Cosa Resources Corp. (TSX-V:

COSA) (OTCQB:

COSAF) (FSE:

SSKU) (“

Cosa” or the

“

Company”) is pleased to announce that it has

entered into an agreement with Haywood Securities Inc., on behalf

of itself and a syndicate of agents (collectively, the

“

Agents”) who have agreed to sell, on a

commercially reasonable efforts private placement basis, up to

8,000,000 units of the Company (the “

Units”) at a

price of C$0.25 per Unit (the “

Unit Issue Price”),

and up to 7,058,824 charity flow-through units of the Company (the

“

Charity FT Units” and, together with the Charity

FT Units, the “

Offered Securities”) at a price of

C$0.425 per Charity FT Unit, for aggregate gross proceeds to the

Company of up to C$5,000,000.20 (collectively, the

“

Offering”).

Cosa’s largest shareholder, Denison Mines Corp.

(TSX:DML, NYSE American: DNN) (“Denison”), has

indicated that it will participate in the Offering up to an amount

that will maintain its holdings in Cosa at approximately 19.95%

following the completion of the Offering, pursuant to its

pre-emptive and top-up rights under the investor rights agreement

between Denison and Cosa dated January 14, 2025. Denison is a

leading Athabasca Basin-focused uranium mining, development, and

exploration company with a market capitalization of over C$2

billion. Denison’s current focus is advancing the development-stage

Wheeler River project, which represents one of the largest

undeveloped uranium mining projects in the infrastructure rich

eastern portion of the Athabasca Basin.

Each Unit will consist of one common share of

the Company (a “Unit Share”) plus

one-half of one common share purchase warrant (each whole warrant,

a “Warrant”). Each Charity FT Unit will consist of

one common share of the Company (a “FT Share”)

that qualifies as a “flow-through share” within the meaning of the

Income Tax Act (Canada) and will qualify as an “eligible

flow-through share” as defined in The Mineral Exploration Tax

Credit Regulations, 2014 (Saskatchewan) plus one-half of one

Warrant. Each Warrant will entitle the holder thereof to purchase

one common share of the Company (a “Warrant

Share”) at an exercise price of C$0.37 for 24 months

following the Closing Date (as defined below).

In addition, the Company has granted the Agents

an option (the “Over-Allotment Option”),

exercisable in whole or in part by the Agents, at any time up to 48

hours prior to the Closing Date (as defined below), to purchase up

to an additional C$1,000,000 worth of Offered Securities.

The Company understands that purchasers of the

Charity FT Units may immediately resell or donate some or all of

the Charity FT Units to registered charities, who may sell such

units (the “Resale Units”) concurrent with closing

of the Offering to purchasers arranged by the Agents at a price per

Resale Unit equal to the Unit Issue Price.

The Company intends to use the net proceeds from

the sale of Units to fund exploration and for additional working

capital purposes. The gross proceeds from the sale of Charity FT

Units will be used by the Company to incur eligible “Canadian

exploration expenses” that qualify as “flow-through critical

mineral mining expenditures” as such terms are defined in the

Income Tax Act (Canada), and to incur “eligible flow-through mining

expenditures” pursuant to The Mineral Exploration Tax Credit

Regulations, 2014 (Saskatchewan) (collectively, the

“Qualifying Expenditures”) related to the

Company’s uranium projects in the Athabasca Basin, Saskatchewan, on

or before December 31, 2026. All Qualifying Expenditures will be

renounced in favour of the subscribers of the Charity FT Units

effective December 31, 2025.

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106 –

Prospectus Exemptions (“NI 45-106”), the Offered

Securities (collectively, the “LIFE Securities”)

sold to purchasers who are not on the President’s List (including

the Offered Securities sold pursuant to the Over-Allotment Option)

will be offered pursuant to the listed issuer financing exemption

under Part 5A of NI 45-106 (the “Listed Issuer Financing

Exemption”). The Unit Shares, FT Shares and Warrant Shares

issuable pursuant to the sale of the LIFE Securities will be

immediately freely tradeable under applicable Canadian securities

legislation.

Any Offered Securities sold to purchasers who

are on the President’s List (including any Offered Securities sold

to Denison) (collectively, the “Non-LIFE

Securities”) will be offered by way of the “accredited

investor”, “family, friends and business associates” and “minimum

amount investment” exemptions under NI 45-106 in all of the

provinces of Canada, except Québec, or in the case of the Units,

also in offshore jurisdictions and the United States on a private

placement basis pursuant to one or more exemptions from the

registration requirements of the U.S. Securities Act. The Unit

Shares, FT Shares and Warrant Shares issuable pursuant to the sale

of the Non-LIFE Securities will be subject to a hold period ending

on the date that is four months plus one day following the Closing

Date under applicable Canadian securities laws.

The Offering is expected to close on or about

February 26, 2025 (the “Closing Date”), or such

other date as the Company and the Agents may agree, and is subject

to certain conditions including, but not limited to, receipt of all

necessary approvals including the approval of the TSX Venture

Exchange.

The Company will pay to the Agents a cash

commission of 5.0% of the gross proceeds raised in respect of the

Offering, other than in respect of Offered Securities issued to

certain purchasers on a president’s list to be agreed upon by the

Company and the Agents (the “President’s List”),

in which case the commission in respect of such issuance shall be

equal to 3.0%. In addition, the Company will issue to the Agents

compensation options, exercisable for a period of 24 months

following the Closing Date, to acquire in aggregate that number of

common shares which is equal to 6.0% of the number of Offered

Securities sold under the Offering at an exercise price equal to

the Unit Issue Price, other than in respect of Offered Securities

issued to purchasers on the President’s List, in which case the

Company will not issue any compensation options.

There is an offering document related to the

Offering that can be accessed under the Company’s profile at

www.sedarplus.ca and on the Company’s website at

www.cosaresources.ca. Prospective investors should read this

offering document before making an investment decision.

The Offered securities described in this news

release have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”), or any United States state securities

laws, and may not be offered or sold, directly or indirectly,

within the United States or to, or for the account or benefit of,

U.S. persons absent registration or an exemption from registration

requirements. This news release does not constitute an offer for

sale of securities, nor a solicitation for offers to buy any

securities in the United States, not in any other jurisdiction in

which such offer, solicitation or sale would be unlawful.

The terms “Unites States” and “U.S. person” used

herein are as defined in Regulation S under the U.S. Securities

Act.

About Cosa Resources Corp.

Cosa Resources is a Canadian uranium exploration

company operating in northern Saskatchewan. The portfolio comprises

roughly 237,000 ha across multiple 100% owned and Cosa operated

Joint Venture projects in the Athabasca Basin region, all of which

are underexplored, and the majority reside within or adjacent to

established uranium corridors.

Cosa’s award-winning management team has a long

track record of success in Saskatchewan. In 2022, members of the

Cosa team were awarded the AME Colin Spence Award for their

previous involvement in discovering IsoEnergy’s Hurricane deposit.

Prior to Hurricane, Cosa personnel led teams or had integral roles

in the discovery of Denison’s Gryphon deposit and 92 Energy's GMZ

zone and held key roles in the founding of both NexGen and

IsoEnergy.

In January of 2025, the Company entered a

transformative strategic collaboration with Denison that has

secured Cosa access to several additional highly prospective

eastern Athabasca uranium exploration projects. As Cosa’s largest

shareholder, Denison gains exposure to Cosa’s potential for

exploration success and its pipeline of uranium projects.

Cosa’s primary focus through 2024 was initial

drilling at the 100% owned Ursa Project, which captures over

60-kilometres of strike length of the Cable Bay Shear Zone, a

regional structural corridor with known mineralization and limited

historical drilling. It potentially represents the last remaining

eastern Athabasca corridor to not yet yield a major discovery,

which the Company believes is primarily due to a lack of modern

exploration. Modern geophysics completed by Cosa in 2023 identified

multiple high-priority target areas characterized by conductive

basement stratigraphy beneath or adjacent to broad zones of

inferred sandstone alteration – a setting that is typical of most

eastern Athabasca uranium deposits. Guided by a recently completed

Ambient Noise Tomography (ANT) survey, Cosa’s second and most

recent drilling campaign at Ursa intersected a significant zone of

unconformity-style sandstone hosted structure and alteration

underlain by several intervals of anomalous radioactivity in the

basement rocks.

Contact

Keith Bodnarchuk, President & CEO

info@cosaresources.ca

+1 888-899-2672 (COSA)

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Information

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

laws. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions or future events or performance (often, but

not always, identified by words or phrases such as "believes",

"anticipates", "expects", "is expected", "scheduled", "estimates",

"pending", "intends", "plans", "forecasts", "targets", or "hopes",

or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "will",

"should" "might", "will be taken", or "occur" and similar

expressions) are not statements of historical fact and may be

forward-looking statements. Forward-looking information herein

includes, but is not limited to, statements that address

activities, events or developments that Cosa expects or anticipates

will or may occur in the future including the closing date of the

Offering, proposed use of proceeds of the Offering and the tax

treatment of the Charity FT Units.

Forward-looking statements and forward-looking

information relating to any future mineral production, liquidity,

enhanced value and capital markets profile of the Company, future

growth potential for the Company and its business, and future

exploration plans are based on management’s reasonable assumptions,

estimates, expectations, analyses and opinions, which are based on

management’s experience and perception of trends, current

conditions and expected developments, and other factors that

management believes are relevant and reasonable in the

circumstances, but which may prove to be incorrect. Assumptions

have been made regarding, among other things, the price of metals;

costs of exploration and development; the estimated costs of

development of exploration projects; the Company’s ability to

operate in a safe and effective manner.

These statements reflect the Company’s

respective current views with respect to future events and are

necessarily based upon a number of other assumptions and estimates

that, while considered reasonable by management, are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors, both

known and unknown, could cause actual results, performance, or

achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward-looking statements or forward-looking information

and the Company has made assumptions and estimates based on or

related to many of these factors. Such factors include, without

limitation: the future tax treatment of the Charity FT Units,

competitive risks and the availability of financing; precious

metals price volatility; risks associated with the conduct of the

Company's mining activities; regulatory, consent or permitting

delays; risks relating to reliance on the Company's management team

and outside contractors; the Company's inability to obtain

insurance to cover all risks, on a commercially reasonable basis or

at all; currency fluctuations; risks regarding the failure to

generate sufficient cash flow from operations; risks relating to

project financing and equity issuances; risks and unknowns inherent

in all mining projects; contests over title to properties,

particularly title to undeveloped properties; laws and regulations

governing the environment, health and safety; operating or

technical difficulties in connection with mining or development

activities; employee relations, labour unrest or unavailability;

the Company's interactions with surrounding communities; the

speculative nature of exploration and development; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company;

litigation risk; and the factors identified in the Company’s public

disclosure documents. Readers are cautioned against attributing

undue certainty to forward-looking statements or forward-looking

information. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

anticipated, estimated or intended. The Company does not intend,

and does not assume any obligation, to update these forward-looking

statements or forward-looking information to reflect changes in

assumptions or changes in circumstances or any other events

affecting such statements or information, other than as required by

applicable law.

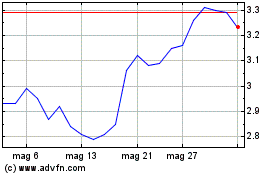

Grafico Azioni Denison Mines (TSX:DML)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Denison Mines (TSX:DML)

Storico

Da Feb 2024 a Feb 2025