Bitcoin’s Big Breakout? Fed’s “Not QE, QE” Just Flipped The Switch

17 Febbraio 2025 - 5:30PM

NEWSBTC

A fresh infusion of liquidity from the US Treasury General Account

(TGA) is making waves among market observers, with some analysts

speculating this could be a key trigger for Bitcoin’s next major

move. While the Federal Reserve continues its Quantitative

Tightening (QT) program, the TGA’s latest cash injection—pegged at

up to $842 billion—has sparked debate over whether we are

witnessing a stealth version of quantitative easing, sometimes

referred to as “Not QE, QE.” Fed’s “Not QE, QE” In a post shared on

X, macro analyst Tomas (@TomasOnMarkets) offered a breakdown of how

this dynamic is playing out: “‘Not QE, QE’ has officially started.

A liquidity injection that could total up to $842bn from the US

Treasury General Account began this week. Functionally, this is

similar to Quantitative Easing, but on a temporary basis.” The

backdrop for this liquidity surge is the binding $36 trillion US

debt limit. With no new debt issuance allowed until a fresh debt

ceiling agreement is reached, the Treasury is forced to rely on

funds from the TGA to cover government spending obligations. This

draws down the TGA balance—$842 billion as of Tuesday, February

11—effectively injecting liquidity into financial markets. Related

Reading: Bitcoin Network Activity Is Declining — Impact On Price?

According to Tomas, the Treasury’s “train” of TGA spending started

in earnest on Wednesday, February 12: “From my understanding, the

official ‘debt ceiling-induced’ Treasury General Account (TGA)

drawdown began on Wednesday February 12… This train is now in

motion and will not stop until lawmakers come to a new debt ceiling

agreement.” He projects that the first segment of this process will

likely involve around $600 billion in injections between February

12 and April 11. After the April tax season, a temporary

replenishment of the TGA could occur, but until a new debt ceiling

deal is reached, the Treasury will presumably continue to spend

down existing cash reserves. While some observers are hailing this

development as a de facto round of QE, Tomas underscores that the

final net impact depends on two critical drains on liquidity: The

Federal Reserve is rolling off assets at about $55 billion per

month, which Tomas expects to continue at least through the next

FOMC meeting in March. Over two months, that translates to an

estimated $110 billion liquidity reduction. With the Treasury

issuing fewer T-bills due to debt-ceiling constraints—termed “net

negative T-bill issuance”—money market funds may have fewer

short-term government securities to buy. This scarcity could prompt

them to park more cash in the Fed’s Reverse Repo facility, which

effectively drains liquidity from the broader market. Tomas notes:

“This may incentivize money market funds to park cash in the Fed’s

Reverse Repo, potentially pushing this chart up… Reverse Repo usage

increasing would be a liquidity drain, as money would be moving

away from markets and into the Reverse Repo facility at the Fed.”

Overall, the true scale of the TGA-based stimulus remains

uncertain. Last week, net injections into the system were estimated

at $50 billion, a figure that could fluctuate in the weeks ahead as

QT and Reverse Repo demand evolve. Another key piece of the puzzle

is the ongoing political deadlock over the debt ceiling. Despite

calls for bipartisan cooperation, divisions within the narrow

Republican majority—combined with broad Democratic

opposition—complicate prospects for a swift resolution. Related

Reading: Analyst Says Bitcoin Is ‘Primed For A Breakout’: Is BTC

Heading For $150,000 Rally? House Republicans recently put forward

a plan tying “trillions of dollars” in tax cuts to raising the debt

ceiling. However, the measure’s passage is far from assured, as

deeply conservative members object to any debt limit increase on

principle. Past increases have typically required cross-party

support, indicating a potentially prolonged standoff. “This comes

down on the shoulders of House Speaker Mike Johnson, as he attempts

to rally lawmakers behind the plan,” Tomas notes, reflecting

widespread skepticism about whether sufficient votes can be

secured. Will Bitcoin Benefit? For Bitcoin traders, these liquidity

ebbs and flows often correlate with broader risk appetite—Bitcoin

has historically seen upward price movements during periods of

loose monetary policy and liquidity injections. Although the

Federal Reserve has signaled no immediate halt to QT, the TGA

drawdown’s near-term flood of cash could still buoy risk assets,

including Bitcoin. Precisely how much of this “Not QE, QE” trickles

into Bitcoin remains to be seen. Yet, for market participants

watching daily net liquidity metrics, the interplay between TGA

drawdowns, QT, and Reverse Repo usage has become a central

storyline. As the standoff in Washington continues, the Bitcoin

space will be monitoring every uptick and downtick in the Fed’s

liquidity charts—hoping it might just flip the switch on Bitcoin’s

next big breakout. At press time, Bitcoin traded at $96,424.

Featured image created with DALL.E, chart from TradingView.com

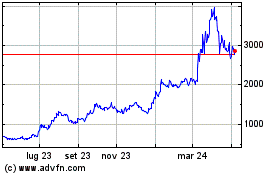

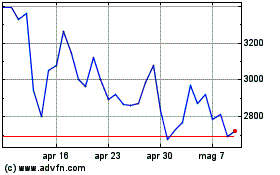

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Feb 2024 a Feb 2025