Bitcoin Backs Down: Ethereum Steals The Spotlight With Surge In Market Dominance

17 Gennaio 2024 - 9:18AM

NEWSBTC

Amidst the lull in the realm of Bitcoin, Ethereum emerges as a

trailblazer, confidently charting its course. While the crypto king

takes a breather following its ETF approval, Ethereum, undeterred,

is experiencing a surge in both price and dominance, propelled by

an influx of new users and the prevailing trend of self-custody.

Recent data from Santiment vividly illustrates Ethereum’s

ascendancy. The platform’s price dominance, reflecting its market

share in comparison to all other cryptocurrencies, has witnessed a

remarkable surge of 22.4% within a mere week. Ethereum’s Remarkable

Surge: Growing Community, Strong On-Chain This surge is not merely

a passive spectacle; Ethereum is actively attracting an astonishing

89,400 new addresses on a daily basis, with an unprecedented 96,300

joining the Ethereum community in a single day. Related Reading:

Stablecoin Takeover? Record Tether 71% Dominance Raises Questions

About Crypto Future Source: Santiment This momentum is not solely

about acquiring new participants; it’s about retention. Ethereum’s

exchange supply, representing the quantity readily available for

sale, is approaching its historical low of 8.05%. This shift

signals a notable move towards self-custody and staking, mitigating

the immediate risk of a substantial selloff and fortifying

Ethereum’s price floor. The on-chain strength witnessed translates

into tangible market action. Following a brief dip that tested the

$2,500 support, Ethereum not only stabilized but turned this

once-resilient level into a launchpad. Ethereum currently trading

at $2,556 on the daily chart: TradingView.com Analysts are now

setting their sights on the $2,700 barrier as the gateway to

unlocking a potential price surge, with FOMO (fear of missing out)

traders anticipated to join the rally. Beyond this juncture, the

horizon appears boundless, with $3,400 emerging as an enticing

target. Caution Amid Excitement: Ethereum’s Unpredictable

Trajectory Yet, amid the excitement, an air of caution permeates

the volatile crypto landscape. A breach below the “hammer”

formation that materialized on Monday holds the potential to send

Ethereum plummeting towards the 20-Day EMA (exponential moving

average) at approximately $2,300. Traders are poised on

tenterhooks, meticulously monitoring these crucial levels to

decipher the forthcoming trajectory of Ethereum’s journey. Related

Reading: Ethereum Classic Maintains 32% Steady Rise – What’s

Driving ETC Up? One undeniable truth emerges: Ethereum is casting

off the shadow of Bitcoin and carving out its unique path. With an

increasing dominance, a fervent user base, and a focus on

self-custody, Ethereum is laying the groundwork for future

expansion. Whether it attains the envisioned $3,400 pinnacle or

steers towards an alternate destiny, one certainty

prevails—Ethereum is an influential force, and its narrative is

only in its nascent stages. History repeating itself.#Bitcoin

dominance peaking before the halving and potentially marking a

cycle top. Altcoins are likely to outperform coming period.

pic.twitter.com/ox36x2M5NG — Michaël van de Poppe (@CryptoMichNL)

January 15, 2024 Meanwhile, in order to bolster Ethereum’s

increasing dominance over Bitcoin, Michaël van de Poppe, the

founder and CEO of trading company MNTrading, observed that Bitcoin

was falling behind Ethereum in terms of the total market

capitalization of cryptocurrencies. In a post on X dated January

12, he included the following graphic with the caption, “#Bitcoin

dominance peaking before the halving and maybe signifying a cycle

top.” It’s conceivable that altcoins will perform better in the

near future. Featured image from Shutterstock

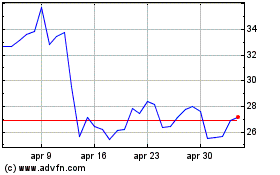

Grafico Azioni Ethereum Classic (COIN:ETCUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Ethereum Classic (COIN:ETCUSD)

Storico

Da Nov 2023 a Nov 2024