Goldshore

Adds More High-Grade

Shears at the Southwest Zone

Intersects 3.25 g/t Au

over 13.05m and 3.88 g/t over 5.6m

VANCOUVER, B.C., April

25, 2023 -- InvesrtorsHub NewsWire -- Goldshore

Resources Inc. (TSXV: GSHR / OTCQB: GSHRF / FWB: 8X00)

("Goldshore" or the "Company"), is pleased

to announce

assay results from

its 100,000-meter drill

program at

the Moss

Gold Project

in Northwest

Ontario, Canada (the

"Moss Gold

Project" or "Moss Gold

Deposit").

Highlights:

-

Results from nine holes drilled to infill

poorly tested parts of the Southwest Zone have delineated

multiple high-grade

structures within the broader mineralized envelope

with best intercepts of:

-

1.47 g/t Au over 16.9m

from 375.3m depth in MMD-22-111, including

-

3.88 g/t over

5.6m from 386.0m

-

1.34 g/t Au over 37.0m

from 400.85m depth in MMD-23-116, including

-

3.25 g/t Au over

13.05m from 405.55m

-

1.63 g/t Au over 14.0m

from 409.0m depth in MMD-23-118A

-

1.97 g/t Au over 10.95m

from 157.0m depth in MMD-23-119

-

Drill results prove that the

Southwest Zone is a

continuation of the Main Zone and not a fault

offset as previously interpreted. Mapping and geophysical data,

together with historical scout drilling, show that

mineralization

continues intermittently for another 3 kilometers to the southwest

and that many of the better targets are yet to be

drilled.

-

With drilling recently completed, the Company

is preparing an updated mineral resource

expected in May ("May 2023

MRE"). The May 2023 MRE will use data from an

additional 72 holes compared to the November 2022 mineral resource

estimate ("November 2022

MRE"). Mineralization in the

resource area remains open in multiple directions.

President and CEO Brett Richards stated:

"These results continue to

support our thesis that the size and scale of the Moss Gold Project

will be large enough to support a material and meaningful update to

the mineral resource estimate, which is expected in early May

2023.

These additional results

highlighting the mineralization in the south-west zone augment the

press release of April 20, 2023, and continue to expand the zone

well outside the historical resource, still open in several

directions and at depth. In addition to the May 2023 MRE, we still

have 30 quality drill targets to be tested. These include gold,

coppercobalt, and polymetallic

prospects. We have drilled less than 10% of the identified targets

on our land package and are currently building a plan to drill test

the better targets. It will be an exciting period when we are ready

to evaluate the additional resource potential of the larger

inventory of targets within our land package.

We have focused on the

currently defined portion of the Moss Gold Deposit as a meaningful

Phase One Project that Goldshore itself can build. The Moss Gold

Deposit remains open at depth and through several yet-to-be drilled

parallel structures; and it is part of an overall 8-kilometer

strike length of gold mineralization in drill holes. This strongly

suggests that the Phase One Project is part of a much larger total

project."

Technical

Overview

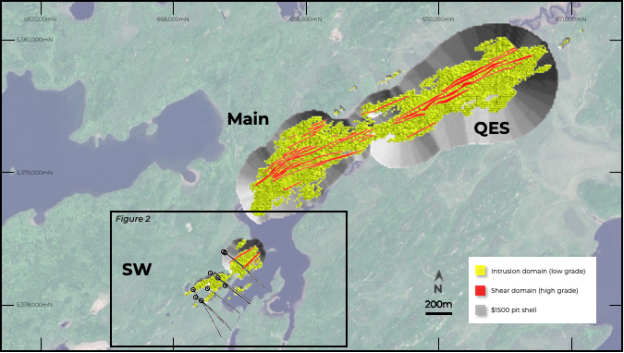

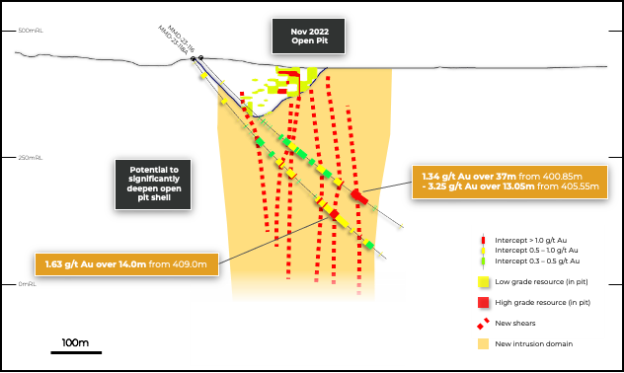

Figure 1 shows the location of the drill holes

in this press release and Figure 2 shows a close up of the drilled

area with significant intercepts. Figure 3 is a typical section

through hole MMD-23-116, -118A. Table 1 shows the significant

intercepts. Table 2 shows the drill hole locations.

Figure 1:

Location of drill holes in this release relative to the

November 2022 MRE

and $1,500 open pit shell constraint.

Figure

2:

close up of Southwest Zone with significant intercepts relative to

the November 2022 MRE and $1,500 open pit shell

constraint.

Figure 3: Drill section through holes MMD-23-116 and -118A showing

the significant expansion of the mineralized model beneath the

November 2022 MRE and $1,500 open pit shell constraint,

which should add to mineral resources in the May 2023 MRE.

The Southwest Zone was previously considered to

be a small fault-offset extension of the Main Zone. As a result, it

was poorly drilled, which led to the definition of only a

small open pit-constrained Mineral Resource

(Figure 1 and 2).

Oriented core measurements from earlier

drilling showed a significant change in strike of the Southwest

Zone, revealing it to be 035º rather than the assumed 065º strike

based on the known orientation of the Main and QES Zones. The nine

holes reported herein were drilled perpendicular to the new strike

to infill a poorly drilled volume in the center of the Southwest

Zone at a closer spacing (30 meters) along each section to confirm

the continuity of high-grade shears. This should enable greater

confidence in the resource and an expansion of the open pit

constraints at depth.

Holes MMD-22-111, MMD-23-116, -118A, and -119

intersected several high-grade shears (e.g., 0.65m @ 36.8 g/t Au in

MMD-23-116) hosting quartz-carbonate veinlets with up to 3-5%

pyritechalcopyrite within a strongly albite-hematite

and silica-sericite-pyrite and carbonate altered diorite intrusion

complex (Figure 4). The shears anastomose along the same

orientation of the zone and trend beyond the area explored by

historical drilling.

Holes MMD-22-107, -110, MMD-23-115, -117, -120

intersected wide intervals of low-grade mineralization within the

altered intrusion containing localized narrow higher-grade shears.

The results are similar to those encountered in the historic

drilling and include:

-

0.58 g/t Au over 37.7m from 11.3m depth in

MMD-22-107

-

0.41 g/t Au over 50.95m from 7.0m depth in

MMD-22-110

-

0.38 g/t Au over 55.1m from 231.9m depth in

MMD-23-116

-

0.43 g/t Au over 122.3 from 24.7m depth in

MMD-23-117

-

0.58 g/t Au over 81.8 from 369.2m depth in

MMD-23-118A

-

0.51 g/t Au over 122.8m from 116.0m depth in

MMD-23-119 and

-

0.61 g/t Au over 33.2m from 447.85m

depth

Hole MMD-22-107, -110, and -111 represent the

most western holes drilled to date in the Southwest Zone, including

historical drilling. They illustrate the continued potential to

expand the Moss Gold Deposit beyond the original footprint with the

newly understood orientation of the shear structures trending

southwest of the historical exploration drilling. Gold has been

intersected in scout drill holes over a further three kilometers

along strike. Our airborne VTEM/magnetics data show that more

favourable targets exist along this corridor in areas that have yet

to be drilled.

Figure

4:

Drill core from 416.4 - 417.05m (0.65 m @ 36.8 g/t Au) in

MMD-23-116 highlighting a pyrite + chalcopyrite mineralized

quartz-carbonate vein within the sheared, altered

intrusion.

Pete Flindell, VP Exploration for Goldshore,

said "These results show that the

Southwest Zone is much better mineralized than historical

drillholes suggested. They also show that the Moss Gold Deposit is

yet to be closed off, confirming our belief that this is a much

bigger mineralized system than is appreciated."

Table 1: Significant downhole gold intercepts

|

HOLE ID

|

FROM

|

TO

|

LENGTH

(m)

|

TRUE WIDTH

(m)

|

CUT GRADE

(g/t Au)

|

UNCUT

GRADE

(g/t Au)

|

|

MMD-22-107

|

11.30

|

49.00

|

37.70

|

24.4

|

0.58

|

0.58

|

|

including

|

25.30

|

30.70

|

5.40

|

3.5

|

2.93

|

2.93

|

|

|

97.10

|

101.80

|

4.70

|

3.2

|

0.40

|

0.40

|

|

|

113.20

|

122.45

|

9.25

|

6.3

|

0.35

|

0.35

|

|

|

175.20

|

177.50

|

2.30

|

1.6

|

0.95

|

0.95

|

|

|

193.60

|

201.50

|

7.90

|

5.5

|

0.33

|

0.33

|

|

|

210.10

|

217.00

|

6.90

|

4.9

|

0.30

|

0.30

|

|

|

222.05

|

225.50

|

3.45

|

2.4

|

0.43

|

0.43

|

|

|

236.00

|

251.00

|

15.00

|

10.7

|

0.32

|

0.32

|

|

|

334.00

|

344.00

|

10.00

|

7.5

|

0.65

|

0.65

|

|

including

|

334.00

|

336.00

|

2.00

|

1.5

|

1.77

|

1.77

|

|

|

|

|

|

|

|

|

|

MMD-22-110

|

7.00

|

57.95

|

50.95

|

33.3

|

0.41

|

0.41

|

|

|

73.05

|

83.55

|

10.50

|

7.0

|

0.35

|

0.35

|

|

|

88.15

|

97.00

|

8.85

|

6.0

|

0.38

|

0.38

|

|

|

104.45

|

112.00

|

7.55

|

5.2

|

0.53

|

0.53

|

|

|

127.00

|

132.90

|

5.90

|

4.1

|

0.49

|

0.49

|

|

|

166.00

|

169.00

|

3.00

|

2.1

|

0.39

|

0.39

|

|

|

174.00

|

182.00

|

8.00

|

5.7

|

0.68

|

0.68

|

|

|

202.95

|

208.00

|

5.05

|

3.6

|

0.35

|

0.35

|

|

|

241.80

|

255.00

|

13.20

|

9.8

|

0.31

|

0.31

|

|

|

273.60

|

277.00

|

3.40

|

2.5

|

0.82

|

0.82

|

|

|

301.00

|

319.00

|

18.00

|

13.6

|

0.57

|

0.57

|

|

including

|

315.05

|

319.00

|

3.95

|

3.0

|

1.83

|

1.83

|

|

|

336.00

|

342.00

|

6.00

|

4.6

|

0.34

|

0.34

|

|

|

379.00

|

388.00

|

9.00

|

7.1

|

1.37

|

1.37

|

|

including

|

379.00

|

381.00

|

2.00

|

1.6

|

4.02

|

4.02

|

|

|

|

|

|

|

|

|

|

MMD-22-111

|

83.00

|

101.15

|

18.15

|

12.6

|

0.30

|

0.30

|

|

|

102.80

|

109.60

|

6.80

|

4.8

|

0.31

|

0.31

|

|

|

115.40

|

122.90

|

7.50

|

5.3

|

0.60

|

0.60

|

|

|

133.00

|

148.90

|

15.90

|

11.5

|

0.51

|

0.51

|

|

|

161.70

|

166.00

|

4.30

|

3.1

|

0.32

|

0.32

|

|

|

180.00

|

184.10

|

4.10

|

3.0

|

0.42

|

0.42

|

|

|

231.00

|

240.85

|

9.85

|

7.4

|

0.30

|

0.30

|

|

|

290.00

|

293.00

|

3.00

|

2.3

|

0.50

|

0.50

|

|

|

375.30

|

392.20

|

16.90

|

13.5

|

1.47

|

1.47

|

|

including

|

386.00

|

391.60

|

5.60

|

4.5

|

3.88

|

3.88

|

|

including

|

391.00

|

391.60

|

0.60

|

0.5

|

16.1

|

16.1

|

|

|

456.00

|

458.05

|

2.05

|

1.7

|

0.32

|

0.32

|

|

|

487.90

|

490.00

|

2.10

|

1.7

|

0.36

|

0.36

|

|

|

|

|

|

|

|

|

|

MMD-23-115

|

56.00

|

77.60

|

21.60

|

15.2

|

0.48

|

0.48

|

|

|

88.40

|

97.35

|

8.95

|

6.3

|

0.69

|

0.69

|

|

including

|

93.40

|

96.00

|

2.60

|

1.8

|

1.50

|

1.50

|

|

|

111.00

|

113.25

|

2.25

|

1.6

|

0.50

|

0.50

|

|

|

120.30

|

132.60

|

12.30

|

8.7

|

0.53

|

0.53

|

|

|

207.00

|

210.00

|

3.00

|

2.2

|

0.42

|

0.42

|

|

|

215.00

|

219.00

|

4.00

|

2.9

|

0.66

|

0.66

|

|

|

241.60

|

251.00

|

9.40

|

7.0

|

0.32

|

0.32

|

|

|

257.00

|

259.55

|

2.55

|

1.9

|

0.33

|

0.33

|

|

|

280.20

|

282.50

|

2.30

|

1.7

|

0.44

|

0.44

|

|

|

|

|

|

|

|

|

|

MMD-23-116

|

65.00

|

67.00

|

2.00

|

1.4

|

0.55

|

0.55

|

|

|

176.00

|

178.00

|

2.00

|

1.5

|

0.32

|

0.32

|

|

|

221.15

|

226.70

|

5.55

|

4.2

|

0.33

|

0.33

|

|

|

231.90

|

287.00

|

55.10

|

42.8

|

0.38

|

0.38

|

|

|

297.30

|

307.00

|

9.70

|

7.6

|

0.44

|

0.44

|

|

|

316.60

|

348.40

|

31.80

|

25.3

|

0.47

|

0.47

|

|

|

359.00

|

377.00

|

18.00

|

14.4

|

0.58

|

0.58

|

|

including

|

374.00

|

377.00

|

3.00

|

2.4

|

1.61

|

1.61

|

|

|

400.85

|

437.85

|

37.00

|

30.1

|

1.34

|

1.46

|

|

including

|

405.55

|

418.60

|

13.05

|

10.6

|

3.25

|

3.59

|

|

including

|

416.40

|

417.05

|

0.65

|

0.5

|

30.0

|

36.8

|

|

|

|

|

|

|

|

|

|

MMD-23-117

|

24.70

|

147.00

|

122.30

|

82.7

|

0.43

|

0.43

|

|

including

|

45.00

|

47.00

|

2.00

|

1.3

|

2.22

|

2.22

|

|

and

|

67.05

|

71.00

|

3.95

|

2.7

|

1.30

|

1.30

|

|

and

|

106.00

|

114.00

|

8.00

|

5.5

|

1.79

|

1.79

|

|

|

165.65

|

182.75

|

17.10

|

11.8

|

0.41

|

0.41

|

|

|

217.35

|

258.00

|

40.65

|

28.5

|

0.35

|

0.35

|

|

including

|

217.35

|

219.40

|

2.05

|

1.4

|

1.86

|

1.86

|

|

|

307.00

|

310.00

|

3.00

|

2.1

|

0.45

|

0.45

|

|

|

353.00

|

388.00

|

35.00

|

25.3

|

0.31

|

0.31

|

|

|

404.65

|

414.10

|

9.45

|

6.9

|

0.99

|

0.99

|

|

including

|

404.65

|

412.90

|

8.25

|

6.0

|

1.03

|

1.03

|

|

|

446.00

|

448.00

|

2.00

|

1.5

|

0.62

|

0.62

|

|

|

|

|

|

|

|

|

|

MMD-23-118A

|

35.85

|

45.00

|

9.15

|

5.5

|

0.88

|

0.88

|

|

|

101.00

|

109.00

|

8.00

|

5.1

|

0.96

|

0.96

|

|

|

202.00

|

220.00

|

18.00

|

12.3

|

0.31

|

0.31

|

|

|

241.30

|

249.10

|

7.80

|

5.4

|

0.30

|

0.30

|

|

|

261.05

|

279.00

|

17.95

|

12.6

|

0.68

|

0.68

|

|

including

|

271.55

|

274.10

|

2.55

|

1.8

|

3.66

|

3.66

|

|

|

290.20

|

310.00

|

19.80

|

14.1

|

0.67

|

0.67

|

|

including

|

306.90

|

309.00

|

2.10

|

1.5

|

1.79

|

1.79

|

|

|

369.20

|

451.00

|

81.80

|

60.7

|

0.58

|

0.58

|

|

including

|

374.80

|

379.00

|

4.20

|

3.1

|

1.03

|

1.03

|

|

and

|

389.45

|

391.90

|

2.45

|

1.8

|

1.45

|

1.45

|

|

and

|

409.00

|

423.00

|

14.00

|

10.4

|

1.63

|

1.63

|

|

|

461.95

|

467.10

|

5.15

|

3.9

|

0.59

|

0.59

|

|

|

483.00

|

485.00

|

2.00

|

1.5

|

2.44

|

2.44

|

|

|

495.05

|

516.55

|

21.50

|

16.4

|

0.37

|

0.37

|

|

|

|

|

|

|

|

|

|

MMD-23-119

|

84.75

|

96.00

|

11.25

|

7.8

|

0.30

|

0.30

|

|

|

116.00

|

238.80

|

122.80

|

87.8

|

0.51

|

0.51

|

|

including

|

157.00

|

167.95

|

10.95

|

7.8

|

1.97

|

1.97

|

|

including

|

165.20

|

165.90

|

0.70

|

0.5

|

19.4

|

19.4

|

|

and

|

189.80

|

192.95

|

3.15

|

2.3

|

1.48

|

1.48

|

|

|

305.00

|

329.50

|

24.50

|

18.2

|

0.41

|

0.41

|

|

|

362.00

|

365.05

|

3.05

|

2.3

|

0.51

|

0.51

|

|

|

414.00

|

417.00

|

3.00

|

2.3

|

0.43

|

0.43

|

|

|

431.20

|

437.20

|

6.00

|

4.6

|

0.31

|

0.31

|

|

|

439.00

|

441.05

|

2.05

|

1.6

|

0.32

|

0.32

|

|

|

447.85

|

481.05

|

33.20

|

25.6

|

0.61

|

0.61

|

|

including

|

479.00

|

481.05

|

2.05

|

1.6

|

3.45

|

3.45

|

|

|

508.00

|

514.40

|

6.40

|

5.0

|

0.58

|

0.58

|

|

|

|

|

|

|

|

|

|

MMD-23-120

|

12.90

|

31.95

|

19.05

|

12.4

|

0.59

|

0.59

|

|

|

43.65

|

61.10

|

17.45

|

11.4

|

0.30

|

0.30

|

|

|

63.00

|

125.00

|

62.00

|

40.9

|

0.32

|

0.32

|

|

|

137.85

|

154.30

|

16.45

|

11.0

|

0.33

|

0.33

|

|

|

165.90

|

170.00

|

4.10

|

2.7

|

0.37

|

0.37

|

|

|

175.00

|

178.85

|

3.85

|

2.6

|

0.80

|

0.80

|

|

|

208.20

|

211.55

|

3.35

|

2.3

|

0.43

|

0.43

|

|

|

241.15

|

263.20

|

22.05

|

15.2

|

0.30

|

0.30

|

|

|

276.00

|

282.10

|

6.10

|

4.2

|

0.61

|

0.61

|

|

|

352.00

|

377.00

|

25.00

|

17.7

|

0.47

|

0.47

|

|

including

|

368.00

|

370.05

|

2.05

|

1.5

|

1.15

|

1.15

|

|

|

|

|

|

|

|

|

|

Intersections calculated

above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a

maximum internal waste interval of 10 metres. Shaded intervals are

intersections calculated above a 1.0 g/t Au cut off. Intervals in

bold are those with a grade thickness factor exceeding 20 gram x

metres / tonne gold. True widths are approximate and assume a

subvertical body.

|

Table 2: Location of drill holes in this press release

|

HOLE

|

EAST

|

NORTH

|

RL

|

AZIMUTH

|

DIP

|

EOH

|

|

MMD-22-107

|

668,208

|

5,378,030

|

442

|

127°

|

-50°

|

450

|

|

MMD-22-110

|

668,166

|

5,378,056

|

448

|

126°

|

-50°

|

402

|

|

MMD-22-111

|

668,147

|

5,378,114

|

445

|

143°

|

-50°

|

552

|

|

MMD-23-115

|

668,388

|

5,378,145

|

429

|

125°

|

-45°

|

324

|

|

MMD-23-116

|

668,387

|

5,378,392

|

446

|

124°

|

-49°

|

525

|

|

MMD-23-117

|

668,334

|

5,378,203

|

435

|

124°

|

-49°

|

450

|

|

MMD-23-118a

|

668,375

|

5,378,401

|

444

|

126°

|

-54°

|

552

|

|

MMD-23-119

|

668,277

|

5,378,239

|

447

|

126°

|

-50°

|

525

|

|

MMD-23-120

|

668,255

|

5,378,123

|

436

|

125°

|

-49°

|

450

|

Analytical

and QA/QC Procedures

All samples were sent to ALS Geochemistry in

Thunder Bay for preparation and analysis was performed in the ALS

Vancouver analytical facility. ALS is accredited by the Standards

Council of Canada (SCC) for the Accreditation of Mineral Analysis

Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were

analyzed for gold via fire assay with an AA finish ("Au-AA23") and

48 pathfinder elements via ICP-MS after four-acid digestion

("ME-MS61"). Samples that assayed over 10 ppm Au were re-run via

fire assay with a gravimetric finish

("Au-GRA21").

In addition to ALS quality assurance / quality

control ("QA/QC") protocols, Goldshore has implemented a quality

control program for all samples collected through the drilling

program. The quality control

program was designed by a qualified and independent third party,

with a focus on the quality of analytical results for gold.

Analytical results are received, imported to our secure on-line

database and evaluated to meet our established guidelines to ensure

that all sample batches pass industry best practice for analytical

quality control. Certified reference materials are considered

acceptable if values returned are within three standard deviations

of the certified value reported by the manufacture of the material.

In addition to the certified reference material, certified blank

material is included in the sample stream to monitor contamination

during sample preparation. Blank material results are assessed

based on the returned gold result being less than ten times the

quoted lower detection limit of the analytical method. The results

of the on-going analytical quality control program are evaluated

and reported to Goldshore by Orix Geoscience Inc.

Grant

of Stock Options and RSUs

In addition, the Company announces that it has

granted a total of 4,100,000 stock options

("Options") to purchase common shares of the

Company to certain directors, officers, employees and consultants.

Such Options are exercisable into common shares of the Company at

an exercise price of $0.25 per common share for a period of five

years from the date of grant. Of the Options, 3,900,000 will vest

1/3 on October 24, 2023, 1/3 on October 24, 2024, and 1/3 on

October 24, 2025; and 200,000 will vest 1/3 immediately and 1/3

annually thereafter. All Options expire on April 24,

2028.

The Company has also issued a total of

1,673,968 restricted share units ("RSUs") to certain directors and officers of

the Company. The RSUs will fully vest on the date that is one year

from the date of grant. Once vested, each RSU represents the right

to receive one common share of the Company, the equivalent cash

value thereof, or a combination of the two, at the Company's

discretion. The grant of Options and issuance of RSUs have been

made in accordance with the Company's Omnibus Incentive Plan (the

"Plan") that was approved by the Company's

directors on November 8, 2022. The Plan remains subject to the

approval of the shareholders of the Company at its next Annual

General and Special Meeting. Any grants of share-based compensation

made under the Plan will also be subject to the approval of

disinterested shareholders at the next Annual General and Special

Meeting of the Company.

In addition, certain directors and officers of

the Company have agreed to forgive an aggregate of $168,833 of

debt, representing accrued consulting fees incurred during the

period from January 2023 to March 2023 and directors' fees incurred

during the period from July 2022 to March 2023.

About

Goldshore

Goldshore is an emerging junior gold

development company and owns 100% of the Moss Gold Project located

in Ontario, with Wesdome Gold Mines Ltd. being a large

shareholder. Supported by an

industry-leading management group, board of directors and advisory

board, Goldshore is positioned to advance the Moss Gold Project

through the next stages of exploration and development.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice

President – Exploration of the Company, a qualified person under NI

43-101 has approved the scientific and technical information

contained in this news release.

Neither the TSXV nor its

Regulation Services Provider (as that term is defined in the

policies of the TSXV) accepts responsibility for the adequacy or

accuracy of this release.

For More Information –

Please Contact:

Brett A. Richards

President, Chief Executive Officer and

Director

Goldshore Resources Inc.

P. +1 604 288 4416

M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes

|

Twitter: GoldShoreRes |

LinkedIn: goldshoreres

Cautionary Note

Regarding Forward-Looking Statements

This news release contains statements that

constitute "forward-looking statements." Such forward looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the Company's actual results, performance or

achievements, or developments to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking

statements. Forward looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects,"

"plans," "anticipates," "believes," "intends," "estimates,"

"projects," "potential" and similar expressions, or that events or

conditions "will," "would," "may," "could" or "should"

occur.

Forward-looking statements in this news release

include, among others, statements relating to expectations

regarding the exploration and development of the Moss Gold Project,

the release of an updated mineral resource estimate and preliminary

economic assessment, and other statements that are not historical

facts. By their nature, forward-looking statements involve known

and unknown risks, uncertainties and other factors which may cause

our actual results, performance or achievements, or other future

events, to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such factors and risks include, among

others: the Company may require additional financing from time to

time in order to continue its operations which may not be available

when needed or on acceptable terms and conditions acceptable;

compliance with extensive government regulation; domestic and

foreign laws and regulations could adversely affect the Company's

business and results of operations; the stock markets have

experienced volatility that often has been unrelated to the

performance of companies and these fluctuations may adversely

affect the price of the Company's securities, regardless of its

operating performance; and the impact of COVID-19.

The forward-looking information contained in

this news release represents the expectations of the Company as of

the date of this news release and, accordingly, is subject to

change after such date. Readers should not place undue importance

on forward-looking information and should not rely upon this

information as of any other date. The Company undertakes no

obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors,

should change.

Grafico Azioni Goldshore Resources (QB) (USOTC:GSHRF)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Goldshore Resources (QB) (USOTC:GSHRF)

Storico

Da Dic 2023 a Dic 2024