- Overwhelming majority of advisors are leveraging models:

less than 1-in-20 advisors do not use model portfolios at

all

- Investors who have assets in models are more satisfied with

their advisor

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT) today released the results of

its Model Portfolios: Adaptive Solutions for Advisory Growth

research, in which advisors report having an average of 39% of

current assets under management in model portfolios - up from 32%

three years ago.

“Model portfolios have evolved into a powerful tool for advisors

seeking to scale their practices efficiently while enhancing the

quality of personalized, client-centered wealth management,” said

Brie Williams, Global Head of Advisory Solutions and Wealth

Intelligence at State Street Global Advisors. “By streamlining

portfolio management, these solutions enable advisors to focus on

delivering holistic financial planning and high-impact advice,

positioning their practice for sustainable growth in an

ever-changing market.”

Model Portfolio Utilization and Use-Cases

More than half of surveyed advisors (54%) utilize custom

(self-built) models for clients while 45% source models available

on their home office/broker-dealer platform, and 53% source from

third-party providers.

The top factors advisors consider when selecting model portfolio

partners include commitment from providers (30%), performance

(29%), and price (27%). Notably, 85% of advisors believe tax

personalization is a benefit of using models.

The research finds that the types of model portfolios utilized

do not differ significantly between investors’ net worth or age,

but rather on clients’ goals and other aspects of their financial

situation. This tracks with what investors see as top benefits of

having their assets in model portfolios:

- My advisor can spend more time helping me make more intelligent

financial planning decisions (89%)

- My advisor can focus on what really matters to me (86%)

- My advisor can be more flexible to my needs (85%)

Gaps Between Advisor, Investor Views on Fees, Value

The research also uncovers a sizable perception gap between

financial advisors and investors when it comes to understanding

fees and being satisfied with value. While most advisors (87%)

believe their clients understand their fees, just 58% of clients

say they understand. Similarly, 88% of advisors think clients are

satisfied with the value for fees paid while 63% of clients feel

this way.

When asked what would improve the value of the services they

receive from their advisor, clients’ top three responses

include:

- Better returns (51%)

- Lower fees (46%)

- More proactive reporting (27%)

Conversely, the top three responses advisors provided when asked

what would improve the value of services they are providing to

clients include:

- Spending more time helping clients make more intelligent

financial planning decisions (40%)

- Portfolio having a track record that fits risk tolerance

(38%)

- Portfolio being constructed by asset managers with more

knowledge of markets (38%)

Satisfaction With Advisor Higher Among Investors In

Models

Investors who know their assets are in model portfolios are more

likely to be satisfied with their financial advisor than investors

who don’t know or who have no assets in model portfolios.

Nearly all investors in model portfolios (95%) are satisfied

with their advisor’s ability to earn their trust and confidence

compared to 79% of investors without assets in models. Similarly,

93% of investors in models are satisfied with their advisor’s

understanding of their financial goals, compared to 79% of

investors without assets in models. Notably, 51% of advisors said

clients expect an element of customization/personalization.

Investors with assets in models are also more satisfied with the

fees they pay for the value of services they receive, as 79% of

model investors are satisfied with their fees compared to 56% of

investors without models.

Despite the growth of and satisfaction with model portfolios,

investors awareness has not improved during the past five years.

Among investors, just over half (57%) of investors are aware of

model portfolios - unchanged from 2019.

“There is a sizeable group of investors who need more

information and education on model portfolios,” added Williams.

“The return on investing in client education is significant for

advisors. Not only do model portfolios help advisors manage their

time more effectively, but they also create opportunities to meet

client expectations in ways that enhance satisfaction and foster

long-term relationships.”

For more information, read State Street Global Advisors’ Model

Portfolios: Adaptive Solutions for Advisory Growth or visit the

State Street ETF Model Portfolios landing page.

About State Street Global Advisors’ Model Portfolios:

Adaptive Solutions for Advisory Growth Research, March-May

2024

State Street Global Advisors Research Center, in partnership

with A2Bplanning and Prodege, conducted an online survey among 200

financial advisors with assets under management (AUM) of $25M or

more and 250 individual investors in the US who work with a

financial advisor and have investable assets of $500K.

In the United States, an online survey among 200 financial

advisors with assets under management (AUM) of USD 25M or more.

Data was collected from May 3–14, 2024.

In the United States and Australia, an online survey of 250

individual investors (each country) who work with a financial

advisor and have investable assets (IA) of USD $500K or more. Data

was collected from May 3–28, 2024.

The information presented in this press release is specific to

the US region.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of

international and domestic asset classes. The funds provide

investors with the flexibility to select investments that are

aligned to their investment strategy. For more information, visit

www.ssga.com.

About State Street Global Advisors

For over four decades, State Street Global Advisors has served

the world’s governments, institutions, and financial advisors. With

a rigorous, risk-aware approach built on research, analysis, and

market-tested experience, and as pioneers in index and ETF

investing, we are always inventing new ways to invest. As a result,

we have become the world’s fourth-largest asset manager* with US

$4.73 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of September 30, 2024 and includes ETF

AUM of $1,515.67 billion USD of which approximately $82.59 billion

USD in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

Important Risk Disclosures

Investing involves risk including the risk of loss of

principal.

The whole or any part of this work may not be reproduced, copied

or transmitted or any of its contents disclosed to third parties

without SSGA’s express written consent.

The information provided does not constitute investment advice

and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not

take into account any investor's particular investment objectives,

strategies, tax status or investment horizon. You should consult

your tax and financial advisor.

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns.

Diversification does not ensure a profit or guarantee against

loss.

The trademarks and service marks referenced herein are the

property of their respective owners. Third party data providers

make no warranties or representations of any kind relating to the

accuracy, completeness or timeliness of the data and have no

liability for damages of any kind relating to the use of such

data.

Investing involves risk including the risk of loss of

principal.

This communication is not intended to be an investment

recommendation or investment advice and should not be relied upon

as such.

Intellectual Property Information: The S&P 500® Index

is a product of S&P Dow Jones Indices LLC or its affiliates

(“S&P DJI”) and have been licensed for use by State Street

Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500

are trademarks of Standard & Poor’s Financial Services LLC

(“S&P”); Dow Jones® is a registered trademark of Dow Jones

Trademark Holdings LLC (“Dow Jones”) and has been licensed for use

by S&P Dow Jones Indices; and these trademarks have been

licensed for use by S&P DJI and sublicensed for certain

purposes by State Street Global Advisors. The fund is not

sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones,

S&P, their respective affiliates, and none of such parties make

any representation regarding the advisability of investing in such

product(s) nor do they have any liability for any errors,

omissions, or interruptions of these indices.

Not FDIC Insured · No Bank Guarantee · May Lose Value

State Street Global Advisors, 1 Iron Street, Boston, MA

02210-1641

© 2024 State Street Corporation

All Rights Reserved.

7368170.1.1.AM.RTL Exp. Date: 12/31/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209434834/en/

Deborah Heindel 617-662-9927 dheindel@statestreet.com

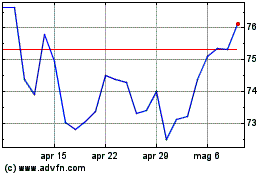

Grafico Azioni State Street (NYSE:STT)

Storico

Da Nov 2024 a Dic 2024

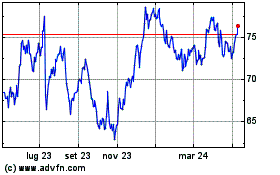

Grafico Azioni State Street (NYSE:STT)

Storico

Da Dic 2023 a Dic 2024