$799.9 million, compared to $804.9 million as of December 31, 2023.

The existing credit facility provides for a $810.0 million term

loan and a $500.0 million revolving credit facility.

Fiscal 2024 Outlook

For fiscal year 2024, SharkNinja expects:

- Net sales to increase 10.0% to 12.0% and Adjusted Net Sales to

increase between 12.0% and 14.0% compared to the prior year.

- Adjusted Net Income per diluted share between $3.66 and $3.82,

reflecting a 14% to 19% increase compared to the prior year.

- Adjusted EBITDA between $840 million and $870 million,

reflecting a 17% to 21% increase compared to the prior year.

- A GAAP effective tax rate of approximately 24% to 25%.

- Diluted weighted average shares outstanding of approximately

141 million.

- Capital expenditures of $160 million to $180 million primarily

to support investments in new product launches, technology, and

incremental investments in tooling to support the diversification

of our sourcing outside of China.

Conference Call Details

A conference call to discuss the first quarter 2024 financial

results is scheduled for today, May 9, 2024, at 8:30 a.m. Eastern

Time. A live audio webcast of the conference call will be available

online at http://ir.sharkninja.com. Investors and analysts

interested in participating in the live call are invited to dial

1-646-307-1963 or 1-800-715-9871 and enter confirmation code

6097407. The webcast will be archived and available for replay.

About SharkNinja, Inc.

SharkNinja, Inc. (NYSE: SN) is a global product design and

technology company, with a diversified portfolio of 5-star rated

lifestyle solutions that positively impact people’s lives in homes

around the world. Powered by two trusted, global brands, Shark and

Ninja, the company has a proven track record of bringing disruptive

innovation to market, and developing one consumer product after

another has allowed SharkNinja to enter multiple product

categories, driving significant growth and market share gains.

Headquartered in Needham, Massachusetts with more than 3,000

associates, the company’s products are sold at key retailers,

online and offline, and through distributors around the world. For

more information, please visit SharkNinja.com and follow

@SharkNinja.

Forward-looking statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our future

business, financial condition, results of operations and prospects

and Fiscal 2024 outlook. These statements are often, but not

always, made through the use of words or phrases such as “may,”

“should,” “could,” “predict,” “potential,” “believe,” “will likely

result,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would” and “outlook,”

or the negative version of those words or phrases or other

comparable words or phrases of a future or forward-looking nature.

These forward-looking statements are not statements of historical

fact, and are based on current expectations, estimates and

projections about our industry as well as certain assumptions made

by management, many of which, by their nature, are inherently

uncertain and beyond our control. These forward-looking statements

are subject to a number of known and unknown risks, uncertainties

and assumptions, which you should consider and read carefully,

including but not limited to:

- our ability to maintain and strengthen our brands to generate

and maintain ongoing demand for our products;

- our ability to commercialize a continuing stream of new

products and line extensions that create demand;

- our ability to effectively manage our future growth;

- general economic conditions and the level of discretionary

consumer spending;

- our ability to expand into additional consumer markets;

- our ability to maintain product quality and product performance

at an acceptable cost;

- our ability to compete with existing and new competitors in our

markets;

- problems with, or loss of, our supply chain or suppliers, or an

inability to obtain raw materials;

- the risks associated with doing business globally;

- inflation, changes in the cost or availability of raw

materials, energy, transportation and other necessary supplies and

services;

- our ability to hire, integrate and retain highly skilled

personnel;

- our ability to maintain, protect and enhance our intellectual

property;

- our ability to securely maintain consumer and other third-party

data;

- our ability to comply with ongoing regulatory

requirements;

- the increased expenses associated with being a public

company;

- our status as a “controlled company” within the meaning of the

rules of NYSE;

- our ability to achieve some or all of the anticipated benefits

of the separation; and

- the payment of any declared dividends.

This list of factors should not be construed as exhaustive and

should be read in conjunction with the other cautionary statements

that are included in this press release. We operate in a very

competitive and rapidly changing environment. New risks emerge from

time to time. It is not possible for us to predict all risks, nor

can we assess the impact of all factors on our business or the

extent to which any factor or combination of factors may cause

actual results to differ materially from those contained in any

forward-looking statements we may make. In light of these risks,

uncertainties and assumptions, the future events and trends

discussed in this press release, and our future levels of activity

and performance, may not occur and actual results could differ

materially and adversely from those described or implied in the

forward-looking statements. As a result, you should not regard any

of these forward-looking statements as a representation or warranty

by us or any other person or place undue reliance on any such

forward-looking statements. Any forward-looking statement speaks

only as of the date on which it is made, and we do not undertake

any obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law. In addition,

statements that contain “we believe” and similar statements reflect

our beliefs and opinions on the relevant subject. These statements

are based on information available to us as of the date of this

press release. While we believe that this information provides a

reasonable basis for these statements, this information may be

limited or incomplete. Our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all relevant information. These statements are

inherently uncertain, and investors are cautioned not to unduly

rely on these statements. We qualify all of our forward-looking

statements by the cautionary statements contained in this press

release.

SHARKNINJA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share data)

(unaudited)

As of

March 31, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

131,894

$

154,061

Accounts receivable, net

780,557

985,172

Inventories

750,032

699,740

Prepaid expenses and other current

assets

61,350

58,311

Total current assets

1,723,833

1,897,284

Property and equipment, net

168,418

166,252

Operating lease right-of-use assets

137,524

63,333

Intangible assets, net

474,495

477,816

Goodwill

834,049

834,203

Deferred tax assets, noncurrent

7

12

Other assets, noncurrent

71,377

48,170

Total assets

$

3,409,703

$

3,487,070

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

409,371

$

459,651

Accrued expenses and other current

liabilities

412,141

620,333

Tax payable

45,088

20,991

Current portion of long-term debt

29,219

24,157

Total current liabilities

895,819

1,125,132

Long-term debt

765,647

775,483

Operating lease liabilities,

noncurrent

139,994

63,043

Deferred tax liabilities, noncurrent

6,391

16,500

Other liabilities, noncurrent

28,282

28,019

Total liabilities

1,836,133

2,008,177

Shareholders’ equity:

Ordinary shares, $0.0001 par value per

share, 1,000,000,000 shares authorized; 139,818,810 and 139,083,369

shares issued and outstanding as of March 31, 2024 and December 31,

2023, respectively

14

14

Additional paid-in capital

996,159

1,009,590

Retained earnings

579,931

470,319

Accumulated other comprehensive loss

(2,534

)

(1,030

)

Total shareholders’ equity

1,573,570

1,478,893

Total liabilities and shareholders’

equity

$

3,409,703

$

3,487,070

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended March

31,

2024

2023

Net sales(1)

$

1,066,228

$

855,282

Cost of sales

539,611

454,739

Gross profit

526,617

400,543

Operating expenses:

Research and development

69,596

58,725

Sales and marketing

214,568

152,120

General and administrative

87,511

67,068

Total operating expenses

371,675

277,913

Operating income

154,942

122,630

Interest expense, net

(14,722

)

(8,489

)

Other income (expense), net

3,248

(2,780

)

Income before income taxes

143,468

111,361

Provision for income taxes

33,856

24,265

Net income

$

109,612

$

87,096

Net income per share, basic

$

0.79

$

0.63

Net income per share, diluted

$

0.78

$

0.63

Weighted-average number of shares used in

computing net income per share, basic

139,448,556

138,982,872

Weighted-average number of shares used in

computing net income per share, diluted

140,703,025

138,982,872

(1) Net sales in our product categories

were as follows:

Three Months Ended March

31,

($ in thousands)

2024

2023

Cleaning Appliances

$

421,920

$

414,869

Cooking and Beverage Appliances

329,642

256,682

Food Preparation Appliances

205,036

117,849

Other

109,630

65,882

Total net sales

$

1,066,228

$

855,282

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended March

31,

2024

2023

Cash flows from operating

activities:

Net income

$

109,612

$

87,096

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

27,817

22,754

Share-based compensation

19,426

848

Provision for credit losses

3,004

744

Non-cash lease expense

4,524

3,881

Deferred income taxes, net

(10,014

)

(5,115

)

Other

508

202

Changes in operating assets and

liabilities:

Accounts receivable

198,729

(8,813

)

Inventories

(52,356

)

40,644

Prepaid expenses and other assets

(25,233

)

74,452

Accounts payable

(48,242

)

(54,003

)

Tax payable

24,097

6,764

Operating lease liabilities

(797

)

(4,480

)

Accrued expenses and other liabilities

(207,193

)

(75,212

)

Net cash provided by operating

activities

43,882

89,762

Cash flows from investing

activities:

Purchase of property and equipment

(23,572

)

(21,655

)

Purchase of intangible asset

(2,835

)

(2,288

)

Capitalized internal-use software

development

(479

)

(333

)

Cash receipts on beneficial interest in

sold receivables

—

16,777

Other investing activities, net

—

(300

)

Net cash used in investing activities

(26,886

)

(7,799

)

Cash flows from financing

activities:

Repayment of debt

(5,063

)

(37,500

)

Distribution paid to Former Parent

—

(60,283

)

Recharge from Former Parent for

share-based compensation

—

(848

)

Net ordinary shares withheld for taxes

upon issuance of restricted stock units

(32,857

)

—

Net cash used in financing activities

(37,920

)

(98,631

)

Effect of exchange rates changes on

cash

(1,243

)

5,349

Net decrease in cash, cash equivalents,

and restricted cash

(22,167

)

(11,319

)

Cash, cash equivalents, and restricted

cash at beginning of period

154,061

218,770

Cash, cash equivalents, and restricted

cash at end of period

$

131,894

$

207,451

Non-GAAP Financial Measures

In addition to the measures presented in our consolidated

financial statements, we regularly review other financial measures,

defined as non-GAAP financial measures by the SEC, to evaluate our

business, measure our performance, identify trends, prepare

financial forecasts, and make strategic decisions.

The key non-GAAP financial measures we consider are Adjusted Net

Sales, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted

Operating Income, Adjusted Net Income, Adjusted Net Income Per

Share, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, and

Adjusted Net Sales growth on a constant currency basis. These

non-GAAP financial measures are used by both management and our

Board, together with comparable GAAP information, in evaluating our

current performance and planning our future business activities.

These non-GAAP financial measures provide supplemental information

regarding our operating performance on a non-GAAP basis that

excludes certain gains, losses and charges of a non-cash nature or

which occur relatively infrequently and/or which management

considers to be unrelated to our core operations and excludes the

financial results from our former Japanese subsidiary, SharkNinja

Co., Ltd. (“SNJP”), and our Asia Pacific Region and Greater China

("APAC") distribution channels, both of which were transferred to

JS Global Lifestyle Company Limited (“JS Global”) concurrently with

the separation (the “Divestitures”), as well as the cost of sales

from (i) inventory markups that were eliminated as a result of the

transition of certain product procurement functions from a

subsidiary of JS Global to SharkNinja concurrently with the

separation and (ii) costs related to the transitional Sourcing

Services Agreement with JS Global that was entered into in

connection with the separation (collectively, the “Product

Procurement Adjustment”). Management believes that tracking and

presenting these non-GAAP financial measures provides management

and the investment community with valuable insight into our ongoing

core operations, our ability to generate cash and the underlying

business trends that are affecting our performance. We believe that

these non-GAAP measures, when used in conjunction with our GAAP

financial information, also allow investors to better evaluate our

financial performance in comparison to other periods and to other

companies in our industry and to better understand and interpret

the results of the ongoing business following the separation and

distribution. These non-GAAP financial measures should not be

viewed as a substitute for our financial results calculated in

accordance with GAAP and you are cautioned that other companies may

define these non-GAAP financial measures differently.

SharkNinja does not provide a reconciliation of forward-looking

Adjusted Net Income and Adjusted EBITDA to GAAP net income because

such reconciliations are not available without unreasonable

efforts. The is due to the inherent difficulty in forecasting with

reasonable certainty certain amounts that are necessary for such

reconciliations, including, in particular, the realized and

unrealized foreign currency gains or losses reported within other

expense. For the same reasons, we are unable to forecast with

reasonable certainty all deductions and additions needed in order

to provide forward-looking GAAP net income at this time. The amount

of these deductions and additions may be material, and, therefore,

could result in forward-looking GAAP net income being materially

different or less than forward-looking Adjusted Net Income and

Adjusted EBITDA. See “Forward-looking statements” above.

We define Adjusted Net Sales as net sales as adjusted to exclude

certain items that we do not consider indicative of our ongoing

operating performance following the separation, including net sales

from our Divestitures. We believe that Adjusted Net Sales is an

appropriate measure of our performance because it eliminates the

impact of our Divestitures that do not relate to the ongoing

performance of our business.

The following table reconciles Adjusted Net Sales to the most

comparable GAAP measure, net sales, for the periods presented:

Three Months Ended March

31,

($ in thousands, except %)

2024

2023

Net sales

$

1,066,228

$

855,282

Divested subsidiary net sales

adjustment(1)

—

(19,649

)

Adjusted Net Sales(2)

$

1,066,228

$

835,633

(1)

Adjusted for net sales from SNJP and the

APAC distribution channels for the three months ended March 31,

2024 and 2023, as if such Divestitures occurred on January 1,

2023.

(2)

The following tables reconcile Adjusted

Net Sales to net sales per product category, for the periods

presented:

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

($ in thousands, except %)

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Cleaning appliances

$

421,920

$

—

$

421,920

$

414,869

$

(16,377

)

$

398,492

Cooking appliances

329,642

—

329,642

256,682

(1,485

)

255,197

Food Preparation Appliances

205,036

—

205,036

117,849

(1,787

)

116,062

Other

109,630

—

109,630

65,882

—

65,882

Total net sales

$

1,066,228

$

—

$

1,066,228

$

855,282

$

(19,649

)

$

835,633

We define Adjusted Gross Profit as gross profit as adjusted to

exclude certain items that we do not consider indicative of our

ongoing operating performance following the separation, including

the net sales and cost of sales from our Divestitures and the cost

of sales from the Product Procurement Adjustment. We define

Adjusted Gross Margin as Adjusted Gross Profit divided by Adjusted

Net Sales. We believe that Adjusted Gross Profit and Adjusted Gross

Margin are appropriate measures of our operating performance

because each eliminates the impact our Divestitures and certain

other adjustments that do not relate to the ongoing performance of

our business.

The following table reconciles Adjusted Gross Profit and

Adjusted Gross Margin to the most comparable GAAP measure, gross

profit and gross margin, respectively, for the periods

presented:

Three Months Ended March

31,

($ in thousands, except %)

2024

2023

Net sales

$

1,066,228

$

855,282

Cost of sales

(539,611

)

(454,739

)

Gross profit

526,617

400,543

Gross margin %

49.4

%

46.8

%

Divested subsidiary net sales

adjustment(1)

—

(19,649

)

Divested subsidiary cost of sales

adjustment(2)

—

13,027

Product Procurement Adjustment(3)

15,098

12,871

Adjusted Gross Profit

$

541,715

$

406,792

Adjusted Net Sales

$

1,066,228

$

835,633

Adjusted Gross Margin

50.8

%

48.7

%

(1)

Adjusted for net sales from SNJP and the

APAC distribution channels for the three months ended March 31,

2024 and 2023, as if such Divestitures occurred on January 1,

2023.

(2)

Adjusted for cost of sales from SNJP and

the APAC distribution channels for the three months ended March 31,

2024 and 2023, as if such Divestitures occurred on January 1,

2023.

(3)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SharkNinja (Hong Kong) Company Limited (“SNHK”), and

no longer purchase inventory from a purchasing office wholly owned

by JS Global. Thus, the markup on all inventory purchased

subsequent to the separation is completely eliminated in

consolidation. As a result of the separation, we pay JS Global a

sourcing service fee to provide value-added sourcing services on a

transitional basis under a Sourcing Services Agreement.

We define Adjusted Operating Income as operating income

excluding (i) share-based compensation, (ii) certain litigation

costs, (iii) amortization of certain acquired intangible assets,

(iv) certain transaction-related costs and (v) certain items that

we do not consider indicative of our ongoing operating performance

following the separation, including operating income from our

Divestitures and cost of sales from our Product Procurement

Adjustment.

The following table reconciles Adjusted Operating Income to the

most comparable GAAP measure, operating income, for the periods

presented:

Three Months Ended March

31,

($ in thousands)

2024

2023

Operating income

$

154,942

$

122,630

Share-based compensation(1)

19,426

848

Litigation costs(2)

6,491

174

Amortization of acquired intangible

assets(3)

4,897

4,897

Transaction-related costs(4)

1,342

18,468

Product Procurement Adjustment(5)

15,098

12,871

Divested subsidiary operating income

adjustment(6)

—

(553

)

Adjusted Operating Income

$

202,196

$

159,335

(1)

Represents non-cash expense related to

restricted stock unit awards issued from the SharkNinja and JS

Global equity incentive plans.

(2)

Represents litigation costs incurred for

certain patent infringement claims and false advertising claims

against us.

(3)

Represents amortization of acquired

intangible assets that we do not consider normal recurring

operating expenses, as the intangible assets relate to JS Global’s

acquisition of our business. We exclude amortization charges for

these acquisition-related intangible assets for purposes of

calculating Adjusted Operating Income, although revenue is

generated, in part, by these intangible assets, to eliminate the

impact of these non-cash charges that are significantly impacted by

the timing and valuation of JS Global’s acquisition of our

business, as well as the inherent subjective nature of purchase

price allocations.

(4)

Represents certain costs incurred related

to the separation and distribution from JS Global and the secondary

offering transactions.

(5)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SNHK, and no longer purchase inventory from a

purchasing office wholly owned by JS Global. Thus, the markup on

all inventory purchased subsequent to the separation is completely

eliminated in consolidation. As a result of the separation, we pay

JS Global a sourcing service fee to provide value-added sourcing

services on a transitional basis under a Sourcing Services

Agreement.

(6)

Adjusted for operating income from SNJP

and the APAC distribution channels for the three months ended March

31, 2024 and 2023, as if such Divestitures occurred on January 1,

2023.

We define Adjusted Net Income as net income excluding (i)

share-based compensation, (ii) certain litigation costs, (iii)

foreign currency gains and losses, net, (iv) amortization of

certain acquired intangible assets, (v) certain transaction-related

costs, (vi) certain items that we do not consider indicative of our

ongoing operating performance following the separation, including

net income from our Divestitures and cost of sales from our Product

Procurement Adjustment and (vii) the tax impact of the adjusted

items.

Adjusted Net Income Per Share is defined as Adjusted Net Income

divided by the diluted weighted average number of ordinary

shares.

The following table reconciles Adjusted Net Income and Adjusted

Net Income Per Share to the most comparable GAAP measures, net

income and net income per share, diluted, respectively, for the

periods presented:

Three Months Ended March

31,

($ in thousands, except share and per

share amounts)

2024

2023

Net income

$

109,612

$

87,096

Share-based compensation(1)

19,426

848

Litigation costs(2)

6,491

174

Foreign currency losses, net(3)

2,167

4,149

Amortization of acquired intangible

assets(4)

4,897

4,897

Transaction-related costs(5)

1,342

18,468

Product Procurement Adjustment(6)

15,098

12,871

Tax impact of adjusting items(7)

(10,476

)

(9,109

)

Divested subsidiary net income

adjustment(8)

—

(395

)

Adjusted Net Income

$

148,557

$

118,999

Net income per share, diluted

$

0.78

$

0.63

Adjusted Net Income Per Share

$

1.06

$

0.86

Diluted weighted-average number of shares

used in computing net income per share and Adjusted Net Income Per

Share(9)

140,703,025

138,982,872

(1)

Represents non-cash expense related to

restricted stock unit awards issued from the SharkNinja and JS

Global equity incentive plans.

(2)

Represents litigation costs incurred for

certain patent infringement claims and false advertising claims

against us.

(3)

Represents foreign currency transaction

gains and losses recognized from the remeasurement of transactions

that were not denominated in the local functional currency,

including gains and losses related to foreign currency derivatives

not designated as hedging instruments.

(4)

Represents amortization of acquired

intangible assets that we do not consider normal recurring

operating expenses, as the intangible assets relate to JS Global’s

acquisition of our business. We exclude amortization charges for

these acquisition-related intangible assets for purposes of

calculated Adjusted Net Income, although revenue is generated, in

part, by these intangible assets, to eliminate the impact of these

non-cash charges that are significantly impacted by the timing and

valuation of JS Global’s acquisition of our business, as well as

the inherent subjective nature of purchase price allocations.

(5)

Represents certain costs incurred related

to the separation and distribution from JS Global and the secondary

offering transactions.

(6)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SNHK, and no longer purchase inventory from a

purchasing office wholly owned by JS Global. Thus, the markup on

all inventory purchased subsequent to the separation is completely

eliminated in consolidation. As a result of the separation, we pay

JS Global a sourcing service fee to provide value-added sourcing

services on a transitional basis under a Sourcing Services

Agreement.

(7)

Represents the income tax effects of the

adjustments included in the reconciliation of net income to

Adjusted Net Income determined using the tax rate of 22.0%, which

approximates our effective tax rate, excluding (i) divested

subsidiary net income adjustment described in footnote (8), and

(ii) certain share-based compensation costs and separation and

distribution-related costs that are not tax deductible.

(8)

Adjusted for net income (loss) from SNJP

and the APAC distribution channels for the three months ended March

31, 2024 and 2023, as if such Divestitures occurred on January 1,

2023.

(9)

In calculating net income per share and

Adjusted Net Income Per Share, we used the number of shares

transferred in the separation and distribution for the denominator

for all periods prior to completion of the separation and

distribution on July 31, 2023.

We define EBITDA as net income excluding: (i) interest expense,

net, (ii) provision for income taxes and (iii) depreciation and

amortization. We define Adjusted EBITDA as EBITDA excluding (i)

share-based compensation cost, (ii) certain litigation costs, (iii)

foreign currency gains and losses, net, (iv) certain

transaction-related costs and (v) certain items that we do not

consider indicative of our ongoing operating performance following

the separation, including Adjusted EBITDA from our Divestitures and

cost of sales from our Product Procurement Adjustment. We define

Adjusted EBITDA Margin as Adjusted EBITDA divided by Adjusted Net

Sales. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA

Margin are appropriate measures because they facilitate a

comparison of our operating performance on a consistent basis from

period to period that, when viewed in combination with our results

according to GAAP, we believe provide a more complete understanding

of the factors and trends affecting our business than GAAP measures

alone.

The following table reconciles EBITDA, Adjusted EBITDA and

Adjusted EBITDA Margin to the most comparable GAAP measure, net

income, for the periods presented:

Three Months Ended March

31,

($ in thousands, except %)

2024

2023

Net income

$

109,612

$

87,096

Interest expense, net

14,722

8,489

Provision for income taxes

33,856

24,265

Depreciation and amortization

27,817

22,754

EBITDA

186,007

142,604

Share-based compensation(1)

19,426

848

Litigation costs(2)

6,491

174

Foreign currency losses, net(3)

2,167

4,149

Transaction-related costs(4)

1,342

18,468

Product Procurement Adjustment(5)

15,098

12,871

Divested subsidiary Adjusted EBITDA

adjustment(6)

—

(1,098

)

Adjusted EBITDA

$

230,531

$

178,016

Adjusted Net Sales

$

1,066,228

$

835,633

Adjusted EBITDA Margin

21.6

%

21.3

%

(1)

Represents non-cash expense related to

restricted stock unit awards issued from the SharkNinja and JS

Global equity incentive plans.

(2)

Represents litigation costs incurred for

certain patent infringement claims and false advertising claims

against us.

(3)

Represents foreign currency transaction

gains and losses recognized from the remeasurement of transactions

that were not denominated in the local functional currency,

including gains and losses related to foreign currency derivatives

not designated as hedging instruments.

(4)

Represents certain costs incurred related

to the separation and distribution from JS Global and the secondary

offering transactions.

(5)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SNHK, and no longer purchase inventory from a

purchasing office wholly owned by JS Global. Thus, the markup on

all inventory purchased subsequent to the separation is completely

eliminated in consolidation. As a result of the separation, we pay

JS Global a sourcing service fee to provide value-added sourcing

services on a transitional basis under a Sourcing Services

Agreement.

(6)

Adjusted for Adjusted EBITDA from SNJP and

the APAC distribution channels for the three months ended March 31,

2024 and 2023, as if such Divestitures occurred on January 1, 2023.

The divested subsidiary Adjusted EBITDA adjustment represents net

(loss) income from our Divestitures excluding interest expense,

income tax expense, depreciation and amortization expense and

foreign currency gains and losses recorded at the subsidiary

level.

We refer to growth rates in Adjusted Net Sales on a constant

currency basis so that results can be viewed without the impact of

fluctuations in foreign currency exchange rates. These amounts are

calculated by translating current year results at prior year

average exchange rates. We believe elimination of the foreign

currency translation impact provides useful information in

understanding and evaluating trends in our operating results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509585349/en/

Investor Relations: Arvind Bhatia, CFA SVP, Investor Relations

IR@sharkninja.com

Anna Kate Heller ICR SharkNinja@icrinc.com

Media Relations: Sarah McKinney VP, Corporate Communications

PR@sharkninja.com

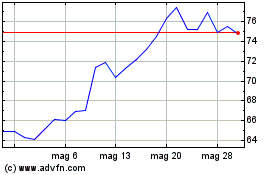

Grafico Azioni Sharkninja (NYSE:SN)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Sharkninja (NYSE:SN)

Storico

Da Feb 2024 a Feb 2025