5 Million Strong: Active Ethereum Wallets Drive Strong Momentum

24 Ottobre 2024 - 12:00AM

NEWSBTC

According to veteran trader Peter Brandt, Ethereum might have just

seen its future looking brighter. Known for his technical

forecasts, Brandt feels the altcoin is on the verge of a bullish

turnaround. He’s identified an inverted Head and Shoulders

formation on the daily chart of Ethereum. This is one of the most

classic buy signals in technical analysis. If ETH can hold above

that neckline at $2,745, we could be looking at a breakout. The

most interesting chart developments I see right now See thread

#1$ETH closing price chart inverted H&S pattern I am flat in

ETH pic.twitter.com/OCG0GcTdxF — Peter Brandt (@PeterLBrandt)

October 21, 2024 Related Reading: ApeCoin Climbs Over 100% On Major

Tech Advancements – Details But the excitement doesn’t stop there.

Data from IntoTheBlock shows that Ethereum’s network is stronger

than ever, boasting over 5 million active addresses across its

mainnet and Layer 2 networks. Though market mood is still mixed,

this statistic confirms Ethereum’s importance in the crypto

ecosystem. Although some investors see Ethereum’s long-term future

improving, others are worried by the short-term hazards. There are

now over 5 million active $ETH addresses across the Ethereum

mainnet and leading L2 networks, outpacing any other Layer 1 asset

by a significant margin. pic.twitter.com/W6JaauNvhV — IntoTheBlock

(@intotheblock) October 21, 2024 A Long-Term Play Ethereum

definitely had its ups and downs. From a price tag as low as $10 to

nearly $4,900 in the past, it’s very obvious that ETH has made

quite a few early believers. And while taking such wild rides can

be full of gut-wrenching moments, Ethereum never failed to ensure

that its core strength lies in the facilitation of smart contracts

and decentralized applications in the blockchain space. However,

Ethereum’s cost basis for many investors has risen as the market

has matured. This has made short-term gains more elusive, leading

some traders to approach the market cautiously. But for those with

a long-term view, Ethereum’s ambitious roadmap and history of

overcoming challenges continue to make it an attractive option.

Ethereum: The Next Path Ethereum’s present pricing behavior has one

of more fascinating technical aspects: its interaction with the

Point of Control (POC). Often considered as a significant support

or resistance, this level could be crucial in deciding Ethereum’s

next direction. As ETH’s price hovers near this point, it suggests

a possible buying opportunity for those looking at the long term.

If the POC holds, Ethereum could build a solid foundation for

future growth. But a break below this level might signal trouble

ahead, so investors should stay cautious. Related Reading: Shiba

Inu Soars: Analyst Predicts 71% Rally In ‘Meme Super Cycle’ –

Details Will The Bullish Reversal Hold? Brandt’s bullish prognosis

gives ETH fans optimism. If Ethereum maintains over $2,745 and the

inverted Head and Shoulders pattern persists, it might climb

significantly. Yet, as always, it’s essential to consider other

market factors—broader trends, technical indicators, and market

sentiment all play a role in shaping the future of Ethereum. While

Ethereum has its challenges, the potential for a bullish breakout

is hard to ignore. Whether you’re in it for the long game or

watching closely for short-term gains, Ethereum’s next move could

be a significant one. Featured image from AFP/Finance Magnates,

chart from TradingView

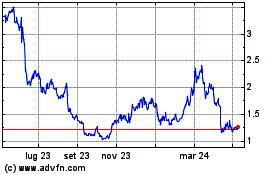

Grafico Azioni ApeCoin (COIN:APEUSD)

Storico

Da Gen 2025 a Feb 2025

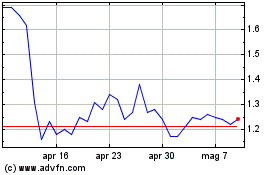

Grafico Azioni ApeCoin (COIN:APEUSD)

Storico

Da Feb 2024 a Feb 2025