Survey Shows 84% of Gold ETF Investors Report Improved

Portfolio Performance Due to Their Gold Holdings

- Gold ownership expands: 38% of U.S. investors surveyed now

hold gold in their portfolios, up from 20% last year.

- Investors in gold view gold as a safe haven during market

volatility (57%) and a hedge against inflation (51%).

- When suggesting investing in gold to clients, 70% of

financial advisors surveyed recommend gold ETFs.

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT), and the World Gold Council,

the market development organization for the gold industry,

celebrate the 20th anniversary of SPDR Gold Shares (GLD). Since its

launch on November 18, 2004, GLD has redefined how investors access

gold, providing a relatively liquid, transparent, and

cost-efficient means of exposure to physical gold. Today, GLD

remains the largest gold ETF in the world with over $78.3 billion

in assets under management.1

Investor Sentiment Toward Gold Remains Strong

To mark the 20th anniversary of GLD, State Street Global

Advisors today released the results of its 2024 Gold ETF Impact

Study, which reveals 38% of surveyed U.S. investors currently hold

gold in their portfolio, marking a significant increase from 20% in

2023. Among those with allocations to gold, 56% said they are

likely to increase their gold exposure within the next 6 to 12

months.

Notably, the study found that 40% of gold investors have started

investing within the last five years, reflecting a growing base of

new adopters. It also found that gold is viewed as a reliable hedge

against inflation and market volatility, with 57% of gold investors

perceiving the precious metal as a safe haven during market

volatility and 51% seeing it as a hedge against inflation.

Furthermore, 73% of gold investors surveyed said that they

anticipate continued stock market volatility over the next 12

months, emphasizing gold's role as a stabilizing force in their

portfolios.

“As we celebrate 20 years of GLD, it’s clear that gold continues

to play a vital role in all types of investor portfolios,” said

George Milling-Stanley, Chief Gold Strategist at State Street

Global Advisors. "GLD has been instrumental in democratizing gold

investing for a wide range of investors."

Millennials Lead the Way

According to the survey, Millennial investors are playing a

significant role in the growing demand for gold, with 61% of

Millennial investors reporting that they hold gold in their

portfolios, compared to 35% of Gen X and 20% of Baby Boomers. The

survey also showed that Millennial investors are also more likely

to choose gold ETFs as their preferred method of investment, with

54% of Millennial gold investors indicating that they utilize gold

ETFs in their portfolios compared to 41% of Gen X and 21% of Baby

Boomers.

“This generational shift underscores gold’s appeal as both a

strategic asset and a store of value, particularly among younger

investors who are drawn to the accessibility and cost-efficiency of

ETFs,” Milling-Stanley said.

Gold ETFs Drive Portfolio Performance and Increase in

Demand

Among gold ETF investors surveyed, 84% reported that their

investment has improved the overall performance of their portfolio,

up from 73% in 2023. Gold ETFs are also increasingly seen as the

most cost-effective way to invest in the precious metal, with 68%

of investors surveyed agreeing that it is less expensive than

buying physical gold. The survey also revealed that 70% of

financial advisors surveyed recommend gold ETFs when they suggest

investing gold to their clients.

“We continue to innovate and evolve the gold market to shape

what investing in gold will look like in the future," said Joseph

Cavatoni, senior market strategist, Americas, World Gold Council.

"Whether it's opening new channels for investors to access GLD or

exploring new initiatives such as digitalization, we strive to

expand avenues to gold investment for generations to come.”

For more insights from the 2024 Gold ETF Impact Study,

read the full report here.

About State Street Global Advisors Gold ETF Impact Survey,

July 8 – August 4, 2024

State Street Global Advisors, in partnership with A2Bplanning

and Prodege, conducted an online survey among individual investors

in the US. Data was collected from July 8 to August 4, 2024, from a

nationally representative sample of 1,502 adults ages 25+ who have

investable assets of $250,000 or more. In addition, an online

survey among financial advisors in the U.S. was conducted, with

data collected from a nationally representative sample of 299

financial advisors with $50 million in assets under management, or

more.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of

international and domestic asset classes. The funds provide

investors with the flexibility to select investments that are

aligned to their investment strategy. For more information, visit

www.ssga.com.

About State Street Global Advisors

For over four decades, State Street Global Advisors has served

the world’s governments, institutions, and financial advisors. With

a rigorous, risk-aware approach built on research, analysis, and

market-tested experience, and as pioneers in index and ETF

investing, we are always inventing new ways to invest. As a result,

we have become the world’s fourth-largest asset manager* with US

$4.73 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of September 30, 2024 and includes ETF

AUM of $1,515.67 billion USD of which approximately $82.59 billion

USD in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

1 As of 10/31/24

Important Risk Disclosures

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns.

Past performance is not a reliable indicator of future

performance.

Diversification does not ensure a profit or guarantee against

loss.

The views expressed in this material are the views of State

Street SPDR through the period ended October 31, 2024 and are

subject to change based on market and other conditions. This

document contains certain statements that may be deemed

forward-looking statements. Please note that any such statements

are not guarantees of any future performance and actual results or

developments may differ materially from those projected.

The trademarks and service marks referenced herein are the

property of their respective owners. Third party data providers

make no warranties or representations of any kind relating to the

accuracy, completeness or timeliness of the data and have no

liability for damages of any kind relating to the use of such

data.

Investing involves risk including the risk of loss of

principal.

This communication is not intended to be an investment

recommendation or investment advice and should not be relied upon

as such.

Investing involves risk, and you could lose money on an

investment in SPDR® Gold Trust (“GLD®” or “GLD).

Commodities and commodity-index linked securities may be

affected by changes in overall market movements, changes in

interest rates, and other factors such as weather, disease,

embargoes, or political and regulatory developments, as well as

trading activity of speculators and arbitrageurs in the underlying

commodities.

Investing in commodities entails significant risk and is not

appropriate for all investors.

Important Information Relating to GLD:

GLD has filed a registration statement (including a

prospectus) with the Securities and Exchange Commission (“SEC”) for

the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration

statement and other documents GLD has filed with the SEC for more

complete information about GLD and this offering. Please see the

GLD prospectus for a detailed discussion of the risks of investing

in GLD shares. The GLD prospectus is available by clicking

here, and the GLDM prospectus is available by clicking

here. You may get these documents for free by visiting EDGAR on

the SEC website at sec.gov or by visiting

spdrgoldshares.com. Alternatively, the Funds or any authorized

participant will arrange to send you the prospectus if you request

it by calling 866.320.4053.

GLD is not an investment company registered under the Investment

Company Act of 1940 (the “1940 Act”) and is not subject to

regulation under the Commodity Exchange Act of 1936 (the “CEA”). As

a result, shareholders of GLD do not have the protections

associated with ownership of shares in an investment company

registered under the 1940 Act or the protections afforded by the

CEA.

GLD shares trade like stocks, are subject to investment risk and

will fluctuate in market value. The value of GLD shares relates

directly to the value of the gold held by GLD (less its expenses),

and fluctuations in the price of gold could materially and

adversely affect an investment in the shares. The price received

upon the sale of the shares, which trade at market price, may be

more or less than the value of the gold represented by them. GLD

does not generate any income, and as GLD regularly sells gold to

pay for its ongoing expenses, the amount of gold represented by

each Share will decline over time to that extent.

The World Gold Council name and logo are a registered trademark

and used with the permission of the World Gold Council pursuant to

a license agreement. The World Gold Council is not responsible for

the content of, and is not liable for the use of or reliance on,

this material. World Gold Council is an affiliate of GLD’s

sponsor.

GLD® is a registered trademark of World Gold Trust Services, LLC

used with the permission of World Gold Trust Services, LLC.

For more information, please contact the Marketing Agent for

GLD: State Street Global Advisors Funds Distributors, LLC, One Iron

Street, Boston, MA, 02210; T: +1 866 320 4053

spdrgoldshares.com

Intellectual Property Information: The S&P 500® Index

is a product of S&P Dow Jones Indices LLC or its affiliates

(“S&P DJI”) and have been licensed for use by State Street

Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500

are trademarks of Standard & Poor’s Financial Services LLC

(“S&P”); Dow Jones® is a registered trademark of Dow Jones

Trademark Holdings LLC (“Dow Jones”) and has been licensed for use

by S&P Dow Jones Indices; and these trademarks have been

licensed for use by S&P DJI and sublicensed for certain

purposes by State Street Global Advisors. The fund is not

sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones,

S&P, their respective affiliates, and none of such parties make

any representation regarding the advisability of investing in such

product(s) nor do they have any liability for any errors,

omissions, or interruptions of these indices.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

1-866-787-2257 or visit www.ssga.com. Read it

carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

Distributor:

State Street Global Advisors Funds Distributors, LLC, member

FINRA, SIPC, an indirect wholly owned subsidiary of State Street

Corporation. References to State Street may include State Street

Corporation and its affiliates. Certain State Street affiliates

provide services and receive fees from the SPDR ETFs.

State Street Global Advisors, 1 Iron Street, Boston, MA

02210-1641

© 2024 State Street Corporation

All Rights Reserved.

6773029.1.1.AM.RTL Exp. Date: 11/30/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241116677119/en/

Deborah Heindel +1 617 662 9927 DHEINDEL@StateStreet.com

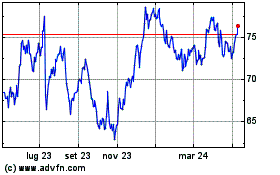

Grafico Azioni State Street (NYSE:STT)

Storico

Da Nov 2024 a Dic 2024

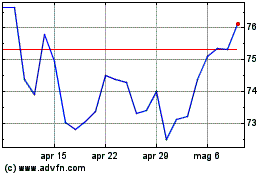

Grafico Azioni State Street (NYSE:STT)

Storico

Da Dic 2023 a Dic 2024