Expert Picks 5 Altcoins To Watch, Declaring Arrival Of The Altseason After Three Years

24 Ottobre 2024 - 3:00AM

NEWSBTC

As the cryptocurrency market emerges from a prolonged seven-month

consolidation phase, following a parabolic uptrend for Bitcoin and

various altcoins in the first quarter of 2024, crypto analyst

OxNobler has boldly declared that today marks the start of the next

significant altseason. Analyst Predicts Major Price Movements Ahead

For Altcoins In a recent post on the social media platform X

(formerly Twitter), OxNobler shared insights on the Altcoin

Indicator, which has just gone parabolic for the first time in

three years. The analyst emphasized the cyclical nature of

market phases, driven by capital inflows that shift from Bitcoin

into larger-cap tokens before eventually reaching lower-cap

altcoins, suggesting a growing liquidity movement that could fuel

significant price surges across the altcoin landscape. Related

Reading: XRP Price Could Face Last Major Crash, Warns Crypto

Analyst Identifying key catalysts for the upcoming liquidity

inflows, OxNobler pointed to several factors: the upcoming US

election, where both candidates express support for Bitcoin,

anticipated Federal Reserve rate cuts, the potential lifting of the

cryptocurrency ban in China, and the expected payout of $16 billion

from FTX in Q4 2024 to Q1 2025. By analyzing historical price

movements and market cycles, OxNobler believes traders can position

themselves for substantial gains in the months ahead. OxNobler has

highlighted several altcoins that he believes are primed for growth

in this new market phase. Key Players In Upcoming Market

Shift Realio Network (RIO): This blockchain-based platform focuses

on the issuance, investment, and lifecycle management of digital

securities and crypto assets. With a current trading price of $0.83

and a market cap of just $4 million, OxNobler believes that RIO is

poised for significant upside, especially given the increasing

interest in Real World Assets (RWA). Major asset managers like

BlackRock are already investing in this sector, potentially driving

demand for altcoins such as RIO. Zero Labs (DEAI): This token

supports a decentralized artificial intelligence ecosystem focused

on data governance. Currently priced at $0.55, DEAI has a market

cap of $50 million, making it an attractive option as AI continues

to gain traction, specially over the past year behind the buzz

surrounding companies like Nvidia. Related Reading: ApeCoin Faces

Strong Resistance As Bears Seize Control At $1.755 SUI: Notable for

its recent performance, SUI has surged 28% over the past month and

an impressive 372% year-to-date, currently trading at $1.98 with a

market cap exceeding $5 billion, positioning it well for the

expected altseason. Render Network (RENDER): This decentralized GPU

rendering network connects users needing GPU computing power with

those willing to rent out their resources. Priced at $5 with a

market cap of $2.6 billion, the analyst suggests that RENDER is

well-positioned to benefit from the increasing demand for GPU

computing in various technological applications. TokenFi (TOKEN):

Aiming to simplify the crypto and asset tokenization process,

TokenFi aspires to become the leading platform in this space,

according to the analyst. Currently, TOKEN trades at $0.047 with a

market cap of $47 million. Featured image from DALL-E, chart from

TradingView.com

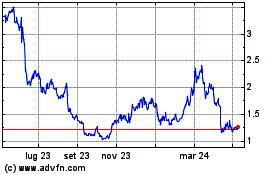

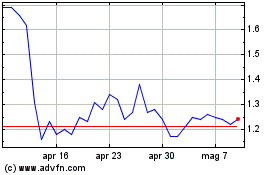

Grafico Azioni ApeCoin (COIN:APEUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni ApeCoin (COIN:APEUSD)

Storico

Da Mar 2024 a Mar 2025