Stablecoin Takeover? Record Tether 71% Dominance Raises Questions About Crypto Future

16 Gennaio 2024 - 11:00AM

NEWSBTC

Tether, the issuer of the ubiquitous USDT stablecoin, cemented its

dominance in 2023, ballooning its market share to a staggering 71%.

This explosive growth, however, comes with a chilling undercurrent:

a United Nations report linking USDT to a surge in cybercrime and

money laundering in Southeast Asia. Glassnode data paints a stark

picture of Tether’s ascent. Its market capitalization reached a

record $95 billion in January 2024, fueled by a 40% increase in

USDT supply over the past year. Meanwhile, competitors like

Circle’s USDC saw their market share shrink, with USDT now

commanding over 7 times the circulation of its nearest rival.

Related Reading: Ethereum Classic Maintains 32% Steady Rise –

What’s Driving ETC Up? Tether Market Dominance Soars USDT

dominance shown in green. Source: Glassnode Paolo Ardoino, Tether’s

new CEO, has prioritized cooperation with U.S. law enforcement. The

company boasts of freezing wallets linked to sanctions lists and

recovering over $435 million in illicit funds. However, the UN

report casts a shadow on these efforts, detailing how USDT

facilitates “sextortion,” “pig butchering” scams, and underground

banking across Asia. While Tether has proactively banned over 1,260

addresses linked to criminal activity, the sheer volume of illicit

transactions raises concerns about the effectiveness of these

measures. USDT market cap currently at $94.904 billion. Chart:

TradingView.com Critics point to Tether’s opaque reserve backing as

a breeding ground for misuse, calling for greater transparency to

combat money laundering. Tether’s Reign At Risk: Regulatory

Challenges The stablecoin market, once touted as a bridge between

traditional finance and the crypto world, now faces a reckoning.

Tether’s dominance is undeniable, but its association with criminal

activity threatens to erode trust and trigger stricter regulations.

Tether total assets nearing the $95 billion level. Source: Gabor

Gurbacs X post. Meanwhile, Circle’s recent IPO filing hints at a

potential shift in the landscape. With regulatory scrutiny

intensifying, Tether’s future hinges on its ability to address

concerns about transparency and combat illicit activity. Can it

clean up its act and maintain its crown, or will the tide turn

towards its more transparent rivals? Only time will tell if

Tether’s reign as the king of stablecoins will weather the storm of

controversy. Related Reading: Solid TVL Slingshots SUI Price To

Break $1 For New All-Time High – Details With its historic 71%

market share, Tether’s reign over the stablecoin realm is

undeniable. Yet, the shadow of illicit activity threatens to

eclipse its success. As regulators sharpen their focus and

competitors like Circle step into the ring, the question looms:

will Tether clean house and retain its crown, or will this be the

tipping point for a stablecoin revolution, reshaping the future of

crypto itself? Only time will tell if Tether’s dominance signals a

bright new era for digital currencies or serves as a cautionary

tale, paving the way for a more transparent and accountable crypto

landscape. The gloves are off, and the fight for the future of

stablecoins is just beginning. Featured image from Shutterstock

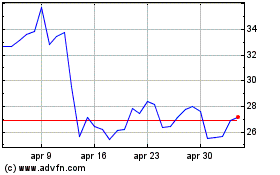

Grafico Azioni Ethereum Classic (COIN:ETCUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Ethereum Classic (COIN:ETCUSD)

Storico

Da Dic 2023 a Dic 2024