Unicredit Removed From Global Bank Ranking; UBS Upgraded After Credit Suisse Takeover

27 Novembre 2023 - 3:28PM

Dow Jones News

By Helena Smolak

The Financial Stability Board removed Italy's UniCredit from its

list of global systemically important banks and moved UBS Group up

a category following its takeover of Credit Suisse.

The international body, which monitors and makes recommendations

about the global financial system, said Monday that it upgraded UBS

to the so-called bucket 2 category that requires higher capital

buffers than bucket 1. The second category houses banks such as

Deutsche Bank and Goldman Sachs.

Credit Suisse was removed from the list following UBS's

acquisition. The FSB added China's Bank of Communications to the

list in the first category, in which institutions must hold 1% in

additional equity capital as a percentage of risk-weighted assets,

compared with 1.5% in the second category.

The new capital requirements don't have to be met until Jan. 1,

2025.

The FSB began the annual rankings in the aftermath of the global

financial crisis, requiring the largest global banks to maintain a

supplementary capital buffer, stratified across five designated

buckets, and undergo more rigorous scrutiny of their

operations.

Write to Helena Smolak at helena.smolak@wsj.com

(END) Dow Jones Newswires

November 27, 2023 09:13 ET (14:13 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

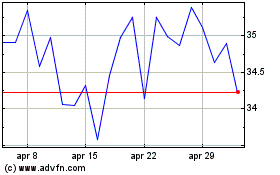

Grafico Azioni Unicredit (BIT:UCG)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Unicredit (BIT:UCG)

Storico

Da Nov 2023 a Nov 2024