State Street Global Advisors and Apollo Global Management Join Forces to Increase and Broaden Investor Access to Private Markets

10 Settembre 2024 - 2:47PM

Business Wire

Two leaders in asset management seek to democratize access to

private assets

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT), announced today that it is

working with Apollo Global Management, Inc. (NYSE: APO), a leading

provider of alternative assets and retirement solutions, and its

affiliates (collectively, Apollo), to expand investor access to

private market opportunities.

“Private assets are one of the fastest growing sectors of the

financial industry. We are excited to be working with Apollo, a

global leader in alternative assets, to continue to increase

accessibility to private markets, opening them to an even larger

cross section of investors,” said Ron O’Hanley, president and chief

executive officer of State Street. “This relationship combines the

strengths of two market leaders to allow even more investors to

participate in this dynamic corner of the financial markets.”

“We are pleased to work with State Street Global Advisors to

help more investors access private market opportunities, including

private investment grade credit,” said Marc Rowan, co-founder and

chief executive officer of Apollo Global Management. “At Apollo, we

believe investors will increasingly supplement their portfolios

with private fixed income and equity strategies as they seek to

build resilient and diversified portfolios to serve their

retirement and investment needs. We are confident our relationship

with State Street will help accelerate this trend as we leverage

our respective strengths to increase private market access in

innovative new ways.”

Over the last decade, assets in private markets have nearly

tripled,1 as large institutional investors have become attracted to

the potential for higher yields and greater diversification, and

their demonstrated resilience during times of volatility. The next

wave of private market investors is seeking exposure to these

growing asset classes through investment vehicles that are

tradable, transparent, and provide liquidity.

“Demand for private assets is expected to continue to grow in

the coming decade, but until now they have mainly been open to

large institutions and ultra-high net worth investors,” said Anna

Paglia, chief business officer at State Street Global Advisors. “We

are pleased to be working with Apollo to democratize access to

private asset exposures through ETFs and other investment products

advised by State Street Global Advisors, making them more

accessible to a wider swathe of investors who seek the benefits of

private market investments. It is our goal to bring these

investments to scale and help facilitate the process of making

private assets more accessible and liquid over time. We see this as

only the beginning of a new wave of innovation as public and

private markets increasingly converge.”

This relationship of a market-leading, global asset manager and

a market leading originator of private assets is designed to open

the door to investing in private markets and expand access to a

wider investor base. By combining the strengths of these two

brands, State Street Global Advisors and Apollo will provide

investors groundbreaking access to the private credit market.

As of June 30, 2024, Apollo reported more than $145 billion of

origination in the last twelve months, supported by its credit

business and broader origination ecosystem spanning 16 standalone

platforms. Apollo focuses on high quality private credit

origination, including both corporate lending and asset-backed

finance, that supports business growth globally.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the

world’s governments, institutions, and financial advisors. With a

rigorous, risk-aware approach built on research, analysis, and

market-tested experience, we build from a breadth of index and

active strategies to create cost-effective solutions. As pioneers

in index and ETF investing, we are always inventing new ways to

invest. As a result, we have become the world’s fourth-largest

asset manager* with US $4.37 trillion† under our care.

1 Ernst & Young, Insights: Private business- Are you

harnessing the growth and resilience of private-capital (April

2024).

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of June 30, 2024 and includes ETF

AUM of $1,393.92 billion USD of which approximately $69.35 billion

USD is in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

State Street Global Advisors, 1 Iron Street, Boston, MA

02210-1641

© 2024 State Street Corporation

All Rights Reserved.

6965408.2.1.AM.RTL Exp. Date: 9/30/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909583912/en/

Deborah Heindel +1 617 662 9927 DHEINDEL@StateStreet.com

Joanna Rose +1 212 822 0491 communications@apollo.com

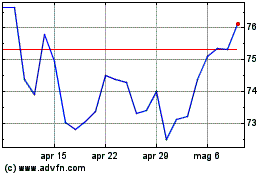

Grafico Azioni State Street (NYSE:STT)

Storico

Da Nov 2024 a Dic 2024

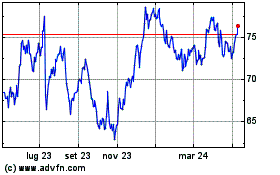

Grafico Azioni State Street (NYSE:STT)

Storico

Da Dic 2023 a Dic 2024