- Delivered industry-leading 2022 earnings, cash flow from

operations, total shareholder return, and return on capital

employed 1

- Generated earnings of $55.7 billion and $76.8 billion of cash

flow from operating activities in 2022 by leveraging an advantaged

portfolio and delivering strong operational performance

- Increased year-over-year Guyana and Permian production by over

30%

- Achieved best-ever annual refining throughput in North America

and the highest globally since 2012 2

- Operated Permian assets achieved zero routine flaring as of

year-end 2022 3

- Started up one of the largest advanced recycling facilities in

North America, capable of processing more than 80 million pounds of

plastic waste per year

Exxon Mobil Corporation (NYSE:XOM):

Results Summary

4Q22

3Q22

Change vs 3Q22

4Q21

Change vs 4Q21

Dollars in millions (except per share

data)

2022

2021

Change vs 2021

12,750

19,660

-6,910

8,870

+3,880

Earnings (U.S. GAAP)

55,740

23,040

+32,700

14,035

18,682

-4,647

8,795

+5,240

Earnings Excluding Identified Items

(non-GAAP)

59,101

23,013

+36,088

3.09

4.68

-1.59

2.08

+1.01

Earnings Per Common Share 4

13.26

5.39

+7.87

3.40

4.45

-1.05

2.05

+1.35

Earnings Excl. Identified Items Per Common

Share 4

14.06

5.38

+8.68

7,463

5,728

+1,735

5,808

+1,655

Capital and Exploration Expenditures

22,704

16,595

+6,109

Exxon Mobil Corporation today announced fourth-quarter 2022

earnings of $12.8 billion, or $3.09 per share assuming dilution,

resulting in full-year earnings of $55.7 billion, or $13.26 per

share assuming dilution. Fourth-quarter results included

unfavorable identified items of $1.3 billion associated with

additional European taxes on the energy sector and asset

impairments, partly offset by one-time adjustments related to the

Sakhalin-1 expropriation. Capital and exploration expenditures were

$7.5 billion in the fourth quarter, bringing full-year 2022

investments to $22.7 billion, consistent with our guidance.

“The hard work and commitment of our people enabled us to

deliver industry-leading operating and financial results and

shareholder returns in 2022,” said Darren Woods, chairman and chief

executive officer.

“While our results clearly benefited from a favorable market,

the counter-cyclical investments we made before and during the

pandemic provided the energy and products people needed as

economies began recovering and supplies became tight. We leaned in

when others leaned out. Our plan for 2023 calls for further

progress on our strategic objectives, which include leading the

industry in safety, operating, and financial performance. We will

continue to invest in our advantaged projects to deliver profitable

growth, help meet society’s growing needs, and reduce emissions in

our operations, while providing innovative solutions that help

others reduce theirs.”

1 One-year (2022) results with industry

peer group estimated using nine month 2022 annualized figures or

announced programs (shareholder distributions); industry peer group

includes BP, Chevron, Shell, and TotalEnergies.

2 Best-ever annual refining throughput in

North America and the highest globally since 2012, both based on

current refinery circuit.

3 References to routine flaring herein are

consistent with the World Bank’s Zero Routine Flaring

Initiative/Global Gas Flaring Reduction Partnership’s (GGFRP)

principle of routine flaring, and excludes safety and non-routine

flaring.

4 Assuming dilution.

Full-year Financial Highlights

- Full-year 2022 earnings were $55.7 billion compared with $23.0

billion in 2021, an increase of $32.7 billion. Identified items

unfavorably impacted earnings by $3.4 billion mainly from

Sakhalin-1 impairments in the first quarter. Earnings excluding

these identified items were $59.1 billion, an increase of $36.1

billion from prior year.

- Other factors impacting results were price and margin

improvements driven by recovering demand and tight supply, the

favorable mark-to-market impact of unsettled derivatives, and

volume increases on strong refining throughput and growth of

advantaged assets. Structural cost savings and disciplined expense

management helped to offset inflation and higher operating costs

from growth projects and capacity additions. In addition, results

also benefited from lower Corporate and Financing costs as well as

net favorable one-time items.

- Structural cost savings now total $7 billion compared to 2019.

The company achieved an additional $2 billion of savings during the

year and is on track to deliver $9 billion of total annual savings

in 2023 vs. 2019.

- Leading peers¹ with 87% total shareholder return for the year

as well as 25% return on capital employed, the highest one-year

return since 2012.

- Cash increased by $22.9 billion in 2022 with free cash flow of

$62.1 billion. Shareholder distributions were $29.8 billion,

including $14.9 billion in dividends and $14.9 billion of share

repurchases. The company also increased and extended its

share-repurchase program with up to $35 billion of cumulative share

repurchases in 2023-2024.

- The Corporation declared a first-quarter dividend of $0.91 per

share, payable on March 10, 2023, to shareholders of record of

Common Stock at the close of business on February 14, 2023.

- Net-debt-to-capital ratio improved to about 5%, reflecting 2022

debt retirements of $7.2 billion and a period-end cash balance of

$29.7 billion, further strengthening the balance sheet and

providing greater financial flexibility.

- Non-core asset sales and divestments generated $5.2 billion of

cash proceeds during the year.

1 One-year (2022) results with industry

peer group estimated using nine month 2022 annualized figures or

announced programs (shareholder distributions); industry peer group

includes BP, Chevron, Shell, and TotalEnergies.

Progress Toward Net Zero

- Permian operated assets achieved a major milestone in the

fourth quarter by achieving zero routine flaring.1 This is a key

part of ongoing efforts to achieve net-zero Scope 1 and Scope 2

greenhouse gas emissions from our Permian operated unconventional

assets by 2030. The company remains on track to meet its goal of

achieving zero routine flaring across all its global Upstream

operated assets by 2030 in support of the World Bank’s Zero Routine

Flaring Initiative.

- The company reduced methane emissions intensity at all operated

assets by more than 40% compared to 2016 levels.2

Biofuels and Hydrogen

- ExxonMobil announced the next step in the development of the

world’s largest low-carbon hydrogen production facility with a

contract award for front-end engineering and design. The integrated

ExxonMobil Baytown facility is expected to produce 1 billion cubic

feet of low-carbon hydrogen per day, that would make it the largest

low-carbon hydrogen project in the world with an expected startup

in 2027-2028. More than 98% of the associated CO2 produced by the

facility, or around 7 million metric tons per year, is expected to

be captured and permanently stored. The carbon capture and storage

network being developed for the project will be made available for

use by third-party CO2 emitters in the area in support of their

decarbonization efforts.3

- ExxonMobil's majority-owned affiliate, Imperial Oil Ltd., will

invest about $560 million to move forward with construction of the

largest renewable diesel facility in Canada. The project at

Imperial’s Strathcona Refinery is expected to produce 20,000

barrels of renewable diesel per day primarily from locally sourced

feedstocks. This is expected to help reduce greenhouse gas

emissions in the Canadian transportation sector by about 3 million

metric tons per year.4

Carbon Capture and Storage

- ExxonMobil and Mitsubishi Heavy Industries (MHI) announced a

joint effort to deploy MHI’s leading carbon capture technology as

part of ExxonMobil’s end-to-end carbon capture and storage solution

for industrial customers.

- The company advanced its evaluation of carbon capture and

storage projects in the United Kingdom and Indonesia. In the United

Kingdom, ExxonMobil, along with Solent Local Enterprise Partnership

and the University of Southampton, announced the first major

decarbonization initiative that would substantially reduce carbon

emissions from industry, transportation, and households across

Southern England. In Indonesia, ExxonMobil and the state-owned

energy company, Pertamina, agreed to progress a previously

announced regional carbon capture and storage hub offshore Java for

domestic and international CO2.

1 References to routine flaring herein are

consistent with the World Bank’s Zero Routine Flaring

Initiative/Global Gas Flaring Reduction Partnership’s (GGFRP)

principle of routine flaring, and excludes safety and non-routine

flaring.

2 2021 vs. 2016 levels (at ExxonMobil

operated assets); we are working to continuously improve our

performance and methods to detect, measure, and address greenhouse

gas emissions.

3 The Baytown hydrogen facility has not

reached final investment decision. Individual opportunities may

advance based on a number of factors, including supportive policy,

technology, and market conditions.

4 Calculated using Canada’s Clean Fuel

Regulation and in comparison to conventional fuels.

EARNINGS AND VOLUME SUMMARY BY

SEGMENT

Upstream

4Q22

3Q22

4Q21

Dollars in millions (unless otherwise

noted)

2022

2021

Earnings/(Loss) (U.S. GAAP)

2,493

3,110

1,768

United States

11,728

3,663

5,708

9,309

4,317

Non-U.S.

24,751

12,112

8,201

12,419

6,085

Worldwide

36,479

15,775

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

2,493

3,110

2,031

United States

11,429

3,926

6,269

8,731

4,597

Non-U.S.

27,989

12,392

8,762

11,841

6,628

Worldwide

39,418

16,318

3,822

3,716

3,816

Production (koebd)

3,737

3,712

- Upstream fourth-quarter 2022 earnings were $8.2 billion

compared to $12.4 billion in the third quarter, a decrease of $4.2

billion. Earnings decreased mainly from lower prices with both

crude and gas realizations down, 15% and 13% respectively, on

higher global inventories. Positive unsettled derivatives

mark-to-market effects of $1.6 billion were driven by the decline

in gas prices and more than offset year-end inventory impacts and

seasonally higher expenses. Identified items unfavorably impacted

earnings by $1.1 billion, mainly from additional European taxes on

the energy sector partly offset by net favorable divestments and

adjustments related to the Sakhalin-1 expropriation. Earnings

excluding these identified items decreased $3.1 billion from $11.8

billion to $8.8 billion.

- Production in the fourth quarter was 3.8 million oil-equivalent

barrels per day. Growth more than offset divestment impacts, as

production increased by more than 100,000 oil-equivalent barrels

per day compared to the prior quarter.

- The Permian delivered record production in the quarter of more

than 560,000 oil-equivalent barrels per day and the company also

loaded the first LNG cargo from the Coral South LNG development in

Mozambique.

- Compared to the same quarter last year, earnings increased $2.1

billion. The improvement was driven by a 46% increase in natural

gas realizations and an increase of nearly 10% in crude

realizations. Results benefited from $1.4 billion positive

unsettled derivatives mark-to-market effects, which more than

offset the impact of year-end inventory impacts and higher

expenses. Excluding divestments and the Sakhalin-1 expropriation,

oil-equivalent production grew by 217,000 barrels per day, driven

by the company's advantaged growth projects in the Permian and

Guyana. Earnings excluding identified items were $8.8 billion for

the quarter, an increase of $2.1 billion compared to the same

quarter last year.

- Full-year earnings were $36.5 billion, an increase of $20.7

billion versus 2021 despite a $2.4 billion unfavorable impact from

identified items, most notably additional European taxes on the

energy sector and the Sakhalin-1 impairment. Earnings excluding

identified items were $39.4 billion, an increase of $23.1

billion.

- Other factors impacting full-year results were improved liquids

and natural gas realizations, reflecting tight supply and

recovering demand, and favorable unsettled derivatives

mark-to-market effects of $2.8 billion resulting from lower gas

prices and the absence of unfavorable 2021 impacts. In addition,

structural cost savings and disciplined expense management largely

offset higher expenses associated with advantaged growth projects

and inflation. Excluding impacts from divestments and the

Sakhalin-1 expropriation, oil-equivalent production grew by about

170,000 barrels per day from continued investment in advantaged

growth projects in the Permian and Guyana. Production in the

Permian grew about 90,000 oil-equivalent barrels per day and Guyana

production grew about 70,000 oil-equivalent barrels per day with

Liza Phase 2 starting up ahead of schedule and both Liza Phase 1

and 2 producing above the investment basis.

Energy Products

4Q22

3Q22

4Q21

Dollars in millions (unless otherwise

noted)

2022

2021

Earnings/(Loss) (U.S. GAAP)

2,188

3,008

699

United States

8,340

668

1,882

2,811

203

Non-U.S.

6,626

(1,014)

4,070

5,819

901

Worldwide

14,966

(347)

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

2,246

3,008

699

United States

8,398

668

2,508

2,811

203

Non-U.S.

7,252

(1,014)

4,754

5,819

901

Worldwide

15,650

(347)

5,423

5,537

5,373

Energy Products Sales (kbd)

5,347

5,130

- Energy Products fourth-quarter 2022 earnings totaled $4.1

billion compared to $5.8 billion in the third quarter, a decrease

of $1.7 billion. Continued strong industry refining margins

partially offset an unfavorable derivatives mark-to-market impact

of $1.0 billion, mainly due to the absence of prior quarter gains.

In addition, increased maintenance spend and lower throughput,

driven by French industrial actions, were offset by favorable

year-end inventory impacts. Identified items associated with

additional European taxes on the energy sector as well as asset

impairments reduced earnings by $0.7 billion. Earnings excluding

these identified items were $4.8 billion for the quarter, a

decrease of $1.1 billion from the third quarter.

- Earnings increased $3.2 billion compared to the fourth quarter

of 2021 due to stronger industry refining margins, increased

marketing and trading contributions, and favorable foreign exchange

impacts, partly offset by increased maintenance expenses and

unfavorable derivatives mark-to-market impacts. In addition,

earnings were unfavorably impacted by identified items of $0.7

billion, mainly additional European taxes on the energy sector and

asset impairments. Earnings excluding identified items were $4.8

billion for the quarter, an increase of $3.9 billion from the same

quarter last year.

- Full-year 2022 earnings were $15.0 billion compared to a loss

of $0.3 billion last year. Identified items reduced earnings by

$0.7 billion mainly from additional European taxes on the energy

sector and asset impairments. Earnings excluding identified items

were $15.7 billion, an increase of $16 billion from last year.

- Results for the year increased from improved industry refining

margins, which benefited from higher demand and low inventories.

Results were also helped by stronger trading and marketing margins,

improved product yields, higher throughput, as well as favorable

foreign exchange and year-end inventory impacts. In addition,

continued disciplined cost management helped to offset higher

expenses from inflation and project activity.

- Refining throughput for the year was 4 million barrels per day,

up 171,000 barrels from 2021 on a current refinery circuit basis,

reflecting best-ever annual refining throughput in North America

and the highest globally since 2012.

- The company mechanically completed its Beaumont Refinery

expansion, the largest in the United States since 2012 and expects

to bring 250,000 barrels per day of crude distillation capacity to

the market in first quarter 2023.

- The company announced an agreement with Par Pacific Holdings

for the sale of the Billings Refinery and select midstream assets

in Montana and Washington, as well as an agreement with Italiana

Petroli for the sale of the Italy fuels business during the

quarter. Additionally, in January an agreement was reached with

Bangchak Corporation for the sale of ExxonMobil's interest in Esso

Thailand, including the Sriracha Refinery, select distribution

terminals, and a network of Esso-branded retail stations.

Chemical Products

4Q22

3Q22

4Q21

Dollars in millions (unless otherwise

noted)

2022

2021

Earnings/(Loss) (U.S. GAAP)

298

635

774

United States

2,328

3,697

(48)

177

597

Non-U.S.

1,215

3,292

250

812

1,371

Worldwide

3,543

6,989

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

298

635

774

United States

2,328

3,697

(48)

177

597

Non-U.S.

1,215

3,292

250

812

1,371

Worldwide

3,543

6,989

4,658

4,680

4,833

Chemical Products Sales (kt)

19,167

19,142

- Chemical Products fourth-quarter 2022 earnings were $0.3

billion compared to $0.8 billion in the third quarter on weaker

margins as a result of continued supply additions and softening

demand in North America and Europe partially offset by lower North

America feed costs.

- Earnings were $1.1 billion lower compared to fourth-quarter

2021 on weaker industry margins and lower sales, reflecting

softening market conditions.

- Full-year earnings of $3.5 billion were above the 10-year

average, though below the record $7.0 billion earned in 2021.

Earnings remained strong despite bottom-of-cycle conditions in Asia

Pacific, increased supply, and the closure of the regional pricing

disconnect between Asia and the Atlantic Basin during the year. In

addition, earnings were unfavorably impacted by product mix

effects, higher expenses from production capacity additions, and

foreign exchange effects from a stronger U.S. dollar.

- The company started up its advanced recycling facility in

Baytown, Texas, one of the largest advanced recycling facilities in

North America, capable of processing more than 80 million pounds of

plastic waste per year.

- The company also successfully started up a new polypropylene

production unit in Baton Rouge, Louisiana, doubling the plant's

polypropylene production to meet growing demand for

high-performance, lightweight, and durable plastics.

Specialty Products

4Q22

3Q22

4Q21

Dollars in millions (unless otherwise

noted)

2022

2021

Earnings/(Loss) (U.S. GAAP)

406

306

763

United States

1,190

1,452

354

456

353

Non-U.S.

1,225

1,807

760

762

1,116

Worldwide

2,415

3,259

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

406

306

265

United States

1,190

954

394

456

217

Non-U.S.

1,265

1,672

800

762

482

Worldwide

2,455

2,625

1,787

1,917

1,835

Specialty Products Sales (kt)

7,810

7,666

- Specialty Products fourth-quarter 2022 earnings were $0.8

billion, in line with the third quarter. The robust quarterly

performance was driven by improved margins with continued pricing

actions and lower energy prices, partly offset by lower volumes on

supply length and higher seasonal expenses.

- Fourth-quarter 2022 earnings were $0.8 billion compared to $1.1

billion in the same quarter last year, a decrease of $0.4 billion

driven by the absence of prior year identified items associated

with asset sales. Earnings excluding identified items were $0.8

billion, $0.3 billion higher than the same quarter last year.

- Quarterly results increased from improved basestock industry

margins and positive year-end inventory effects, partly offset by

lower sales volumes.

- Full-year earnings were $2.4 billion compared with $3.3 billion

in 2021, a decrease of $0.8 billion. Identified items reduced

earnings by $0.7 billion, mainly associated with the absence of an

asset sale gain. Earnings excluding identified items were $2.5

billion, a decrease of $0.2 billion compared to last year.

- Full-year results were also impacted by decreased margins with

higher feed costs and energy prices largely offset by continued

focus on revenue management, increased expenses from higher

maintenance and inflation, and unfavorable foreign exchange impacts

partly offset by positive year-end inventory effects.

Corporate and Financing

4Q22

3Q22

4Q21

Dollars in millions (unless otherwise

noted)

2022

2021

(531)

(152)

(603)

Earnings/(Loss) (U.S. GAAP)

(1,663)

(2,636)

(531)

(552)

(587)

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

(1,965)

(2,572)

- Corporate and Financing reported net charges of $0.5 billion in

the fourth quarter of 2022 compared to charges of $0.2 billion in

the third quarter, an increase of $0.4 billion driven by the

absence of prior quarter identified items related to tax and other

reserve adjustments.

- Net charges of $0.5 billion in the fourth quarter of 2022 were

down $0.1 billion from the same quarter of 2021.

- Full-year net charges of $1.7 billion declined $1.0 billion

from last year, mainly due to decreased pension-related expenses,

favorable one-time tax impacts, lower financing costs, and

favorable identified item impacts of $0.4 billion associated with

tax and other reserve adjustments.

.

CASH FLOW FROM OPERATIONS AND ASSET

SALES EXCLUDING WORKING CAPITAL

4Q22

3Q22

4Q21

Dollars in millions

2022

2021

13,055

20,198

9,079

Net income/(loss) including noncontrolling

interests

57,577

23,598

5,064

5,642

5,661

Depreciation and depletion (includes

impairments)

24,040

20,607

(200)

1,667

1,930

Changes in operational working capital

(194)

4,162

(298)

(3,082)

454

Other

(4,626)

(238)

17,621

24,425

17,124

Cash Flow from Operating Activities

(U.S. GAAP)

76,797

48,129

1,333

2,682

2,601

Proceeds associated with asset sales

5,247

3,176

18,954

27,107

19,725

Cash Flow from Operations and Asset

Sales (non-GAAP)

82,044

51,305

200

(1,667)

(1,930)

Changes in operational working capital

194

(4,162)

19,154

25,440

17,795

Cash Flow from Operations and Asset

Sales excluding Working Capital (non-GAAP)

82,238

47,143

FREE CASH FLOW

4Q22

3Q22

4Q21

Dollars in millions

2022

2021

17,621

24,425

17,124

Cash Flow from Operating Activities

(U.S. GAAP)

76,797

48,129

(5,783)

(4,876)

(4,089)

Additions to property, plant and

equipment

(18,407)

(12,076)

(2,175)

(272)

(1,762)

Additional investments and advances

(3,090)

(2,817)

1,270

88

1,140

Other investing activities including

collection of advances

1,508

1,482

1,333

2,682

2,601

Proceeds from asset sales and returns of

investments

5,247

3,176

12,266

22,047

15,014

Free Cash Flow (non-GAAP)

62,055

37,894

RETURN ON AVERAGE CAPITAL

EMPLOYED

Dollars in millions (unless otherwise

noted)

2022

2021

Net income/(loss) attributable to

ExxonMobil (U.S. GAAP)

55,740

23,040

Financing costs (after-tax)

Gross third-party debt

(1,213)

(1,196)

ExxonMobil share of equity companies

(198)

(170)

All other financing costs – net

276

11

Total financing costs

(1,135)

(1,355)

Earnings/(loss) excluding financing

costs (non-GAAP)

56,875

24,395

Total assets (U.S. GAAP)

369,067

338,923

Less liabilities and noncontrolling

interests share of assets and liabilities

Total current liabilities excluding notes

and loans payable

(68,411)

(52,367)

Total long-term liabilities excluding

long-term debt

(56,990)

(63,169)

Noncontrolling interests share of assets

and liabilities

(9,205)

(8,746)

Add ExxonMobil share of debt-financed

equity company net assets

3,705

4,001

Total capital employed

(non-GAAP)

238,166

218,642

Average capital employed

(non-GAAP)

228,404

222,890

Return on average capital employed –

corporate total (non-GAAP)

24.9%

10.9%

CALCULATION OF STRUCTURAL COST

SAVINGS

OPERATING COSTS AND CASH OPERATING

EXPENSES

Dollars in billions

2019

2022

Components of operating costs

From ExxonMobil’s Consolidated

statement of income

(U.S. GAAP)

Production and manufacturing expenses

36.8

42.6

Selling, general and administrative

expenses

11.4

10.1

Depreciation and depletion (includes

impairments)

19.0

24.0

Exploration expenses, including dry

holes

1.3

1.0

Non-service pension and postretirement

benefit expense

1.2

0.5

Subtotal

69.7

78.2

ExxonMobil’s share of equity company

expenses

9.1

13.0

Total operating costs

(non-GAAP)

78.8

91.2

Less:

Depreciation and depletion (includes

impairments)

19.0

24.0

Non-service pension and postretirement

benefit expense

1.2

0.5

Other adjustments (includes equity company

depreciation

and depletion)

3.6

3.5

Total cash operating expenses (cash

opex) (non-GAAP)

55.0

63.2

Energy and production taxes

11.0

23.8

Market

Activity /

Other

Structural

Savings

Total cash operating expenses (cash

opex) excluding energy and production taxes (non-GAAP)

44.0

+3

-1

-7

39.4

This press release also references structural cost savings.

Structural cost savings describe decreases in cash opex excluding

energy and production taxes as a result of operational

efficiencies, workforce reductions, and other cost-saving measures

that are expected to be sustainable compared to 2019 levels.

Relative to 2019, estimated cumulative structural cost savings

totaled $7 billion. The total change between periods in expenses

above will reflect both structural cost savings and other changes

in spend, including market factors, such as inflation and foreign

exchange impacts, as well as changes in activity levels and costs

associated with new operations. Estimates of cumulative annual

structural savings may be revised depending on whether cost

reductions realized in prior periods are determined to be

sustainable compared to 2019 levels. Structural cost savings are

stewarded internally to support management's oversight of spending

over time. This measure is useful for investors to understand the

Corporation's efforts to optimize spending through disciplined

expense management.

ExxonMobil will discuss financial and operating results and

other matters during a webcast at 7:30 a.m. Central Time on January

31, 2023. To listen to the event or access an archived replay,

please visit www.exxonmobil.com.

Cautionary Statement

Outlooks; projections; descriptions of strategic, operating, and

financial plans and objectives; statements of future ambitions and

plans; and other statements of future events or conditions in this

release, are forward-looking statements. Similarly, discussion of

future carbon capture, biofuel and hydrogen plans to drive towards

net zero emissions are dependent on future market factors, such as

continued technological progress and policy support, and represent

forward-looking statements. Actual future results, including

financial and operating performance; total capital expenditures and

mix, including allocations of capital to low carbon solutions; cost

reductions and efficiency gains, including the ability to offset

inflationary pressure; plans to reduce future emissions and

emissions intensity; ambitions to reach Scope 1 and Scope 2 net

zero from operated assets by 2050, reaching Scope 1 and 2 net zero

in Upstream Permian Basin unconventional operated assets by 2030,

eliminating routine flaring in-line with World Bank Zero Routine

Flaring, reaching near-zero methane emissions from its operations,

meeting ExxonMobil’s emission reduction goals and plans, divestment

and start-up plans, and associated project plans as well as

technology efforts, timing and outcome of projects to capture and

store CO2, and produced biofuels; timing and outcome of hydrogen

projects; cash flow, dividends and shareholder returns, including

the timing and amounts of share repurchases; future debt levels and

credit ratings; business and project plans, timing, costs,

capacities and returns; and resource recoveries and production

rates could differ materially due to a number of factors. These

include global or regional changes in the supply and demand for

oil, natural gas, petrochemicals, and feedstocks and other market

conditions that impact prices and differentials for our products;

government policies supporting lower carbon investment

opportunities such as the U.S. Inflation Reduction Act or policies

limiting the attractiveness of future investment such as the

European tax on the energy sector; variable impacts of trading

activities on our margins and results each quarter; actions of

competitors and commercial counterparties; the outcome of

commercial negotiations, including final agreed terms and

conditions; the ability to access debt markets; the ultimate

impacts of COVID-19, including the effects of government responses

on people and economies; reservoir performance, including

variability and timing factors applicable to unconventional

resources; the outcome of exploration projects and decisions to

invest in future reserves; timely completion of development and

other construction projects; final management approval of future

projects and any changes in the scope, terms, or costs of such

projects as approved; changes in law, taxes, or regulation

including environmental regulations, trade sanctions, and timely

granting of governmental permits and certifications; government

policies and support and market demand for low carbon technologies;

war, and other political or security disturbances; expropriations,

seizure, or capacity, insurance or shipping limitations by foreign

governments or laws; opportunities for potential investments or

divestments and satisfaction of applicable conditions to closing,

including regulatory approvals; the capture of efficiencies within

and between business lines and the ability to maintain near-term

cost reductions as ongoing efficiencies; unforeseen technical or

operating difficulties and unplanned maintenance; the development

and competitiveness of alternative energy and emission reduction

technologies; the results of research programs and the ability to

bring new technologies to commercial scale on a cost-competitive

basis; and other factors discussed under Item 1A. Risk Factors of

ExxonMobil’s 2021 Form 10-K.

Forward-looking and other statements regarding our

environmental, social and other sustainability efforts and

aspirations are not an indication that these statements are

necessarily material to investors or requiring disclosure in our

filing with the SEC. In addition, historical, current, and

forward-looking environmental, social and sustainability-related

statements may be based on standards for measuring progress that

are still developing, internal controls and processes that continue

to evolve, and assumptions that are subject to change in the

future, including future rule-making.

Frequently Used Terms and Non-GAAP

Measures

This press release includes cash flow from operations and asset

sales (non-GAAP). Because of the regular nature of our asset

management and divestment program, the company believes it is

useful for investors to consider proceeds associated with the sales

of subsidiaries, property, plant and equipment, and sales and

returns of investments together with cash provided by operating

activities when evaluating cash available for investment in the

business and financing activities. A reconciliation to net cash

provided by operating activities for 2021 and 2022 periods is shown

on page 8.

This press release also includes cash flow from operations and

asset sales excluding working capital (non-GAAP). The company

believes it is useful for investors to consider these numbers in

comparing the underlying performance of the company's business

across periods when there are significant period-to-period

differences in the amount of changes in working capital. A

reconciliation to net cash provided by operating activities for

2021 and 2022 periods is shown on page 8.

This press release also includes earnings/(loss) excluding

identified items (non-GAAP), which are earnings/(loss) excluding

individually significant non-operational events with an absolute

corporate total earnings impact of at least $250 million in a given

quarter. The earnings/(loss) impact of an identified item for an

individual segment may be less than $250 million when the item

impacts several periods or several segments. Earnings/(loss)

excluding identified items does include non-operational earnings

events or impacts that are below the $250 million threshold

utilized for identified items. When the effect of these events is

significant in aggregate, it is indicated in analysis of period

results as part of quarterly earnings press release and

teleconference materials. Management uses these figures to improve

comparability of the underlying business across multiple periods by

isolating and removing significant non-operational events from

business results. The Corporation believes this view provides

investors increased transparency into business results and trends

and provides investors with a view of the business as seen through

the eyes of management. Earnings excluding identified items is not

meant to be viewed in isolation or as a substitute for net

income/(loss) attributable to ExxonMobil as prepared in accordance

with U.S. GAAP. A reconciliation to earnings is shown for 2022 and

2021 periods in Attachments II-a and II-b. Corresponding per share

amounts are shown on page 1 and in Attachment II-a, including a

reconciliation to earnings/(loss) per common share – assuming

dilution (U.S. GAAP).

This press release also includes total taxes including

sales-based taxes. This is a broader indicator of the total tax

burden on the Corporation’s products and earnings, including

certain sales and value-added taxes imposed on and concurrent with

revenue-producing transactions with customers and collected on

behalf of governmental authorities (“sales-based taxes”). It

combines “Income taxes” and “Total other taxes and duties” with

sales-based taxes, which are reported net in the income statement.

The company believes it is useful for the Corporation and its

investors to understand the total tax burden imposed on the

Corporation’s products and earnings. A reconciliation to total

taxes is shown in Attachment I-a.

This press release also references free cash flow (non-GAAP).

Free cash flow is the sum of net cash provided by operating

activities and net cash flow used in investing activities. This

measure is useful when evaluating cash available for financing

activities, including shareholder distributions, after investment

in the business. Free cash flow is not meant to be viewed in

isolation or as a substitute for net cash provided by operating

activities. A reconciliation to net cash provided by operating

activities for 2021 and 2022 periods is shown on page 8.

References to resources or resource base may include quantities

of oil and natural gas classified as proved reserves, as well as

quantities that are not yet classified as proved reserves, but that

are expected to be ultimately recoverable. The term “resource base”

or similar terms are not intended to correspond to SEC definitions

such as “probable” or “possible” reserves. A reconciliation of

production excluding divestments, entitlements, and government

mandates to actual production is contained in the Supplement to

this release included as Exhibit 99.2 to the Form 8-K filed the

same day as this news release.

The term “project” as used in this release can refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

Projects or plans may not reflect investment decisions made by the

company. Individual opportunities may advance based on a number of

factors, including availability of supportive policy, technology

for cost-effective abatement, and alignment with our partners and

other stakeholders. The company may refer to these opportunities as

projects in external disclosures at various stages throughout their

progression.

This press release also references return on capital employed

(ROCE) (non-GAAP). The Corporation’s total ROCE is net income

attributable to ExxonMobil, excluding the after-tax cost of

financing, divided by total corporate average capital employed. The

Corporation has consistently applied its ROCE definition for many

years and views it as one of the best measures of historical

capital productivity in our capital-intensive, long-term industry,

both to evaluate management’s performance and to demonstrate to

shareholders that capital has been used wisely over the long term.

Additional measures, which are more cash-flow based, are used to

make investment decisions. A reconciliation to net income/(loss)

attributable to ExxonMobil and to Total assets for 2021 and 2022

periods are shown on page 8.

Reference to Earnings

References to corporate earnings mean net income attributable to

ExxonMobil (U.S. GAAP) from the consolidated income statement.

Unless otherwise indicated, references to earnings, Upstream,

Energy Products, Chemical Products, Specialty Products and

Corporate and Financing segment earnings, and earnings per share

are ExxonMobil’s share after excluding amounts attributable to

noncontrolling interests.

Exxon Mobil Corporation has numerous affiliates, many with names

that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For

convenience and simplicity, those terms and terms such as

Corporation, company, our, we, and its are sometimes used as

abbreviated references to specific affiliates or affiliate groups.

Similarly, ExxonMobil has business relationships with thousands of

customers, suppliers, governments, and others. For convenience and

simplicity, words such as venture, joint venture, partnership,

co-venturer, and partner are used to indicate business and other

relationships involving common activities and interests, and those

words may not indicate precise legal relationships. ExxonMobil's

ambitions, plans and goals do not guarantee any action or future

performance by its affiliates or Exxon Mobil Corporation's

responsibility for those affiliates' actions and future

performance, each affiliate of which manages its own affairs.

Throughout this press release, both Exhibit 99.1 as well as

Exhibit 99.2, due to rounding, numbers presented may not add up

precisely to the totals indicated.

ATTACHMENT I-a

CONDENSED CONSOLIDATED STATEMENT OF

INCOME

(Preliminary)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Dollars in millions

2022

2021

2022

2021

Revenues and other income

Sales and other operating revenue

93,164

81,305

398,675

276,692

Income from equity affiliates

605

2,078

11,463

6,657

Other income

1,660

1,582

3,542

2,291

Total revenues and other income

95,429

84,965

413,680

285,640

Costs and other deductions

Crude oil and product purchases

50,761

45,489

228,959

155,164

Production and manufacturing expenses

10,365

10,783

42,609

36,035

Selling, general and administrative

expenses

2,832

2,514

10,095

9,574

Depreciation and depletion (includes

impairments)

5,064

5,661

24,040

20,607

Exploration expenses, including dry

holes

348

524

1,025

1,054

Non-service pension and postretirement

benefit expense

100

100

482

786

Interest expense

207

221

798

947

Other taxes and duties

6,910

7,944

27,919

30,239

Total costs and other

deductions

76,587

73,236

335,927

254,406

Income/(Loss) before income

taxes

18,842

11,729

77,753

31,234

Income tax expense/(benefit)

5,787

2,650

20,176

7,636

Net income/(loss) including

noncontrolling interests

13,055

9,079

57,577

23,598

Net income/(loss) attributable to

noncontrolling interests

305

209

1,837

558

Net income/(loss) attributable to

ExxonMobil

12,750

8,870

55,740

23,040

OTHER FINANCIAL DATA

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2022

2021

2022

2021

Earnings per common share (U.S.

dollars)

3.09

2.08

13.26

5.39

Earnings per common share - assuming

dilution (U.S. dollars)

3.09

2.08

13.26

5.39

Dividends on common stock

Total

3,767

3,763

14,939

14,924

Per common share (U.S. dollars)

0.91

0.88

3.55

3.49

Millions of common shares

outstanding

Average - assuming dilution

4,138

4,275

4,205

4,275

Income taxes

5,787

2,650

20,176

7,636

Total other taxes and duties

7,754

8,659

31,455

32,955

Total taxes

13,541

11,309

51,631

40,591

Sales-based taxes

6,113

5,987

25,434

21,872

Total taxes including sales-based

taxes

19,654

17,296

77,065

62,463

ExxonMobil share of income taxes of equity

companies

1,512

918

7,594

2,756

ATTACHMENT I-b

CONDENSED CONSOLIDATED BALANCE

SHEET

(Preliminary)

Dollars in millions (unless otherwise

noted)

December 31,

2022

December 31,

2021

ASSETS

Current assets

Cash and cash equivalents

29,640

6,802

Cash and cash equivalents – restricted

25

—

Notes and accounts receivable – net

41,749

32,383

Inventories

Crude oil, products and merchandise

20,434

14,519

Materials and supplies

4,001

4,261

Other current assets

1,782

1,189

Total current assets

97,631

59,154

Investments, advances and long-term

receivables

49,793

45,195

Property, plant and equipment, at cost,

less accumulated depreciation and depletion

204,692

216,552

Other assets, including intangibles –

net

16,951

18,022

Total Assets

369,067

338,923

LIABILITIES

Current liabilities

Notes and loans payable

634

4,276

Accounts payable and accrued

liabilities

63,197

50,766

Income taxes payable

5,214

1,601

Total current liabilities

69,045

56,643

Long-term debt

40,559

43,428

Postretirement benefits reserves

10,045

18,430

Deferred income tax liabilities

22,874

20,165

Long-term obligations to equity

companies

2,338

2,857

Other long-term obligations

21,733

21,717

Total Liabilities

166,594

163,240

EQUITY

Common stock without par value

(9,000 million shares authorized, 8,019

million shares issued)

15,752

15,746

Earnings reinvested

432,860

392,059

Accumulated other comprehensive income

(13,270)

(13,764)

Common stock held in treasury

(3,937 million shares at December 31,

2022, and 3,780 million shares at December 31, 2021)

(240,293)

(225,464)

ExxonMobil share of equity

195,049

168,577

Noncontrolling interests

7,424

7,106

Total Equity

202,473

175,683

Total Liabilities and Equity

369,067

338,923

ATTACHMENT I-c

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS

(Preliminary)

Twelve Months Ended December

31,

Dollars in millions (unless otherwise

noted)

2022

2021

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income/(loss) including noncontrolling

interests

57,577

23,598

Depreciation and depletion (includes

impairments)

24,040

20,607

Changes in operational working capital,

excluding cash and debt

(194)

4,162

All other items – net

(4,626)

(238)

Net cash provided by operating

activities

76,797

48,129

CASH FLOWS FROM INVESTING

ACTIVITIES

Additions to property, plant and

equipment

(18,407)

(12,076)

Proceeds from asset sales and returns of

investments

5,247

3,176

Additional investments and advances

(3,090)

(2,817)

Other investing activities including

collection of advances

1,508

1,482

Net cash used in investing

activities

(14,742)

(10,235)

CASH FLOWS FROM FINANCING

ACTIVITIES

Additions to long-term debt

637

46

Reductions in long-term debt

(5)

(8)

Additions to short-term debt ¹

198

12,687

Reductions in short-term debt ¹

(8,075)

(29,396)

Additions/(Reductions) in commercial

paper, and debt with three months or less maturity

25

(2,983)

Contingent consideration payments

(58)

(30)

Cash dividends to ExxonMobil

shareholders

(14,939)

(14,924)

Cash dividends to noncontrolling

interests

(267)

(224)

Changes in noncontrolling interests

(1,475)

(436)

Common stock acquired

(15,155)

(155)

Net cash provided by (used in)

financing activities

(39,114)

(35,423)

Effects of exchange rate changes on

cash

(78)

(33)

Increase/(Decrease) in cash and cash

equivalents

22,863

2,438

Cash and cash equivalents at beginning of

period

6,802

4,364

Cash and cash equivalents at end of

period

29,665

6,802

¹ Includes commercial paper with a

maturity greater than three months

ATTACHMENT II-a

KEY FIGURES: IDENTIFIED ITEMS

4Q22

3Q22

4Q21

Dollars in Millions

2022

2021

12,750

19,660

8,870

Earnings/(Loss) (U.S. GAAP)

55,740

23,040

Identified Items

(530)

(697)

(752)

Impairments

(4,202)

(752)

—

587

1,081

Gain/(Loss) on sale of assets

886

1,081

(1,825)

324

—

Tax-related items

(1,501)

—

—

—

(4)

Severance

—

(52)

1,070

764

(250)

Other

1,456

(250)

(1,285)

978

75

Total Identified Items

(3,361)

27

14,035

18,682

8,795

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

59,101

23,013

4Q22

3Q22

4Q21

Dollars Per Common Share

2022

2021

3.09

4.68

2.08

Earnings/(Loss) Per Common Share ¹

(U.S. GAAP)

13.26

5.39

Identified Items Per Common Share

¹

(0.13)

(0.16)

(0.17)

Impairments

(1.00)

(0.17)

—

0.14

0.26

Gain/(Loss) on sale of assets

0.21

0.26

(0.44)

0.08

—

Tax-related items

(0.36)

—

—

—

—

Severance

—

(0.02)

0.26

0.18

(0.06)

Other

0.35

(0.06)

(0.31)

0.23

0.03

Total Identified Items Per Common Share

¹

(0.80)

0.01

3.40

4.45

2.05

Earnings/(Loss) Excl. Identified Items

Per Common Share ¹ (non-GAAP)

14.06

5.38

¹ Assuming dilution

ATTACHMENT II-b

KEY FIGURES: IDENTIFIED ITEMS BY

SEGMENT

Fourth Quarter 2022

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

2,493

5,708

2,188

1,882

298

(48)

406

354

(531)

12,750

Identified Items

Impairments

—

(216)

(58)

(216)

—

—

—

(40)

—

(530)

Tax-related items

—

(1,415)

—

(410)

—

—

—

—

—

(1,825)

Other

—

1,070

—

—

—

—

—

—

—

1,070

Total Identified Items

—

(561)

(58)

(626)

—

—

—

(40)

—

(1,285)

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

2,493

6,269

2,246

2,508

298

(48)

406

394

(531)

14,035

Third Quarter 2022

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

3,110

9,309

3,008

2,811

635

177

306

456

(152)

19,660

Identified Items

Impairments

—

(697)

—

—

—

—

—

—

—

(697)

Gain/(Loss) on sale of assets

—

587

—

—

—

—

—

—

—

587

Tax-related items

—

—

—

—

—

—

—

—

324

324

Other

—

688

—

—

—

—

—

—

76

764

Total Identified Items

—

578

—

—

—

—

—

—

400

978

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

3,110

8,731

3,008

2,811

635

177

306

456

(552)

18,682

Fourth Quarter 2021

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

1,768

4,317

699

203

774

597

763

353

(603)

8,870

Identified Items

Impairments

(263)

(489)

—

—

—

—

—

—

—

(752)

Gain/(Loss) on sale of assets

—

459

—

—

—

—

498

136

(12)

1,081

Severance

—

—

—

—

—

—

—

—

(4)

(4)

Other

—

(250)

—

—

—

—

—

—

—

(250)

Total Identified Items

(263)

(280)

—

—

—

—

498

136

(16)

75

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

2,031

4,597

699

203

774

597

265

217

(587)

8,795

2022

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

11,728

24,751

8,340

6,626

2,328

1,215

1,190

1,225

(1,663)

55,740

Identified Items

Impairments

—

(3,790)

(58)

(216)

—

—

—

(40)

(98)

(4,202)

Gain/(Loss) on sale of assets

299

587

—

—

—

—

—

—

—

886

Tax-related items

—

(1,415)

—

(410)

—

—

—

—

324

(1,501)

Other

—

1,380

—

—

—

—

—

—

76

1,456

Total Identified Items

299

(3,238)

(58)

(626)

—

—

—

(40)

302

(3,361)

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

11,429

27,989

8,398

7,252

2,328

1,215

1,190

1,265

(1,965)

59,101

2021

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate & Financing

Total

Dollars in millions

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

3,663

12,112

668

(1,014)

3,697

3,292

1,452

1,807

(2,636)

23,040

Identified Items

Impairments

(263)

(489)

—

—

—

—

—

—

—

(752)

Gain/(Loss) on sale of assets

—

459

—

—

—

—

498

136

(12)

1,081

Severance

—

—

—

—

—

—

—

—

(52)

(52)

Other

—

(250)

—

—

—

—

—

—

—

(250)

Total Identified Items

(263)

(280)

—

—

—

—

498

136

(64)

27

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

3,926

12,392

668

(1,014)

3,697

3,292

954

1,672

(2,572)

23,013

ATTACHMENT III

KEY FIGURES: UPSTREAM VOLUMES

4Q22

3Q22

4Q21

Net production of crude oil, natural gas

liquids, bitumen and synthetic oil, thousand barrels per day

(kbd)

2022

2021

789

783

770

United States

776

721

682

641

571

Canada/Other Americas

588

560

4

4

17

Europe

4

22

223

249

235

Africa

238

248

725

666

752

Asia

705

695

38

46

40

Australia/Oceania

43

43

2,461

2,389

2,385

Worldwide

2,354

2,289

4Q22

3Q22

4Q21

Natural gas production available for sale,

million cubic feet per day (mcfd)

2022

2021

2,383

2,351

2,713

United States

2,551

2,746

74

158

189

Canada/Other Americas

148

195

536

541

844

Europe

667

808

89

70

48

Africa

71

43

3,704

3,304

3,468

Asia

3,418

3,465

1,381

1,539

1,322

Australia/Oceania

1,440

1,280

8,167

7,963

8,584

Worldwide

8,295

8,537

3,822

3,716

3,816

Oil-equivalent production (koebd)¹

3,737

3,712

1 Natural gas is converted to an

oil-equivalent basis at six million cubic feet per one thousand

barrels.

ATTACHMENT IV

KEY FIGURES: MANUFACTURING THROUGHPUT

AND SALES

4Q22

3Q22

4Q21

Refinery throughput, thousand barrels per

day (kbd)

2022

2021

1,694

1,742

1,740

United States

1,702

1,623

433

426

416

Canada

418

379

1,157

1,253

1,246

Europe

1,192

1,210

532

557

546

Asia Pacific

539

571

167

187

170

Other

179

162

3,983

4,165

4,118

Worldwide

4,030

3,945

4Q22

3Q22

4Q21

Energy Products sales, thousand barrels

per day (kbd)

2022

2021

2,507

2,479

2,396

United States

2,426

2,267

2,916

3,058

2,976

Non-U.S.

2,921

2,863

5,423

5,537

5,373

Worldwide

5,347

5,130

2,270

2,335

2,325

Gasolines, naphthas

2,232

2,158

1,798

1,818

1,804

Heating oils, kerosene, diesel

1,774

1,749

349

365

267

Aviation fuels

338

220

210

252

265

Heavy fuels

235

269

796

767

712

Other energy products

768

734

5,423

5,537

5,373

Worldwide

5,347

5,130

4Q22

3Q22

4Q21

Chemical Products sales, thousand metric

tons (kt)

2022

2021

1,583

1,658

1,807

United States

7,270

7,017

3,076

3,023

3,026

Non-U.S.

11,897

12,126

4,658

4,680

4,833

Worldwide

19,167

19,142

4Q22

3Q22

4Q21

Specialty Products sales, thousand metric

tons (kt)

2022

2021

455

483

467

United States

2,049

1,943

1,332

1,434

1,368

Non-U.S.

5,762

5,723

1,787

1,917

1,835

Worldwide

7,810

7,666

ATTACHMENT V

KEY FIGURES: CAPITAL AND EXPLORATION

EXPENDITURES

4Q22

3Q22

4Q21

Dollars in millions

2022

2021

Upstream

2,118

1,837

1,307

United States

6,968

4,018

3,297

2,244

2,934

Non-U.S.

10,034

8,236

5,415

4,081

4,241

Total

17,002

12,254

Energy Products

343

316

331

United States

1,351

982

405

274

344

Non-U.S.

1,059

1,005

748

590

675

Total

2,410

1,987

Chemical Products

332

310

300

United States

1,123

1,200

824

644

380

Non-U.S.

1,842

825

1,156

954

680

Total

2,965

2,025

Specialty Products

12

15

167

United States

46

185

90

72

44

Non-U.S.

222

141

102

87

211

Total

268

326

Other

42

16

1

Other

59

3

7,463

5,728

5,808

Worldwide

22,704

16,595

CASH CAPITAL EXPENDITURES

4Q22

3Q22

4Q21

Dollars in millions

2022

2021

5,783

4,876

4,089

Additions to property, plant and

equipment

18,407

12,076

905

184

622

Net investments and advances

1,582

1,335

6,688

5,060

4,711

Total Cash Capital Expenditures

19,989

13,411

ATTACHMENT VI

KEY FIGURES: QUARTER

EARNINGS/(LOSS)

Results Summary

4Q22

3Q22

Change

vs

3Q22

4Q21

Change

vs

4Q21

Dollars in millions (except per share

data)

2022

2021

Change

vs

2021

12,750

19,660

-6,910

8,870

+3,880

Earnings/(Loss) (U.S. GAAP)

55,740

23,040

+32,700

14,035

18,682

-4,647

8,795

+5,240

Earnings/(Loss) Excluding Identified Items

(non-GAAP)

59,101

23,013

+36,088

3.09

4.68

-1.59

2.08

+1.01

Earnings Per Common Share ¹

13.26

5.39

+7.87

3.40

4.45

-1.05

2.05

+1.35

Earnings/(Loss) Excl. Identified Items Per

Common Share ¹

14.06

5.38

+8.68

7,463

5,728

+1,735

5,808

+1,655

Capital and Exploration Expenditures

22,704

16,595

+6,109

¹ Assuming dilution

ATTACHMENT VII

KEY FIGURES: EARNINGS/(LOSS) BY

QUARTER

Dollars in millions

2022

2021

2020

2019

2018

First Quarter

5,480

2,730

(610)

2,350

4,650

Second Quarter

17,850

4,690

(1,080)

3,130

3,950

Third Quarter

19,660

6,750

(680)

3,170

6,240

Fourth Quarter

12,750

8,870

(20,070)

5,690

6,000

Full Year

55,740

23,040

(22,440)

14,340

20,840

Dollars per common share ¹

2022

2021

2020

2019

2018

First Quarter

1.28

0.64

(0.14)

0.55

1.09

Second Quarter

4.21

1.10

(0.26)

0.73

0.92

Third Quarter

4.68

1.57

(0.15)

0.75

1.46

Fourth Quarter

3.09

2.08

(4.70)

1.33

1.41

Full Year

13.26

5.39

(5.25)

3.36

4.88

1 Computed using the average number of

shares outstanding during each period; assuming dilution

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230131005178/en/

Media Relations 972-940-6007

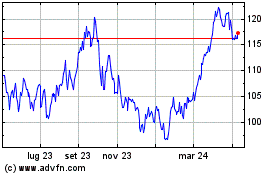

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Nov 2024 a Dic 2024

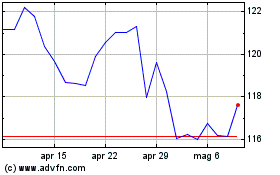

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Dic 2023 a Dic 2024