Injective (INJ) Breaks $18 Resistance: Investors Expect Higher Prices

12 Settembre 2024 - 10:00PM

NEWSBTC

Injective (INJ) has been outperforming the broader crypto market in

recent hours, gaining over 19% since Monday, while most

cryptocurrencies have experienced declines of 2% to 4% since

yesterday. Related Reading: Is Chainlink (LINK) $12 Breakout

Imminent? Data Reveals A Rising Open Interest This strong

performance comes after the altcoin broke through the $18

resistance level, signaling bullish momentum. Investors and

analysts are now eyeing higher prices for INJ, with some suggesting

it could be poised for even more significant gains shortly.

However, INJ must test key supply levels and establish support

within critical demand zones for this uptrend to continue. The

current optimism surrounding Injective is backed by encouraging

price action, but sustained upward movement will be needed to

confirm a lasting trend. As the market watches closely, INJ’s

ability to hold these levels may determine its potential for

further growth in the coming days. Injective Setting New Local

Highs Injective (INJ) has experienced a strong surge after

days of choppy and uncertain price action. Now, trading above the

4-hour $18 resistance, the altcoin has ignited excitement among

investors and analysts, who believe INJ could be a top performer in

this market cycle. One notable analyst, Crypto General on X,

has shared his technical perspective on INJ, setting high

expectations for a $53 price target in the coming months. His

analysis points out that INJ is currently rebounding from its lower

trendline support, a critical level that has served as a foundation

for this rally. According to Crypto General, INJ could

experience a powerful upward movement if this support holds.

However, he also warns that if the price fails to maintain this

level, we could see a decline toward the $14 range, which would

signal a reversal of recent gains. Investors are carefully watching

this development, as INJ’s recent price action could set the stage

for more significant moves in the near term. The key will be

whether INJ maintains its momentum and breaks through resistance

levels. If bulls can push the price above its next resistance zone,

a rally toward the mid-$20 range could be on the horizon, further

solidifying its position in the market. Related Reading: Solana

(SOL) Surges Past $130 Resistance As Funding Rate Signals Bullish

Momentum As the market establishes its direction, price action in

the coming days will play a pivotal role in determining INJ’s

performance in the weeks ahead. Whether it continues to rise or

faces a pullback will likely depend on broader market conditions

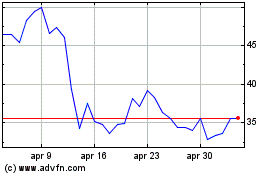

and the ability of bulls to sustain upward momentum. INJ Price

Action Details INJ is trading at $19.38 after a significant

surge from yearly lows near $15. This upward movement has propelled

the price above the 4-hour 200 exponential moving average (EMA) at

$18.41 for the first time since late August. The 4H 200 EMA is a

crucial indicator of short-term market strength. If INJ can

successfully retest and hold above this level, it would suggest a

bullish continuation, signaling that further upward momentum is

likely. Related Reading: Avalanche (AVAX) Ready To Target $28:

Investors Expect A Reversal Maintaining this position above the 4H

200 EMA would allow INJ to target higher price levels, with

resistance and supply zones near $23 as the next key hurdle.

However, if the price fails to hold this level and loses support at

$18, a retrace toward lower demand zones around $16 could occur. In

the short term, how INJ behaves around the 4H 200 EMA will be

pivotal in shaping its next price action phase. Featured image from

Dall-E, chart from TradingView

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Dic 2023 a Dic 2024