L'Oréal Would Pay to Disentangle Itself From Nestlé -- Update

09 Febbraio 2018 - 4:55PM

Dow Jones News

By Matthew Dalton and Saabira Chaudhuri

PARIS--Cosmetics giant L'Oréal SA said it has the financial

firepower to buy the roughly $27 billion worth of its stock held by

Nestlé SA, opening the door to negotiations over how to decouple

two of the world's biggest consumer-goods companies.

"If one day Nestlé decides that they want to sell part of their

shares or their shares, obviously we would be a buyer," said

L'Oréal Chief Executive Jean-Paul Agon in an interview. "And

obviously, we would buy them to cancel them."

"It would be very accretive," Mr. Agon added.

The sale would end a decadeslong relationship that stabilized

L'Oreal's shareholder structure and delivered years of strong

returns for Nestlé. It would also cement control of L'Oréal for

Françoise Bettencourt Meyers, the only child of the late L'Oréal

heiress Liliane Bettencourt. Ms. Bettencourt Meyers and her

children, who currently own 33% of the shares, would see their

stake rise to 43% if the sale and share cancellation were to go

through.

Nestle's longstanding stake in L'Oréal has come under scrutiny

since Daniel Loeb, the activist investor who built up a 1.3% stake

in Nestlé last year, launched a campaign to get the Swiss

consumer-goods company to sell its L'Oréal shares. Mark Schneider,

Nestlé's new chief executive, has so far batted away Mr. Loeb's

suggestions, saying that L'Oréal is a good investment. He hasn't,

however, ruled out selling the stake.

Nestlé declined to comment.

Ms. Bettencourt's death last year has also raised questions

about Nestlé's ownership. Her heirs and Nestlé have an agreement

that prevents either party from increasing its stake in L'Oréal

until six months after Ms. Bettencourt's death--though there is an

exemption if either stake rises because the number of shares

outstanding has fallen. The six-month period expires on March

21.

Nestlé, the Swiss consumer-goods giant, and L'Oréal, the world's

biggest cosmetics company, have been intertwined since 1974, when

Ms. Bettencourt, heiress to the L'Oréal cosmetics fortune, swapped

a large slice of L'Oréal for shares in Nestlé to fend off a feared

nationalization by the French state.

To finance the purchase, L'Oréal has a cash pile that rose to

EUR3 billion ($3.7 billion) from EUR1.8 billion over the course of

last year. It also has a stake in pharmaceutical company Sanofi SA

worth around EUR7.6 billion that it could sell to fund the

buyback.

"In case that would not be enough, we've got many love letters

from great banks that said they would love to lend us some money,"

Mr. Agon said.

Martin Deboo, an analyst at Jefferies in London, said L'Oréal

has the cash flow to take on debt for the transaction.

"They would deleverage from there quite quickly. It would not be

a crazy thing to do for their balance sheet," Mr. Deboo said.

L'Oréal on Thursday reported that revenue rose 4.8% last year to

EUR26 billion, excluding one-off deals like last year's sale of the

Body Shop. While its luxury brands grew strongly, the company has

struggled to drive sales of older mass-market brands such as Revlon

and Maybelline.

Mr. Loeb has repeatedly called on the Nestlé to sell its 23.29%

stake in L'Oréal, saying shareholders should be allowed to choose

whether they want to invest in the French beauty company.

"For them it's a nice ringfenced, passive store of value," Mr.

Deboo said. "And I don't think they're in any rush to dispose of

it."

Mr. Loeb has suggested the L'Oréal stake could be exchanged for

Nestlé shares, saying this method would immediately flatter

Nestlé's return on equity and increase its share value as per-share

earnings received a boost from the reduced share count.

Nestlé has been criticized by Mr. Loeb and other investors for

having something of an identity crisis. The company sells

everything from chocolate and bottled water to skin cream and

medicinal foods.

Last month, Mr. Loeb in a quarterly letter to investors,

reiterated his call for Nestlé to sell its piece of L'Oréal saying

it is unclear how a minority stake in the beauty business

contributes to Nestlé's stated aim as being a nutrition, health and

wellness company.

"We continue to believe that this financial investment ought to

be monetized and that there are better uses for this capital,"

wrote Mr. Loeb.

Write to Matthew Dalton at Matthew.Dalton@wsj.com and Saabira

Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 09, 2018 10:40 ET (15:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

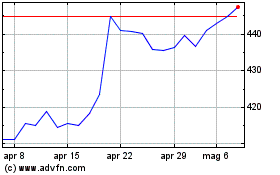

Grafico Azioni LOreal (EU:OR)

Storico

Da Apr 2024 a Mag 2024

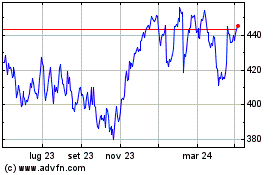

Grafico Azioni LOreal (EU:OR)

Storico

Da Mag 2023 a Mag 2024