Goldman Sachs Raises $2.5 Billion to Buy Stakes in Private-Equity Firms

22 Febbraio 2018 - 1:29PM

Dow Jones News

By Dawn Lim and Laura Kreutzer

Goldman Sachs Group Inc. raised $2.5 billion to buy minority

stakes in private-equity firms, betting on an industry that is

commanding increasing influence as more businesses choose to stay

private longer.

Petershill, a group within Goldman's asset-management arm,

gathered more than the $2 billion it targeted. An announcement is

expected as soon as Thursday.

Goldman is zeroing on an industry that has secured a record

amount of dollars from pensions and endowments in recent years to

buy and lend money to businesses. U.S. private-equity firms in 2017

raised the most money in a year since 2007.

These firms can be attractive targets for investors who want to

hold long-term stakes, as the firms' funds typically lock up the

money of major institutions for at least a decade, earning fees and

a cut of profits along the way. The investment pool Goldman raised

for the strategy, which includes Petershill Private Equity LP and

other related funds, channels the approach of Warren Buffett's

Berkshire Hathaway Inc., in that it doesn't set deadlines to exit

its bets.

Over time, Goldman could cash in on the positions by selling

stakes to investment managers and other buyers. It also could take

a portion of the portfolio public, making it available for retail

investors and mutual funds to invest in. There is no guarantee

Petershill will make these moves.

If Goldman does list a pool of manager stakes, it would further

open up a market that has largely been out of the reach of

mom-and-pop investors. The majority of private-equity firms don't

list their shares publicly -- and their funds typically don't

accept checks from small investors. This means that only large

institutions, such as pensions and endowments, as well as the

ultrarich have broad exposure to the asset class.

"If you're a public investor, there are not a lot of ways to

invest in private equity through the public markets," said Michael

Brandmeyer, co-chief investment officer of Goldman's alternative

investments and manager selection group, where the Petershill unit

is housed. "We think there could be a potentially enthusiastic

audience for a listing."

Goldman has already put a chunk of its new fund to work,

acquiring minority stakes in private-equity firms. The fund

generally will buy passive stakes in midsize firms with assets of

$5 billion to $20 billion that Goldman believes have potential to

expand.

The latest Petershill pool has taken stakes in

technology-focused firm Accel-KKR, energy-infrastructure investor

ArcLight Capital Partners and oil-and-gas manager Riverstone

Holdings.

These sorts of transactions set a price tag for private-equity

firms, allowing founders to put a dollar figure on the wealth they

have created and paving the way for some of them to transfer

ownership to other executives. Firms that sell a minority stake can

use the new cash to fund expansion efforts. The Petershill unit

also can act as a sounding board for the firms it backs.

"Many organizations are collections of excellent investors,"

said Christopher Kojima, who heads Goldman's alternative

investments and manager selection group, which oversees more than

$200 billion. "But many of them might not be institutions."

The first Petershill fund, which Goldman launched in 2007 to

invest in hedge funds, delivered 2.5 times its investor money, even

as many hedge funds across the industry delivered disappointing

returns and bled investor money. Goldman fully exited all

hedge-fund positions in that pool after it struck a deal to sell

stakes in five managers to Affiliated Managers Group Inc. for about

$800 million in 2016. Goldman is continuing to manage a pool of

hedge-fund interests from another $1.5 billion Petershill fund,

taking the view that sound firms can deliver returns even as the

industry faces challenges.

"Our focus is on firms with their best years ahead of them,"

said Mr. Kojima.

Goldman made its first direct investment in a private-equity

firm in 2016 when it acquired a minority stake in Littlejohn &

Co. It joins a number of other investment firms -- including

Neuberger Berman Group LLC's Dyal Capital Partners, Blackstone

Group LP and Carlyle Group LP -- that are pursuing stakes in

private-equity firms as well.

Write to Dawn Lim at dawn.lim@wsj.com and Laura Kreutzer at

laura.kreutzer@wsj.com

Write to Dawn Lim at dawn.lim@wsj.com and Laura Kreutzer at

laura.kreutzer@wsj.com

(END) Dow Jones Newswires

February 22, 2018 07:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

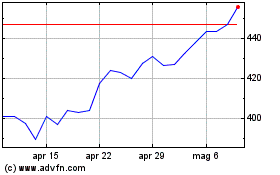

Grafico Azioni Goldman Sachs (NYSE:GS)

Storico

Da Mar 2024 a Apr 2024

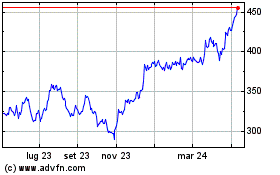

Grafico Azioni Goldman Sachs (NYSE:GS)

Storico

Da Apr 2023 a Apr 2024