Operadora de Fondos Banorte Adopts Charles River’s Cloud-Based Platform

08 Ottobre 2024 - 5:26PM

Business Wire

Charles River Development, a State Street Company, announced

today that Operadora de Fondos Banorte, SA de CV, SOFI, Grupo

Financiero Banorte ("BANORTE"), one of Mexico’s largest mutual fund

companies, is now live on Charles River’s cloud-based Investment

Management Solution (IMS). Banorte utilizes Charles River IMS to

modernize their front, middle and back-office operations and to

streamline the management of their domestic and international

equity, fixed income, and multi-asset portfolios.

Banorte will benefit from Charles River IMS’s modern cloud

technology that delivers automated workflows and straight-through

processing for portfolio construction, performance attribution,

order management, and compliance. The solution’s global,

multi-asset view of cash and positions in real time helps drive

better decision-making and maximizes operational efficiency.

“The complexities of managing global multi asset portfolios,

meeting the needs of our investors, and delivering innovative

products to market were key drivers to transition to Charles

River’s cloud platform,” said Alejandro Aguilar Ceballos, CEO of

Operadora de Fondos Banorte. “Charles River IMS allows us to

capture greater efficiencies with automation and simplified

workflows, freeing internal resources to focus on business

priorities and better serve our clients.”

“We are thrilled to expand our collaborative partnership with

Banorte in support of their goals and growth strategy,” said Spiros

Giannaros, CEO and President of Charles River Development. “Our

platform provides Banorte the flexibility to modernize their

operating model while expanding product offerings, supporting

future growth, and keeping pace with changing market

conditions.”

About Grupo Financiero Banorte (GFNorte)

Grupo Financiero Banorte (GFNorte), is a leading financial

institution in Mexico, with the largest business diversification

and continuously seeking ways to innovate in the financial sector,

offering a wide variety of traditional and digital products and

services, through its broker dealer, annuities & insurance

companies, retirement saving funds (Afore), mutual funds, leasing

and factoring company, warehousing and recently announcing the

inclusion of a digital bank. Banorte is the second largest

financial group in Mexico in terms of loan portfolio, the number

two provider of loans to governments and the second largest bank in

mortgage loans. In addition, the retirement fund administrator

Afore XXI Banorte, of which GFNorte owns 50%, is the largest in the

country in terms of assets under management. Banorte is the only

commercial bank, among the six largest institutions, whose

decisions are made locally without the influence of external parent

companies, which has proven to be an advantage in adapting with

agility to the changes and alternatives presented by the

country.

About Charles River Development, A State Street

Company

Investment and wealth managers, asset owners and insurers in

over 30 countries rely on Charles River IMS to manage USD $60

Trillion in assets. Together with State Street’s middle and

back-office services, Charles River’s cloud-based front office

technology forms the foundation of State Street Alpha®. Charles

River IMS helps automate and simplify the investment process across

asset classes, from portfolio management and risk analytics through

trading and post-trade settlement, with integrated compliance and

managed data throughout. Charles River for Private Markets helps

solve complex data challenges for investors in private credit, real

estate, private equity, and infrastructure. Charles River’s partner

ecosystem enables clients to access the data, analytics,

application and liquidity providers that support their product and

asset class mix. With more than 146% increase in headcount over the

last 5+ years, Charles River serves clients globally offering 24/7

support. To learn more visit www.crd.com.

*Statistics as of Q2 2024. Assets are inclusive of clients using

the platform for purposes of secondary compliance.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $44.3 trillion in assets

under custody and/or administration and $4.4 trillion* in assets

under management as of June 30, 2024, State Street operates

globally in more than 100 geographic markets and employs

approximately 53,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

* Assets under management as of June 30, 2024 includes

approximately $69 billion of assets with respect to SPDR® products

for which State Street Global Advisors Funds Distributors, LLC

(SSGA FD) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

© 2024 State Street Corporation - All Rights Reserved

7011043.1.1.GBL

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008595445/en/

Media Ed Patterson epatterson@statestreet.com (404)

213-3106

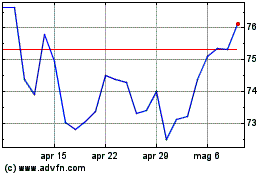

Grafico Azioni State Street (NYSE:STT)

Storico

Da Nov 2024 a Dic 2024

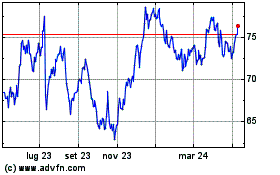

Grafico Azioni State Street (NYSE:STT)

Storico

Da Dic 2023 a Dic 2024