Ageas to Sell Hong Kong Life Insurance Business

31 Agosto 2015 - 3:10AM

Dow Jones News

BRUSSELS—Belgian insurance company Ageas said Sunday it will

sell its Hong Kong Life insurance business to Chinese

asset-management firm JD Capital for €1.23 billion ($1.4

billion).

Ageas said it expects to complete the sale in the first half of

2016 subject to regulatory approvals.

The company said in a news release it remains firmly committed

to its Asian businesses but will focus on its joint ventures and

partnership in India, Malaysia, China, Philippines, Thailand and

Vietnam.

"The decision to sell our business in Hong Kong follows a

strategic review of our Asian activities in which we concluded that

it is in the group's best interest to realign our strategy towards

the fast growing emerging markets of Asia," said Ageas Chief

Executive Bart de Smet.

Ageas, the former insurance unit of failed financial firm

Fortis, bought Hong Kong's Pacific Century Insurance and rebranded

the company to Ageas in 2007

The company said the sale of the Hong Kong unit would have an

estimated positive €450 million impact on its net results.

The Hong Kong unit has more than 2,500 professional financial

advisers and saw gross inflows of €481 million last year.

Beijing-based JD Capital, established in 2007, is listed on the

Chinese National Equities Exchange and Quotations. It has offices

across China, Asia and North America operating a variety of

financial-service firms including one of China's largest

private-equity investment firms.

Write to Laurence Norman at laurence.norman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 30, 2015 20:55 ET (00:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

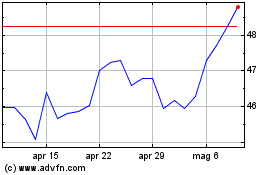

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Mag 2024 a Giu 2024

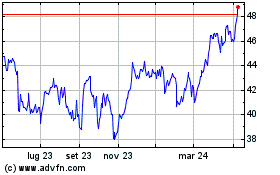

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Giu 2023 a Giu 2024